- United Kingdom

- /

- Diversified Financial

- /

- AIM:TRU

Further Upside For TruFin plc (LON:TRU) Shares Could Introduce Price Risks After 31% Bounce

Those holding TruFin plc (LON:TRU) shares would be relieved that the share price has rebounded 31% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.1% over the last year.

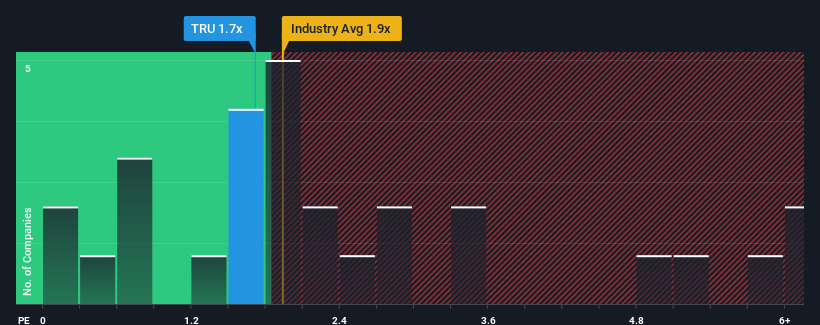

Although its price has surged higher, you could still be forgiven for feeling indifferent about TruFin's P/S ratio of 1.7x, since the median price-to-sales (or "P/S") ratio for the Diversified Financial industry in the United Kingdom is also close to 1.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for TruFin

How TruFin Has Been Performing

TruFin certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on TruFin.How Is TruFin's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like TruFin's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 151% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 134% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 15% during the coming year according to the sole analyst following the company. With the rest of the industry predicted to shrink by 19%, that would be a fantastic result.

With this information, we find it odd that TruFin is trading at a fairly similar P/S to the industry. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

What We Can Learn From TruFin's P/S?

TruFin appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We note that even though TruFin trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You need to take note of risks, for example - TruFin has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if TruFin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TRU

TruFin

Provides niche lending, early payment services, and video game publishing in the United Kingdom.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives