- United Kingdom

- /

- Commercial Services

- /

- AIM:WATR

3 UK Penny Stocks With Market Caps Under $90M

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. In such a climate, investors often look for opportunities that offer both value and potential growth, which is where penny stocks can come into play. Although the term 'penny stocks' might seem outdated, these smaller or newer companies can still present significant opportunities when they are backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.85 | £467.47M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.20 | £828.88M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.74 | £202.9M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.415 | £347M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.9644 | £394.28M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.48 | £188.48M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.328 | £204.82M | ★★★★★☆ |

| Tristel (AIM:TSTL) | £4.20 | £200.13M | ★★★★★★ |

| Character Group (AIM:CCT) | £2.80 | £52.57M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4745 | $275.84M | ★★★★★★ |

Click here to see the full list of 471 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Checkit (AIM:CKT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Checkit plc, with a market cap of £22.14 million, offers intelligent operations management platforms designed for deskless workforces in the United Kingdom and the Americas.

Operations: The company generates £13 million in revenue from its Electronic Components & Parts segment.

Market Cap: £22.14M

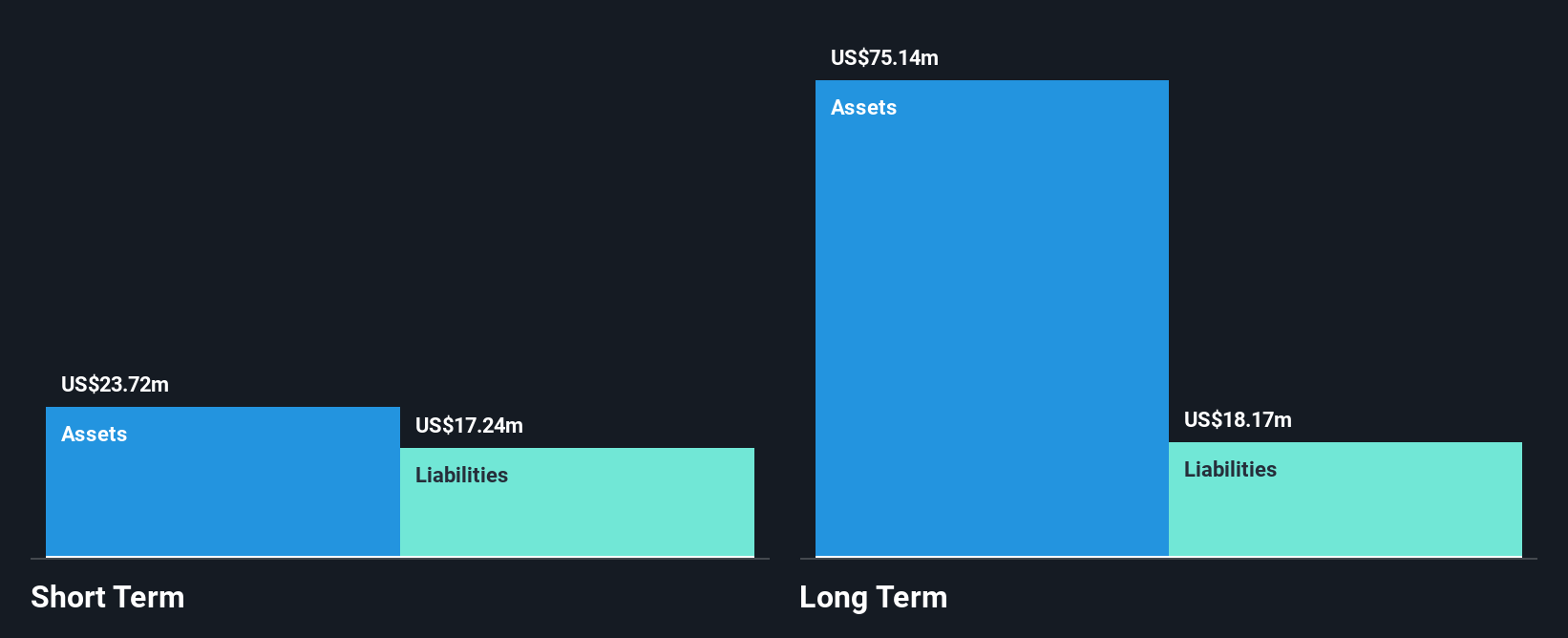

Checkit plc, with a market cap of £22.14 million, is focused on intelligent operations management platforms and reported half-year sales of £6.7 million, up from £5.7 million the previous year. Despite being debt-free and having short-term assets exceeding liabilities, Checkit remains unprofitable with a net loss of £2.6 million for the period ending July 2024. The company trades significantly below estimated fair value but faces challenges such as high share price volatility and an inexperienced board with an average tenure of 2.6 years. Revenue is forecast to grow by 15% annually, though profitability isn't expected soon.

- Take a closer look at Checkit's potential here in our financial health report.

- Review our growth performance report to gain insights into Checkit's future.

Water Intelligence (AIM:WATR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Water Intelligence plc, with a market cap of £70.01 million, offers leak detection and remediation services for both potable and non-potable water across the United States, the United Kingdom, Australia, Canada, and other international markets.

Operations: The company's revenue is primarily derived from US Corporate Operated Locations ($53.53 million), followed by Franchise Related Activities ($10.83 million), International Corporate Operated Locations ($7.80 million), and Franchise Royalty Income ($6.66 million).

Market Cap: £70.01M

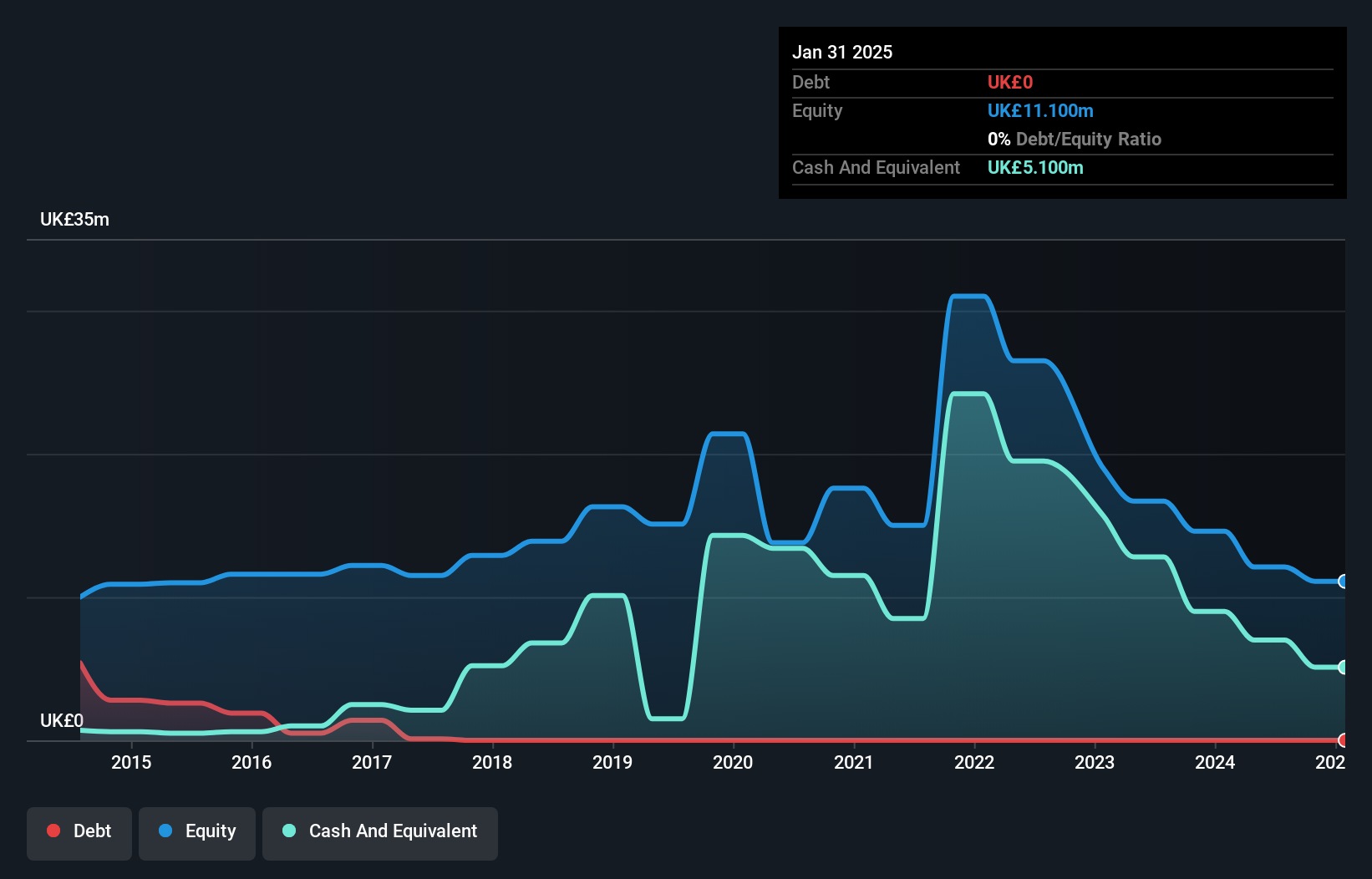

Water Intelligence plc, with a market cap of £70.01 million, has demonstrated consistent earnings growth of 15.9% annually over the past five years and reported half-year sales of US$41.53 million for June 2024, up from US$38.67 million the previous year. The company is undertaking a share buyback program authorized at its recent AGM and has refinanced debt to support strategic growth plans without shareholder dilution. Despite trading below estimated fair value, Water Intelligence maintains stable profit margins and covers interest payments well, though its Return on Equity remains low at 7.8%.

- Dive into the specifics of Water Intelligence here with our thorough balance sheet health report.

- Evaluate Water Intelligence's prospects by accessing our earnings growth report.

Life Settlement Assets (LSE:LSAA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Life Settlement Assets PLC is a closed-ended investment trust company that manages investments in whole and fractional interests in life settlement policies from U.S. life insurance companies, with a market cap of $85.23 million.

Operations: The company generates revenue of $16.68 million from its life settlement portfolios.

Market Cap: $85.23M

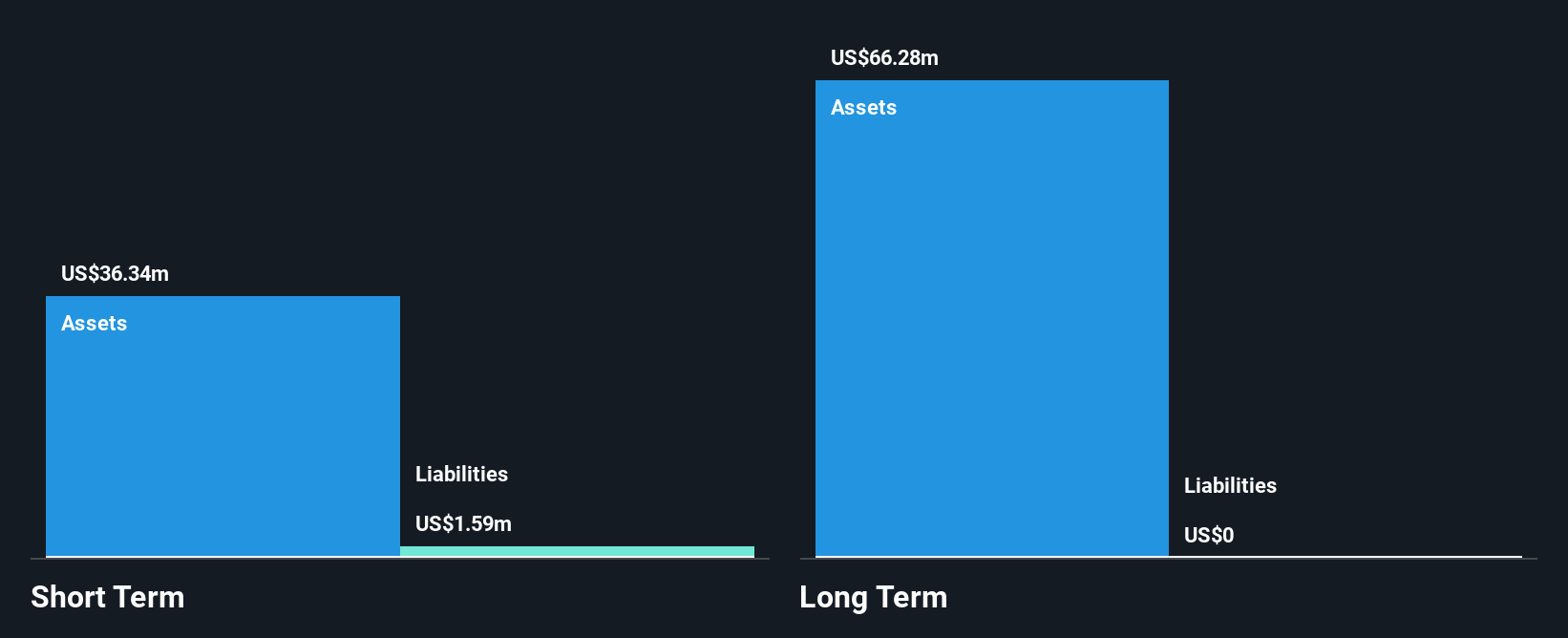

Life Settlement Assets PLC, with a market cap of US$85.23 million, has shown significant earnings growth of 410.7% over the past year despite a five-year decline trend. The company remains debt-free and maintains high-quality earnings with stable weekly volatility at 3%. Its recent half-year results reported revenue of US$8.13 million and net income of US$3.51 million, reflecting improved profit margins from the previous year. The firm completed a share buyback totaling US$2.95 million, enhancing shareholder value without dilution concerns. However, its Return on Equity is relatively low at 6.4%, indicating room for improvement in efficiency metrics.

- Navigate through the intricacies of Life Settlement Assets with our comprehensive balance sheet health report here.

- Gain insights into Life Settlement Assets' historical outcomes by reviewing our past performance report.

Taking Advantage

- Reveal the 471 hidden gems among our UK Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Water Intelligence might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:WATR

Water Intelligence

Provides leak detection and remediation services for potable and non-potable water in the United States, the United Kingdom, Australia, Canada, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives