- United Kingdom

- /

- Capital Markets

- /

- AIM:POLR

Is It Smart To Buy Polar Capital Holdings plc (LON:POLR) Before It Goes Ex-Dividend?

Polar Capital Holdings plc (LON:POLR) stock is about to trade ex-dividend in 3 days. Investors can purchase shares before the 17th of December in order to be eligible for this dividend, which will be paid on the 8th of January.

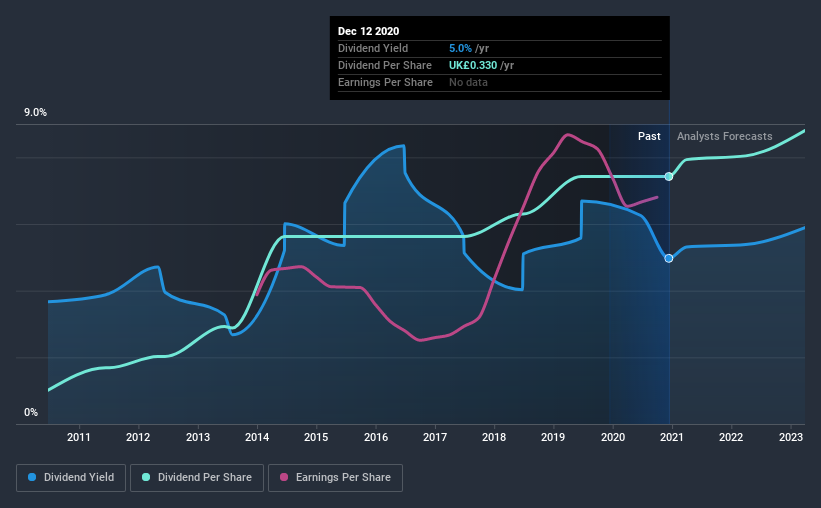

Polar Capital Holdings's next dividend payment will be UK£0.09 per share, on the back of last year when the company paid a total of UK£0.33 to shareholders. Based on the last year's worth of payments, Polar Capital Holdings has a trailing yield of 5.0% on the current stock price of £6.64. If you buy this business for its dividend, you should have an idea of whether Polar Capital Holdings's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

View our latest analysis for Polar Capital Holdings

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Polar Capital Holdings paid out more than half (75%) of its earnings last year, which is a regular payout ratio for most companies.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Fortunately for readers, Polar Capital Holdings's earnings per share have been growing at 11% a year for the past five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the last 10 years, Polar Capital Holdings has lifted its dividend by approximately 22% a year on average. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

Final Takeaway

Is Polar Capital Holdings worth buying for its dividend? Polar Capital Holdings has an acceptable payout ratio and its earnings per share have been improving at a decent rate. We think this is a pretty attractive combination, and would be interested in investigating Polar Capital Holdings more closely.

While it's tempting to invest in Polar Capital Holdings for the dividends alone, you should always be mindful of the risks involved. Case in point: We've spotted 1 warning sign for Polar Capital Holdings you should be aware of.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Polar Capital Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:POLR

Polar Capital Holdings

Polar Capital Holdings plc is a publicly owned investment manager.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026