- United Kingdom

- /

- Capital Markets

- /

- LSE:FGEN

Exploring November 2024's Undervalued Small Caps On UK With Insider Action

Reviewed by Simply Wall St

As the United Kingdom's markets react to weak trade data from China, with both the FTSE 100 and FTSE 250 indices experiencing declines, investors are closely monitoring how these global economic shifts impact small-cap stocks. In this environment, identifying potentially undervalued small caps with insider action can offer intriguing opportunities for those looking to navigate the current market conditions effectively.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Senior | 18.9x | 0.6x | 34.73% | ★★★★★★ |

| J D Wetherspoon | 15.3x | 0.4x | 22.32% | ★★★★★★ |

| NWF Group | 8.2x | 0.1x | 38.55% | ★★★★★☆ |

| John Wood Group | NA | 0.2x | 40.79% | ★★★★★☆ |

| Genus | 162.8x | 1.9x | 17.56% | ★★★★★☆ |

| Headlam Group | NA | 0.2x | 25.23% | ★★★★★☆ |

| Optima Health | NA | 1.3x | 36.45% | ★★★★☆☆ |

| Sabre Insurance Group | 11.2x | 1.5x | 12.86% | ★★★☆☆☆ |

| Marlowe | NA | 0.8x | 38.99% | ★★★☆☆☆ |

| THG | NA | 0.3x | -267.98% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

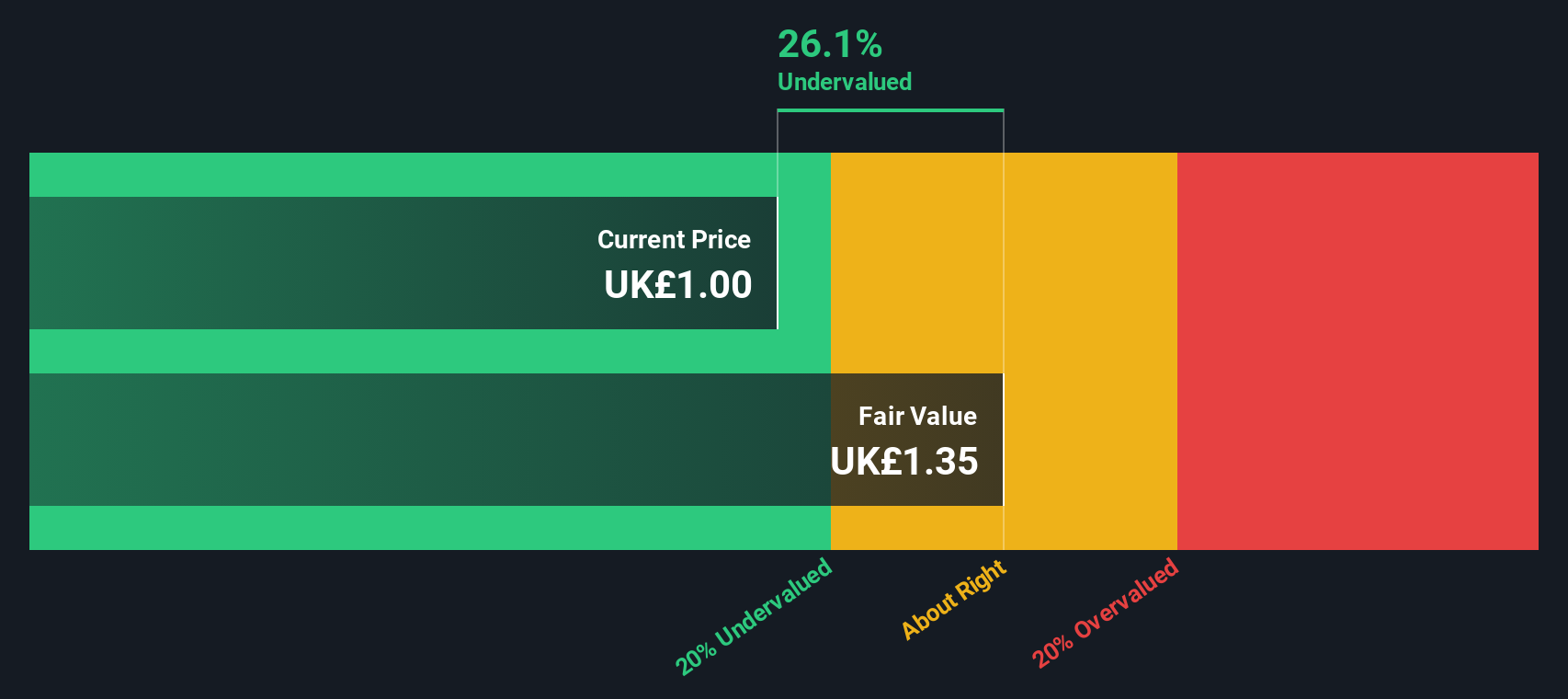

Learning Technologies Group (AIM:LTG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Learning Technologies Group is a company specializing in digital learning and talent management solutions, with operations divided into Content & Services and Software & Platforms segments, and a market capitalization of approximately £1.2 billion.

Operations: Learning Technologies Group generates revenue primarily from Content & Services (£390.17 million) and Software & Platforms (£137.88 million). The company's gross profit margin has experienced fluctuations, reaching 14.67% in mid-2014 and peaking at 33.92% by the end of 2019, before settling at approximately 14.67% by mid-2024.

PE: 15.1x

Learning Technologies Group, a small UK company, is navigating a complex landscape with recent M&A discussions. General Atlantic's cash offer of £790 million for LTG highlights potential market interest. Despite volatile share prices and forecasted earnings decline by 9% annually over three years, insider confidence remains strong with significant purchases in the past year. The board declared an interim dividend of £0.0045 per share amidst these developments, indicating cautious optimism about future prospects.

- Unlock comprehensive insights into our analysis of Learning Technologies Group stock in this valuation report.

Understand Learning Technologies Group's track record by examining our Past report.

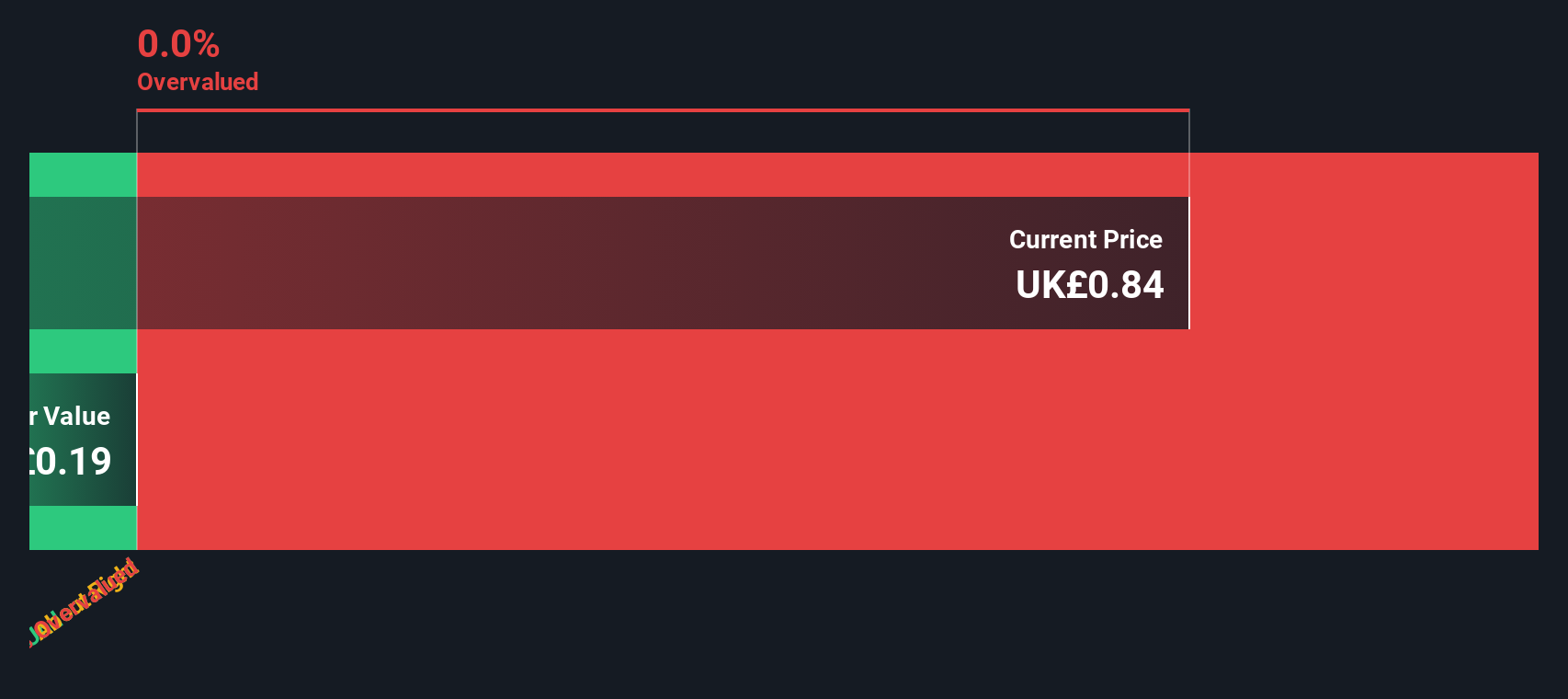

Foresight Environmental Infrastructure (LSE:FGEN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Foresight Environmental Infrastructure focuses on investing in environmental infrastructure projects, with a market capitalization of approximately £3.03 billion.

Operations: Foresight Environmental Infrastructure primarily generates revenue from its environmental infrastructure investments. The company has consistently reported a gross profit margin of 100% over the observed periods, indicating that its revenue equals its gross profit. Operating expenses have shown a gradual increase, reaching £10.11 million by March 2024, impacting net income margins which have fluctuated significantly, with recent figures showing negative trends.

PE: -39.8x

Foresight Environmental Infrastructure, a small UK company, is currently seen as undervalued in the market. Despite reporting less than £1 million in revenue and relying entirely on external borrowing for funding, which poses higher risk, insider confidence is evident through recent share purchases. The company's buyback plan announced on August 15, 2024, aims to repurchase up to £20 million worth of shares. This strategic move could potentially enhance shareholder value and signal optimism about future prospects.

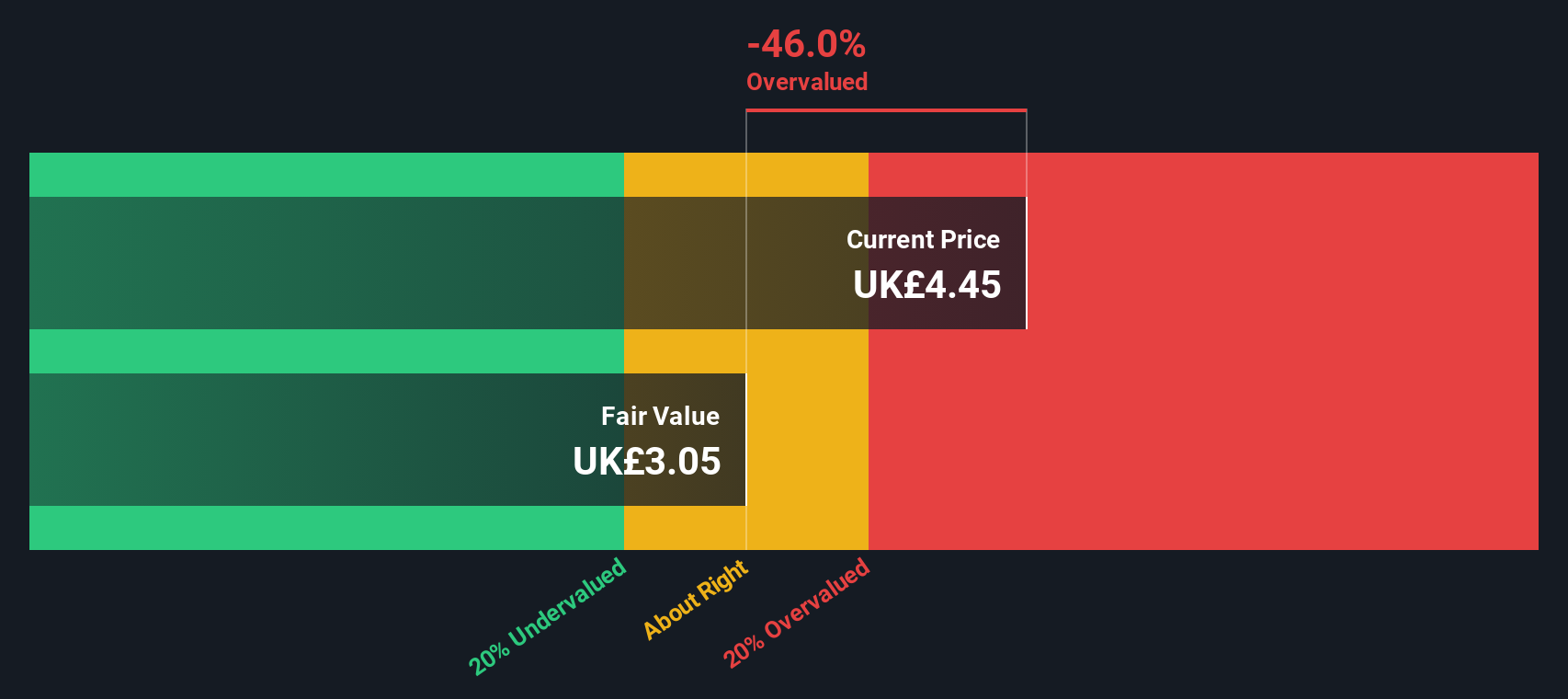

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pinewood Technologies Group is a company that specializes in software solutions, with operations focused on providing innovative technology services to its clients, and has a market capitalization of £1.75 billion.

Operations: Pinewood Technologies Group's revenue primarily stems from its software segment, with a recent gross profit margin of 88.98%. The company has experienced fluctuations in net income margin, which was notably high at 33.88% in the latest period.

PE: 36.9x

Pinewood Technologies Group, a small UK stock, recently secured a five-year contract with Marshall Motor Group to implement its systems across 120 dealerships. This move follows successful integration into Litha Motors' UK businesses. Despite reporting sales growth to £16.1 million for the half-year ending July 2024, net income dropped significantly from £26.9 million to £5 million year-over-year. Insider confidence is evident as they purchased shares between August and October 2024, indicating potential belief in future growth prospects despite recent earnings challenges.

Taking Advantage

- Navigate through the entire inventory of 24 Undervalued UK Small Caps With Insider Buying here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FGEN

Foresight Environmental Infrastructure

John Laing Environmental Assets Group Limited is a fund of John Laing Capital Management Limited.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives