- United Kingdom

- /

- Capital Markets

- /

- LSE:TCAP

TP ICAP Group (LON:TCAP) Will Pay A Smaller Dividend Than Last Year

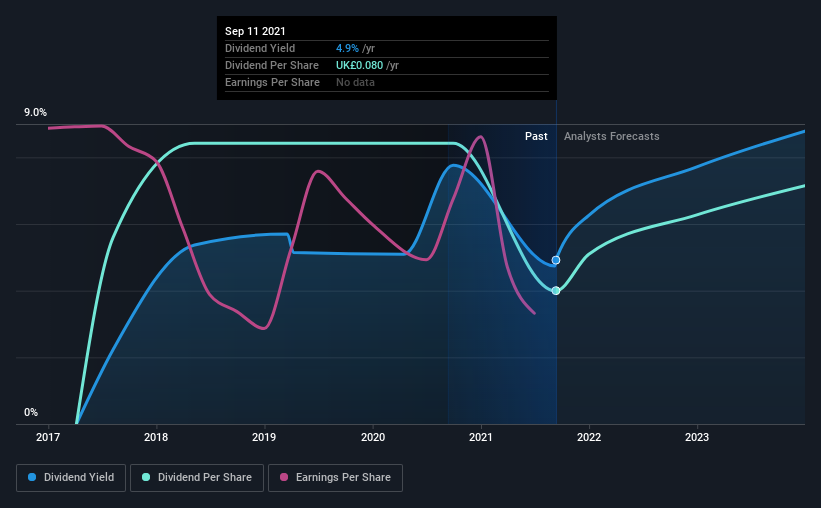

TP ICAP Group PLC (LON:TCAP) has announced it will be reducing its dividend payable on the 5th of November to UK£0.04, which is 29% lower than what investors received last year. However, the dividend yield of 3.7% is still a decent boost to shareholder returns.

See our latest analysis for TP ICAP Group

TP ICAP Group's Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. Before making this announcement, TP ICAP Group was paying out quite a large proportion of both earnings and cash flow, with the dividend being 1,577% of cash flows. Paying out such a high proportion of cash flows certainly exposes the company to cutting the dividend if cash flows were to reduce.

Over the next year, EPS is forecast to expand by 113.0%. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 35% which brings it into quite a comfortable range.

TP ICAP Group's Dividend Has Lacked Consistency

Looking back, the company hasn't been paying the most consistent dividend, but with such a short dividend history it could be too early to draw solid conclusions. The first annual payment during the last 4 years was UK£0.11 in 2017, and the most recent fiscal year payment was UK£0.08. The dividend has shrunk at around 8.1% a year during that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth May Be Hard To Come By

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. TP ICAP Group has seen earnings per share falling at 5.1% per year over the last three years. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

The company has also been raising capital by issuing stock equal to 41% of shares outstanding in the last 12 months. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

The Dividend Could Prove To Be Unreliable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The track record isn't great, and the payments are a bit high to be considered sustainable. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 5 warning signs for TP ICAP Group (1 is a bit unpleasant!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you’re looking to trade TP ICAP Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TP ICAP Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:TCAP

TP ICAP Group

Provides intermediary services, contextual insights, trade execution, pre-trade and settlement services, and data-led solutions in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives