- United Kingdom

- /

- Capital Markets

- /

- AIM:IPX

A Quick Analysis On Impax Asset Management Group's (LON:IPX) CEO Compensation

Ian Simm became the CEO of Impax Asset Management Group plc (LON:IPX) in 2005, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Impax Asset Management Group pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Impax Asset Management Group

How Does Total Compensation For Ian Simm Compare With Other Companies In The Industry?

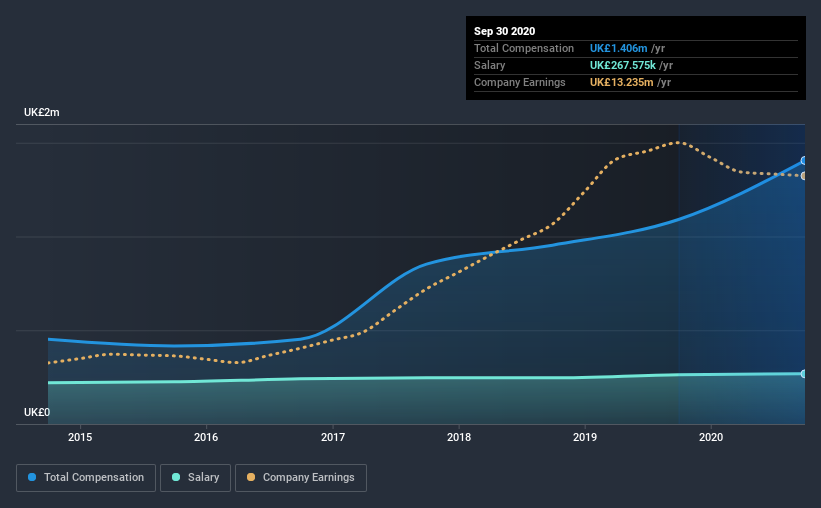

According to our data, Impax Asset Management Group plc has a market capitalization of UK£1.1b, and paid its CEO total annual compensation worth UK£1.4m over the year to September 2020. Notably, that's an increase of 29% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at UK£268k.

On comparing similar companies from the same industry with market caps ranging from UK£734m to UK£2.3b, we found that the median CEO total compensation was UK£814k. This suggests that Ian Simm is paid more than the median for the industry. Moreover, Ian Simm also holds UK£80m worth of Impax Asset Management Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£268k | UK£263k | 19% |

| Other | UK£1.1m | UK£828k | 81% |

| Total Compensation | UK£1.4m | UK£1.1m | 100% |

Talking in terms of the industry, salary represented approximately 49% of total compensation out of all the companies we analyzed, while other remuneration made up 51% of the pie. In Impax Asset Management Group's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Impax Asset Management Group plc's Growth Numbers

Impax Asset Management Group plc has seen its earnings per share (EPS) increase by 18% a year over the past three years. Its revenue is up 19% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Impax Asset Management Group plc Been A Good Investment?

Boasting a total shareholder return of 348% over three years, Impax Asset Management Group plc has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

As we touched on above, Impax Asset Management Group plc is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But EPS growth and shareholder returns have been top-notch for the past three years. So, in acknowledgment of the overall excellent performance, we believe CEO compensation is appropriate. The pleasing shareholder returns are the cherry on top. We wouldn't be wrong in saying that shareholders feel that Ian's performance creates value for the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 3 warning signs for Impax Asset Management Group that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Impax Asset Management Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:IPX

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.