- United Kingdom

- /

- Capital Markets

- /

- AIM:SEED

3 UK Penny Stocks With Market Caps Over £2M To Consider

Reviewed by Simply Wall St

The United Kingdom market has remained flat over the past week, but it is up 5.6% over the past year, with earnings expected to grow by 15% annually in the coming years. For those interested in investing in smaller or newer companies, penny stocks—despite their somewhat outdated name—can still present valuable opportunities. These stocks often combine financial robustness with potential for growth, offering investors a chance to uncover hidden value and stability within promising companies.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.20 | £828.88M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Supreme (AIM:SUP) | £1.575 | £183.66M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.44 | £355.43M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.81 | £61.34M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.21 | £103.3M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.33 | £205.12M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.405 | £435.71M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.372 | $216.25M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.475 | £187.85M | ★★★★★☆ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Feedback (AIM:FDBK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Feedback plc is a medical imaging technology company that provides software and systems for medical imaging professionals, with a market cap of £2.73 million.

Operations: The company generates revenue from its medical imaging segment, amounting to £1.18 million.

Market Cap: £2.73M

Feedback plc, with a market cap of £2.73 million, operates in the medical imaging technology sector and has reported sales of £1.18 million for the year ending May 31, 2024. Despite being debt-free and having short-term assets exceeding liabilities, Feedback remains unprofitable with increasing losses over five years at a rate of 26.7% annually. The company recently completed several follow-on equity offerings totaling over £5 million to bolster its cash runway beyond the current forecasted 11 months based on free cash flow estimates. Management is relatively inexperienced with an average tenure of just under a year.

- Dive into the specifics of Feedback here with our thorough balance sheet health report.

- Examine Feedback's earnings growth report to understand how analysts expect it to perform.

Flowtech Fluidpower (AIM:FLO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Flowtech Fluidpower plc, along with its subsidiaries, distributes engineering components and assemblies for the fluid power industry across the United Kingdom, Europe, and internationally, with a market cap of £55.27 million.

Operations: The company's revenue is primarily derived from Great Britain (£81.16 million), Ireland (£21.65 million), and Benelux (£10.73 million).

Market Cap: £55.27M

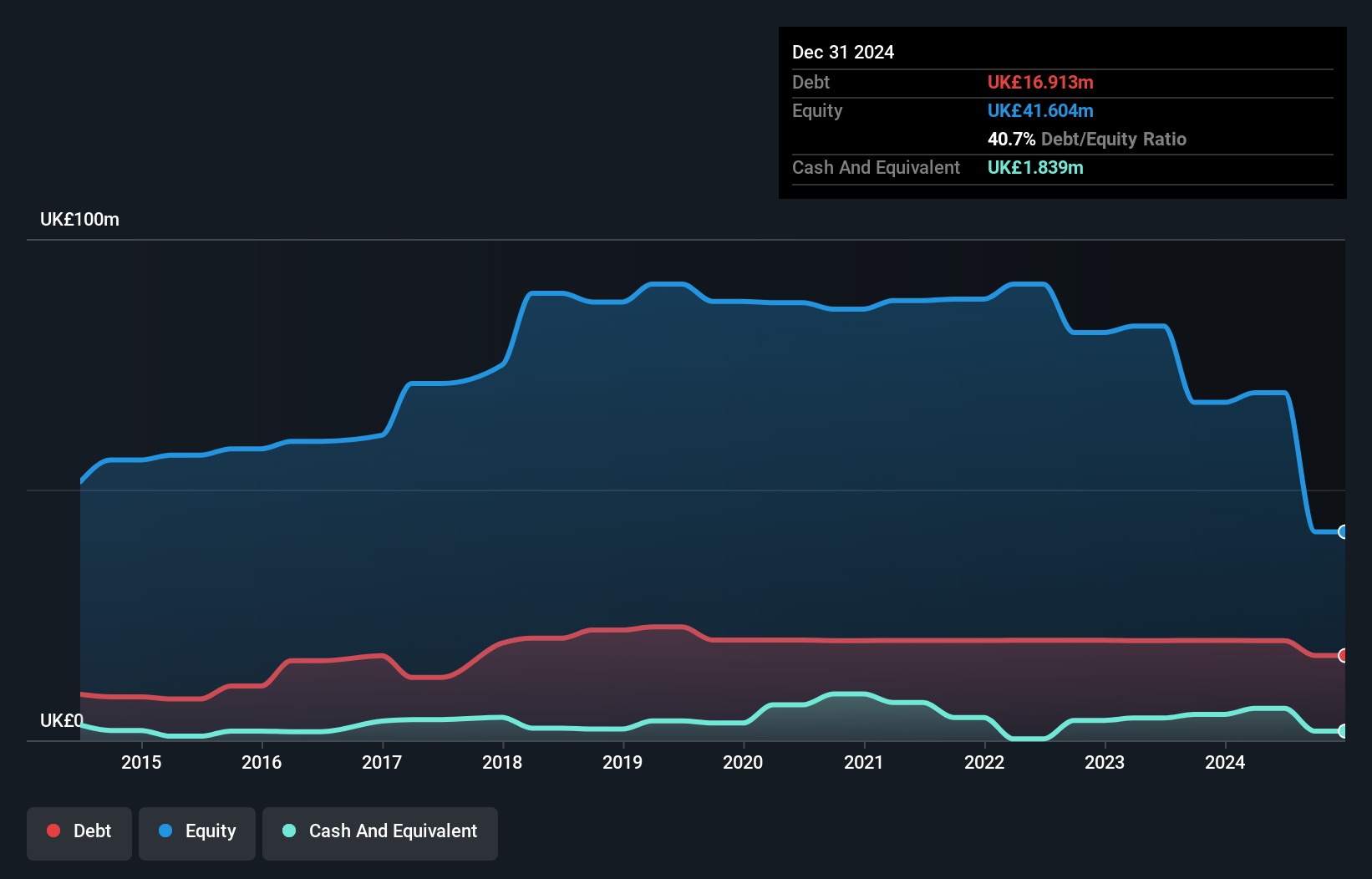

Flowtech Fluidpower plc, with a market cap of £55.27 million, faces challenges as it remains unprofitable and has seen earnings decline by 70.2% annually over the past five years. Despite this, its short-term assets (£60.2M) comfortably cover both short-term (£20.7M) and long-term liabilities (£25.1M), indicating strong liquidity management. The company’s debt is well-covered by operating cash flow (37.2%), although interest coverage is weak (2.1x). Recent earnings for H1 2024 showed a decrease in sales to £55.71 million from £59.07 million year-on-year, with net income dropping to £0.251 million from £1.4 million previously reported.

- Click here to discover the nuances of Flowtech Fluidpower with our detailed analytical financial health report.

- Understand Flowtech Fluidpower's earnings outlook by examining our growth report.

Seed Innovations (AIM:SEED)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Seed Innovations Limited is a venture capital firm focusing on early-stage investments, with a market cap of £2.99 million.

Operations: The company reported revenue from its Financial Services - Closed End Funds segment amounting to £-1.11 million.

Market Cap: £2.99M

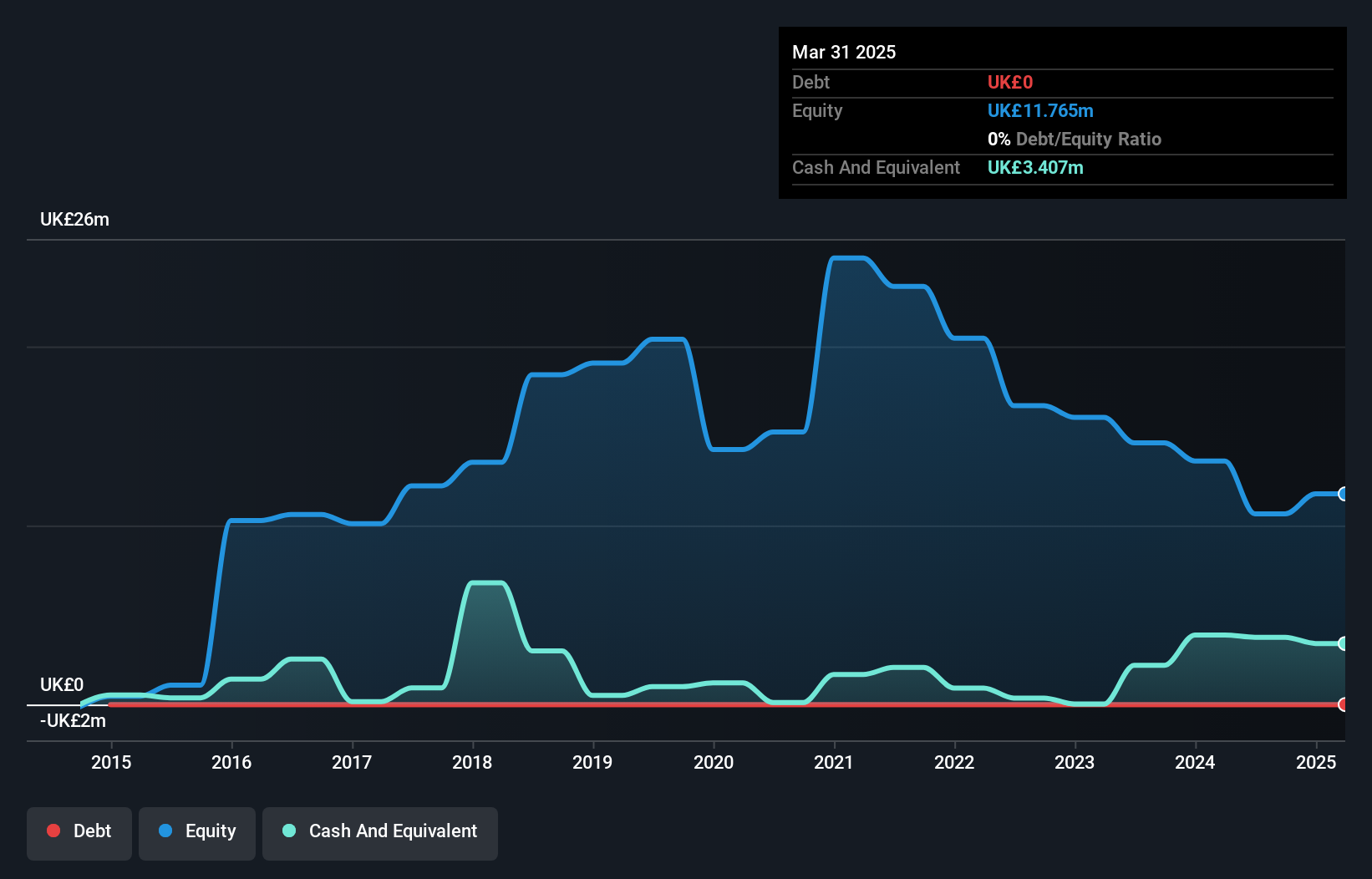

Seed Innovations Limited, with a market cap of £2.99 million, is pre-revenue and unprofitable, facing challenges from declining earnings over the past five years at a rate of 23.6% annually. Despite this, it remains debt-free and possesses short-term assets (£6.3M) that significantly exceed its short-term liabilities (£28K). The management team and board are experienced with average tenures exceeding five years. However, the company has less than a year of cash runway if free cash flow continues to decrease at historical rates but maintains sufficient cash runway based on current free cash flow levels without further reductions.

- Click to explore a detailed breakdown of our findings in Seed Innovations' financial health report.

- Evaluate Seed Innovations' historical performance by accessing our past performance report.

Next Steps

- Unlock more gems! Our UK Penny Stocks screener has unearthed 462 more companies for you to explore.Click here to unveil our expertly curated list of 465 UK Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SEED

Seed Innovations

A venture capital firm specializing in early stage investments.

Flawless balance sheet low.

Market Insights

Community Narratives