- United Kingdom

- /

- Consumer Finance

- /

- LSE:KSPI

Investors Aren't Entirely Convinced By Joint Stock Company Kaspi.kz's (LON:KSPI) Earnings

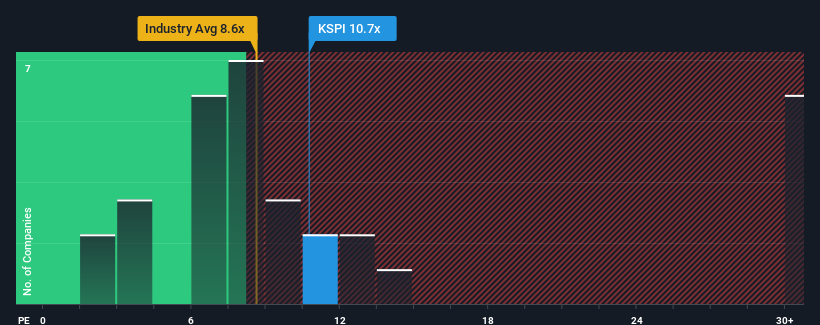

When close to half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 16x, you may consider Joint Stock Company Kaspi.kz (LON:KSPI) as an attractive investment with its 10.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been pleasing for Kaspi.kz as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Kaspi.kz

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Kaspi.kz's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 48% last year. The strong recent performance means it was also able to grow EPS by 222% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 21% over the next year. That's shaping up to be materially higher than the 13% growth forecast for the broader market.

With this information, we find it odd that Kaspi.kz is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Kaspi.kz's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Kaspi.kz currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 1 warning sign for Kaspi.kz that we have uncovered.

If you're unsure about the strength of Kaspi.kz's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kaspi.kz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:KSPI

Kaspi.kz

Provides payments, marketplace, and fintech solutions for consumers and merchants in the Republic of Kazakhstan.

Flawless balance sheet with solid track record and pays a dividend.