- United Kingdom

- /

- Capital Markets

- /

- AIM:POLR

The Compensation For Polar Capital Holdings plc's (LON:POLR) CEO Looks Deserved And Here's Why

It would be hard to discount the role that CEO Gavin Rochussen has played in delivering the impressive results at Polar Capital Holdings plc (LON:POLR) recently. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 08 September 2021. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

See our latest analysis for Polar Capital Holdings

Comparing Polar Capital Holdings plc's CEO Compensation With the industry

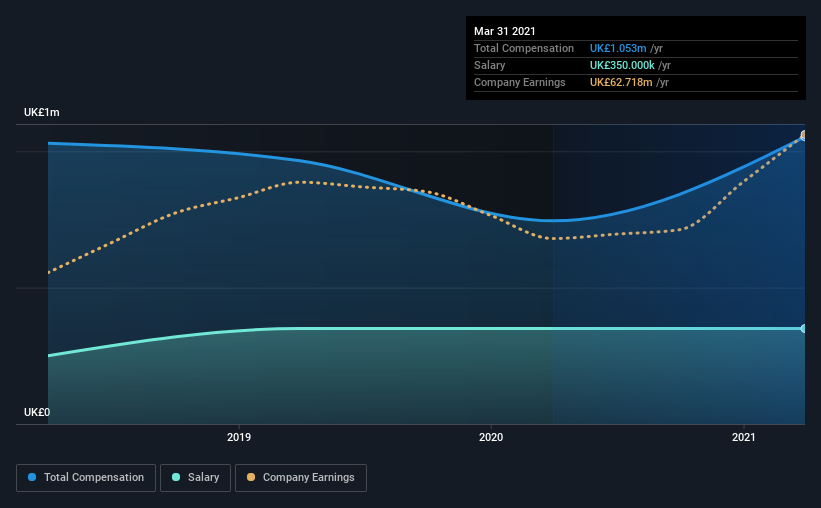

Our data indicates that Polar Capital Holdings plc has a market capitalization of UK£921m, and total annual CEO compensation was reported as UK£1.1m for the year to March 2021. Notably, that's an increase of 41% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at UK£350k.

In comparison with other companies in the industry with market capitalizations ranging from UK£727m to UK£2.3b, the reported median CEO total compensation was UK£1.3m. So it looks like Polar Capital Holdings compensates Gavin Rochussen in line with the median for the industry. Moreover, Gavin Rochussen also holds UK£13m worth of Polar Capital Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£350k | UK£350k | 33% |

| Other | UK£703k | UK£395k | 67% |

| Total Compensation | UK£1.1m | UK£745k | 100% |

Talking in terms of the broader industry, salary and other compensation roughly make up 50% each, of the total compensation. Polar Capital Holdings pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Polar Capital Holdings plc's Growth

Polar Capital Holdings plc's earnings per share (EPS) grew 23% per year over the last three years. In the last year, its revenue is up 35%.

Shareholders would be glad to know that the company has improved itself over the last few years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Polar Capital Holdings plc Been A Good Investment?

We think that the total shareholder return of 69%, over three years, would leave most Polar Capital Holdings plc shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 2 warning signs for Polar Capital Holdings that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Polar Capital Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Polar Capital Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:POLR

Polar Capital Holdings

Polar Capital Holdings plc is a publicly owned investment manager.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives