- United Kingdom

- /

- Food

- /

- LSE:AEP

Hargreaves Services And 2 Top UK Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

The United Kingdom market has remained flat over the past week but has shown a 7.5% increase over the past year, with earnings projected to grow by 14% annually. In this context, dividend stocks that offer consistent payouts and potential for capital appreciation can be appealing options for investors seeking stability and income in their portfolios.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.71% | ★★★★★★ |

| OSB Group (LSE:OSB) | 8.43% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.08% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.03% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.02% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.07% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.54% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 5.18% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.71% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.51% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

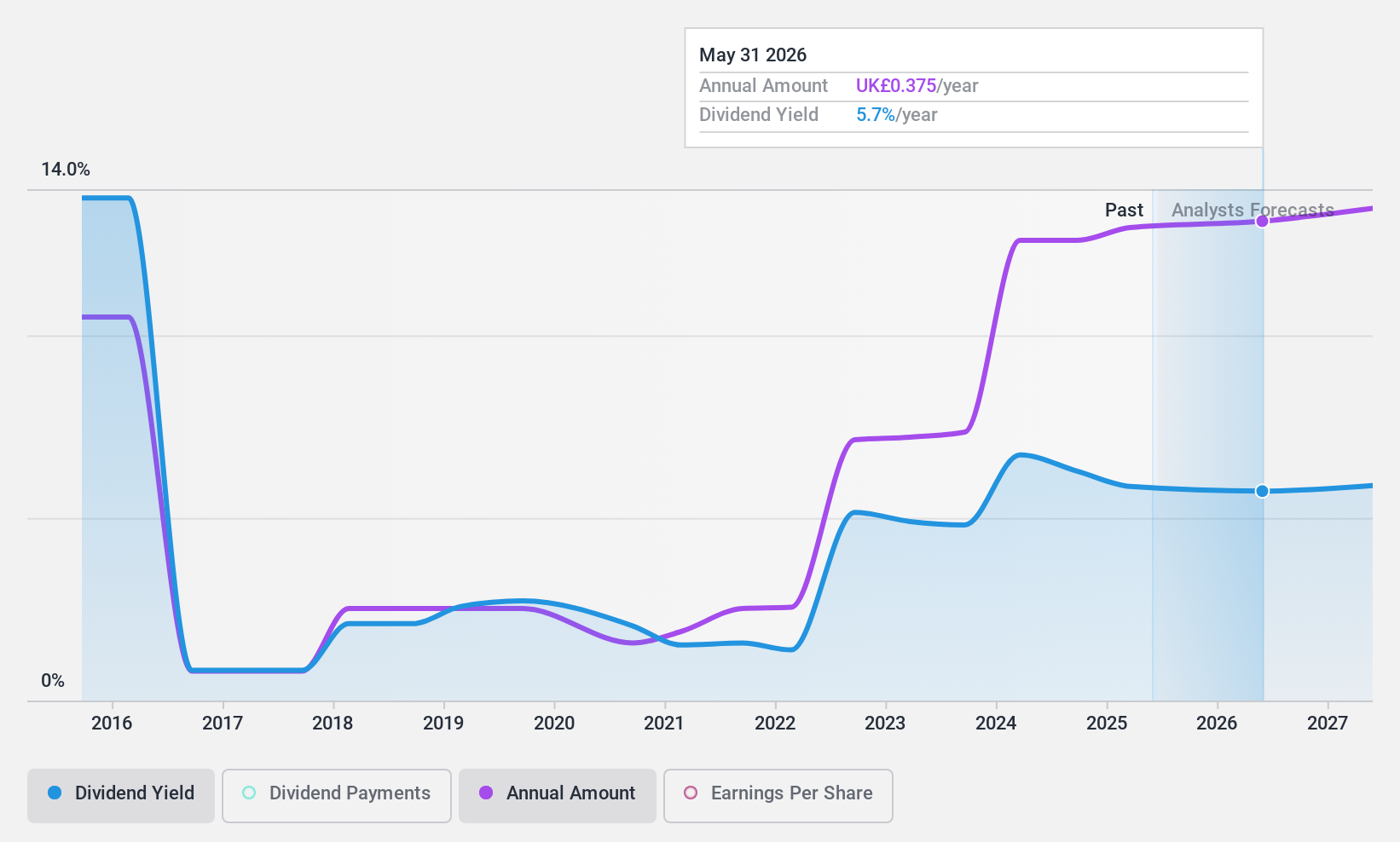

Hargreaves Services (AIM:HSP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hargreaves Services Plc offers environmental and industrial services across the United Kingdom, Europe, Hong Kong, and internationally, with a market cap of £179.97 million.

Operations: Hargreaves Services Plc generates revenue primarily from its Services segment, which accounts for £206.86 million, complemented by contributions from Hargreaves Land at £7.04 million.

Dividend Yield: 6.6%

Hargreaves Services has announced a significant increase in its full-year dividend to 36.0 pence, up from 21.0 pence last year, despite net income declining to £12.28 million from £27.92 million. While the dividend yield of 6.59% is attractive and among the top quartile in the UK market, concerns exist over sustainability due to high payout ratios and volatile past payments. The company's dividends are covered by cash flows but not by earnings, indicating potential risks for investors prioritizing stability.

- Unlock comprehensive insights into our analysis of Hargreaves Services stock in this dividend report.

- According our valuation report, there's an indication that Hargreaves Services' share price might be on the expensive side.

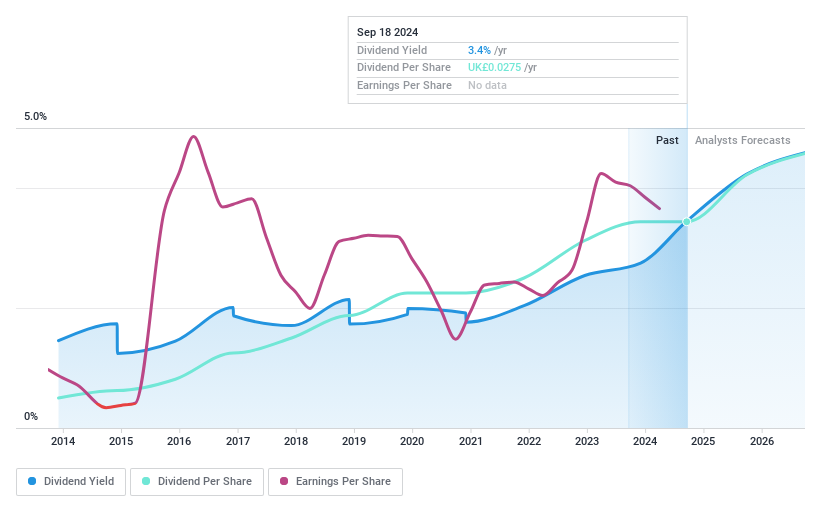

Oxford Metrics (AIM:OMG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oxford Metrics plc is a smart sensing and software company operating in the United Kingdom and internationally, with a market cap of £80.18 million.

Operations: Oxford Metrics plc generates revenue through its Vicon segment, with £23.62 million from the UK and £21.09 million from the USA.

Dividend Yield: 4.5%

Oxford Metrics has shown stable and reliable dividend growth over the past decade, though its current 4.51% yield is below the top UK payers. The dividend is not well covered by free cash flows due to a high cash payout ratio of 739.2%, despite being covered by earnings with a payout ratio of 70.7%. Recent board changes include Dr Ian Wilcock's appointment, potentially bringing strategic growth expertise to the company amidst ongoing financial guidance projecting revenues up to £42 million for FY2024.

- Navigate through the intricacies of Oxford Metrics with our comprehensive dividend report here.

- According our valuation report, there's an indication that Oxford Metrics' share price might be on the cheaper side.

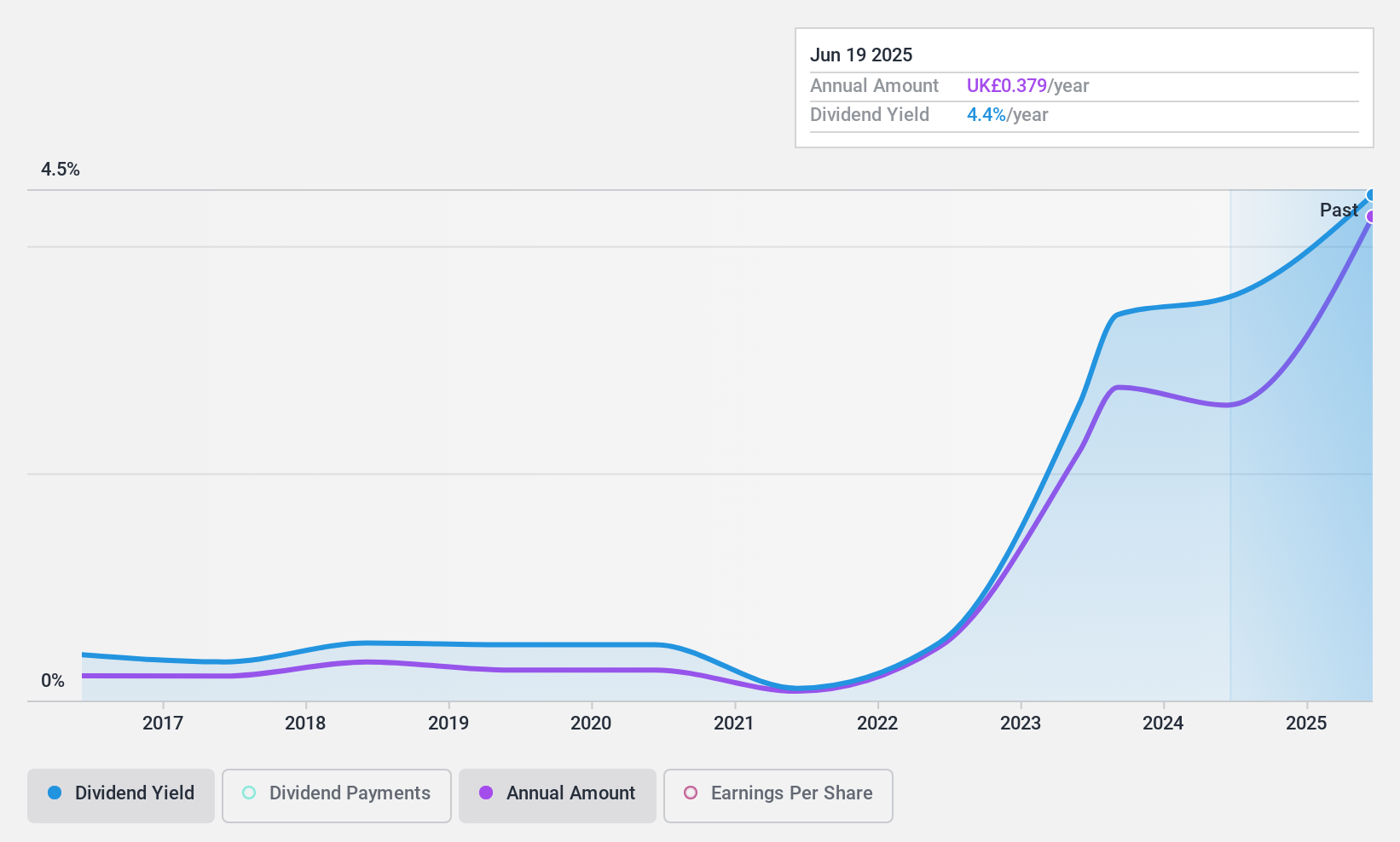

Anglo-Eastern Plantations (LSE:AEP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anglo-Eastern Plantations Plc, along with its subsidiaries, owns, operates, and develops agricultural plantations in Indonesia and Malaysia with a market capitalization of approximately £260.62 million.

Operations: The company's revenue is primarily derived from the cultivation of plantations, amounting to $364.23 million.

Dividend Yield: 3.5%

Anglo-Eastern Plantations has experienced volatile dividend payments over the past decade, with a current yield of 3.48%, lower than top UK payers. Despite this volatility, dividends are well covered by earnings and cash flows, with payout ratios of 10.7% and 24.4% respectively. Recent leadership changes include Kevin Wong Tack Wee as CEO and Marcus Chan as Executive Director (Corporate Affairs), potentially driving strategic growth and enhancing governance amidst stable financial performance with net income rising to US$27.87 million for H1 2024.

- Click to explore a detailed breakdown of our findings in Anglo-Eastern Plantations' dividend report.

- Our valuation report unveils the possibility Anglo-Eastern Plantations' shares may be trading at a discount.

Key Takeaways

- Click here to access our complete index of 60 Top UK Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AEP

Anglo-Eastern Plantations

Owns, operates, and develops agriculture plantations in Indonesia and Malaysia.

Flawless balance sheet, good value and pays a dividend.