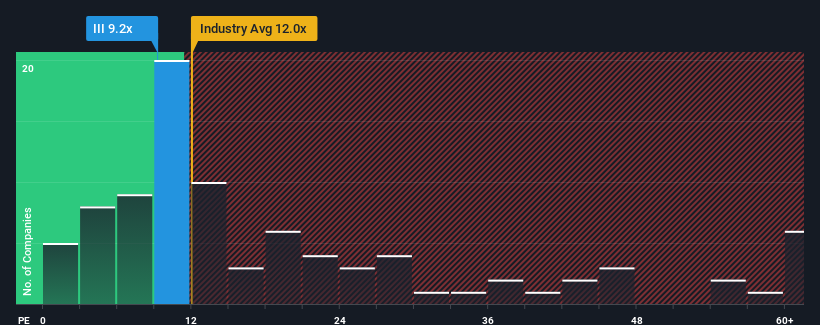

3i Group plc's (LON:III) price-to-earnings (or "P/E") ratio of 9.2x might make it look like a buy right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios above 17x and even P/E's above 29x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

3i Group hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for 3i Group

Is There Any Growth For 3i Group?

In order to justify its P/E ratio, 3i Group would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 6.3%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 51% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 15% each year over the next three years. That's shaping up to be similar to the 14% per annum growth forecast for the broader market.

With this information, we find it odd that 3i Group is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of 3i Group's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for 3i Group with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of 3i Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if 3i Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:III

3i Group

A private equity firm specializing in mature companies, growth capital, middle markets, infrastructure, and management leveraged buyouts and buy-ins.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives