- United Kingdom

- /

- Specialty Stores

- /

- LSE:DNLM

3 UK Dividend Stocks Yielding Up To 6.5%

Reviewed by Simply Wall St

As the FTSE 100 index faces headwinds from weak trade data out of China, investors in the UK market are navigating a landscape marked by global economic uncertainties. In such conditions, dividend stocks can offer a degree of stability and income potential, making them an attractive option for those seeking to weather market volatility while benefiting from consistent returns.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 9.41% | ★★★★★★ |

| Treatt (LSE:TET) | 3.37% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 5.96% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.78% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.00% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.52% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.33% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.03% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.56% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.85% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

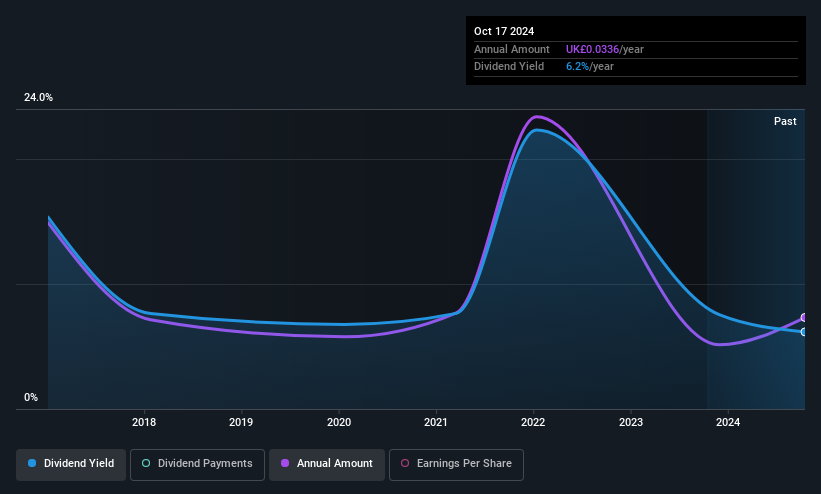

Livermore Investments Group (AIM:LIV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Livermore Investments Group Limited is a publicly owned investment manager with a market cap of £92.19 million.

Operations: Livermore Investments Group Limited generates revenue from its Equity and Debt Instruments Investment Activities, amounting to $12.91 million.

Dividend Yield: 5.7%

Livermore Investments Group declared an interim cash dividend of $0.0423 per share, reflecting a high dividend yield of 5.66%, placing it among the top UK payers. However, with a payout ratio of 106.2%, dividends are not well covered by earnings, though cash flow coverage is better at 39.9%. Earnings have declined significantly from $13.89 million to $6.59 million year-over-year, and past dividend payments have been volatile and unreliable despite growth over the decade.

- Click here to discover the nuances of Livermore Investments Group with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Livermore Investments Group's current price could be inflated.

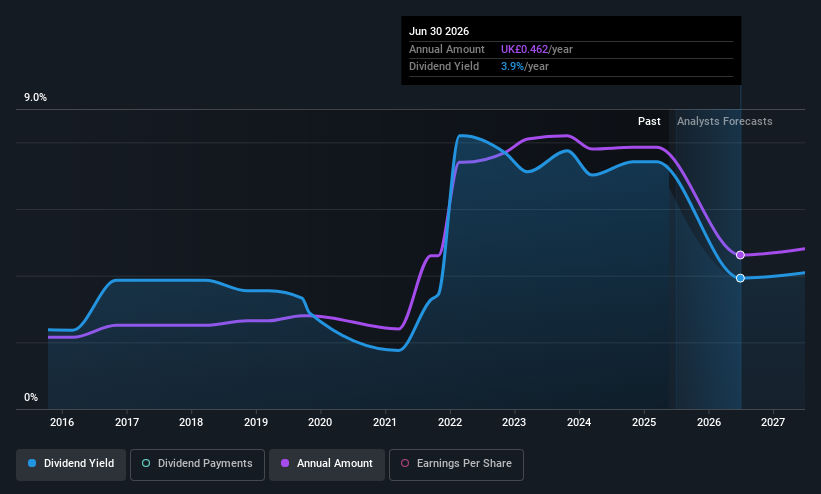

Dunelm Group (LSE:DNLM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dunelm Group plc operates as a retailer of homewares in the United Kingdom with a market cap of £2.42 billion.

Operations: Dunelm Group plc generates revenue primarily from its homewares retail segment, amounting to £1.73 billion.

Dividend Yield: 6.6%

Dunelm Group's dividend yield of 6.56% ranks in the top 25% of UK payers, with a payout ratio of 58.6%, indicating coverage by earnings and cash flows. Despite past volatility and unreliability in dividends, recent sales reached £1.77 billion for the year to June 2025, suggesting potential stability. The appointment of Clodagh Moriarty as CEO may influence future performance positively, given her extensive retail experience from Sainsbury's.

- Navigate through the intricacies of Dunelm Group with our comprehensive dividend report here.

- Our expertly prepared valuation report Dunelm Group implies its share price may be too high.

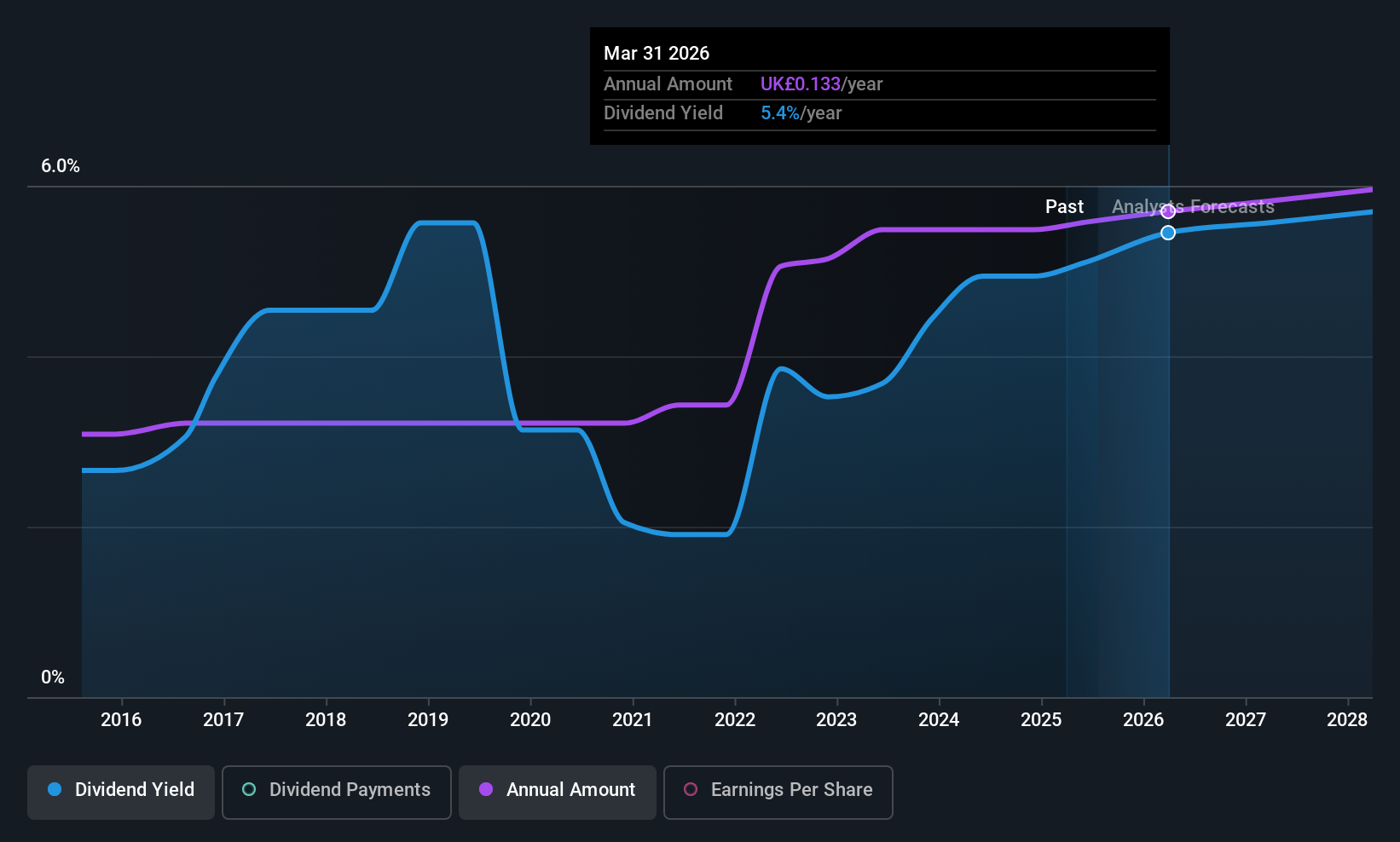

Pets at Home Group (LSE:PETS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Pets at Home Group Plc operates as an omnichannel retailer of pet food, pet-related products, and accessories in the United Kingdom, with a market cap of £1.10 billion.

Operations: Pets at Home Group Plc generates revenue through its Retail segment, which accounts for £1.31 billion, and its Vet Group segment, contributing £175.30 million.

Dividend Yield: 5.4%

Pets at Home Group offers a stable dividend yield of 5.36%, supported by a payout ratio of 68.3% and a cash payout ratio of 34.8%, ensuring coverage by earnings and cash flows. The company has consistently increased dividends over the past decade, with the latest annual dividend reaching 13 pence per share. Trading below estimated fair value, Pets at Home also completed a £25 million share buyback to enhance shareholder value further.

- Click to explore a detailed breakdown of our findings in Pets at Home Group's dividend report.

- The valuation report we've compiled suggests that Pets at Home Group's current price could be quite moderate.

Seize The Opportunity

- Explore the 57 names from our Top UK Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DNLM

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives