- United Kingdom

- /

- Capital Markets

- /

- LSE:WCW

Spotlight On UK Penny Stocks: 3 Picks With Market Caps Under £5M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices both experiencing declines amid weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, penny stocks—often representing smaller or newer companies—remain an intriguing investment area for those seeking potential growth opportunities. While the term 'penny stock' might seem outdated, it still signifies a sector where investors can uncover hidden value in companies with strong financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.45 | £507.73M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.85 | £149.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.935 | £14.12M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.13 | £27.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6575 | $382.22M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.744 | £275.11M | ✅ 5 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.285 | £62.07M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £175.56M | ✅ 4 ⚠️ 2 View Analysis > |

| ME Group International (LSE:MEGP) | £1.592 | £601.34M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 301 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

CML Microsystems (AIM:CML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CML Microsystems plc, with a market cap of £50.15 million, designs and manufactures semiconductor products for industrial, professional, and commercial applications across the Americas, Europe, the Far East, and internationally.

Operations: The company's revenue is primarily derived from its semiconductor components for the communications industry, amounting to £19.55 million.

Market Cap: £50.15M

CML Microsystems plc, with a market cap of £50.15 million, recently reported half-year earnings showing sales of £9.18 million and net income of £1.84 million, reflecting improved profitability despite a decline in sales from the previous year. The company declared an interim dividend of 5 pence per share, though its sustainability is questionable given that dividends are not well covered by earnings or free cash flows. CML's financial stability is supported by no debt and sufficient short-term assets to cover liabilities; however, it faces challenges with low return on equity and declining earnings growth over recent years despite having experienced management and board members.

- Click here to discover the nuances of CML Microsystems with our detailed analytical financial health report.

- Learn about CML Microsystems' historical performance here.

TMT Investments (AIM:TMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TMT Investments PLC is a venture capital and private equity firm that focuses on startups, early-stage, small, and mid-sized companies with a market cap of $84.29 million.

Operations: The firm generates revenue of $6.96 million from its investments in the technology, media, and telecommunications sector.

Market Cap: $84.29M

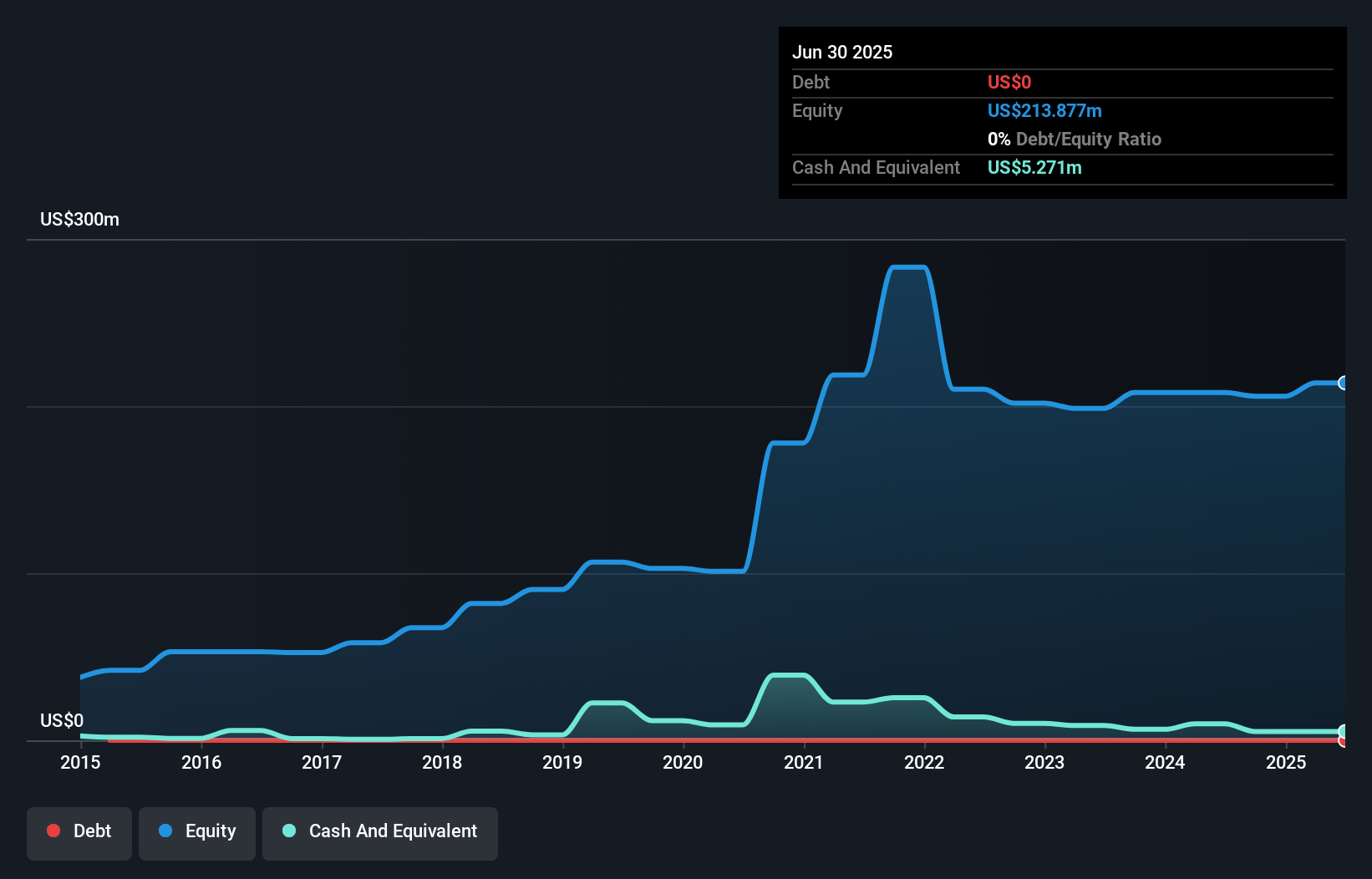

TMT Investments PLC, with a market cap of US$84.29 million, operates debt-free and maintains high-quality earnings despite facing challenges such as declining profits over the past five years. The company has stable weekly volatility at 7% and its short-term assets of $5.3 million comfortably cover liabilities of $661.4K. While its net profit margin has decreased from last year, TMT's seasoned management team and board bring extensive experience to navigate these hurdles. However, low return on equity at 2.7% and negative earnings growth indicate potential concerns for future performance in the capital markets sector.

- Click to explore a detailed breakdown of our findings in TMT Investments' financial health report.

- Gain insights into TMT Investments' past trends and performance with our report on the company's historical track record.

Walker Crips Group (LSE:WCW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Walker Crips Group plc, with a market cap of £5.75 million, operates in the United Kingdom offering a range of financial products and services through its subsidiaries.

Operations: The company generates revenue through its Investment Management segment (£27.91 million), Software as a Service (SaaS) segment (£0.02 million), and Financial Planning & Wealth Management segment (£3.42 million).

Market Cap: £5.75M

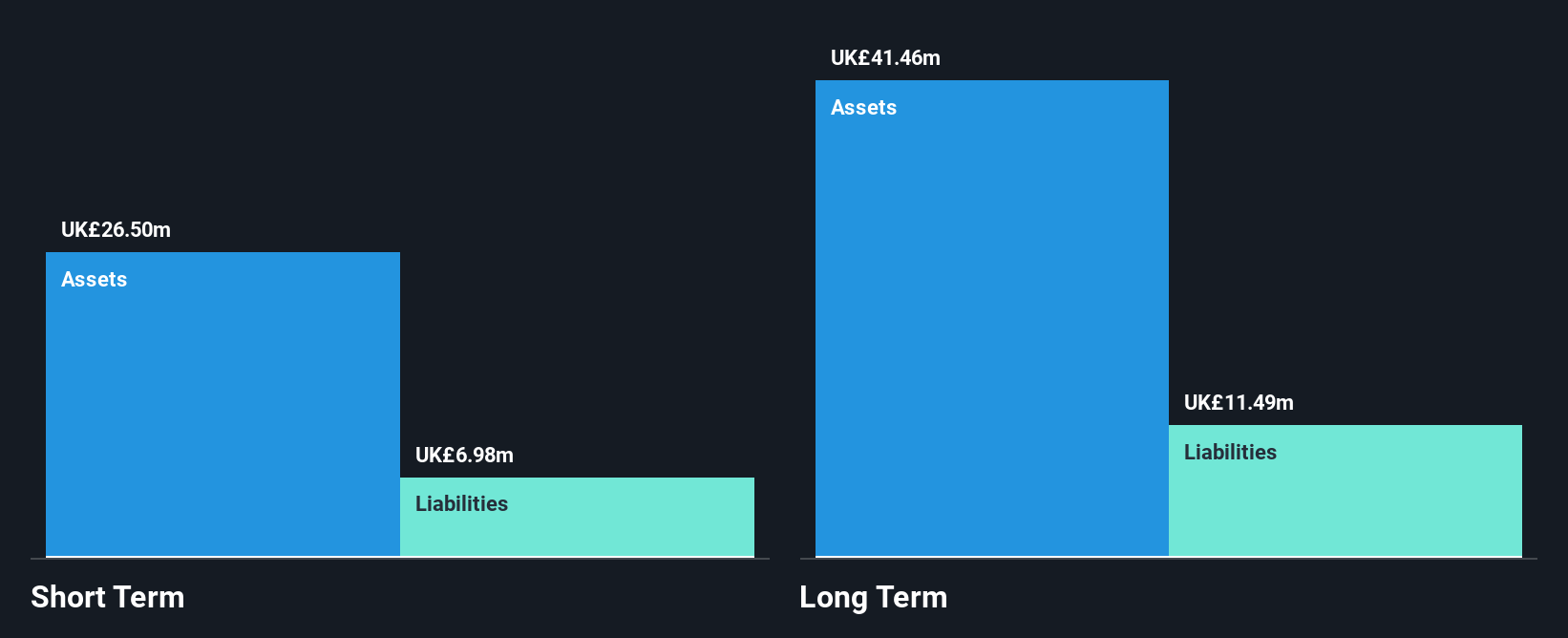

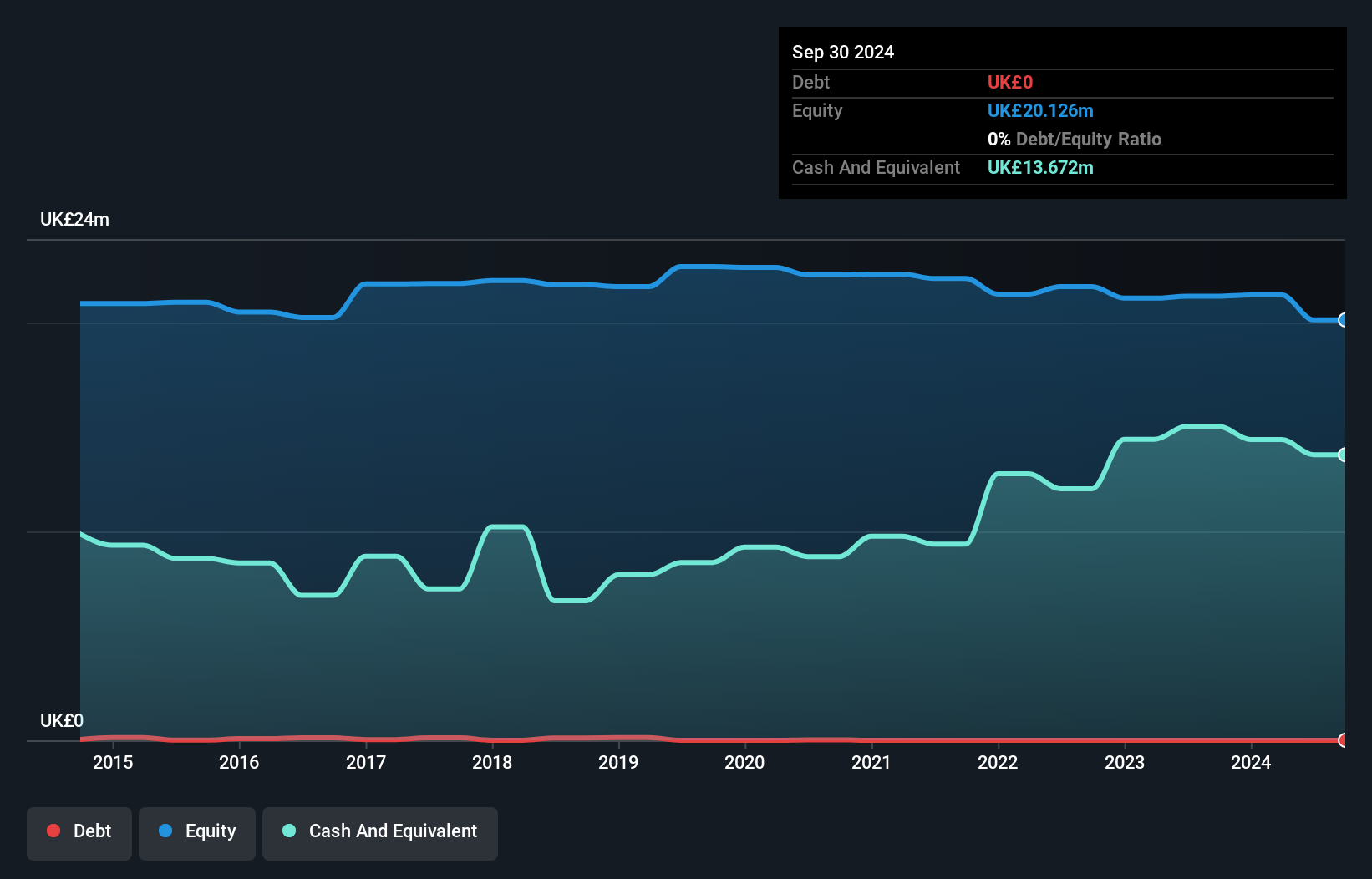

Walker Crips Group plc, with a market cap of £5.75 million, operates debt-free and has short-term assets of £45.8 million exceeding both its long-term liabilities (£1.6 million) and short-term liabilities (£35.1 million). Despite being unprofitable with a negative return on equity (-13.53%), the company is undergoing significant changes, including a 70.97% stake acquisition by PhillipCapital UK Ltd for £4.23 million, subject to approvals expected between January and March 2026. The management team is relatively new with an average tenure of 0.6 years, while the board remains experienced with an average tenure of 13.6 years.

- Unlock comprehensive insights into our analysis of Walker Crips Group stock in this financial health report.

- Examine Walker Crips Group's past performance report to understand how it has performed in prior years.

Summing It All Up

- Investigate our full lineup of 301 UK Penny Stocks right here.

- Ready For A Different Approach? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walker Crips Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WCW

Walker Crips Group

Provides financial products and services in the United Kingdom.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success