- United Kingdom

- /

- Biotech

- /

- AIM:BVXP

3 UK Dividend Stocks Offering Yields Up To 6.7%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index has recently experienced a downturn, influenced by weak trade data from China, which has impacted companies with close ties to the Chinese economy. Amidst these market fluctuations, investors may find value in dividend stocks that offer stable income streams; such stocks can provide a buffer against volatility while contributing to long-term financial goals.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 9.25% | ★★★★★★ |

| Treatt (LSE:TET) | 3.42% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 5.98% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.78% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.03% | ★★★★★★ |

| Man Group (LSE:EMG) | 7.03% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.58% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.07% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.66% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.73% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

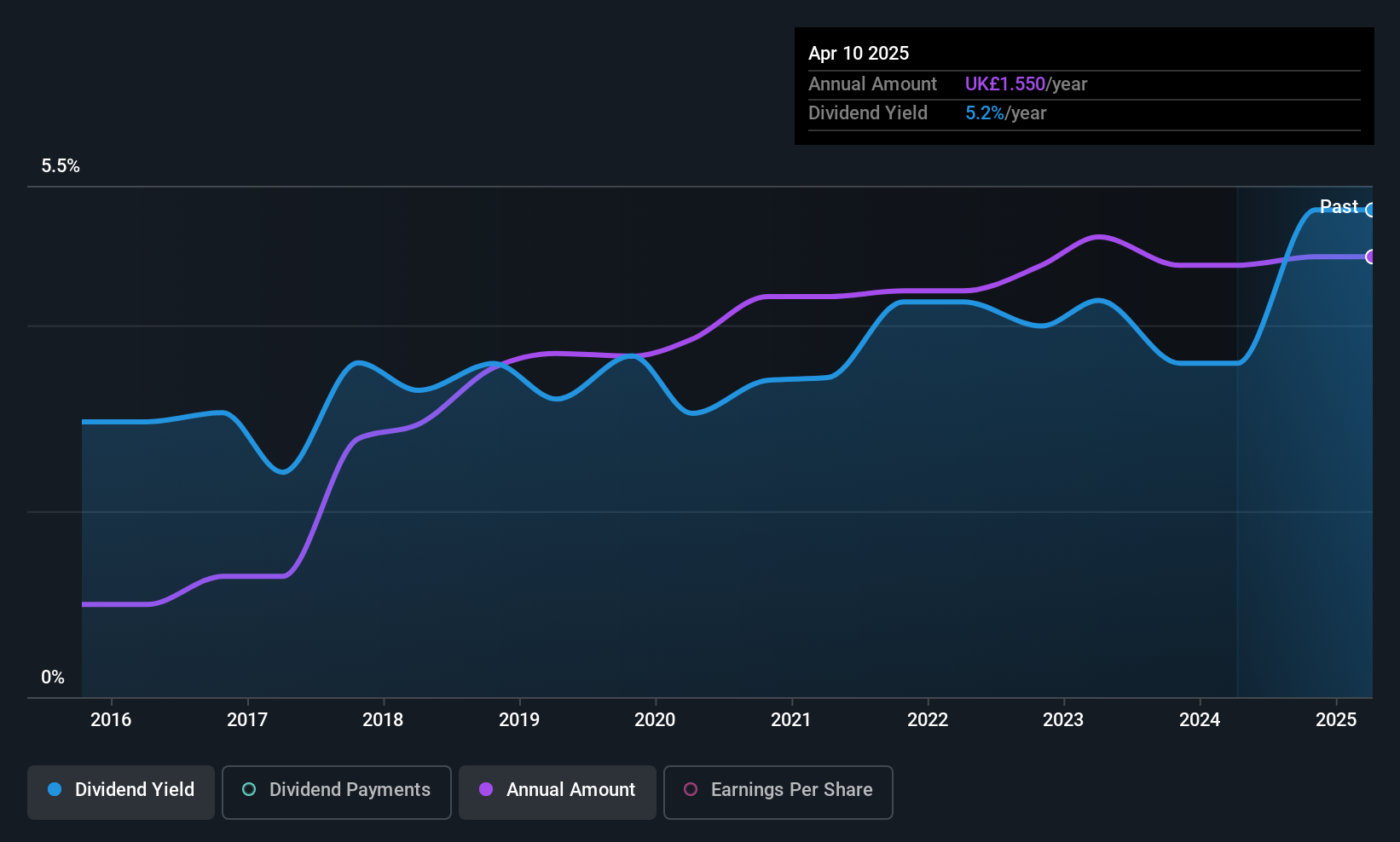

Bioventix (AIM:BVXP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bioventix PLC develops, produces, and distributes sheep monoclonal antibodies for global diagnostic use, with a market cap of £142.38 million.

Operations: Bioventix PLC generates its revenue primarily from the biotechnology segment, amounting to £13.66 million.

Dividend Yield: 5.7%

Bioventix offers a compelling dividend yield of 5.69%, placing it in the top 25% of UK dividend payers. While its dividends have been stable and reliable over the past decade, growing with minimal volatility, concerns arise due to its high payout ratios—104.5% from earnings and 107.8% from cash flows—indicating unsustainability. Despite trading at a discount to estimated fair value, the coverage by earnings and cash flow remains inadequate for long-term sustainability.

- Click here to discover the nuances of Bioventix with our detailed analytical dividend report.

- Our expertly prepared valuation report Bioventix implies its share price may be lower than expected.

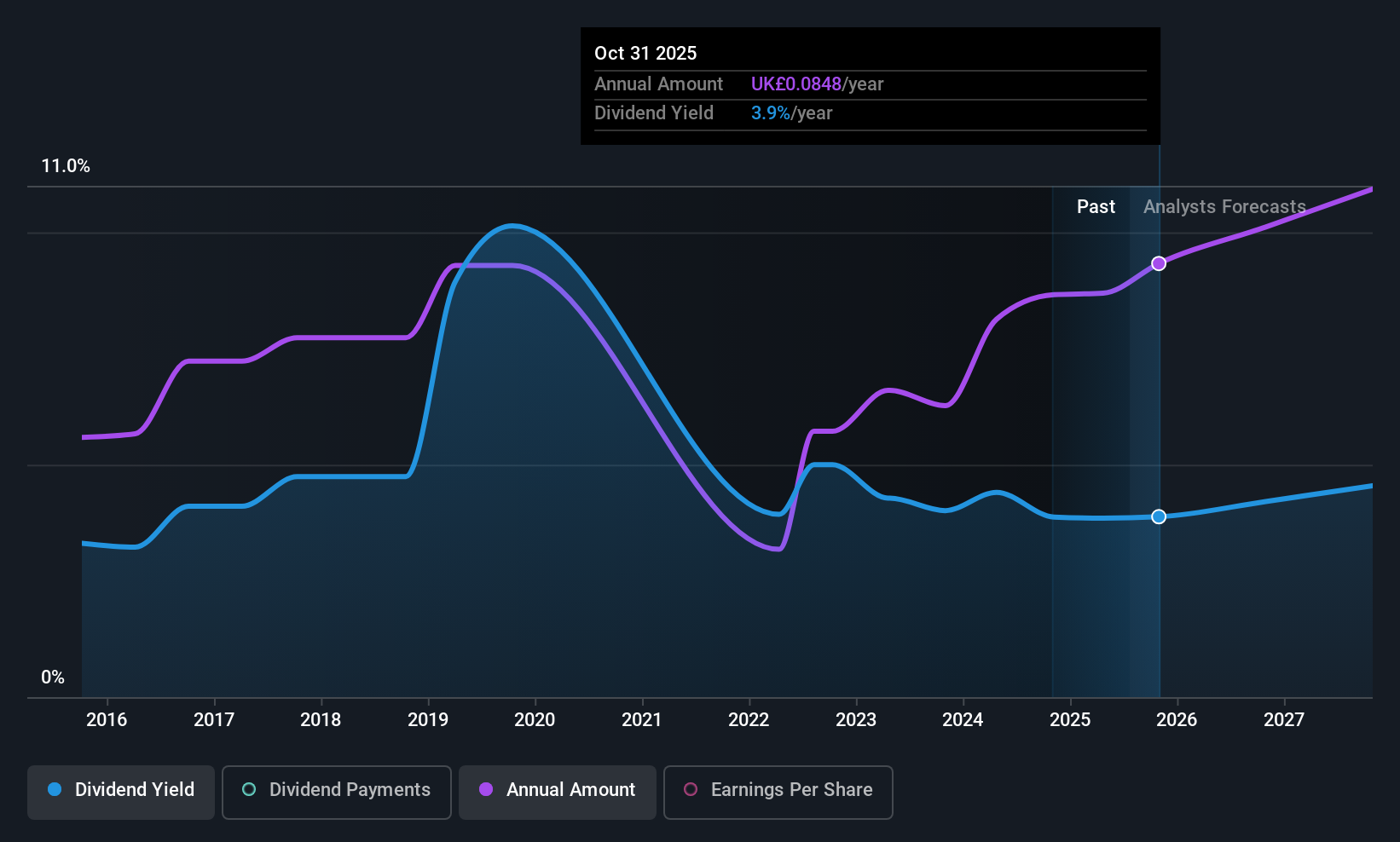

ME Group International (LSE:MEGP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ME Group International plc operates, sells, and services a range of instant-service equipment in the United Kingdom with a market cap of £827.08 million.

Operations: ME Group International plc generates revenue from its operations involving the sale and servicing of instant-service equipment in the UK.

Dividend Yield: 3.6%

ME Group International's dividend yield of 3.61% falls short of the top UK payers, yet its dividends are well-covered by earnings with a payout ratio of 29.4%. Recent increases in interim dividends, up 11.6%, highlight potential growth despite past volatility and an unstable track record over a decade. The company's recent earnings report shows modest revenue growth to £153.79 million, indicating financial stability amidst strategic evaluations for enhancing shareholder value.

- Click to explore a detailed breakdown of our findings in ME Group International's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of ME Group International shares in the market.

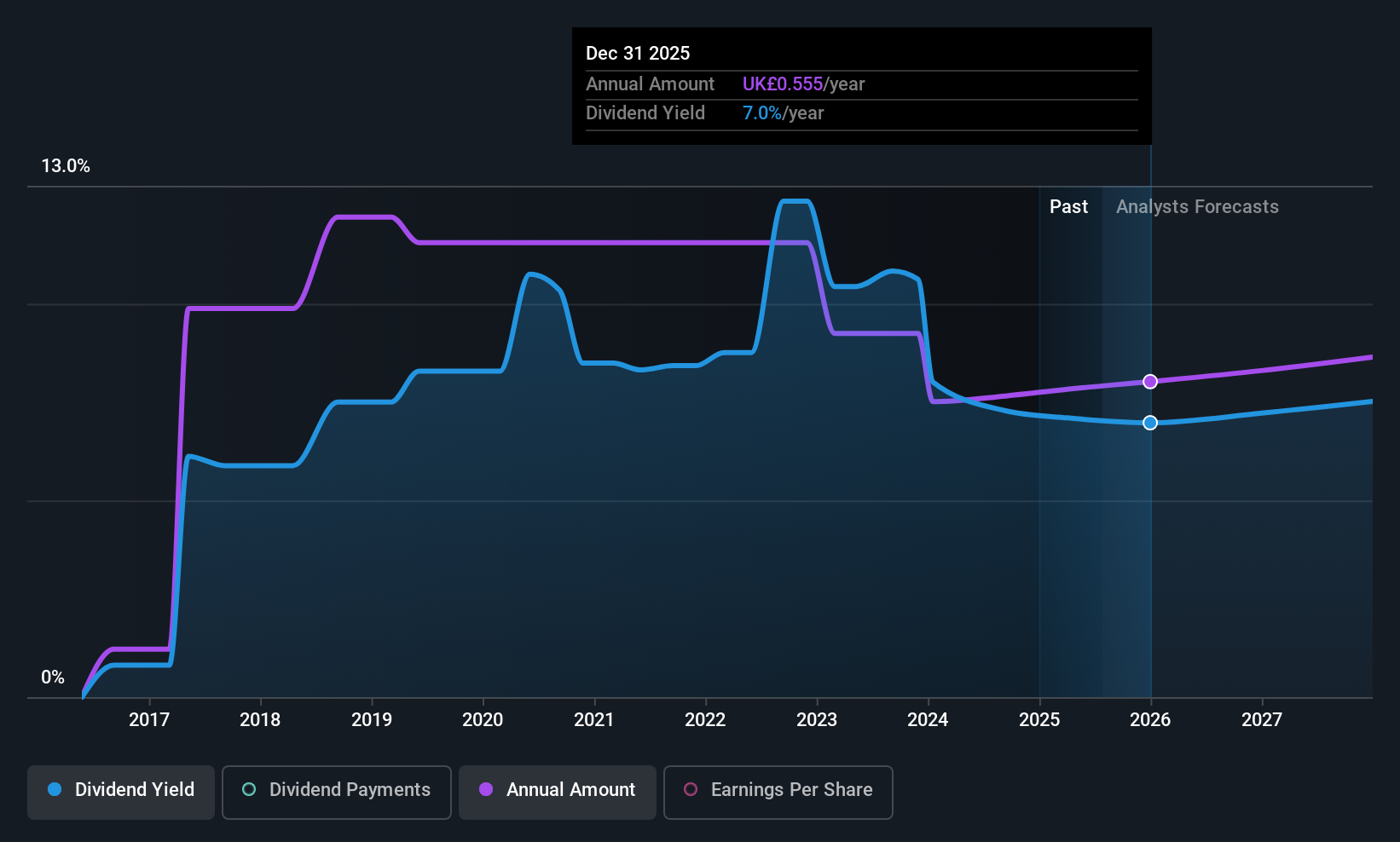

Pollen Street Group (LSE:POLN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pollen Street Group, headquartered in London and founded in 2015, operates as a financial services company with a market cap of £486.32 million.

Operations: Pollen Street Group generates revenue through its Asset Manager segment, which contributes £66.80 million, and its Investment Company segment, which adds £60.38 million.

Dividend Yield: 6.7%

Pollen Street Group's dividend yield of 6.71% ranks in the top 25% of UK dividend payers, supported by a cash payout ratio of 38.6% and earnings payout ratio of 68.1%. Despite these strengths, its dividends have been volatile over a nine-year history, raising concerns about reliability. The company's price-to-earnings ratio of 9.8x suggests good value compared to the broader market, while recent board changes may impact future strategic direction.

- Navigate through the intricacies of Pollen Street Group with our comprehensive dividend report here.

- Our valuation report unveils the possibility Pollen Street Group's shares may be trading at a discount.

Summing It All Up

- Get an in-depth perspective on all 59 Top UK Dividend Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bioventix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BVXP

Bioventix

Bioventix PLC creates, manufactures, and supplies sheep monoclonal antibodies (SMAs) for diagnostic applications worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives