- United Kingdom

- /

- Consumer Finance

- /

- LSE:ASAI

Exploring 3 Undervalued European Small Caps With Notable Insider Activity

Reviewed by Simply Wall St

As European markets experience a positive upswing, with the pan-European STOXX Europe 600 Index closing 2.35% higher, small-cap stocks are drawing increased attention from investors looking to capitalize on potential growth opportunities. In this environment of relatively subdued inflation and rising major stock indexes across Europe, identifying small-cap companies with strong fundamentals and notable insider activity can be particularly appealing for those seeking value in the market.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.2x | 0.7x | 43.94% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 38.24% | ★★★★★☆ |

| Eastnine | 11.7x | 7.4x | 48.91% | ★★★★★☆ |

| Senior | 24.7x | 0.8x | 23.98% | ★★★★★☆ |

| Eurocell | 16.3x | 0.3x | 40.06% | ★★★★☆☆ |

| Fastighets AB Trianon | 9.3x | 4.5x | -54.48% | ★★★★☆☆ |

| Gooch & Housego | 43.7x | 1.0x | 26.58% | ★★★☆☆☆ |

| Kendrion | 28.9x | 0.7x | 42.73% | ★★★☆☆☆ |

| Fiskars Oyj Abp | 38.2x | 0.9x | 27.45% | ★★★☆☆☆ |

| CVS Group | 45.3x | 1.3x | 27.52% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Logistri Fastighets (DB:6DV0)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Logistri Fastighets operates in the real estate sector, focusing on rental properties, with a market capitalization of approximately SEK 1.49 billion.

Operations: Logistri Fastighets generates revenue primarily from real estate rental activities, with the latest reported revenue at SEK 168.56 million. The company has experienced fluctuations in its net income margin, reaching as high as 1.69% and more recently recorded at 0.58%. Operating expenses have shown variability, including instances of negative values due to adjustments or reversals in previous expenses.

PE: 10.8x

Logistri Fastighets, a smaller player in the European market, has showcased growth potential with recent financial results. For Q3 2025, sales increased to SEK 46.79 million from SEK 33.22 million the previous year, while net income rose to SEK 35.2 million from SEK 17.56 million. The company is expanding its portfolio by acquiring properties for Hitachi Energy's logistics center and Stromsholmen's manufacturing site under long-term leases, reflecting strategic business moves despite reliance on external borrowing for funding. Notably, insider confidence is evident with significant share purchases during October 2025's private placement involving key stakeholders like Henrik Viktorsson and others.

- Click to explore a detailed breakdown of our findings in Logistri Fastighets' valuation report.

Explore historical data to track Logistri Fastighets' performance over time in our Past section.

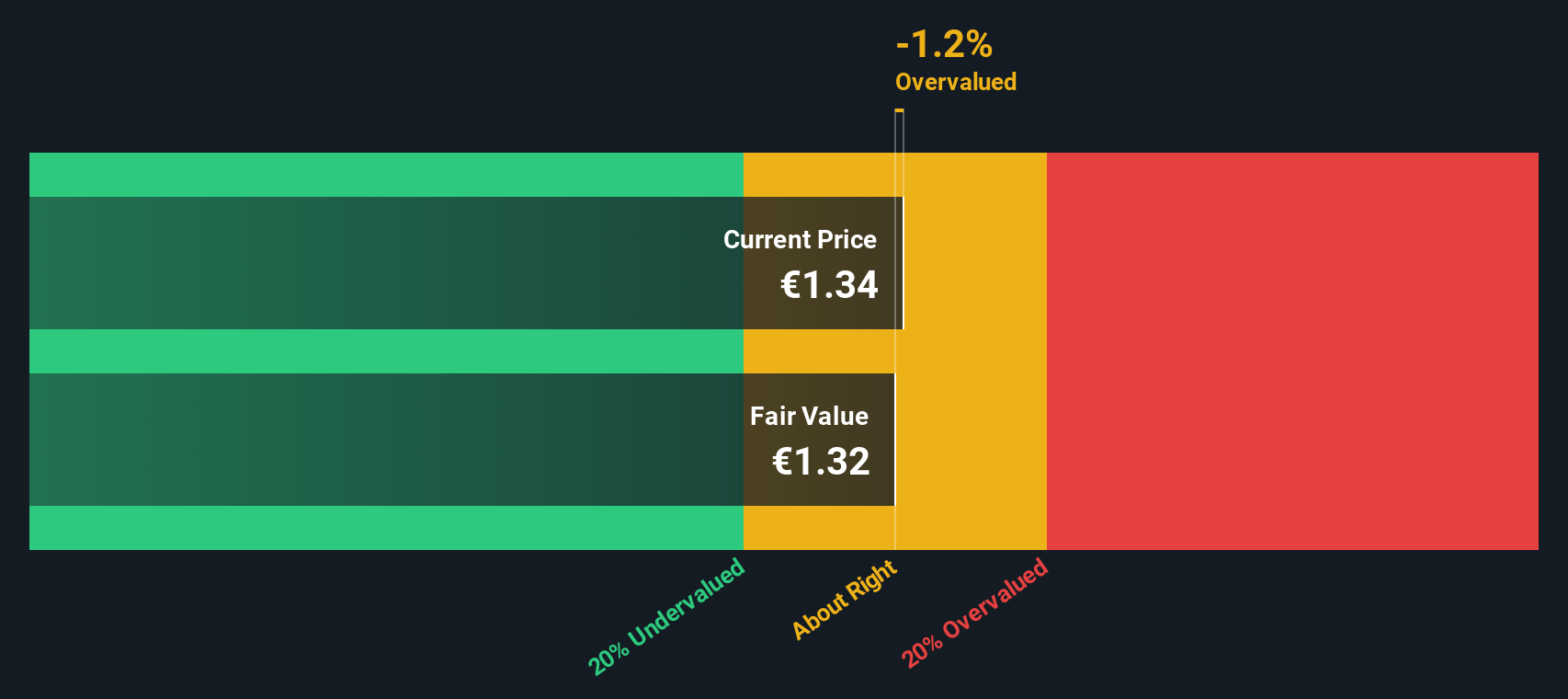

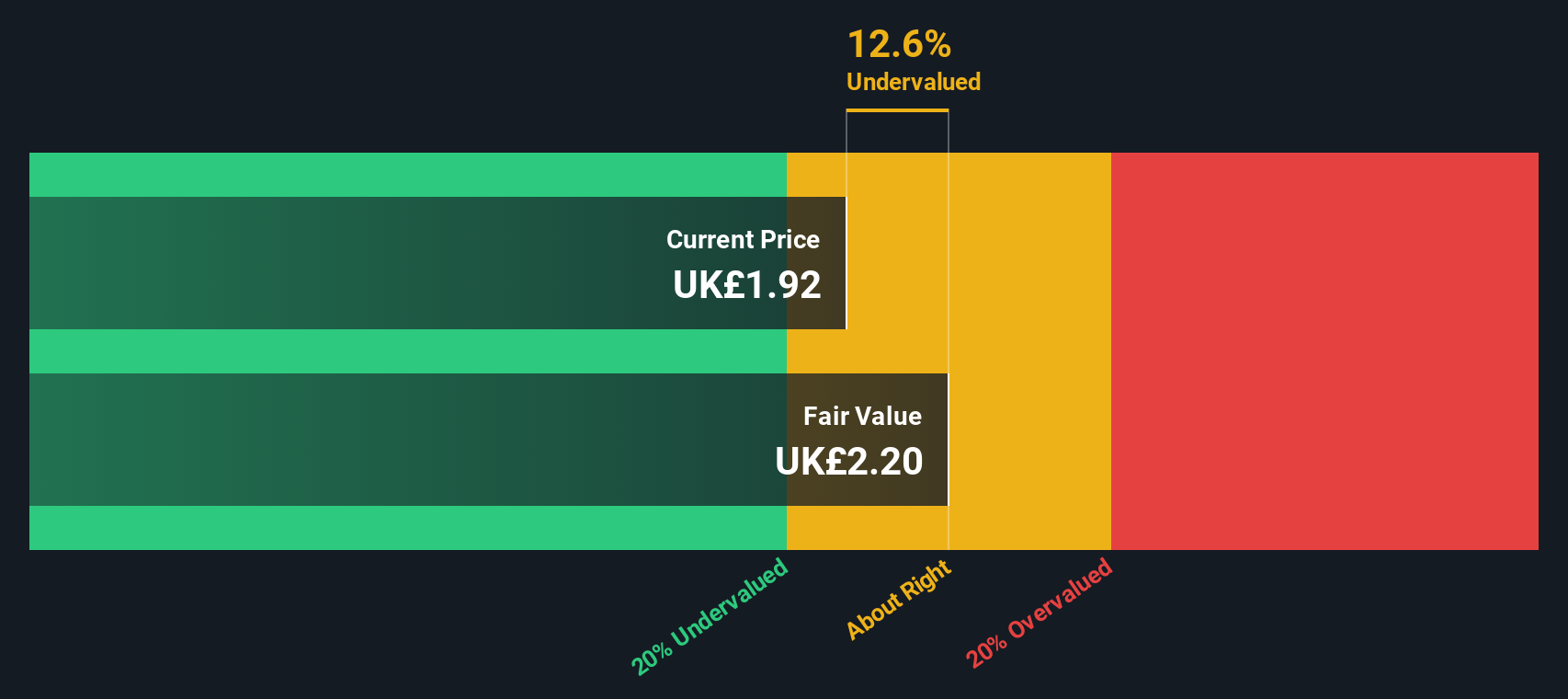

ASA International Group (LSE:ASAI)

Simply Wall St Value Rating: ★★★★★☆

Overview: ASA International Group is a microfinance institution providing financial services across South Asia, East Africa, West Africa, and South East Asia with a market cap of $0.23 billion.

Operations: ASA International Group generates significant revenue from its operations in East Africa ($65.82 million) and West Africa ($65.29 million), with additional contributions from South Asia and South East Asia. The company has consistently reported a gross profit margin close to 100% over the years, indicating that cost of goods sold is negligible or not applicable in their financial reporting. Operating expenses, particularly general and administrative expenses, represent a substantial portion of the company's costs, impacting net income margins which have varied significantly across periods but reached up to 19.70%.

PE: 6.4x

ASA International Group, a European company with small capitalization, shows potential as an undervalued stock. Recent earnings for the half-year ended June 30, 2025, revealed net income of US$27.1 million, doubling last year's figure of US$13.5 million. The company declared a dividend increase to US$0.048 per share from US$0.03 in 2024, signaling strong financial health despite reliance on external borrowing for funding. Insider confidence is evident with recent insider share purchases within the past year, indicating belief in future growth prospects bolstered by new CFO Geert Embrechts's extensive experience set to drive strategic execution from February 2026 onward.

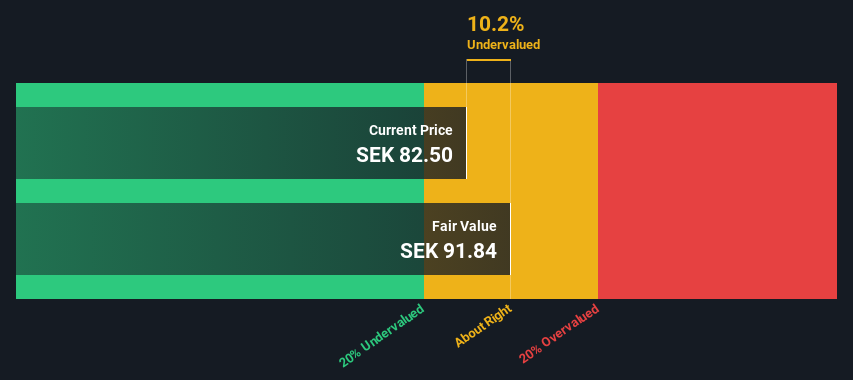

AcadeMedia (OM:ACAD)

Simply Wall St Value Rating: ★★★★★☆

Overview: AcadeMedia is a leading education provider in Northern Europe, operating across adult education, compulsory and upper secondary schools, as well as preschools and international segments, with a market capitalization of SEK 5.66 billion.

Operations: AcadeMedia generates revenue primarily from its Upper Secondary Schools (SEK 6.66 billion) and Preschool & International segments (SEK 7.79 billion), with significant contributions also coming from Compulsory School (SEK 4.91 billion) and Adult Education (SEK 1.96 billion). The company's gross profit margin has shown variability, reaching up to 31.25% in recent periods, while operating expenses are a substantial component of costs, including general and administrative expenses which have been around SEK 1.82 billion recently.

PE: 12.0x

AcadeMedia, a European education provider, shows potential as an undervalued stock with promising growth prospects. Their recent expansion in Germany aims to address the country's significant preschool shortage by adding over 500 new places across seven units. The company's earnings for Q1 2025 reflected steady growth, with sales increasing to SEK 4.1 billion from SEK 3.8 billion the previous year. Insider confidence is evident as their CFO acquired 3,000 shares valued at approximately SEK 298,680 in September, marking a notable increase of one-third in their holdings. Despite relying on external borrowing for funding—considered higher risk—their strategic investments and updated dividend policy indicate a commitment to shareholder returns and sustainable growth amid evolving market conditions.

Key Takeaways

- Access the full spectrum of 69 Undervalued European Small Caps With Insider Buying by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ASAI

ASA International Group

Operates as a microfinance institution in Asia and Africa.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026