- United Kingdom

- /

- Oil and Gas

- /

- LSE:GENL

3 High Growth UK Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting vulnerabilities tied to global economic shifts. In such uncertain times, stocks with high insider ownership can be appealing as they often signal confidence from those closest to the company, potentially offering resilience amidst broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 80.4% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.7% | 28.2% |

| Facilities by ADF (AIM:ADF) | 12.9% | 144.7% |

| Foresight Group Holdings (LSE:FSG) | 34% | 29.0% |

| Enteq Technologies (AIM:NTQ) | 31% | 53.8% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 29.6% |

| PensionBee Group (LSE:PBEE) | 38.8% | 67.7% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 189.1% |

Let's explore several standout options from the results in the screener.

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mortgage Advice Bureau (Holdings) plc, along with its subsidiaries, offers mortgage advice services in the United Kingdom and has a market cap of £399.90 million.

Operations: The company generates revenue primarily through the provision of financial services, amounting to £243.31 million.

Insider Ownership: 19.8%

Earnings Growth Forecast: 29.6% p.a.

Mortgage Advice Bureau (Holdings) plc has seen substantial insider buying over the past three months, indicating confidence in its growth prospects. Despite a recent dip in earnings, with net income at £3.7 million for the half-year ended June 2024 compared to £6.42 million a year prior, analysts forecast significant annual earnings growth of 29.57%. However, its dividend yield of 4.07% is not well covered by earnings, and share price volatility remains high.

- Unlock comprehensive insights into our analysis of Mortgage Advice Bureau (Holdings) stock in this growth report.

- According our valuation report, there's an indication that Mortgage Advice Bureau (Holdings)'s share price might be on the expensive side.

Genel Energy (LSE:GENL)

Simply Wall St Growth Rating: ★★★★☆☆

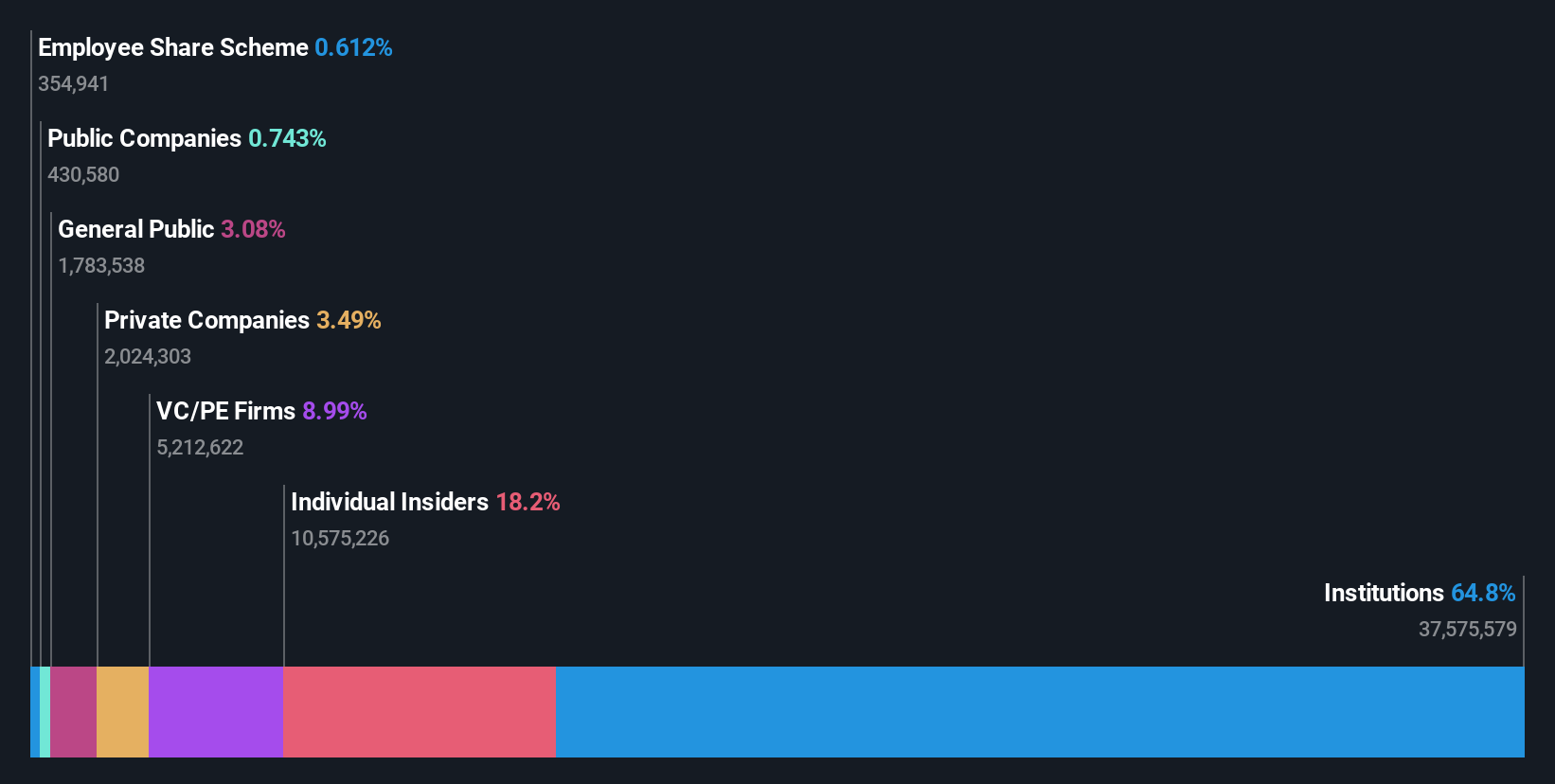

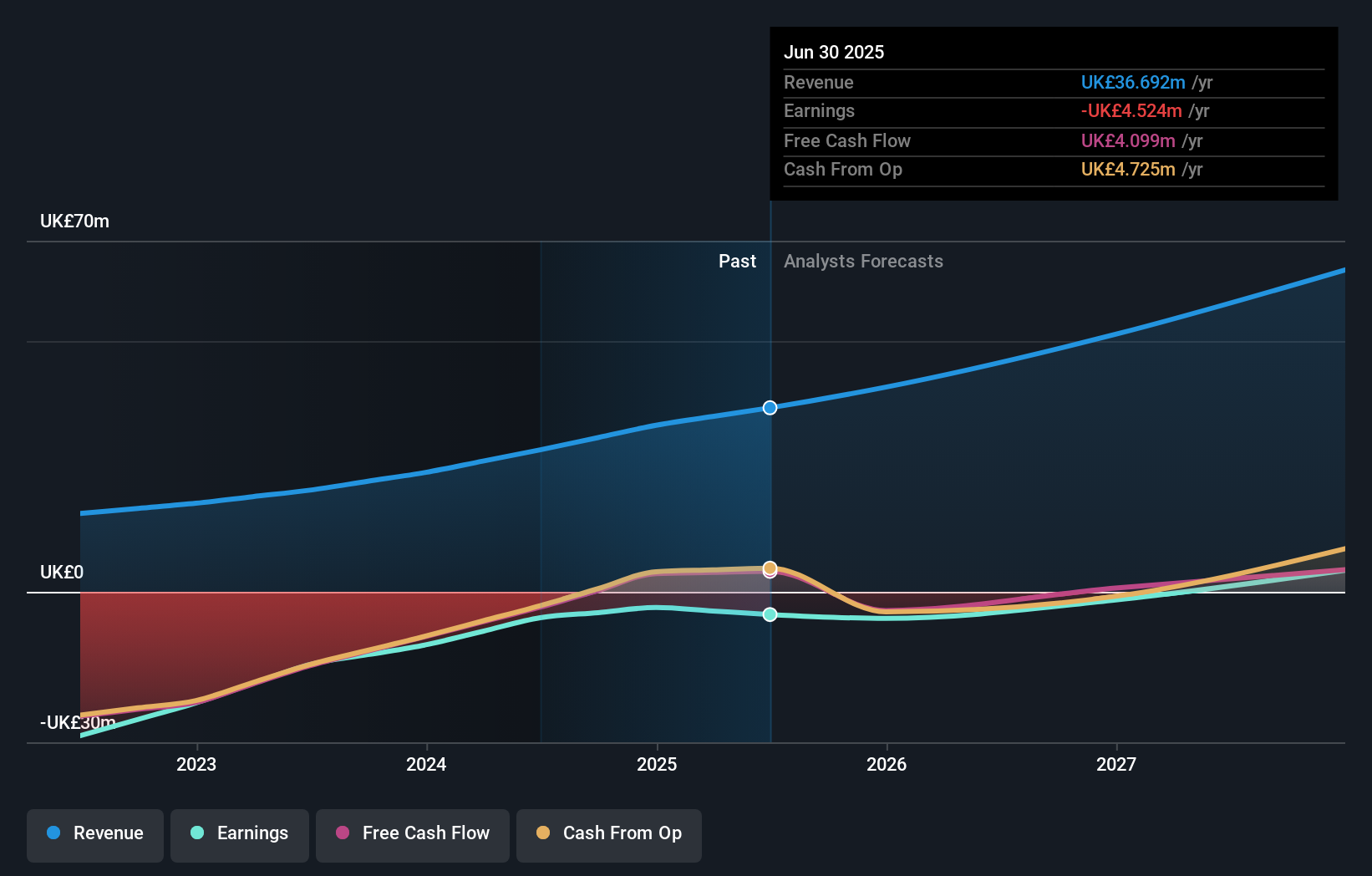

Overview: Genel Energy plc is an independent oil and gas exploration and production company with a market cap of £216.20 million.

Operations: The company generates revenue from its production segment, amounting to $74.40 million.

Insider Ownership: 25.7%

Earnings Growth Forecast: 56.5% p.a.

Genel Energy is expected to achieve profitability within three years, with earnings forecasted to grow at 56.49% annually, surpassing average market growth. Despite revenue growth of 15.4% per year being slower than desired, it remains above the UK market rate. Trading below fair value by 46.3%, insider confidence is evident with substantial buying in recent months and no significant selling activity. Recent board appointments enhance leadership stability and strategic direction.

- Click here to discover the nuances of Genel Energy with our detailed analytical future growth report.

- Our valuation report here indicates Genel Energy may be undervalued.

PensionBee Group (LSE:PBEE)

Simply Wall St Growth Rating: ★★★★★☆

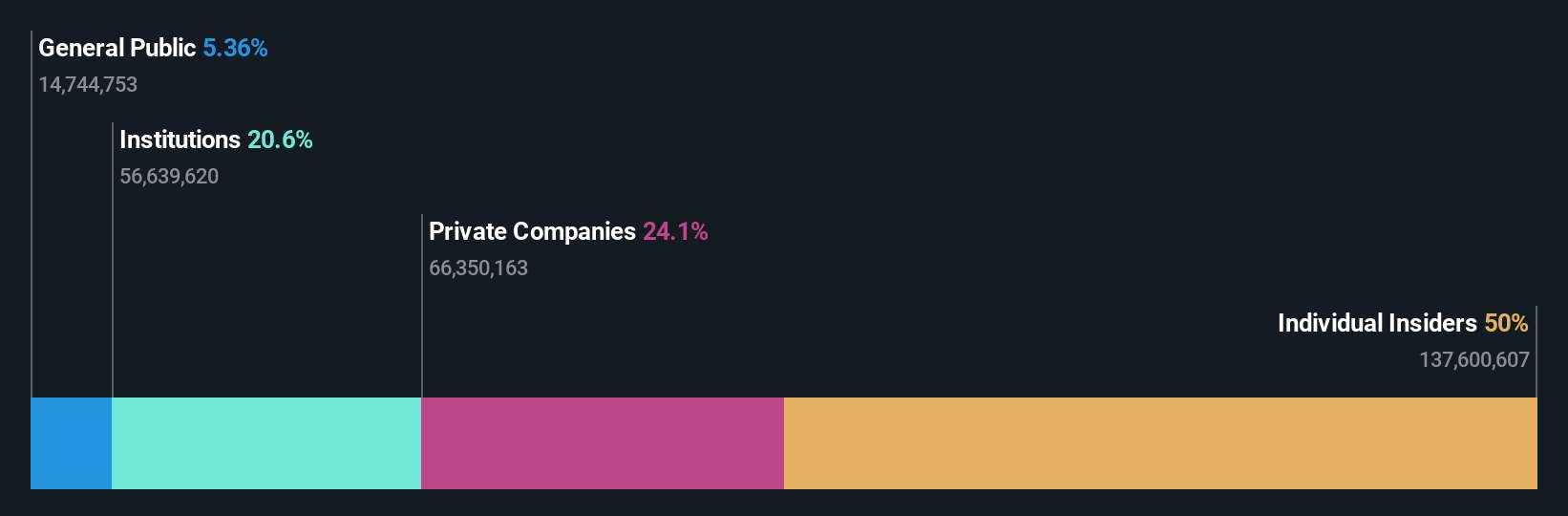

Overview: PensionBee Group plc is a direct-to-consumer financial technology company offering online pension services in the United Kingdom and the United States, with a market cap of £372.96 million.

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to £28.32 million.

Insider Ownership: 38.8%

Earnings Growth Forecast: 67.7% p.a.

PensionBee Group is forecast to achieve profitability within three years, with anticipated revenue growth of 20.7% annually, outpacing the UK market. Despite recent shareholder dilution through a £20 million equity offering, analysts expect a 27.1% stock price increase. The company reported improved financials with sales rising to £15.37 million and a reduced net loss of £3.68 million for H1 2024 compared to last year, signaling positive momentum in earnings performance.

- Dive into the specifics of PensionBee Group here with our thorough growth forecast report.

- The valuation report we've compiled suggests that PensionBee Group's current price could be inflated.

Turning Ideas Into Actions

- Dive into all 61 of the Fast Growing UK Companies With High Insider Ownership we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GENL

Genel Energy

Through its subsidiaries, operates as an independent oil and gas exploration and production company.

Reasonable growth potential with adequate balance sheet.