- United Kingdom

- /

- Oil and Gas

- /

- AIM:BLOE

3 UK Penny Stocks With Market Caps Under £200M

Reviewed by Simply Wall St

The UK market has recently experienced some turbulence, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China. Despite these broader market challenges, there remains potential for investors to explore opportunities in smaller or newer companies. Penny stocks, while an outdated term, still hold relevance today as they can offer surprising value when backed by solid financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.215 | £834.53M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.33 | £169.38M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.18 | £415.73M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Serabi Gold (AIM:SRB) | £0.89 | £67.4M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.23 | £104.97M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.292 | £199.26M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.215 | £411.4M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.404 | $234.86M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.40 | £209.85M | ★★★★★★ |

Click here to see the full list of 464 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Block Energy (AIM:BLOE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Block Energy Plc is involved in the exploration, development, and production of oil and gas in the Republic of Georgia with a market cap of £4.88 million.

Operations: The company generates $8.13 million in revenue from its operations in Georgia.

Market Cap: £4.88M

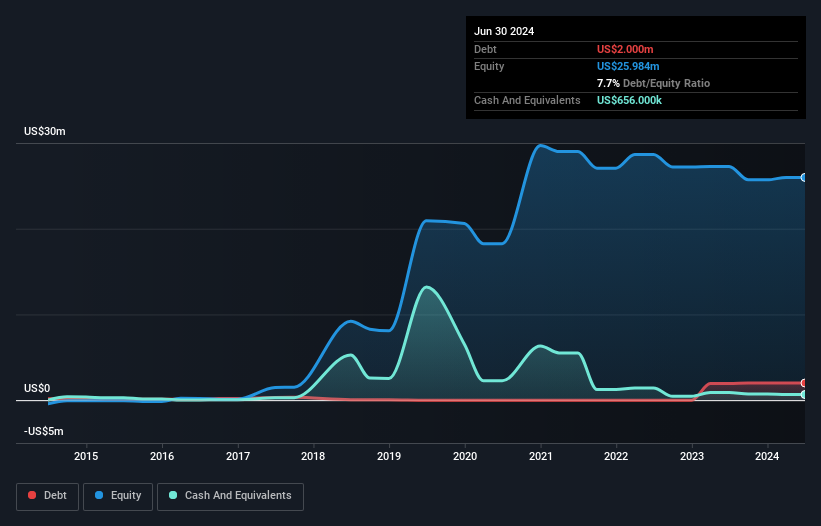

Block Energy Plc, with a market cap of £4.88 million, operates in the oil and gas sector in Georgia and reported US$3.69 million in sales for the first half of 2024, showing improved financial performance from a net loss to a slight net income. Despite being unprofitable overall, Block Energy has reduced losses by 18.8% annually over five years and maintains a satisfactory net debt to equity ratio of 5.2%. The company is exploring strategic growth through carbon capture initiatives with Rustavi Azot, aiming for commercialisation via cost-effective methods leveraging existing infrastructure and industrial emissions proximity.

- Unlock comprehensive insights into our analysis of Block Energy stock in this financial health report.

- Assess Block Energy's previous results with our detailed historical performance reports.

Futura Medical (AIM:FUM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Futura Medical plc researches, develops, and sells pharmaceutical and healthcare products for sexual health, with a market cap of £100.70 million.

Operations: The company generates revenue primarily from the development and commercialisation of MED3000, amounting to £8.40 million.

Market Cap: £100.7M

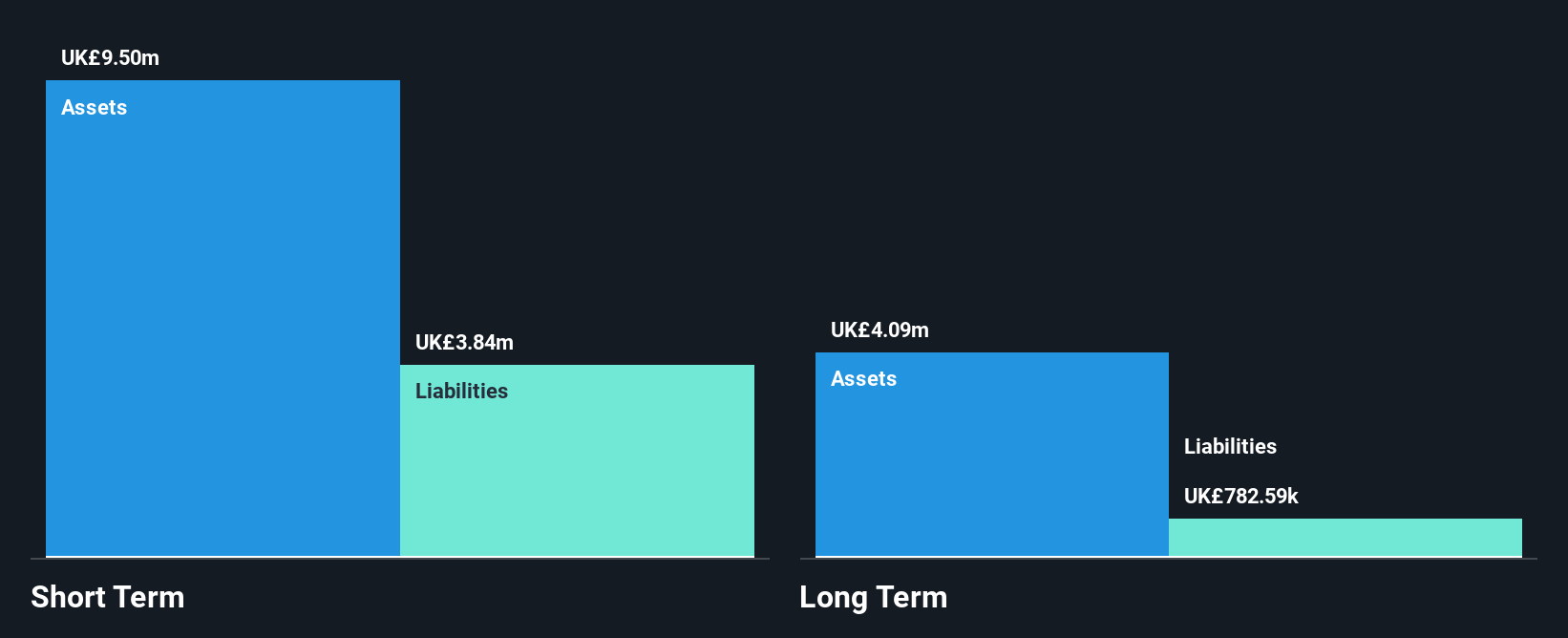

Futura Medical plc, with a market cap of £100.70 million, has shown significant revenue growth, reporting £7 million in sales for the first half of 2024 compared to £1.7 million the previous year. Despite being unprofitable with a negative return on equity of -48.05%, it has reduced losses over five years by 6.8% annually and remains debt-free. The company is trading significantly below its estimated fair value and analysts anticipate substantial stock price appreciation. However, it faces high volatility and less than one year of cash runway based on current free cash flow trends, posing potential financial challenges ahead.

- Navigate through the intricacies of Futura Medical with our comprehensive balance sheet health report here.

- Explore Futura Medical's analyst forecasts in our growth report.

Thalassa Holdings (LSE:THAL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thalassa Holdings Limited is a holding company focused on the research and development of autonomous underwater vehicles, with a market cap of £2.11 million.

Operations: Thalassa Holdings Limited has not reported any specific revenue segments.

Market Cap: £2.11M

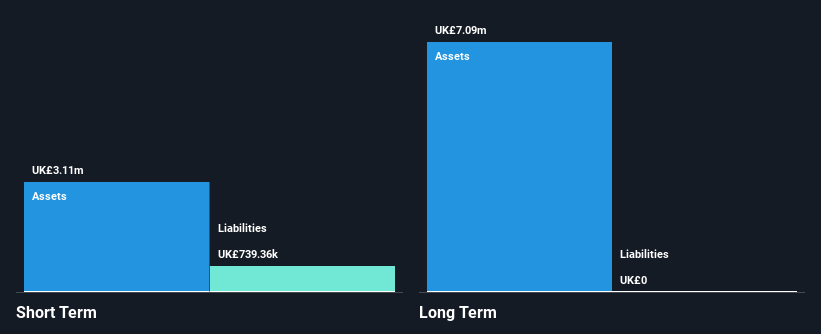

Thalassa Holdings Limited, with a market cap of £2.11 million, is pre-revenue, generating less than US$1m (£236K) annually. Despite being unprofitable, it has reduced losses by 35.2% per year over the past five years and reported a net income of £0.24 million for the first half of 2024 compared to a loss previously. The company is debt-free and has sufficient cash runway for more than three years based on current free cash flow trends. Its board is experienced with an average tenure of 16.6 years, providing stability amidst its financial challenges and growth potential in autonomous underwater vehicle research and development.

- Take a closer look at Thalassa Holdings' potential here in our financial health report.

- Learn about Thalassa Holdings' historical performance here.

Summing It All Up

- Discover the full array of 464 UK Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Block Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BLOE

Block Energy

Explores for, develops, and produces oil and gas in the Republic of Georgia.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives