- United Kingdom

- /

- Consumer Finance

- /

- AIM:RFX

We Think Shareholders Will Probably Be Generous With Ramsdens Holdings PLC's (LON:RFX) CEO Compensation

Key Insights

- Ramsdens Holdings' Annual General Meeting to take place on 3rd of March

- Salary of UK£279.0k is part of CEO Peter Kenyon's total remuneration

- The total compensation is similar to the average for the industry

- Ramsdens Holdings' total shareholder return over the past three years was 55% while its EPS grew by 181% over the past three years

We have been pretty impressed with the performance at Ramsdens Holdings PLC (LON:RFX) recently and CEO Peter Kenyon deserves a mention for their role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 3rd of March. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

Check out our latest analysis for Ramsdens Holdings

Comparing Ramsdens Holdings PLC's CEO Compensation With The Industry

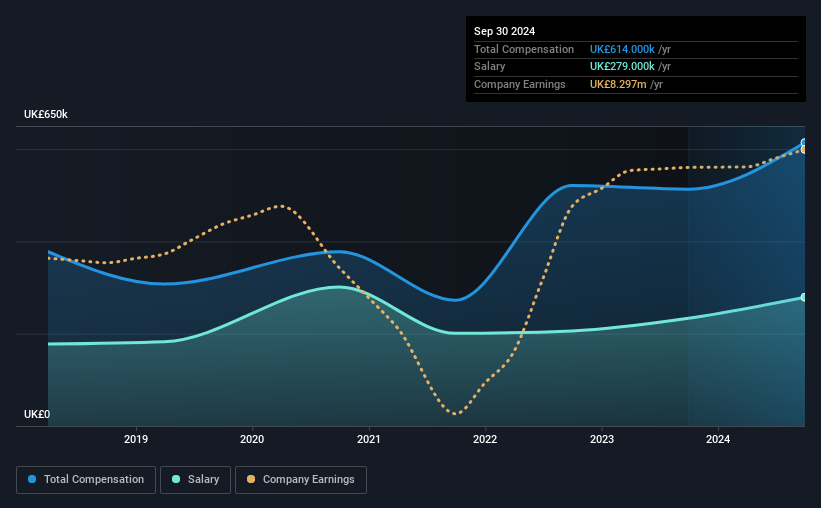

At the time of writing, our data shows that Ramsdens Holdings PLC has a market capitalization of UK£77m, and reported total annual CEO compensation of UK£614k for the year to September 2024. We note that's an increase of 20% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at UK£279k.

On comparing similar-sized companies in the British Consumer Finance industry with market capitalizations below UK£158m, we found that the median total CEO compensation was UK£575k. So it looks like Ramsdens Holdings compensates Peter Kenyon in line with the median for the industry. What's more, Peter Kenyon holds UK£2.8m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | UK£279k | UK£233k | 45% |

| Other | UK£335k | UK£280k | 55% |

| Total Compensation | UK£614k | UK£513k | 100% |

Talking in terms of the industry, salary represented approximately 62% of total compensation out of all the companies we analyzed, while other remuneration made up 38% of the pie. In Ramsdens Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Ramsdens Holdings PLC's Growth

Ramsdens Holdings PLC has seen its earnings per share (EPS) increase by 181% a year over the past three years. Its revenue is up 14% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Ramsdens Holdings PLC Been A Good Investment?

Most shareholders would probably be pleased with Ramsdens Holdings PLC for providing a total return of 55% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for Ramsdens Holdings that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:RFX

Ramsdens Holdings

Engages in the provision of diversified financial services in the United Kingdom and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives