- United Kingdom

- /

- Capital Markets

- /

- LSE:LWDB

Undiscovered Gems B.P. Marsh & Partners And 2 Other Promising UK Stocks

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index experiences fluctuations due to weak trade data from China and broader global economic uncertainties, investors are increasingly turning their attention to smaller, potentially undervalued opportunities within the market. In this landscape, identifying promising small-cap stocks like B.P. Marsh & Partners can offer a strategic edge, particularly for those seeking resilience and growth potential amidst volatile conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| Bioventix | NA | 7.39% | 5.15% | ★★★★★★ |

| Georgia Capital | NA | 6.53% | 10.96% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.15% | 75.08% | 74.27% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

B.P. Marsh & Partners (AIM:BPM)

Simply Wall St Value Rating: ★★★★★★

Overview: B.P. Marsh & Partners PLC specializes in investing in early-stage and SME financial services intermediary businesses both in the United Kingdom and internationally, with a market capitalization of £247.59 million.

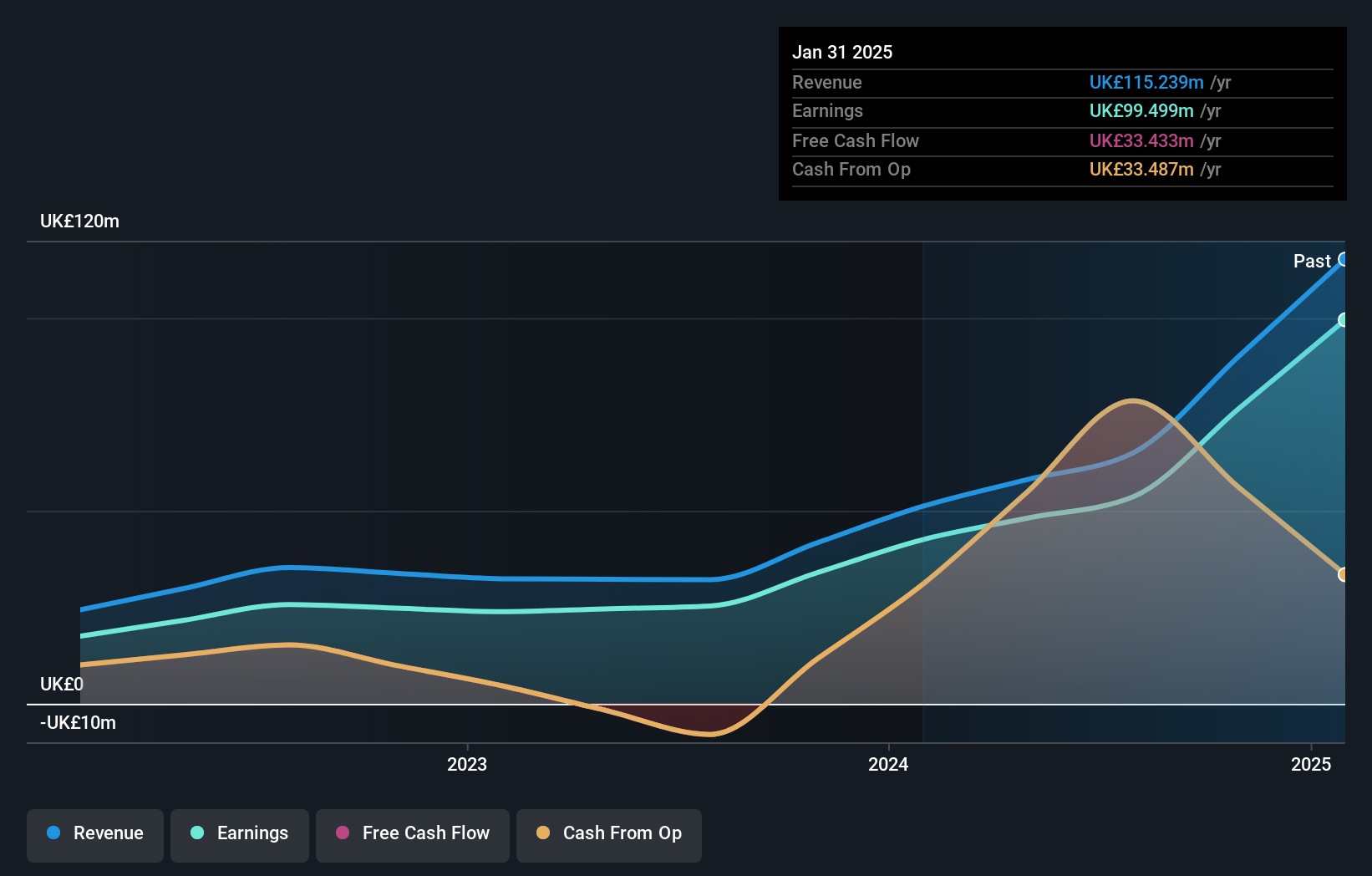

Operations: B.P. Marsh & Partners generates revenue primarily through the provision of consultancy services and trading investments in financial services, amounting to £115.24 million.

B.P. Marsh & Partners is making waves with its recent 134% earnings growth, outpacing the Capital Markets industry's 5.2%. The firm boasts a debt-free balance sheet, eliminating concerns over interest payments and underscoring its financial health. Trading at 33.1% below estimated fair value, it presents an intriguing opportunity for investors seeking undervalued assets. The company recently completed a follow-on equity offering of £23.57 million to bolster its resources further, which seems to align with their strategic growth plans. With high-quality non-cash earnings and positive free cash flow, B.P. Marsh appears well-positioned in the market landscape.

- Get an in-depth perspective on B.P. Marsh & Partners' performance by reading our health report here.

Sylvania Platinum (AIM:SLP)

Simply Wall St Value Rating: ★★★★★★

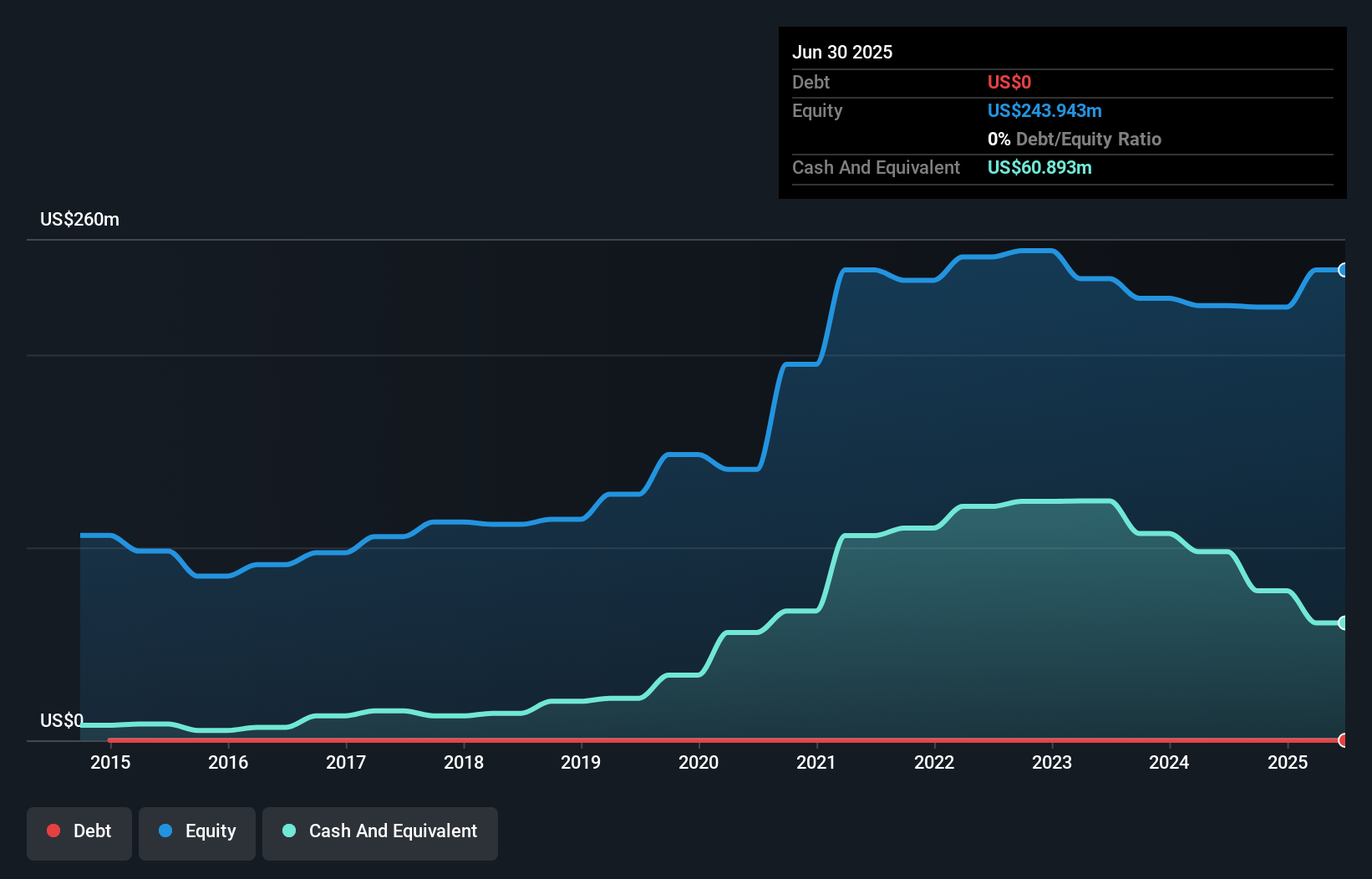

Overview: Sylvania Platinum Limited, with a market cap of £200.28 million, operates in South Africa focusing on the retreatment of platinum group metals (PGM) bearing chrome tailings materials.

Operations: Sylvania Platinum generates revenue through the retreatment of PGM-bearing chrome tailings materials. The company's financial performance is highlighted by a net profit margin of 29.5%, indicating efficient management of its expenses relative to income.

Sylvania Platinum, a nimble player in the metals and mining sector, has shown remarkable financial performance with earnings surging by 188.8% over the past year. Trading at 89.4% below its estimated fair value, this debt-free company offers an intriguing prospect for investors seeking undervalued opportunities. Recent results highlight sales of $104 million compared to $82 million previously, while net income jumped to $20 million from $7 million last year. The Thaba joint venture is set to diversify revenue streams with PGMs and chrome, although rising costs and regulatory challenges in South Africa could pose hurdles ahead.

Law Debenture (LSE:LWDB)

Simply Wall St Value Rating: ★★★★★☆

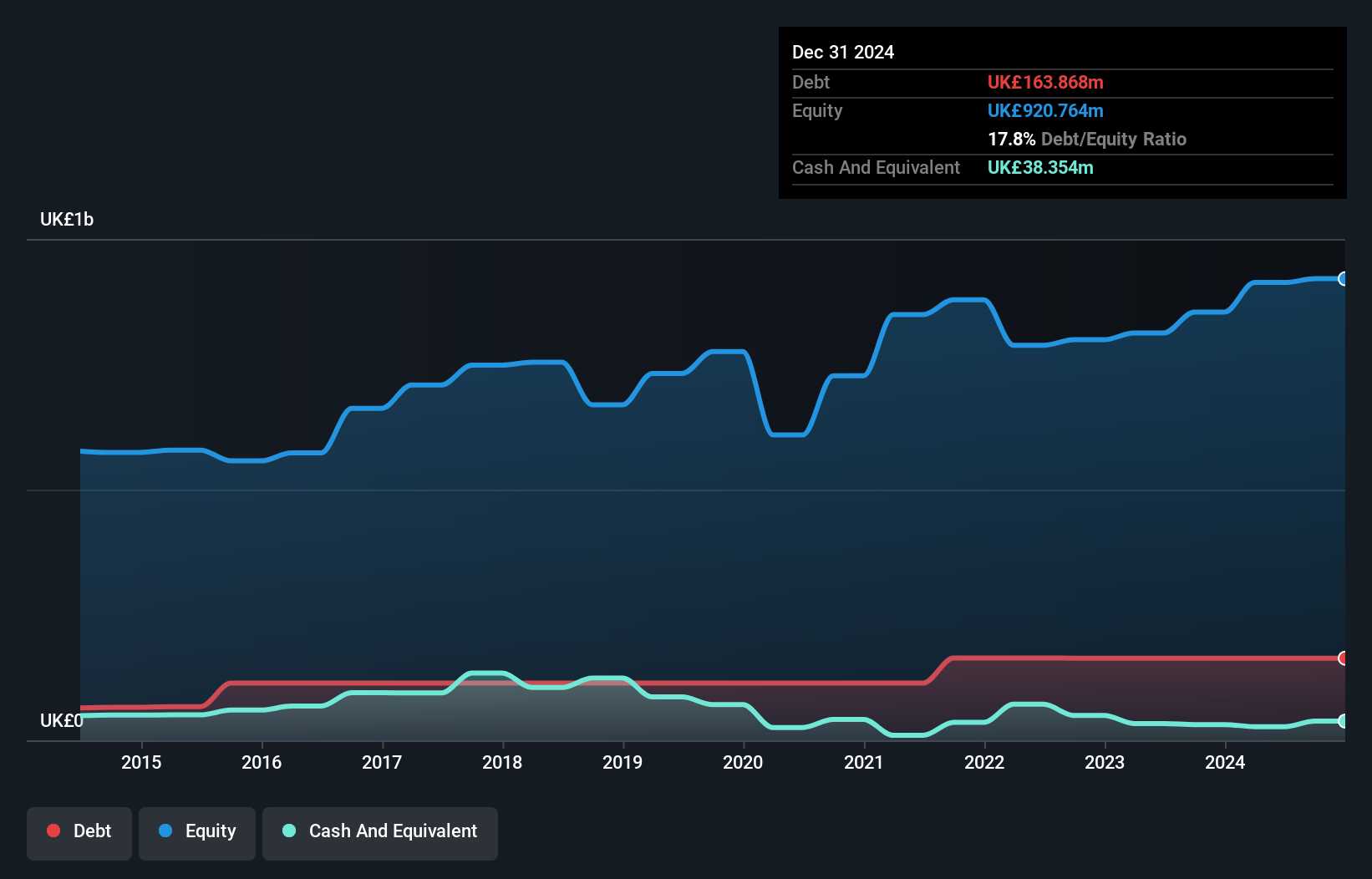

Overview: The Law Debenture Corporation p.l.c. is an investment trust that offers independent professional services globally to various entities and individuals, with a market cap of £1.34 billion.

Operations: Law Debenture generates revenue primarily from two segments: its investment portfolio, contributing £38.42 million, and independent professional services, adding £63.99 million. The net profit margin is a key metric to consider when evaluating financial performance over time.

Law Debenture, a unique player in the UK market, has demonstrated robust financial health with its debt to equity ratio decreasing from 18.7% to 15.4% over five years. The company's earnings growth of 20.9% last year outpaced the industry average of 5.2%, showcasing its competitive edge. With a price-to-earnings ratio of just 7.9x compared to the broader UK market's 16.3x, it offers compelling value for investors seeking opportunities beyond large caps. Recent half-year results highlight significant revenue and net income increases to £188 million and £155 million respectively, reflecting strong operational performance and strategic positioning in capital markets.

- Dive into the specifics of Law Debenture here with our thorough health report.

Gain insights into Law Debenture's past trends and performance with our Past report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 63 UK Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LWDB

Law Debenture

An investment trust, provides independent professional services to companies, agencies, organizations, and individuals worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives