- United Kingdom

- /

- Capital Markets

- /

- LSE:AMIF

3 Promising UK Penny Stocks With Market Caps Under £600M

Reviewed by Simply Wall St

The London stock market has recently faced challenges, with the FTSE 100 index declining due to weak trade data from China, highlighting ongoing global economic uncertainties. Despite these broader market pressures, investors may find opportunities in penny stocks—companies often overlooked but potentially rewarding when backed by strong financials. While the term 'penny stock' might seem outdated, it still signifies a segment where smaller or newer companies can offer both value and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £450.28M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.95 | £319.11M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.05 | £303.34M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.96 | £152.99M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.77 | £459.81M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.33 | £166.23M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.22 | £80.48M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.842 | £71.47M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.45 | £223.63M | ★★★★★☆ |

Click here to see the full list of 446 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Griffin Mining (AIM:GFM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration, development, and mining of mineral properties, with a market cap of £338.17 million.

Operations: The company's revenue is primarily generated from the Caijiaying Zinc Gold Mine, contributing $162.25 million.

Market Cap: £338.17M

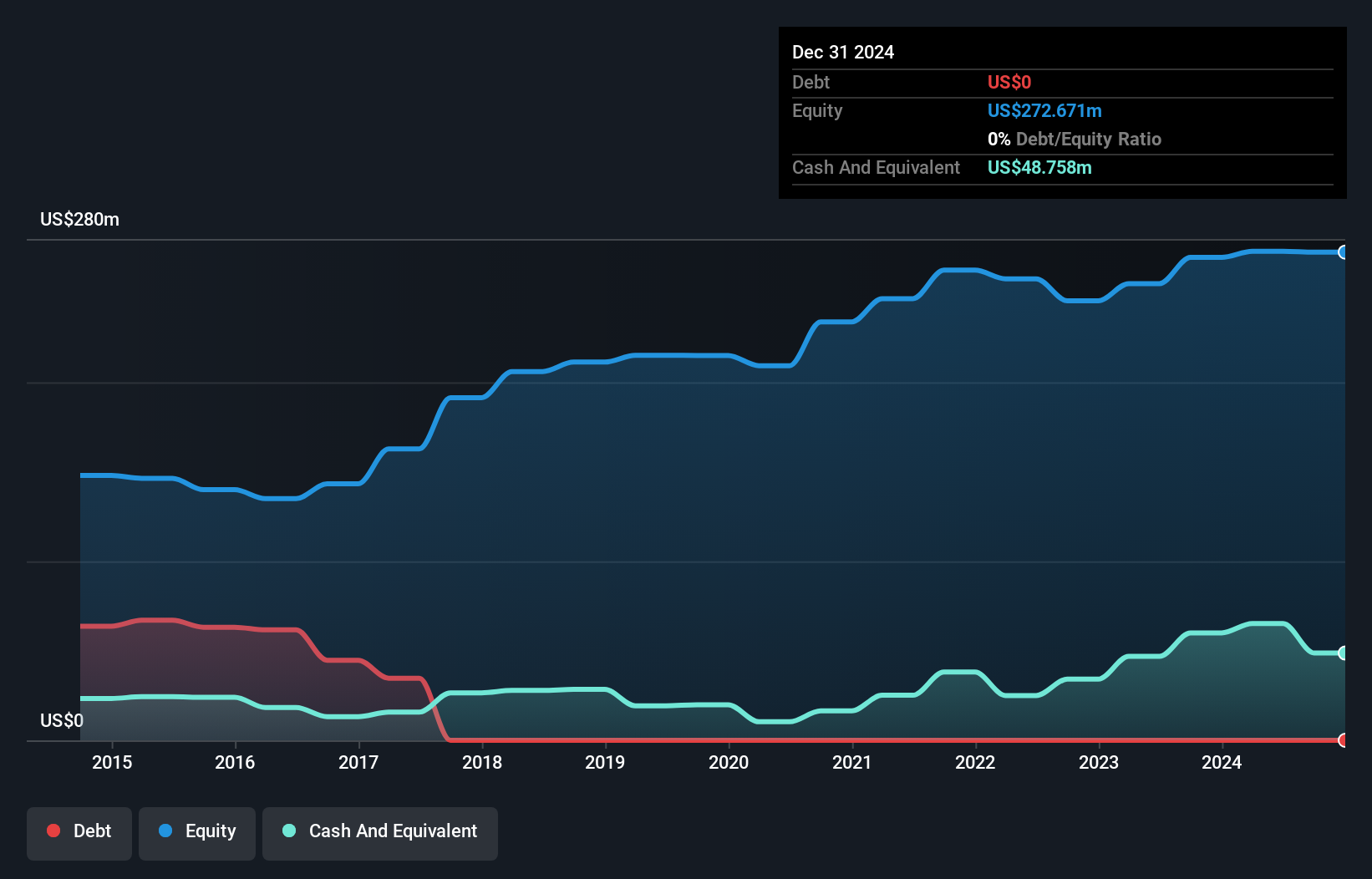

Griffin Mining, with a market cap of £338.17 million, has demonstrated significant earnings growth, achieving a 116.5% increase over the past year, outpacing the industry average. The company is debt-free and maintains strong financial health with short-term assets exceeding liabilities. Despite recent production declines in zinc and other minerals compared to last year, operations at the Caijiaying Mine have resumed following approval from the Emergency Response Bureau. Griffin's stock trades below its estimated fair value by 19.1%, offering potential value for investors seeking exposure to mining sector penny stocks in the UK market.

- Take a closer look at Griffin Mining's potential here in our financial health report.

- Examine Griffin Mining's earnings growth report to understand how analysts expect it to perform.

Amicorp FS (UK) (LSE:AMIF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Amicorp FS (UK) plc offers fund administration, business process outsourcing, and governance and compliance services to investment funds, asset managers, and family offices in the UK, with a market cap of $155.96 million.

Operations: Amicorp FS (UK) plc generates its revenue primarily from fund administration ($9.06 million), business process outsourcing ($3.82 million), and governance and compliance services ($1.60 million).

Market Cap: $155.96M

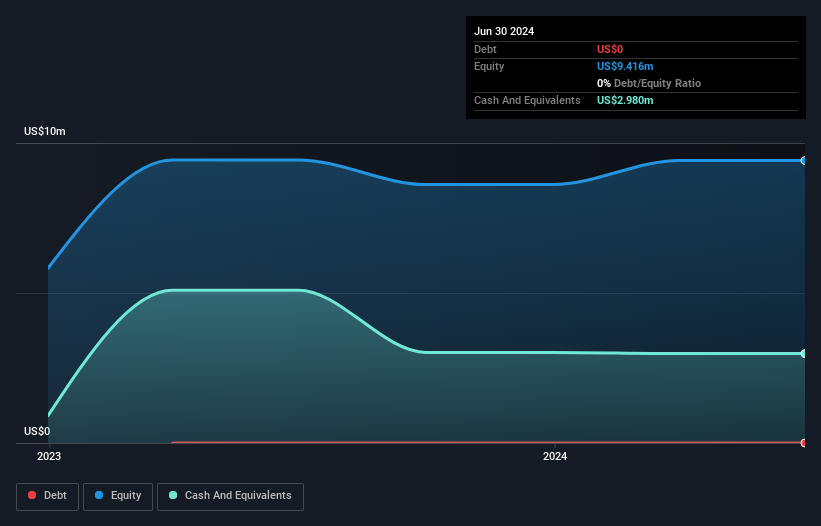

Amicorp FS (UK) plc, with a market cap of $155.96 million, has recently turned profitable, marking a significant milestone for the company. Its revenue streams include fund administration ($9.06 million), business process outsourcing ($3.82 million), and governance and compliance services ($1.60 million). The firm is debt-free, alleviating concerns over interest coverage, while its short-term assets of $11.3 million comfortably cover both short-term and long-term liabilities totaling $2.85 million combined. Despite increased volatility in its share price recently, Amicorp's financial position remains robust with no meaningful shareholder dilution in the past year.

- Navigate through the intricacies of Amicorp FS (UK) with our comprehensive balance sheet health report here.

- Explore Amicorp FS (UK)'s analyst forecasts in our growth report.

AO World (LSE:AO.)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AO World plc, along with its subsidiaries, operates as an online retailer specializing in domestic appliances and ancillary services in the United Kingdom and Germany, with a market cap of £594.86 million.

Operations: The company generates revenue of £1.07 billion from its online retailing of domestic appliances and ancillary services.

Market Cap: £594.86M

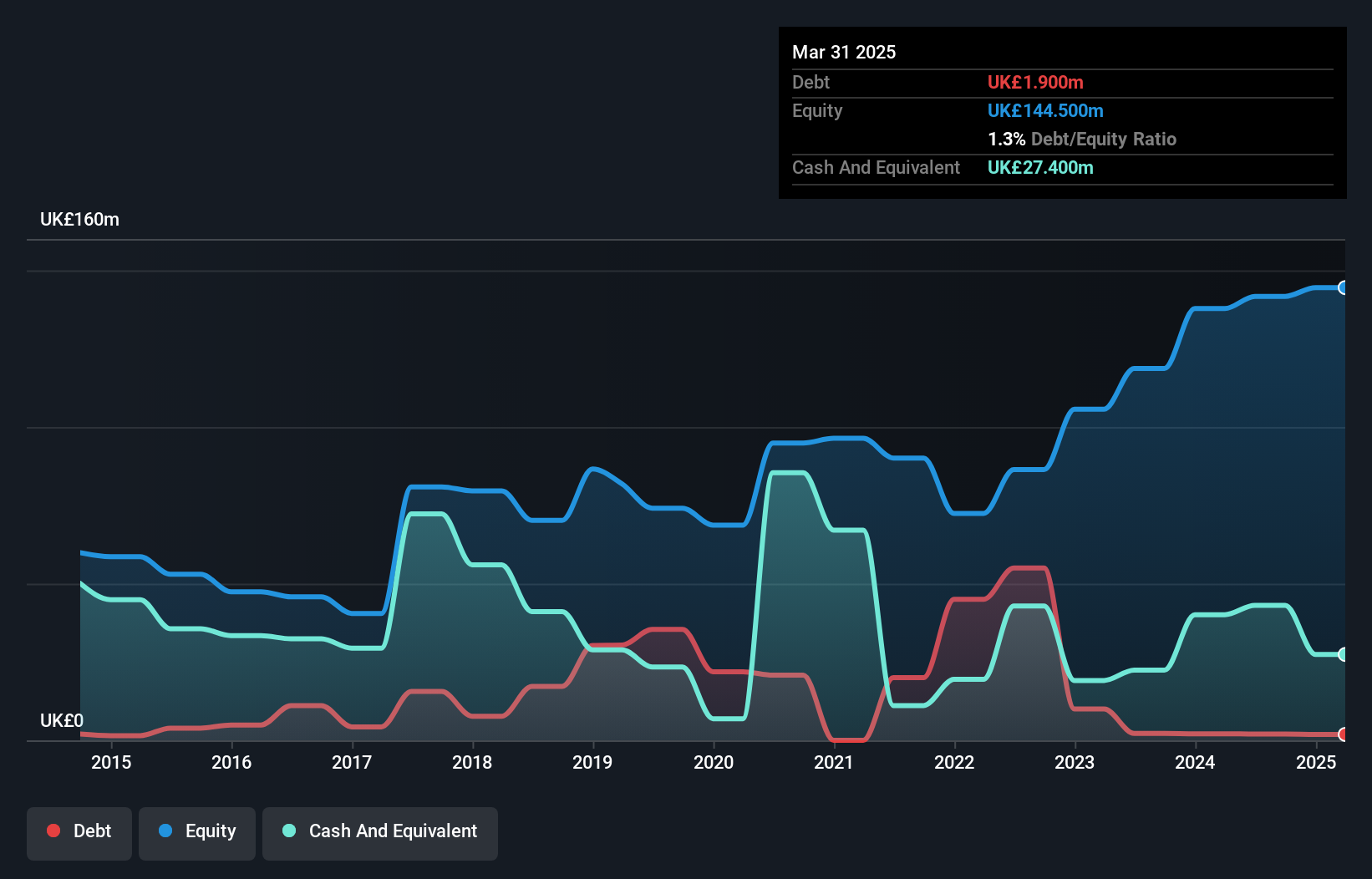

AO World plc, with a market cap of £594.86 million, has shown resilience in the penny stock landscape with stable financial metrics and strategic growth prospects. Recent earnings for the half year ended September 30, 2024, indicated sales of £512.1 million and net income of £11.2 million, reflecting an upward trajectory from the previous year. The company's operating cash flow robustly covers its debt by a very large margin (3375%), while short-term assets exceed long-term liabilities significantly (£251.4M vs £49.5M). Although short-term liabilities slightly surpass short-term assets (£264.6M), seasoned management and board experience bolster confidence in navigating these challenges effectively.

- Click here to discover the nuances of AO World with our detailed analytical financial health report.

- Gain insights into AO World's outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Jump into our full catalog of 446 UK Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AMIF

Amicorp FS (UK)

Provides fund administration, business process outsourcing, and governance and compliance services for investment funds, asset managers, and family offices in the United Kingdom.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives