- United Kingdom

- /

- Auto Components

- /

- AIM:AUTG

February 2025's Top Penny Stocks On The UK Exchange

Reviewed by Simply Wall St

The UK market has been facing challenges as the FTSE 100 index recently faltered due to weak trade data from China, highlighting concerns about global economic recovery. Despite these broader market pressures, there are still opportunities for investors willing to explore smaller companies. Penny stocks, though an older term, remain relevant as they often represent newer or less-established companies with potential value. By focusing on those with strong financials and growth potential, investors can uncover promising opportunities among these lesser-known stocks.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.96 | £152.99M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.855 | £468.01M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.95 | £319.11M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £448.86M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.09 | £307.32M | ★★★★☆☆ |

| ME Group International (LSE:MEGP) | £2.185 | £823.34M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.25 | £160.52M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.23 | £80.67M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.866 | £73.51M | ★★★★★★ |

Click here to see the full list of 442 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Autins Group (AIM:AUTG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Autins Group plc is an investment holding company that specializes in providing noise, vibration, and harshness insulation materials, with a market cap of £3.82 million.

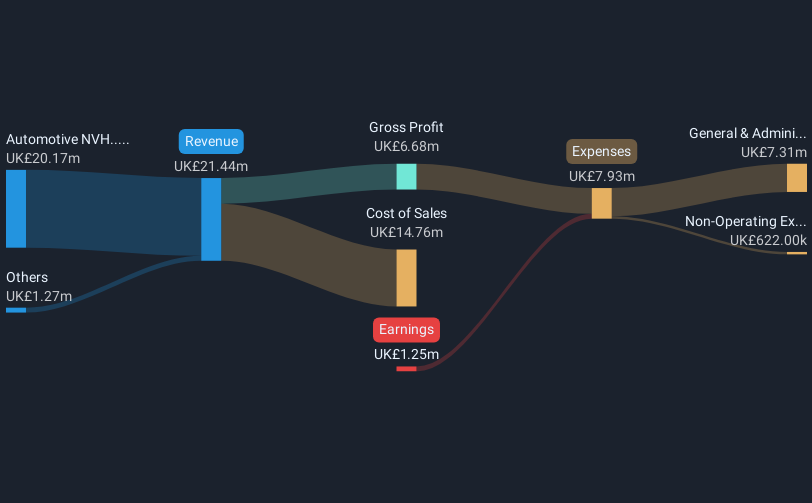

Operations: The company generates revenue primarily from its Automotive NVH segment, which accounts for £20.17 million.

Market Cap: £3.82M

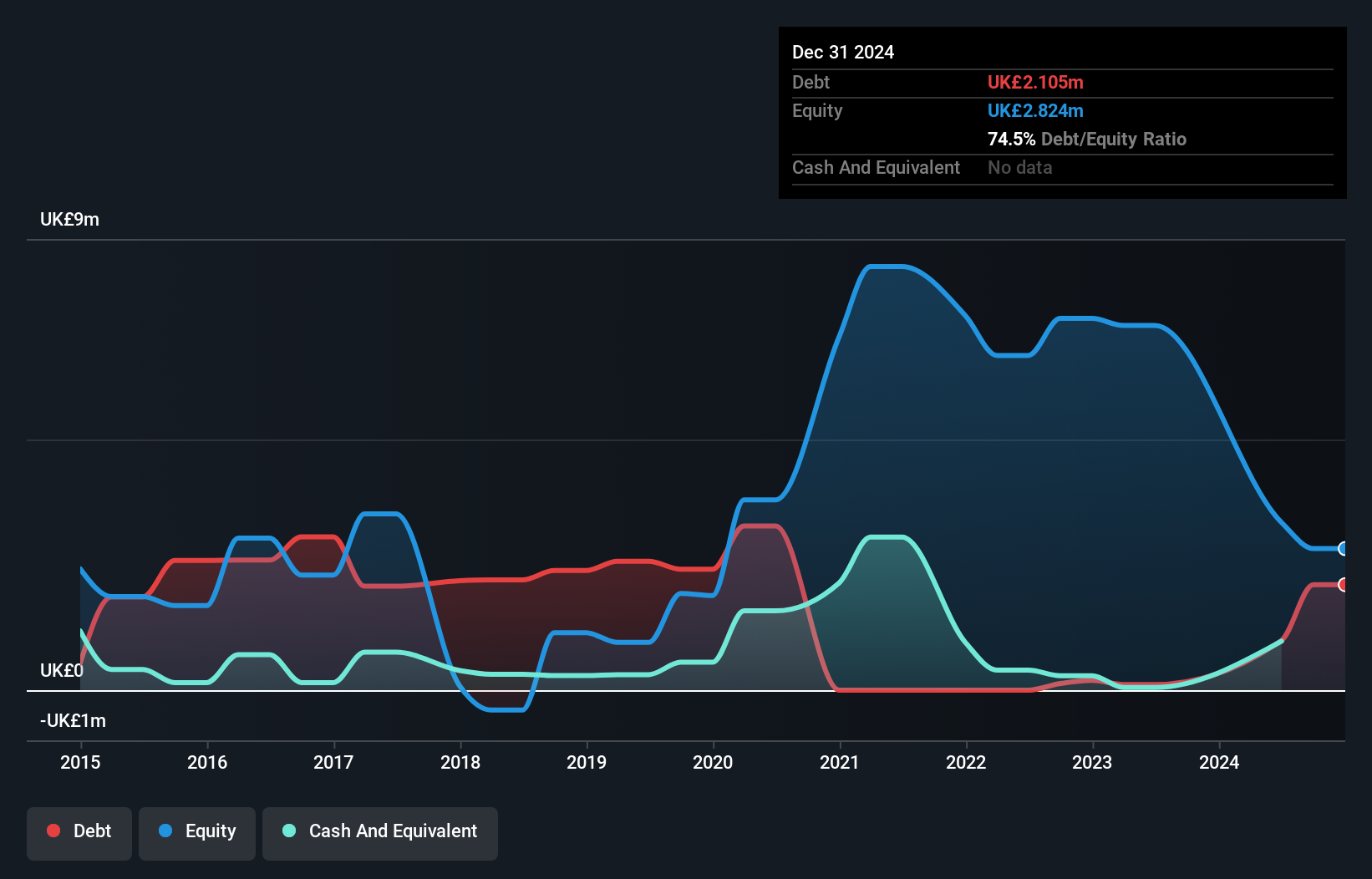

Autins Group plc, with a market cap of £3.82 million, operates primarily in the Automotive NVH segment, generating £20.17 million in revenue. Despite reporting a net loss of £1.25 million for the year ended September 2024, its financial position shows some resilience; short-term assets exceed liabilities and it maintains a satisfactory net debt to equity ratio of 12.4%. The company has not diluted shareholders recently and possesses sufficient cash runway for over three years due to positive free cash flow growth. However, challenges include an inexperienced board and management team alongside ongoing unprofitability with negative return on equity at -13%.

- Jump into the full analysis health report here for a deeper understanding of Autins Group.

- Learn about Autins Group's historical performance here.

Westminster Group (AIM:WSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Westminster Group PLC is a specialist security and services company that designs and supplies technology security solutions globally, with a market cap of £3.97 million.

Operations: The company generates revenue from two main segments: Technology, contributing £1.20 million, and Managed Services (including Managed Services Guarding), which accounts for £4.83 million.

Market Cap: £3.97M

Westminster Group PLC, with a market cap of £3.97 million, operates in the security solutions sector and is currently unprofitable. Despite this, it maintains financial stability with short-term assets exceeding both its short- and long-term liabilities. The company has not diluted shareholders recently and holds a satisfactory net debt to equity ratio of 0.5%. Recent board changes include the addition of Figen Murray OBE, enhancing expertise in security measures. A new USD 300,000 contract for entry screening solutions underscores potential growth opportunities despite historical earnings declines and high share price volatility.

- Unlock comprehensive insights into our analysis of Westminster Group stock in this financial health report.

- Assess Westminster Group's previous results with our detailed historical performance reports.

Funding Circle Holdings (LSE:FCH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Funding Circle Holdings plc operates online lending platforms in the UK, US, and internationally, with a market cap of £357.15 million.

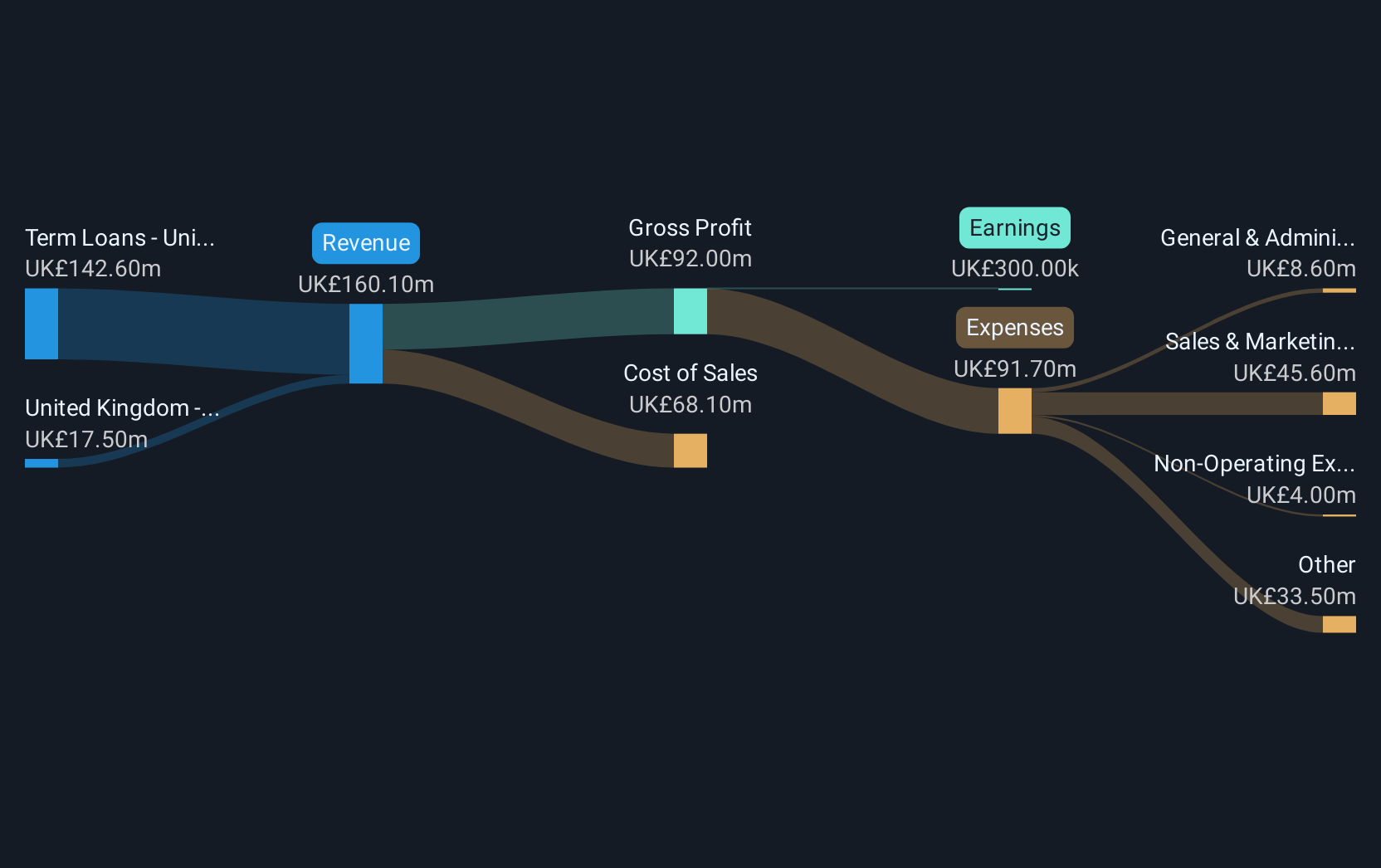

Operations: The company's revenue is primarily derived from its UK operations, with £10.8 million from FlexiPay and £138.6 million from Term Loans.

Market Cap: £357.15M

Funding Circle Holdings plc, with a market cap of £357.15 million, is an unprofitable company focused on online lending platforms. Despite its current financial challenges, the company has managed to reduce its debt-to-equity ratio over the past five years and maintains more cash than total debt. Short-term assets significantly exceed liabilities, providing a strong liquidity position. The recent partnership with Pri0r1ty Intelligence Group PLC offers potential growth opportunities by expanding access to SME financing solutions up to £750,000 quickly and efficiently. Analysts anticipate earnings growth of 87.7% annually despite high share price volatility and negative return on equity (-14.41%).

- Take a closer look at Funding Circle Holdings' potential here in our financial health report.

- Understand Funding Circle Holdings' earnings outlook by examining our growth report.

Key Takeaways

- Explore the 442 names from our UK Penny Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:AUTG

Autins Group

An investment holding company, supplies noise vibration and harshness insulation materials.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives