- United Kingdom

- /

- Capital Markets

- /

- LSE:EJFI

EJF Investments (LON:EJFI) Has Re-Affirmed Its Dividend Of UK£0.027

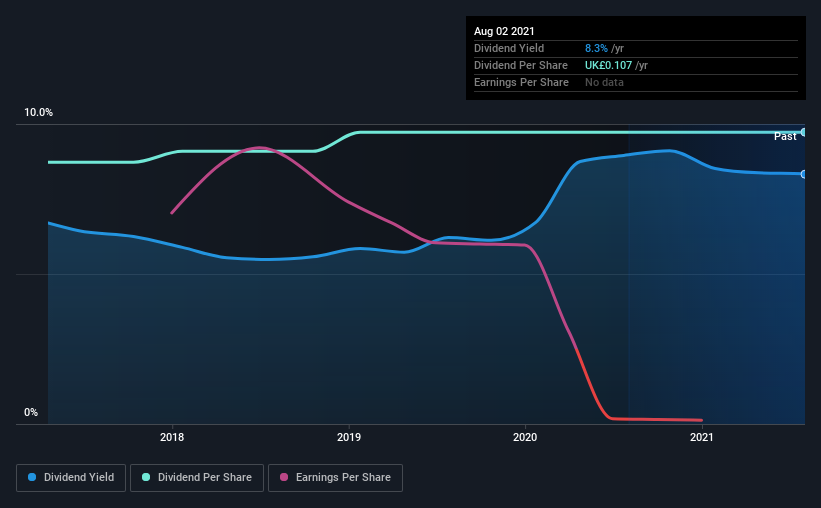

EJF Investments Limited (LON:EJFI) has announced that it will pay a dividend of UK£0.027 per share on the 31st of August. This makes the dividend yield 8.3%, which will augment investor returns quite nicely.

Check out our latest analysis for EJF Investments

EJF Investments' Distributions May Be Difficult To Sustain

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. EJF Investments is unprofitable despite paying a dividend, and it is paying out 121% of its free cash flow. This makes us feel that the dividend will be hard to maintain.

Recent, EPS has fallen by 87.5%, so this could continue over the next year. This means the company will be unprofitable and managers could face the tough choice between continuing to pay the dividend or taking pressure off the balance sheet.

EJF Investments Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The first annual payment during the last 4 years was UK£0.096 in 2017, and the most recent fiscal year payment was UK£0.11. This means that it has been growing its distributions at 2.7% per annum over that time. EJF Investments hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

The Dividend Has Limited Growth Potential

Investors could be attracted to the stock based on the quality of its payment history. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the past three years, it looks as though EJF Investments' EPS has declined at around 88% a year. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

We're Not Big Fans Of EJF Investments' Dividend

Overall, this isn't a great candidate as an income investment, even though the dividend was stable this year. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. The dividend doesn't inspire confidence that it will provide solid income in the future.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, EJF Investments has 3 warning signs (and 2 which are a bit concerning) we think you should know about. We have also put together a list of global stocks with a solid dividend.

When trading EJF Investments or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EJF Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:EJFI

Adequate balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026