- United Kingdom

- /

- Diversified Financial

- /

- AIM:LIT

Should You Be Adding Litigation Capital Management (LON:LIT) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Litigation Capital Management (LON:LIT), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Litigation Capital Management

How Fast Is Litigation Capital Management Growing Its Earnings Per Share?

In the last three years Litigation Capital Management's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Litigation Capital Management's EPS has risen over the last 12 months, growing from AU$0.28 to AU$0.35. This amounts to a 24% gain; a figure that shareholders will be pleased to see.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Not all of Litigation Capital Management's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The good news is that Litigation Capital Management is growing revenues, and EBIT margins improved by 2.3 percentage points to 93%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

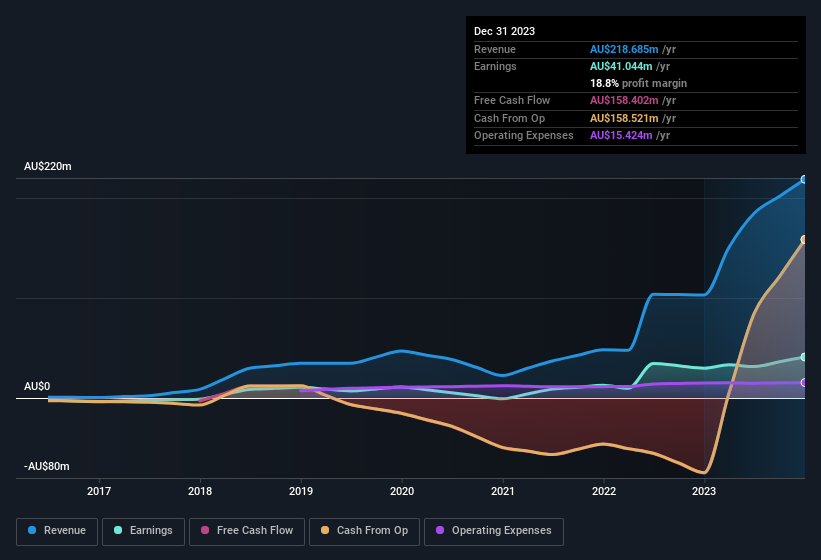

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Litigation Capital Management isn't a huge company, given its market capitalisation of UK£123m. That makes it extra important to check on its balance sheet strength.

Are Litigation Capital Management Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that Litigation Capital Management insiders have a significant amount of capital invested in the stock. Indeed, they hold AU$20m worth of its stock. That's a lot of money, and no small incentive to work hard. Those holdings account for over 16% of the company; visible skin in the game.

Is Litigation Capital Management Worth Keeping An Eye On?

One important encouraging feature of Litigation Capital Management is that it is growing profits. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. We don't want to rain on the parade too much, but we did also find 1 warning sign for Litigation Capital Management that you need to be mindful of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in GB with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:LIT

Litigation Capital Management

Provides litigation finance and risk management services in Australia and the United Kingdom.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives