- United Kingdom

- /

- Diversified Financial

- /

- AIM:EQLS

Equals Group Leads 3 Undiscovered Gems with Strong Fundamentals

Reviewed by Simply Wall St

In the current landscape, the United Kingdom's markets are navigating through a challenging period marked by global economic uncertainties, as evidenced by recent declines in key indices such as the FTSE 100 and FTSE 250. Amid these broader market pressures, particularly from China's sluggish recovery impacting commodity-dependent sectors, investors are increasingly seeking stocks with robust fundamentals that can weather economic headwinds. Identifying companies with strong financial health and growth potential becomes crucial in this environment, making Equals Group and two other undiscovered gems noteworthy for their solid foundations amidst fluctuating market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Equals Group (AIM:EQLS)

Simply Wall St Value Rating: ★★★★★★

Overview: Equals Group plc develops and sells payment platforms, including prepaid currency cards and international money transfers, to private clients and corporations in the United Kingdom, with a market cap of £205.49 million.

Operations: Equals Group generates revenue primarily from its Solutions (£42.15 million) and International Payments (£40.71 million) segments, with additional contributions from Currency Cards (£15.46 million) and Banking (£8.26 million). The company has a market capitalization of £205.49 million, reflecting its position in the financial technology sector within the UK market.

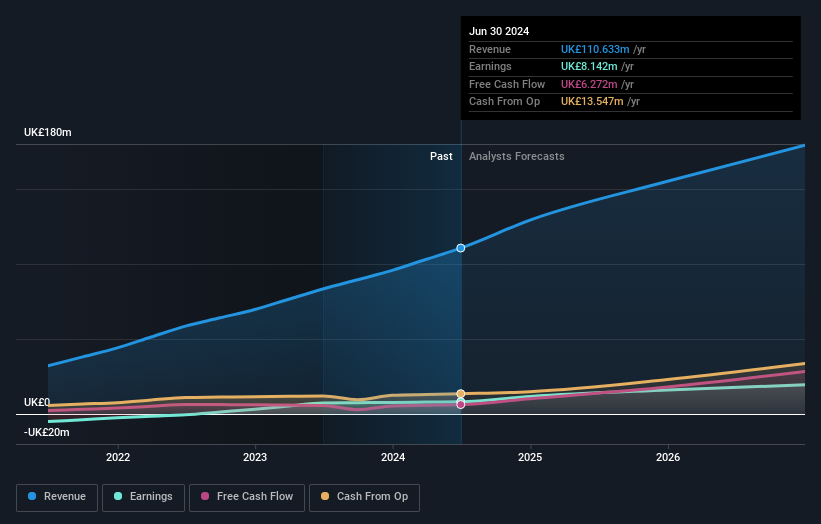

Equals Group, a nimble player in the financial sector, showcases impressive growth with earnings increasing by 10.8% over the past year, outpacing the industry average of 2.8%. The company remains debt-free and boasts high-quality earnings, providing a sturdy foundation for future endeavors. Recent developments include M&A discussions with a consortium led by Railsr and TowerBrook Capital Partners at an indicative offer of £1.35 per share. Additionally, Equals reported half-year sales of £55.92 million compared to £40.98 million previously, alongside a net income rise to £5.18 million from last year's £4.79 million.

- Click to explore a detailed breakdown of our findings in Equals Group's health report.

Review our historical performance report to gain insights into Equals Group's's past performance.

Midwich Group (AIM:MIDW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Midwich Group plc, along with its subsidiaries, is a distributor of audio visual solutions to trade customers across various regions including the United Kingdom, Ireland, Europe, the Middle East, Africa, Asia Pacific, and North America with a market cap of £271.62 million.

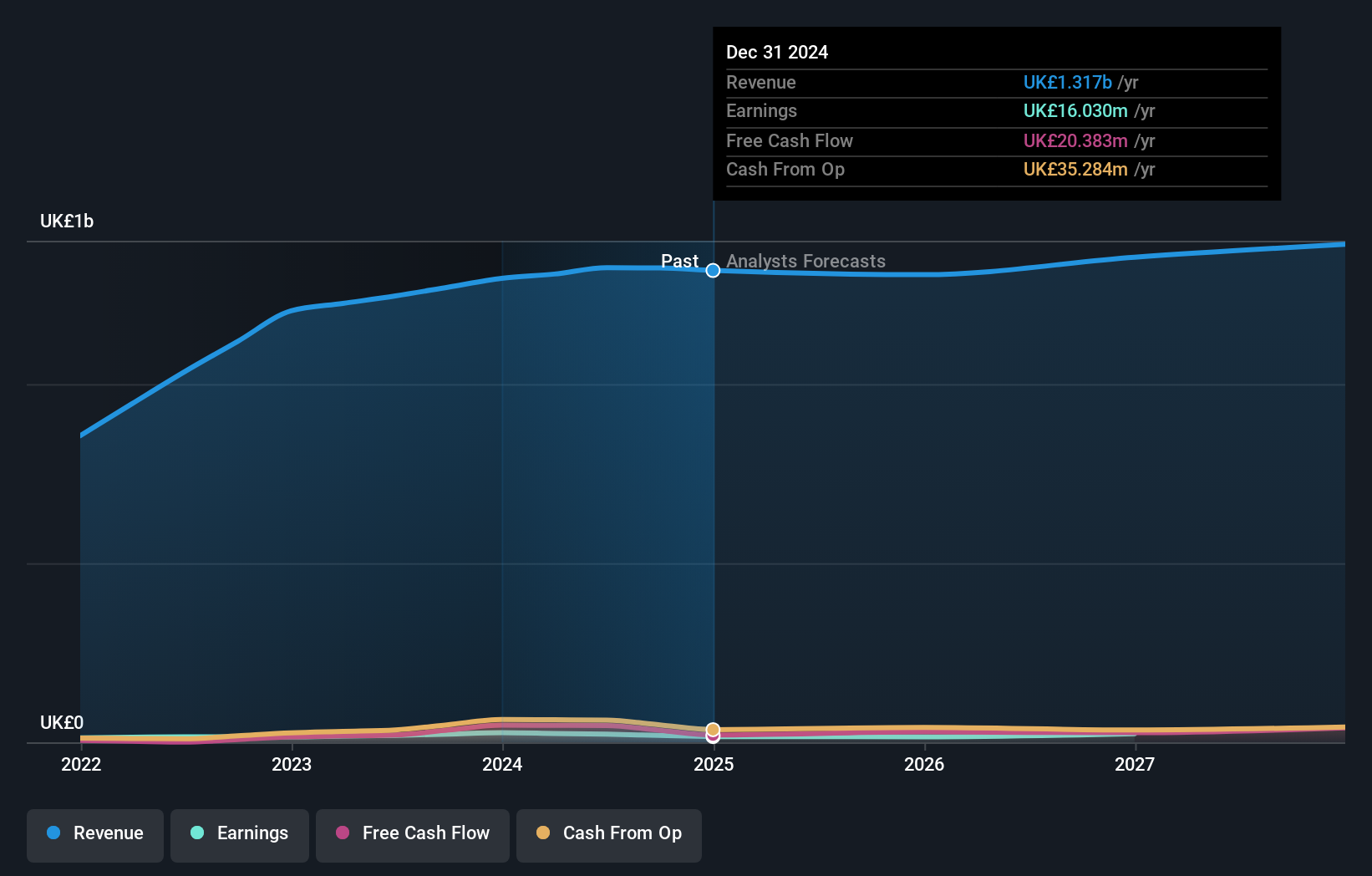

Operations: Midwich Group generates revenue primarily through the wholesale of computer peripherals, amounting to £1.32 billion. The company's financial performance can be evaluated by examining its gross profit margin, which reflects the efficiency of its core operations.

Midwich Group, a notable player in the UK, has demonstrated robust performance with earnings growth of 16.7% over the past year, outpacing the electronic industry's 9.3%. Despite this, net income for H1 2024 fell to £6.62 million from £10.96 million a year ago, reflecting market challenges. The company is trading at an attractive valuation—57% below its estimated fair value—while its debt-to-equity ratio improved from 140.7% to 85.4% over five years, indicating better financial health. Midwich's strategic overhead reduction aims to bolster operating profit margins amidst ongoing AV market difficulties this year.

- Get an in-depth perspective on Midwich Group's performance by reading our health report here.

Gain insights into Midwich Group's historical performance by reviewing our past performance report.

Alpha Group International (LSE:ALPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Alpha Group International plc offers foreign exchange risk management and alternative banking solutions across the United Kingdom, Europe, Canada, and internationally, with a market capitalization of £873.73 million.

Operations: The company's revenue streams include Alpha Pay (£72.30 million), Institutional (£67.47 million), Corporate London excluding Amsterdam (£46.92 million), Corporate Amsterdam (£9.57 million), and Corporate Toronto (£3.72 million).

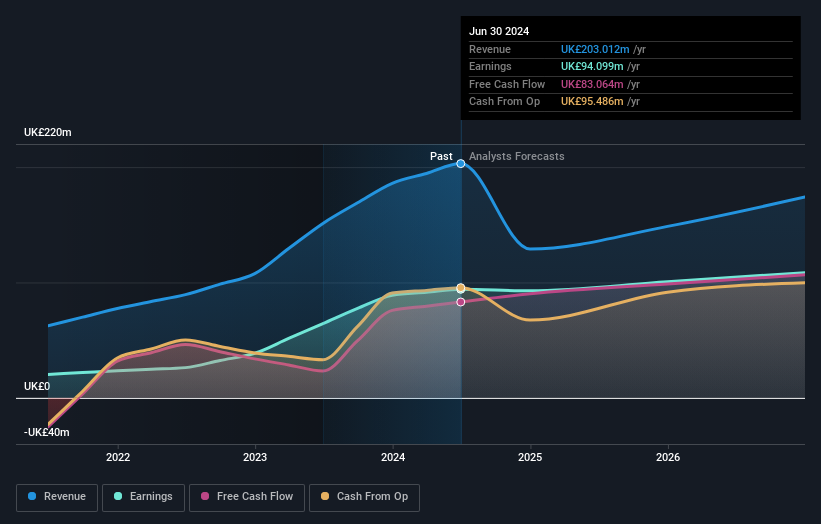

Alpha Group International, a promising player in the UK financial landscape, showcases robust growth with earnings surging by 46% over the past year, outpacing its industry peers. The company is debt-free and trades at a favorable price-to-earnings ratio of 9.4x compared to the broader UK market's 16.2x. Recent executive changes see Clive Kahn stepping into the CEO role in January 2025, following Morgan Tillbrook's decision to step down but retain a significant shareholding for continuity and confidence. With high-quality non-cash earnings and positive free cash flow, Alpha seems well-positioned for continued success.

- Dive into the specifics of Alpha Group International here with our thorough health report.

Understand Alpha Group International's track record by examining our Past report.

Where To Now?

- Click this link to deep-dive into the 80 companies within our UK Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equals Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EQLS

Equals Group

Through its subsidiaries, develops and sells payment platforms to private clients and corporations through prepaid currency cards, international money transfers, and current accounts in the United Kingdom.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives