- United Kingdom

- /

- Capital Markets

- /

- LSE:ALPH

Undiscovered Gems In The United Kingdom To Explore This January 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index grapples with global economic challenges, particularly stemming from weak trade data from China, investors are increasingly turning their attention to smaller-cap stocks that may offer unique opportunities amidst broader market volatility. In this environment, identifying promising small-cap companies requires a keen focus on those with strong fundamentals and growth potential that can withstand external pressures and leverage niche markets effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Somero Enterprises | NA | 8.19% | 7.39% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

LBG Media (AIM:LBG)

Simply Wall St Value Rating: ★★★★★★

Overview: LBG Media plc is an online media publisher with operations in the United Kingdom, Ireland, Australia, the United States, and internationally, with a market capitalization of £261.35 million.

Operations: LBG Media generates revenue primarily from its online media publishing activities, amounting to £82.54 million. The company's market capitalization stands at £261.35 million.

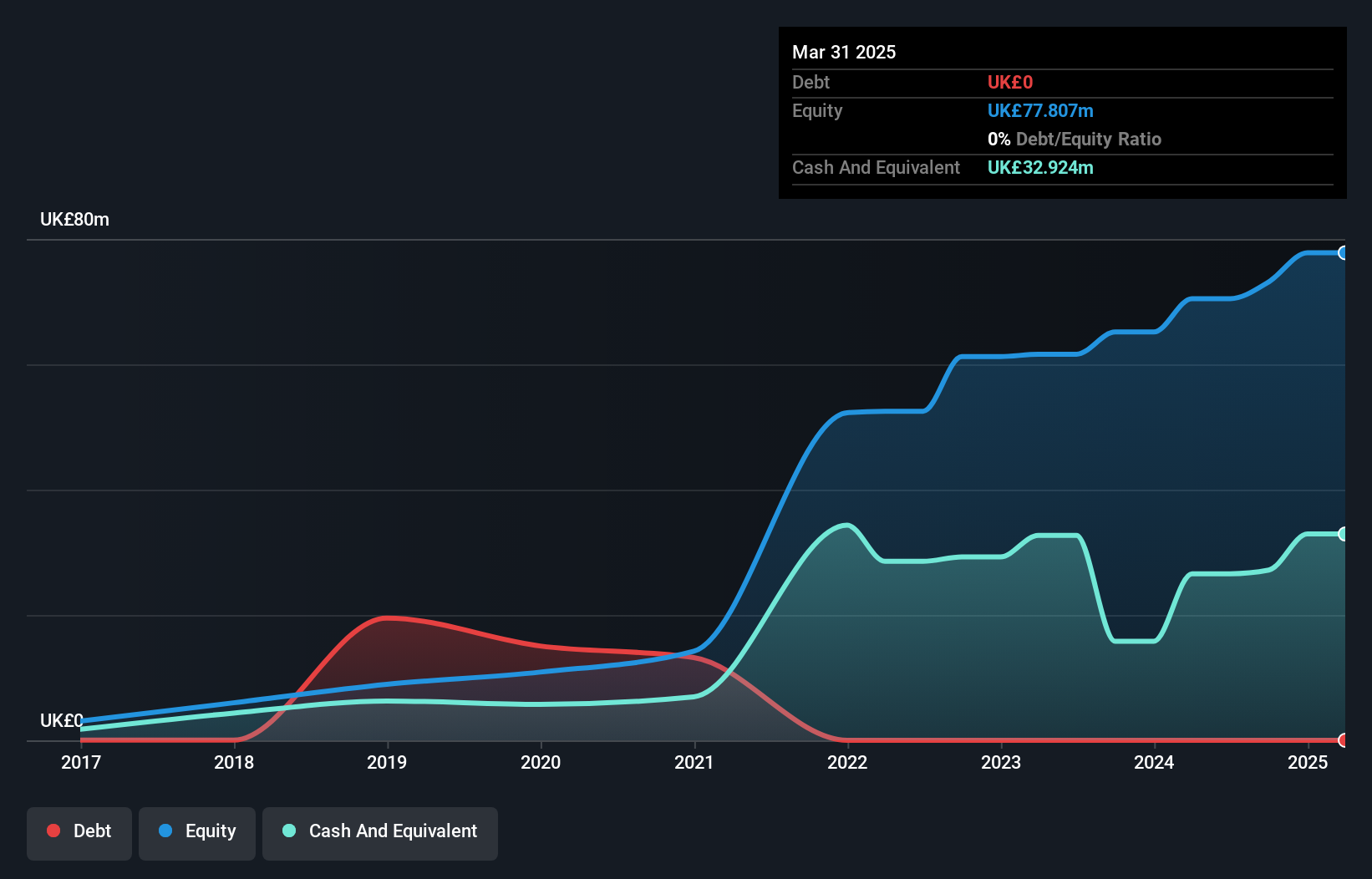

LBG Media, a nimble player in the UK market, saw its earnings surge by 33% over the past year, outpacing the entertainment industry's significant downturn. Despite a £3.5M one-off loss impacting recent results, it remains debt-free—a stark contrast to its 65.4% debt-to-equity ratio five years ago—and trades at 30.5% below estimated fair value. The company is free cash flow positive with £13.06M reported as of June 2024 and forecasts suggest continued earnings growth at an annual rate of 24.51%. Recent board changes include Richard Flint's resignation as Non-Executive Director due to other commitments.

- Delve into the full analysis health report here for a deeper understanding of LBG Media.

Evaluate LBG Media's historical performance by accessing our past performance report.

Alpha Group International (LSE:ALPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Alpha Group International plc offers foreign exchange risk management and alternative banking solutions across the United Kingdom, Europe, Canada, and other international markets, with a market capitalization of approximately £1 billion.

Operations: Alpha Group International plc generates revenue primarily through its Alpha Pay (£72.30 million) and Institutional (£67.47 million) segments, with additional contributions from Corporate Toronto, Corporate Amsterdam, and Corporate London excluding Amsterdam. The company has a market capitalization of approximately £1 billion.

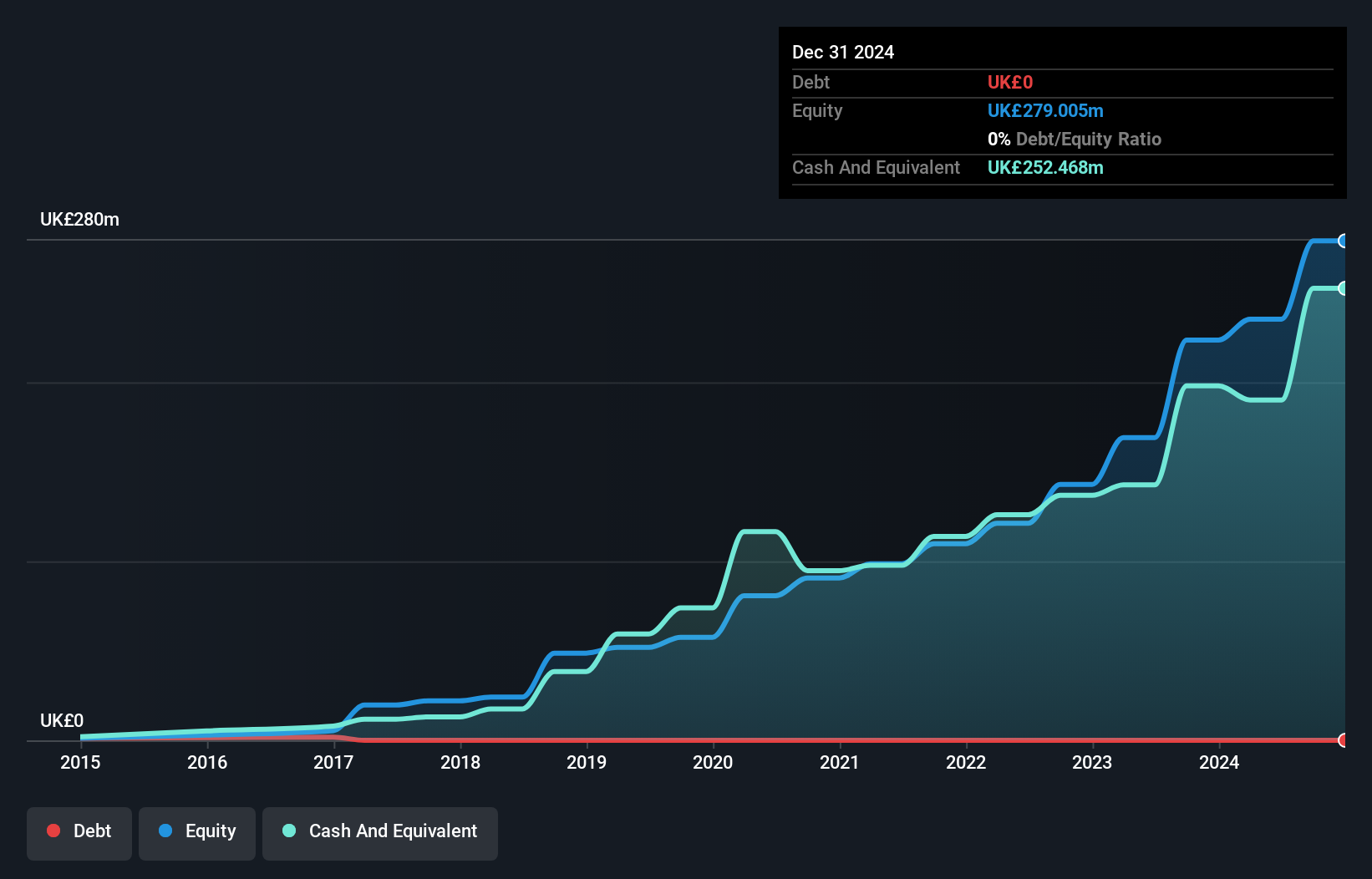

Alpha Group International stands out with its impressive earnings growth of 46.3% over the past year, easily surpassing the Capital Markets industry's 12.5%. This performance is bolstered by a debt-free status, making it an attractive option in terms of financial stability. The company trades at a favorable price-to-earnings ratio of 10.6x compared to the UK market's average of 16x, suggesting good relative value. Additionally, Alpha boasts high-quality non-cash earnings and positive free cash flow, which likely contribute to its robust financial health and potential for sustained growth in the coming years.

Irish Continental Group (LSE:ICGC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Irish Continental Group plc is a maritime transport company with a market cap of £730.74 million.

Operations: Irish Continental Group generates revenue primarily through its Ferries segment, contributing €430.10 million, and its Container and Terminal segment, which adds €195.80 million.

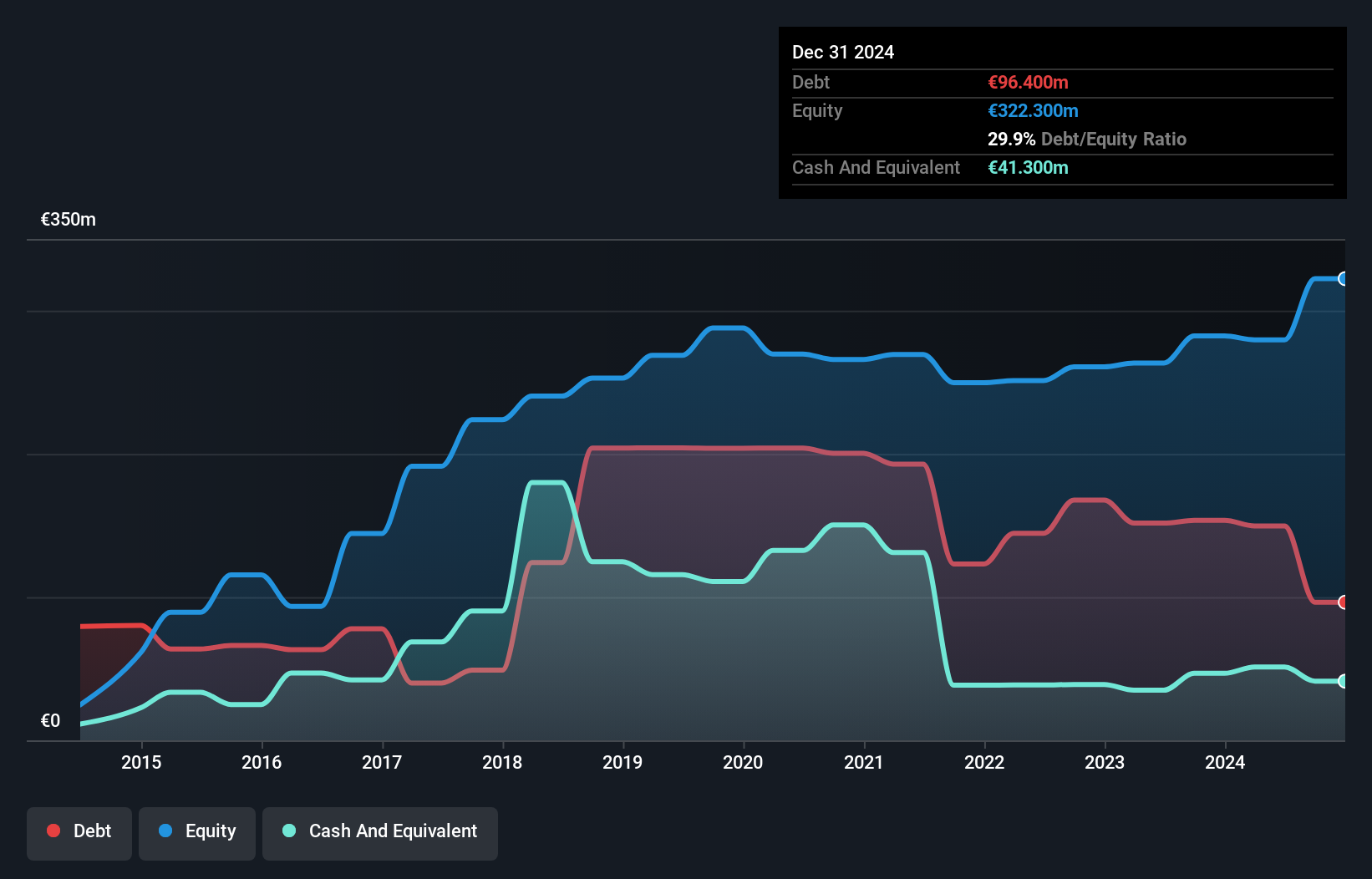

Irish Continental Group, a player in the shipping industry, is trading at 19.2% below its estimated fair value, making it an intriguing option for investors. Over the past five years, its debt to equity ratio has improved significantly from 76% to 53.5%, while interest payments are comfortably covered by EBIT with a 10x coverage ratio. Earnings have grown by 7.2%, outpacing the industry's -38.7%. Despite significant insider selling recently, ICGC maintains high-quality earnings and positive free cash flow of €90.5 million as of June 2024, suggesting robust financial health and potential for future growth.

Key Takeaways

- Access the full spectrum of 63 UK Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ALPH

Alpha Group International

Provides foreign exchange risk management and alternative banking solutions in the United Kingdom, Europe, Canada, and internationally.

Flawless balance sheet and undervalued.