- United Kingdom

- /

- Basic Materials

- /

- AIM:SRC

3 UK Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced some turbulence, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting the global economic interconnections that affect domestic markets. In such a climate, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors, particularly when these stocks have strong fundamentals or are positioned to benefit from eventual economic recoveries.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.49 | £12.20 | 46.8% |

| SigmaRoc (AIM:SRC) | £1.156 | £2.29 | 49.5% |

| Norcros (LSE:NXR) | £2.89 | £5.49 | 47.4% |

| Nichols (AIM:NICL) | £10.30 | £18.66 | 44.8% |

| Gooch & Housego (AIM:GHH) | £5.56 | £11.05 | 49.7% |

| Fevertree Drinks (AIM:FEVR) | £8.72 | £15.72 | 44.5% |

| Essentra (LSE:ESNT) | £1.08 | £1.98 | 45.5% |

| Barratt Redrow (LSE:BTRW) | £3.864 | £7.55 | 48.8% |

| AstraZeneca (LSE:AZN) | £124.74 | £239.66 | 48% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.215 | £4.36 | 49.2% |

Let's dive into some prime choices out of the screener.

SigmaRoc (AIM:SRC)

Overview: SigmaRoc plc, with a market cap of £1.25 billion, operates through its subsidiaries to invest in and acquire projects within the quarried materials sector.

Operations: The company's revenue is primarily derived from the production and sale of construction material products and services, amounting to £1.02 billion.

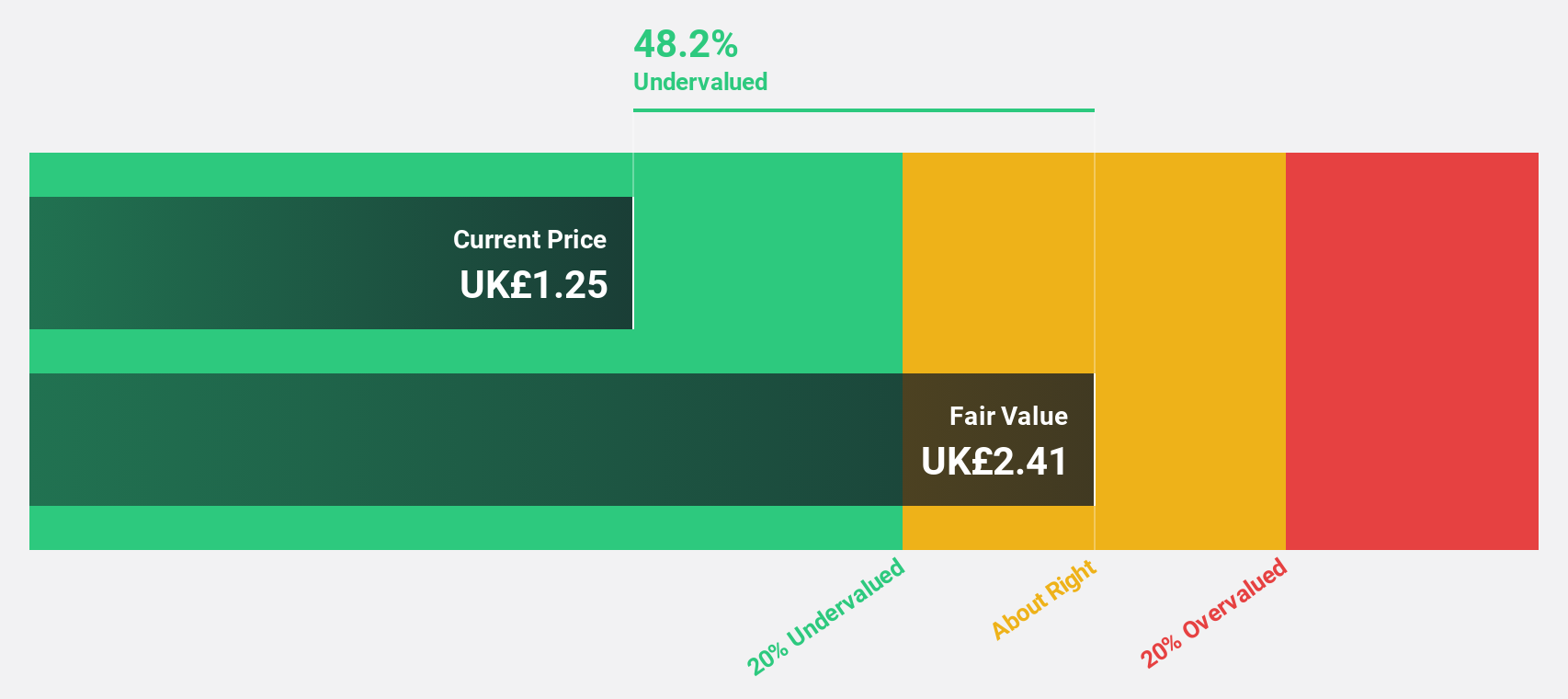

Estimated Discount To Fair Value: 49.5%

SigmaRoc is trading at £1.16, significantly below the estimated fair value of £2.29, suggesting it may be undervalued based on cash flows. Recent earnings show a net income increase to £24.32 million from £3.25 million year-on-year, while revenue is set to grow faster than the UK market at 4.8% annually. Despite potential delays in the AMeLi project with ArcelorMittal, SigmaRoc's financial forecasts remain unaffected in the near term.

- Upon reviewing our latest growth report, SigmaRoc's projected financial performance appears quite optimistic.

- Dive into the specifics of SigmaRoc here with our thorough financial health report.

ASA International Group (LSE:ASAI)

Overview: ASA International Group PLC operates as a microfinance institution in Asia and Africa with a market cap of £194 million.

Operations: The company's revenue is primarily derived from its operations in South Asia ($40.66 million), East Africa ($65.82 million), West Africa ($65.29 million), and South East Asia ($34.92 million).

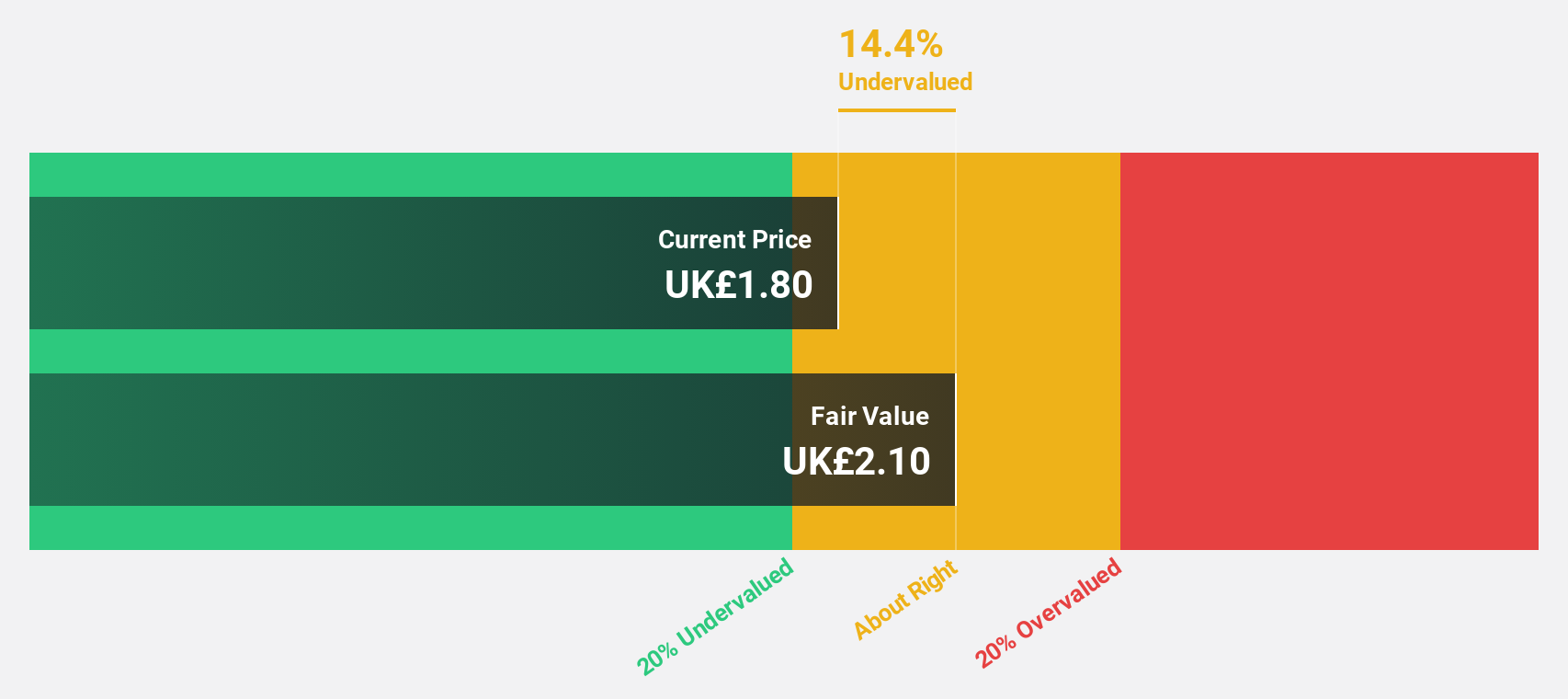

Estimated Discount To Fair Value: 14.3%

ASA International Group is currently trading at £1.79, below its estimated fair value of £2.09, indicating potential undervaluation based on cash flows. The company reported a net income increase to US$27.1 million from US$13.5 million year-on-year and announced a 60% higher interim dividend of US$0.048 per share compared to the previous year, though this is not well covered by free cash flows. Earnings are forecast to grow faster than the UK market at 18.1% annually, despite high volatility in share price recently and concerns over debt coverage by operating cash flow.

- Our expertly prepared growth report on ASA International Group implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of ASA International Group with our detailed financial health report.

Barratt Redrow (LSE:BTRW)

Overview: Barratt Redrow plc operates in the housebuilding industry within the United Kingdom and has a market capitalization of approximately £5.41 billion.

Operations: The company's revenue primarily comes from its housebuilding operations, generating approximately £5.58 billion.

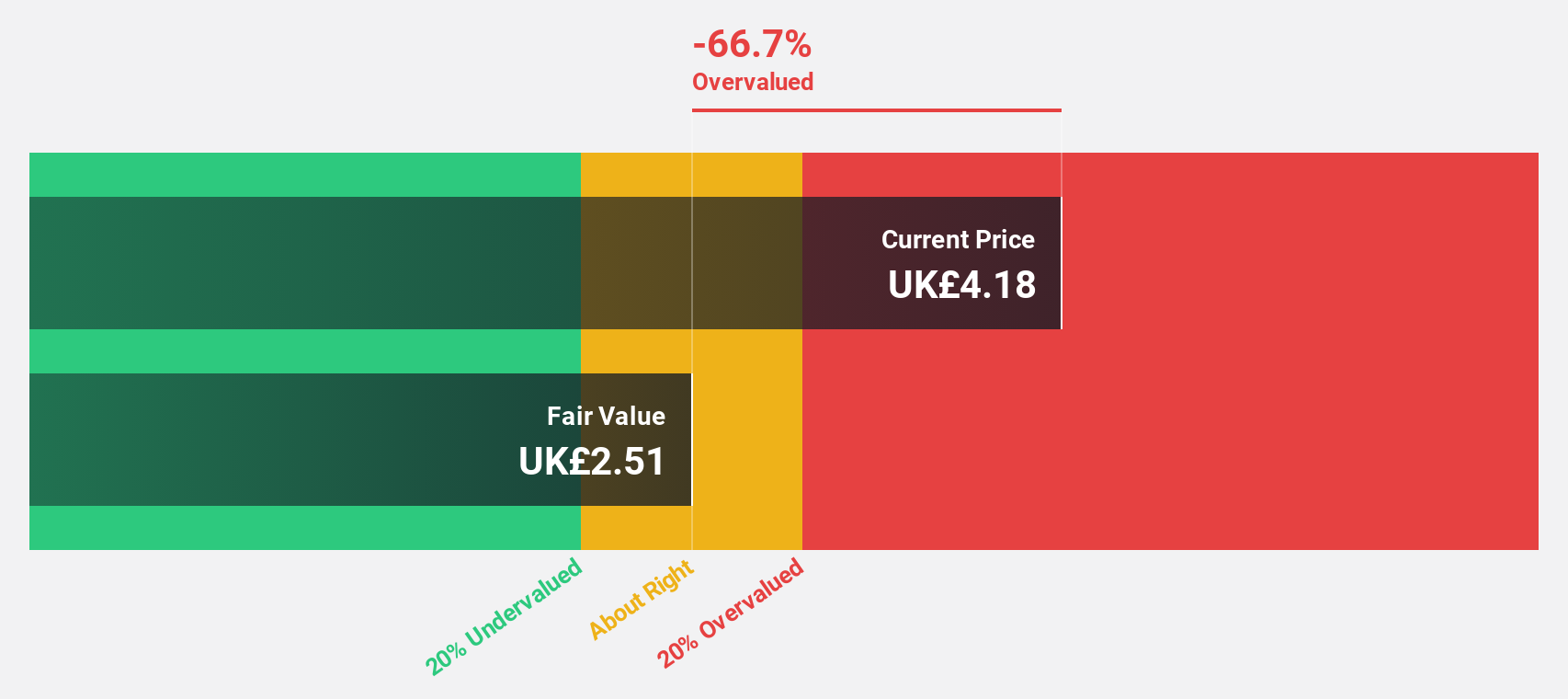

Estimated Discount To Fair Value: 48.8%

Barratt Redrow is trading at £3.86, significantly below its estimated fair value of £7.55, highlighting potential undervaluation based on cash flows. Earnings grew by 62.5% over the past year with net income rising to £186.4 million from £114.1 million previously, yet the dividend yield of 4.55% isn't well covered by earnings or free cash flow, posing sustainability concerns despite a forecasted annual earnings growth of 23.9%, outpacing the UK market's growth rate.

- Our comprehensive growth report raises the possibility that Barratt Redrow is poised for substantial financial growth.

- Get an in-depth perspective on Barratt Redrow's balance sheet by reading our health report here.

Taking Advantage

- Delve into our full catalog of 51 Undervalued UK Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SRC

SigmaRoc

Through its subsidiaries, invests in and/or acquires projects in the quarried materials sector.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives