- United Kingdom

- /

- Capital Markets

- /

- AIM:TMT

Discover UK Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the UK market grapples with global economic challenges, including weak trade data from China impacting the FTSE indices, investors are keenly observing potential opportunities. Penny stocks, though sometimes seen as a relic of past market eras, continue to offer intriguing possibilities for those seeking affordability and growth potential. These smaller or newer companies can provide significant returns when backed by strong financials, making them worth watching in current conditions.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.105 | £793.09M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.48 | £66.37M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.12 | £95.58M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.825 | £182.42M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.302 | £200.81M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.30 | £427.66M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.436 | $253.46M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.07 | £81.04M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.18 | £480.53M | ★★★★★★ |

Click here to see the full list of 470 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Solid State (AIM:SOLI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Solid State plc, with a market cap of £74.16 million, designs, manufactures, and supplies electronic equipment across the United Kingdom, Europe, Asia, North America, and internationally.

Operations: The company's revenue is derived from its Systems Division, which generated £103.47 million, and its Components Division, contributing £59.83 million.

Market Cap: £74.16M

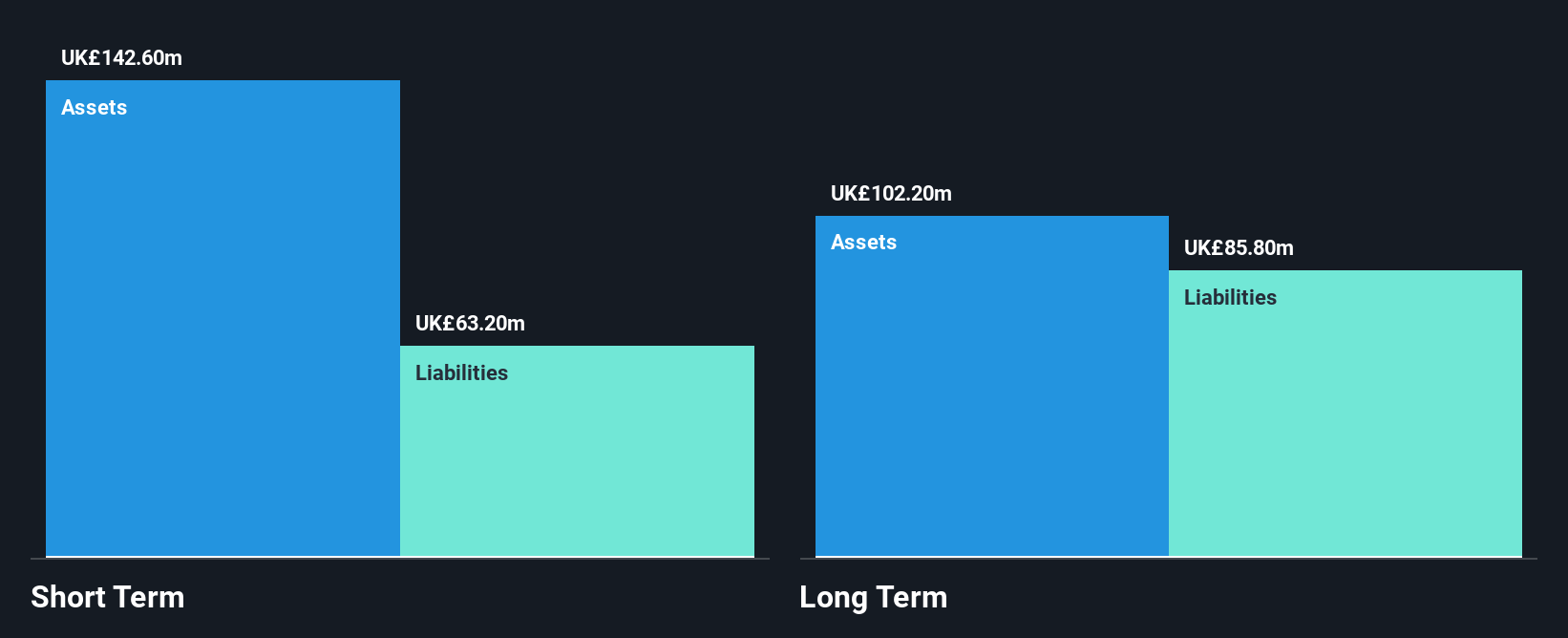

Solid State plc, with a market cap of £74.16 million, has shown significant earnings growth over the past year at 32.6%, outpacing the electronic industry average. Despite this growth, recent financial results indicate a decline in sales and net income compared to last year, raising concerns about future performance. The company maintains a satisfactory debt level and its interest payments are well covered by EBIT. However, volatility in share price and insider selling could be potential red flags for investors. Solid State's management team is experienced but forecasts suggest earnings may decline significantly in coming years.

- Dive into the specifics of Solid State here with our thorough balance sheet health report.

- Understand Solid State's earnings outlook by examining our growth report.

TMT Investments (AIM:TMT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TMT Investments PLC is a venture capital and private equity firm focused on startups, early stage, small, and mid-sized companies, with a market cap of $95.61 million.

Operations: The firm's revenue is derived from investing in the TMT sector, amounting to $10.44 million.

Market Cap: $95.61M

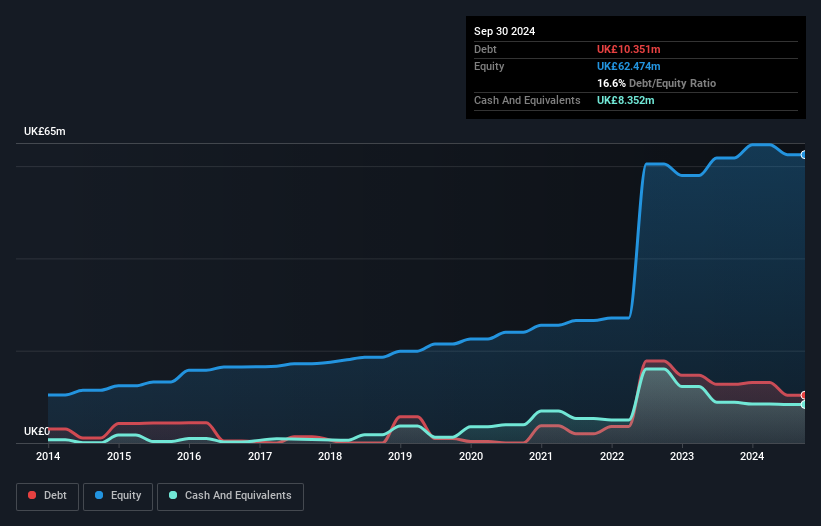

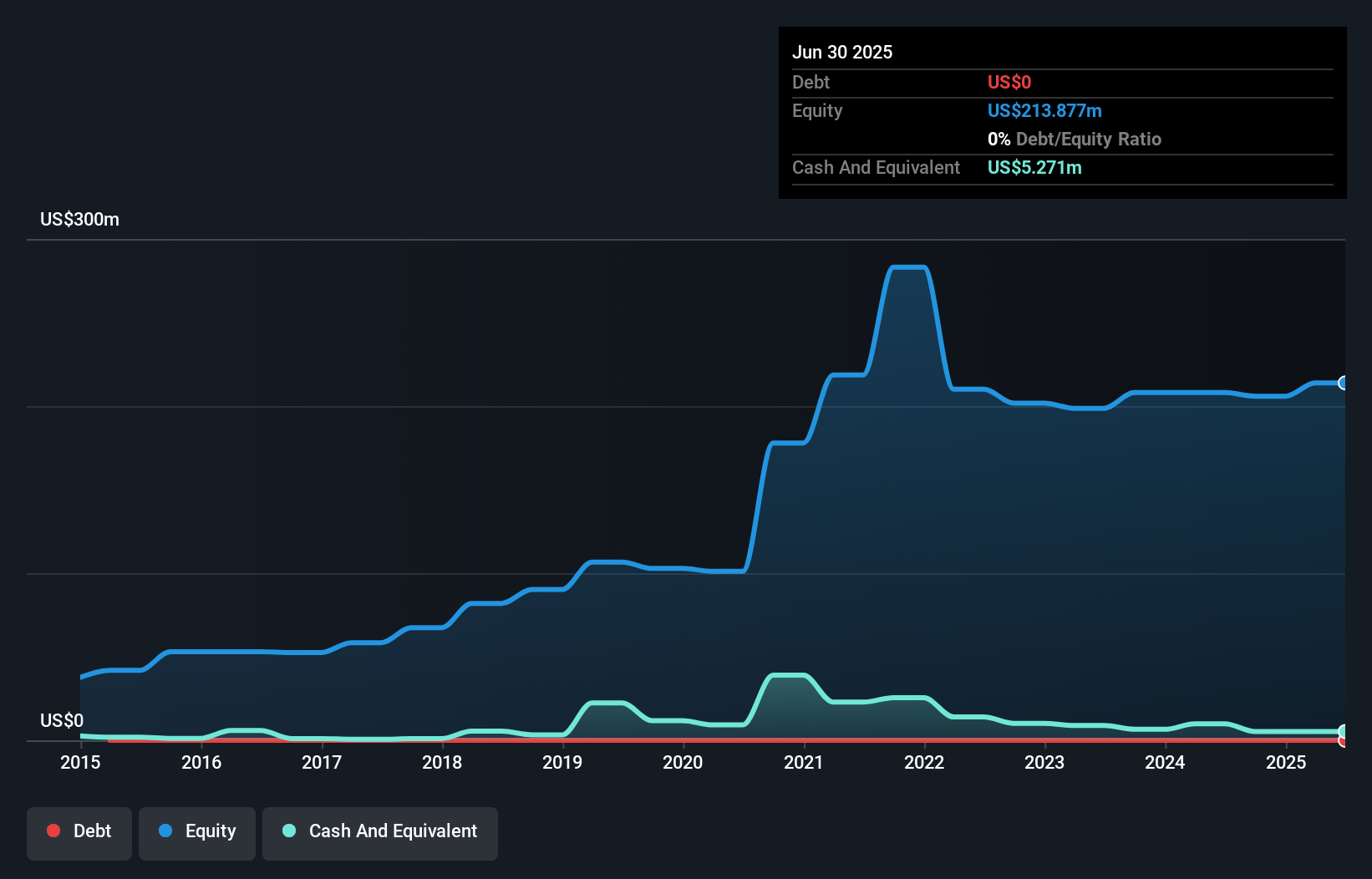

TMT Investments PLC, with a market cap of US$95.61 million, has recently turned profitable after years of declining earnings. The firm is debt-free and its short-term assets significantly exceed liabilities, indicating strong financial health. Its Price-To-Earnings ratio of 10.2x suggests it may be undervalued compared to the broader UK market average. Despite a low Return on Equity at 4.5%, the company benefits from an experienced board and management team with over a decade in tenure each. With high-quality earnings reported this year, TMT's stable weekly volatility adds to its investment appeal amidst penny stocks.

- Click to explore a detailed breakdown of our findings in TMT Investments' financial health report.

- Review our historical performance report to gain insights into TMT Investments' track record.

Luceco (LSE:LUCE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Luceco plc manufactures and distributes wiring accessories, LED lighting, and portable power products across the United Kingdom, Europe, the Middle East, the Americas, Asia Pacific, and Africa with a market cap of £200.81 million.

Operations: The company's revenue is derived from three primary segments: Wiring Accessories (£90.4 million), LED Lighting (£77.5 million), and Portable Power (£49.6 million).

Market Cap: £200.81M

Luceco plc, with a market cap of £200.81 million, showcases robust financial health through significant earnings growth of 51.2% over the past year and high quality earnings. The company benefits from an experienced board with an average tenure of 6.8 years and a strong Return on Equity at 20.2%. Despite its high net debt to equity ratio of 42.7%, Luceco's interest payments are well covered by EBIT (7.5x), and its operating cash flow effectively covers its debt (81.4%). Recent efforts to explore M&A opportunities highlight strategic growth intentions supported by a solid balance sheet and cash flow generation capabilities.

- Take a closer look at Luceco's potential here in our financial health report.

- Gain insights into Luceco's outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Unlock our comprehensive list of 470 UK Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TMT Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TMT

TMT Investments

A venture capital and private equity firm specializing in startups, early stage, small and mid-sized companies.

Flawless balance sheet low.

Market Insights

Community Narratives