- United Kingdom

- /

- Commercial Services

- /

- AIM:CPP

3 UK Penny Stocks With Market Caps Under £20M To Consider

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced turbulence, with the FTSE 100 index closing lower amid concerns over weak trade data from China. For investors looking beyond well-established companies, penny stocks—typically smaller or newer firms—offer unique opportunities that remain relevant despite being considered a somewhat outdated term. These stocks can provide a blend of value and growth potential, especially when backed by strong financials and solid fundamentals, making them an intriguing option for those seeking under-the-radar investments.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.25 | £847.72M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.75 | £372.96M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.22 | £104.15M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.445 | £354.36M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.84 | £63.62M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.625 | £189.49M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.316 | £202.97M | ★★★★★☆ |

| Alumasc Group (AIM:ALU) | £3.01 | £108.25M | ★★★★★★ |

| Central Asia Metals (AIM:CAML) | £1.60 | £278.36M | ★★★★★★ |

| Billington Holdings (AIM:BILN) | £4.40 | £54.31M | ★★★★★★ |

Click here to see the full list of 466 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

CPPGroup (AIM:CPP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CPPGroup Plc provides assistance products and services across the United Kingdom, India, Spain, Turkey, and other international markets with a market cap of £11.50 million.

Operations: The company's revenue segments include £0.93 million from Blink, £174.81 million from India, £9.33 million from Legacy operations, and £6.44 million from Turkey.

Market Cap: £11.5M

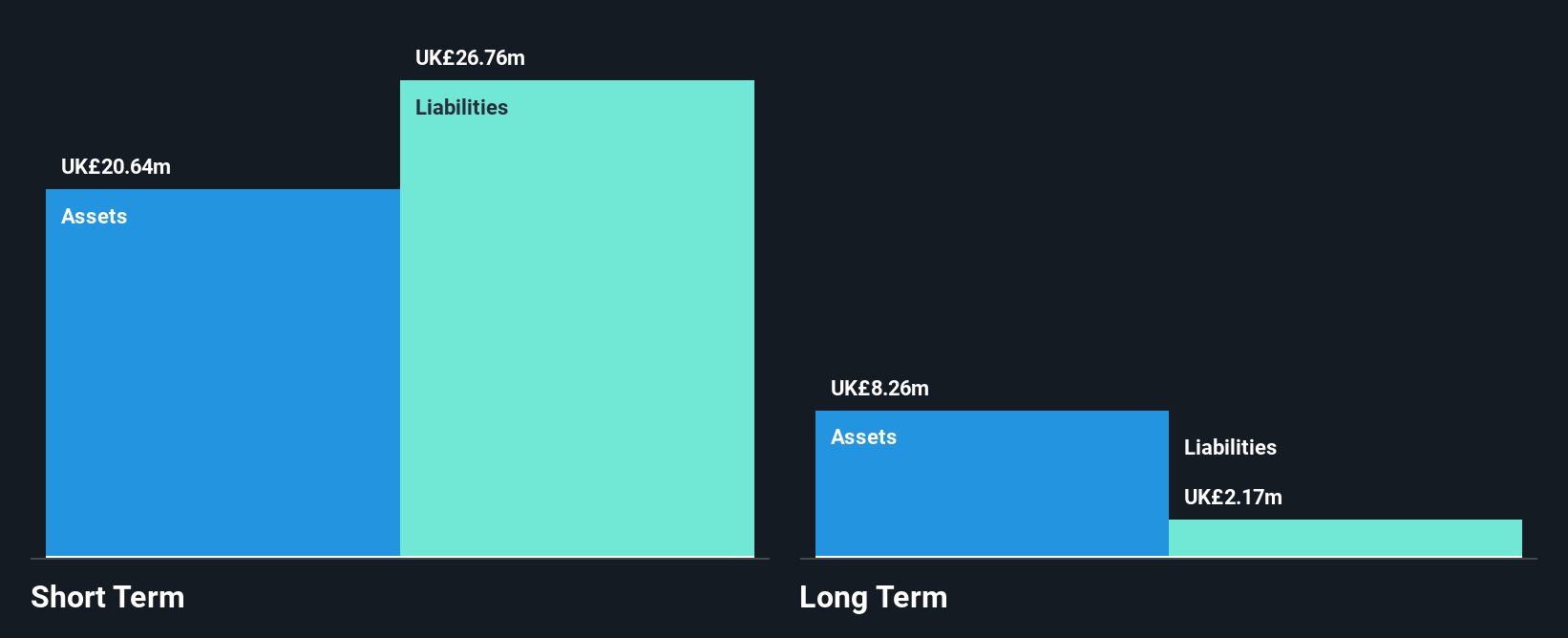

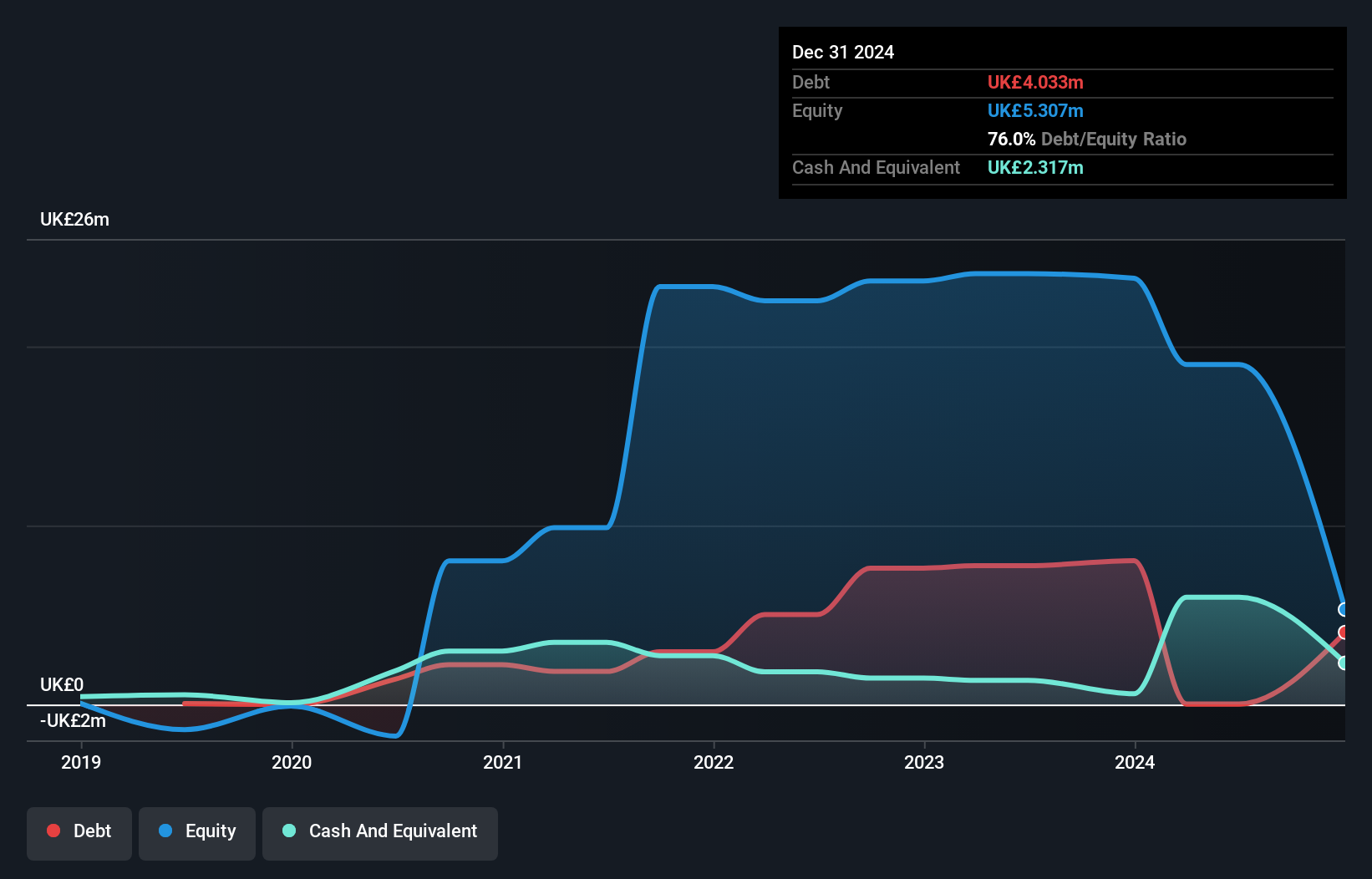

CPPGroup Plc, with a market cap of £11.50 million, operates across multiple international markets but remains unprofitable with a negative return on equity. Despite its debt-free status and sufficient cash runway for over three years if free cash flow grows at historical rates, the company faces challenges such as shareholder dilution and short-term liabilities exceeding short-term assets by £2 million. Recent earnings reports show improvement in net loss from £5.3 million to £0.344 million year-over-year, yet profitability remains elusive. The management team is relatively experienced, though the board's average tenure suggests limited experience overall.

- Unlock comprehensive insights into our analysis of CPPGroup stock in this financial health report.

- Assess CPPGroup's future earnings estimates with our detailed growth reports.

eEnergy Group (AIM:EAAS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: eEnergy Group Plc operates as an integrated energy services company in the United Kingdom and Ireland, with a market cap of £18.59 million.

Operations: The company generates revenue through its integrated energy services operations across the United Kingdom and Ireland.

Market Cap: £18.59M

eEnergy Group Plc, with a market cap of £18.59 million, has recently secured a position on the NHS Commercial Solutions Sustainable Estates Framework Agreement, enhancing its public sector partnerships and credibility as a trusted supplier. Despite this strategic advantage, the company remains unprofitable and has experienced increased losses over the past year. The management team is relatively new with an average tenure of 0.8 years, which might impact stability during this growth phase. While short-term assets exceed liabilities, eEnergy faces challenges with shareholder dilution and limited cash runway under current free cash flow conditions.

- Dive into the specifics of eEnergy Group here with our thorough balance sheet health report.

- Explore eEnergy Group's analyst forecasts in our growth report.

musicMagpie (AIM:MMAG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: musicMagpie plc operates in the re-commerce sector, focusing on consumer technology, books, and disc media products across the United Kingdom and the United States, with a market cap of £8.68 million.

Operations: The company's revenue is derived from Media and Books (£40.02 million), Technology - Rental (£8.05 million), and Technology - Outright (£80.42 million).

Market Cap: £8.68M

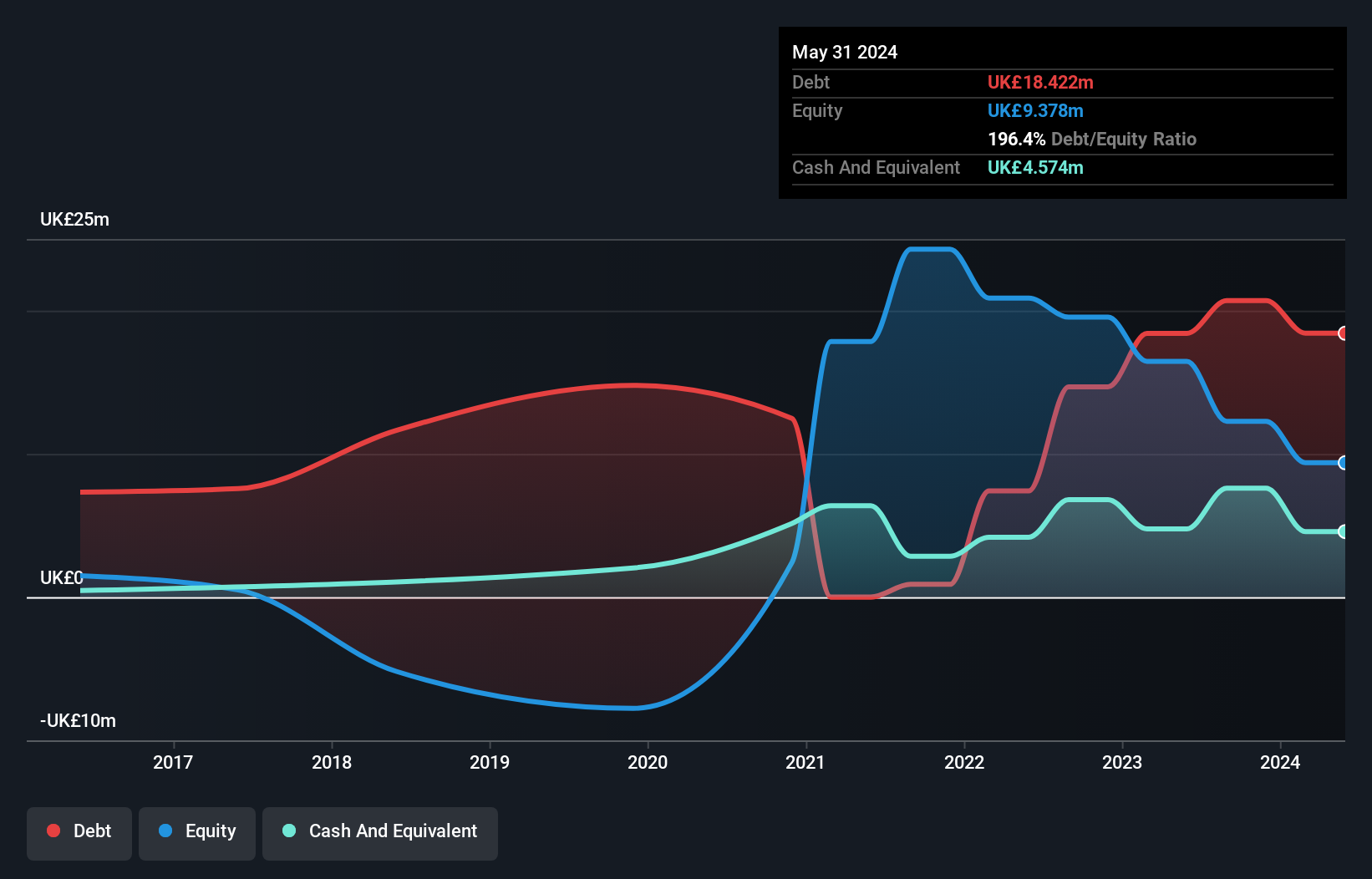

musicMagpie plc, with a market cap of £8.68 million, is currently unprofitable but maintains a cash runway exceeding three years, assuming stable operations. Its revenue streams include Media and Books (£40.02 million) and Technology - Outright (£80.42 million). Despite high net debt to equity ratio (147.7%), the company has improved its financial position from negative shareholder equity five years ago to positive now. Recent developments involve an acquisition by AO World plc for £9.8 million, expected to complete in Q1 2025, leading to musicMagpie's delisting from AIM and re-registration as a private entity upon completion.

- Click to explore a detailed breakdown of our findings in musicMagpie's financial health report.

- Evaluate musicMagpie's historical performance by accessing our past performance report.

Taking Advantage

- Gain an insight into the universe of 466 UK Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CPP

CPPGroup

Engages in creating embedded and ancillary real-time assistance products and resolution service in the India, Turkey, and internationally.

Slight and fair value.

Market Insights

Community Narratives