- United Kingdom

- /

- Diversified Financial

- /

- AIM:ORCH

Orchard Funding Group plc (LON:ORCH) Stock Rockets 33% But Many Are Still Ignoring The Company

The Orchard Funding Group plc (LON:ORCH) share price has done very well over the last month, posting an excellent gain of 33%. The annual gain comes to 145% following the latest surge, making investors sit up and take notice.

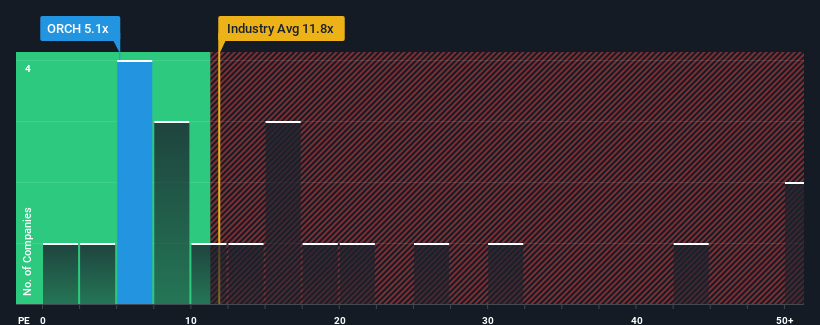

Although its price has surged higher, Orchard Funding Group may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 5.1x, since almost half of all companies in the United Kingdom have P/E ratios greater than 16x and even P/E's higher than 27x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

While the market has experienced earnings growth lately, Orchard Funding Group's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Orchard Funding Group

How Is Orchard Funding Group's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Orchard Funding Group's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 7.8%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 88% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 78% as estimated by the only analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 18%, which is noticeably less attractive.

With this information, we find it odd that Orchard Funding Group is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Orchard Funding Group's P/E

Orchard Funding Group's recent share price jump still sees its P/E sitting firmly flat on the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Orchard Funding Group's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Orchard Funding Group (of which 1 makes us a bit uncomfortable!) you should know about.

If these risks are making you reconsider your opinion on Orchard Funding Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:ORCH

Orchard Funding Group

Through its subsidiaries, offers insurance premium finance, professional fee funding, finance, and secured property lending services in the United Kingdom.

Solid track record with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026