- United Kingdom

- /

- Consumer Finance

- /

- LSE:IPF

International Personal Finance (LON:IPF) Share Prices Have Dropped 70% In The Last Five Years

It is doubtless a positive to see that the International Personal Finance plc (LON:IPF) share price has gained some 46% in the last three months. But that is little comfort to those holding over the last half decade, sitting on a big loss. In that time the share price has delivered a rude shock to holders, who find themselves down 70% after a long stretch. So we're hesitant to put much weight behind the short term increase. We'd err towards caution given the long term under-performance.

See our latest analysis for International Personal Finance

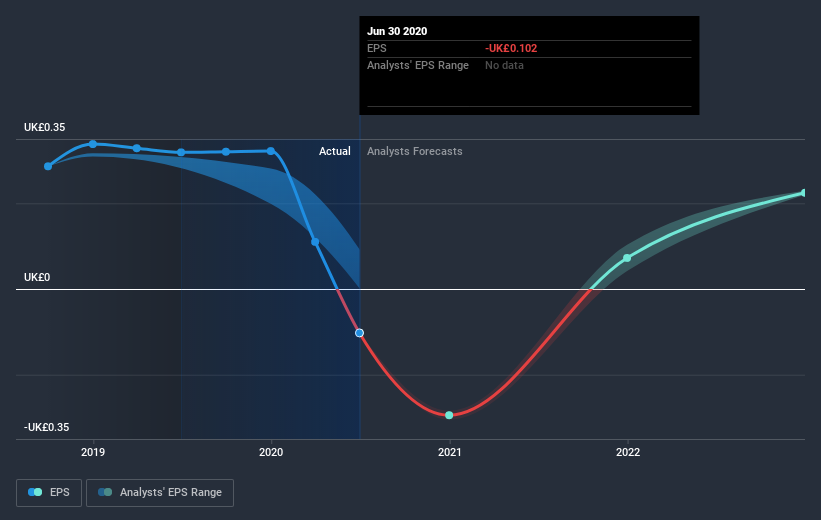

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

In the last half decade International Personal Finance saw its share price fall as its EPS declined below zero. The recent extraordinary items contributed to this situation. At present it's hard to make valid comparisons between EPS and the share price. But we would generally expect a lower price, given the situation.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on International Personal Finance's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between International Personal Finance's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that International Personal Finance's TSR, which was a 61% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

We regret to report that International Personal Finance shareholders are down 38% for the year. Unfortunately, that's worse than the broader market decline of 8.7%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for International Personal Finance (1 is concerning) that you should be aware of.

We will like International Personal Finance better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade International Personal Finance, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:IPF

International Personal Finance

Engages in financial services business in Europe and Mexico.

Very undervalued with proven track record.

Market Insights

Community Narratives