Exploring European Undervalued Small Caps With Insider Action

Reviewed by Simply Wall St

As European markets continue to navigate a complex landscape of trade tensions and economic shifts, the pan-European STOXX Europe 600 Index has shown resilience, rising for a fourth consecutive week amid hopes for easing trade disputes. In this environment, small-cap stocks have garnered attention due to their potential for growth and agility in adapting to changing conditions. Identifying promising opportunities among these smaller companies often involves looking at factors such as strong fundamentals, strategic positioning within their industries, and any insider actions that might signal confidence in future performance.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 12.2x | 0.6x | 34.09% | ★★★★★☆ |

| Savills | 24.9x | 0.6x | 40.44% | ★★★★☆☆ |

| FRP Advisory Group | 12.1x | 2.2x | 17.18% | ★★★★☆☆ |

| AKVA group | 15.1x | 0.7x | 49.19% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.6x | 48.10% | ★★★★☆☆ |

| Eastnine | 18.1x | 8.7x | 39.64% | ★★★★☆☆ |

| Absolent Air Care Group | 24.1x | 1.9x | 45.67% | ★★★☆☆☆ |

| Italmobiliare | 11.6x | 1.5x | -204.97% | ★★★☆☆☆ |

| Arendals Fossekompani | NA | 1.7x | 39.12% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.5x | 43.87% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

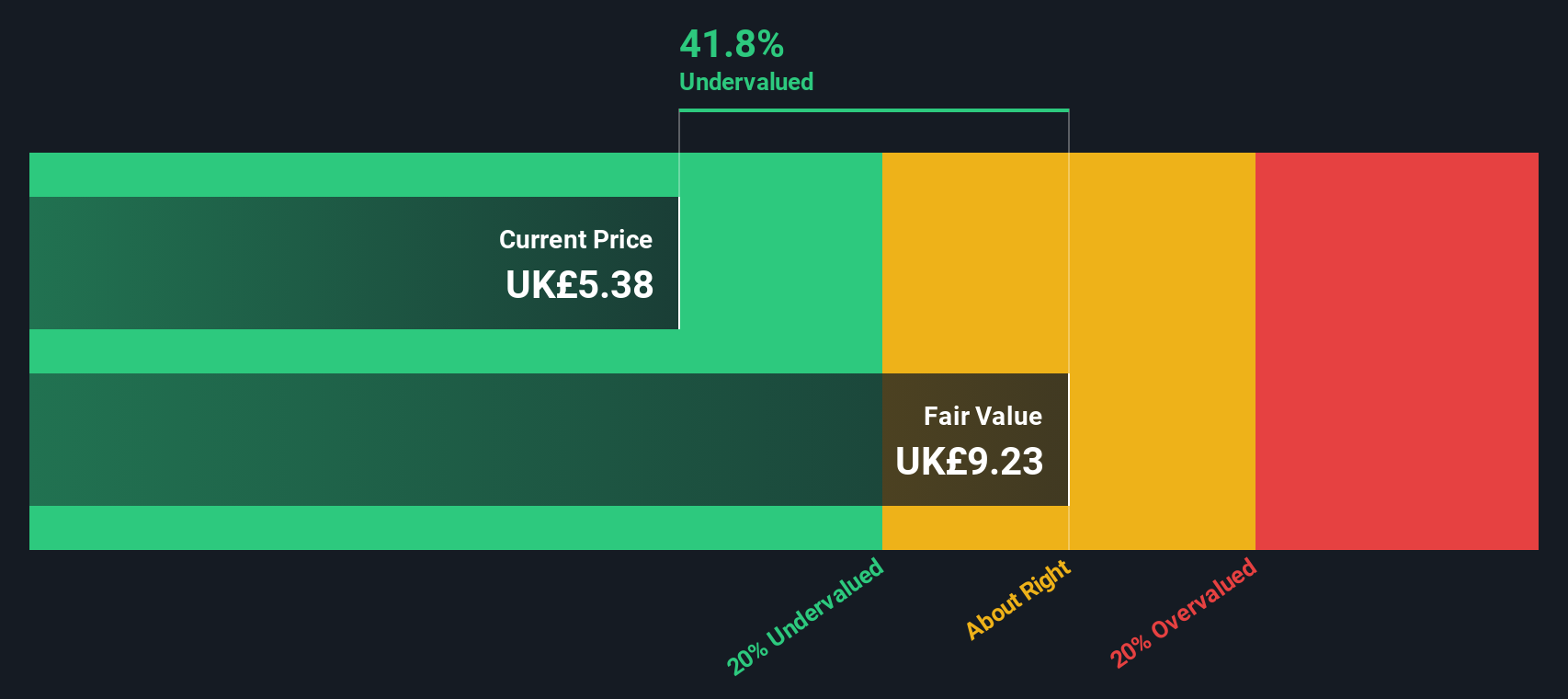

Science Group (AIM:SAG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Science Group operates in consultancy services, audio chips and modules, and submarine atmosphere management systems, with a market capitalization of £0.21 billion.

Operations: Consultancy Services is the primary revenue stream, contributing £72.21 million, followed by Systems - Submarine Atmosphere Management at £25.86 million and Systems - Audio Chips and Modules at £11.97 million. The gross profit margin showed a notable increase from 23.77% to 48.21% over the observed periods before settling around 40%.

PE: 16.7x

Science Group, a smaller European company, has shown mixed financial performance. For 2024, sales slightly decreased to £110.67 million from £113.34 million the previous year, but net income more than doubled to £12.02 million. Earnings per share increased significantly as well. They completed a buyback of over 1 million shares for £4.69 million in late 2024, indicating insider confidence in their value proposition despite potential earnings decline and reliance on external borrowing for funding.

- Unlock comprehensive insights into our analysis of Science Group stock in this valuation report.

Evaluate Science Group's historical performance by accessing our past performance report.

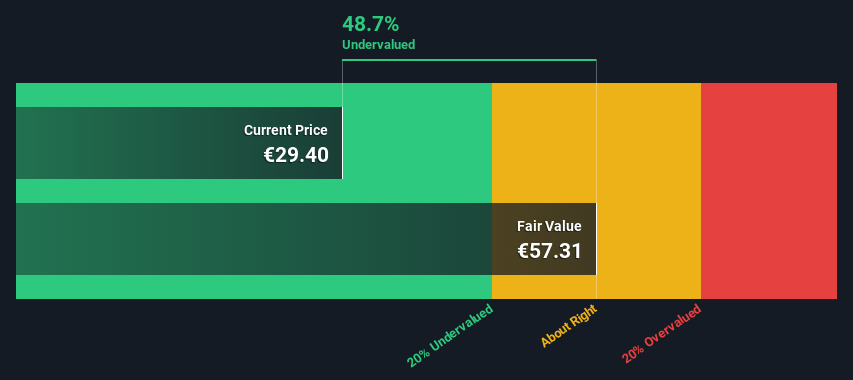

Sanlorenzo (BIT:SL)

Simply Wall St Value Rating: ★★★★★★

Overview: Sanlorenzo is a luxury yacht manufacturer with operations in the Yacht, Bluegame, Superyacht, and Nautor Swan divisions, and it has a market capitalization of €1.51 billion.

Operations: The company generates revenue primarily from the Yacht, Bluegame, Superyacht, and Nautor Swan divisions. The gross profit margin saw an increase to 29.24% by the end of 2024, reflecting a notable rise in profitability.

PE: 10.5x

Sanlorenzo, a prominent player in the luxury yacht industry, showcases potential as an undervalued investment. The company reported a net income of €103.12 million for 2024, up from €92.84 million the previous year, with earnings per share at €2.92. Insider confidence is evident as Massimo Perotti acquired 30,000 shares valued at approximately €842K in March 2025, reflecting trust in future growth despite reliance on external borrowing for funding. Earnings are projected to grow by 4.45% annually, suggesting steady progress ahead.

- Dive into the specifics of Sanlorenzo here with our thorough valuation report.

Gain insights into Sanlorenzo's historical performance by reviewing our past performance report.

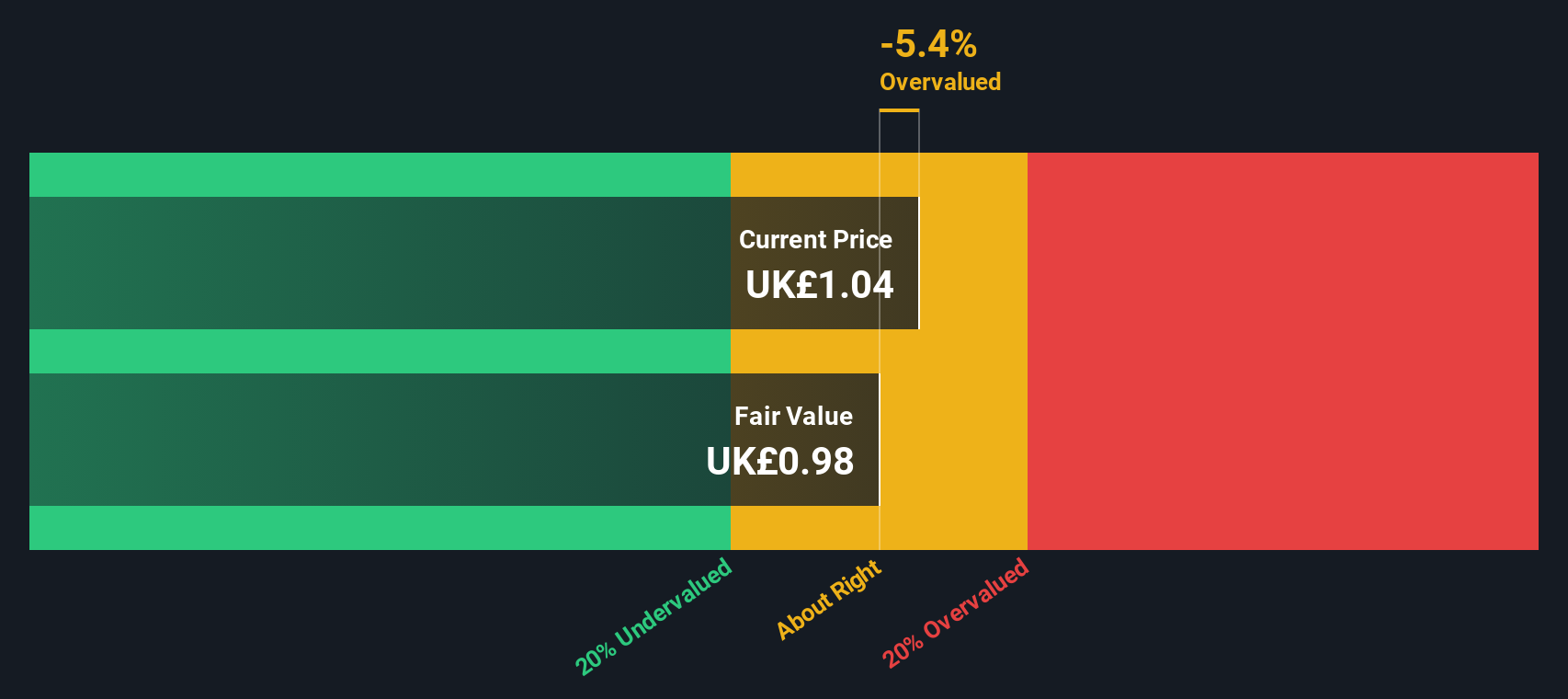

Vanquis Banking Group (LSE:VANQ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vanquis Banking Group operates in the financial services sector, providing credit cards, loans, vehicle finance, and second charge mortgages, with a market capitalization of approximately £0.42 billion.

Operations: Vanquis Banking Group's revenue streams are primarily driven by its Cards segment, contributing £238.10 million, and Vehicle Finance at £34.20 million. The company experienced fluctuations in its net income margin, peaking at 32.75% in Q4 2016 before encountering significant declines to -44.28% by the end of 2024.

PE: -1.6x

Vanquis Banking Group, a small-cap player in the European financial sector, faces challenges with a reported net loss of £119.3 million for 2024, compared to a £11.7 million loss in 2023. The absence of customer deposits means reliance on external borrowing, adding risk to its funding structure. Despite these hurdles, insider confidence remains as insiders have been purchasing shares over the past six months. Earnings are projected to grow significantly at 85% annually, suggesting potential recovery and growth opportunities ahead.

Where To Now?

- Embark on your investment journey to our 65 Undervalued European Small Caps With Insider Buying selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:SL

Sanlorenzo

Designs, builds, and sells boats and pleasure boats in Italy, rest of Europe, the Asia-Pacific, the United States, the Middle East, and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives