- United Kingdom

- /

- Diversified Financial

- /

- AIM:FIN

Not Many Are Piling Into Finseta Plc (LON:FIN) Stock Yet As It Plummets 37%

To the annoyance of some shareholders, Finseta Plc (LON:FIN) shares are down a considerable 37% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 62% share price decline.

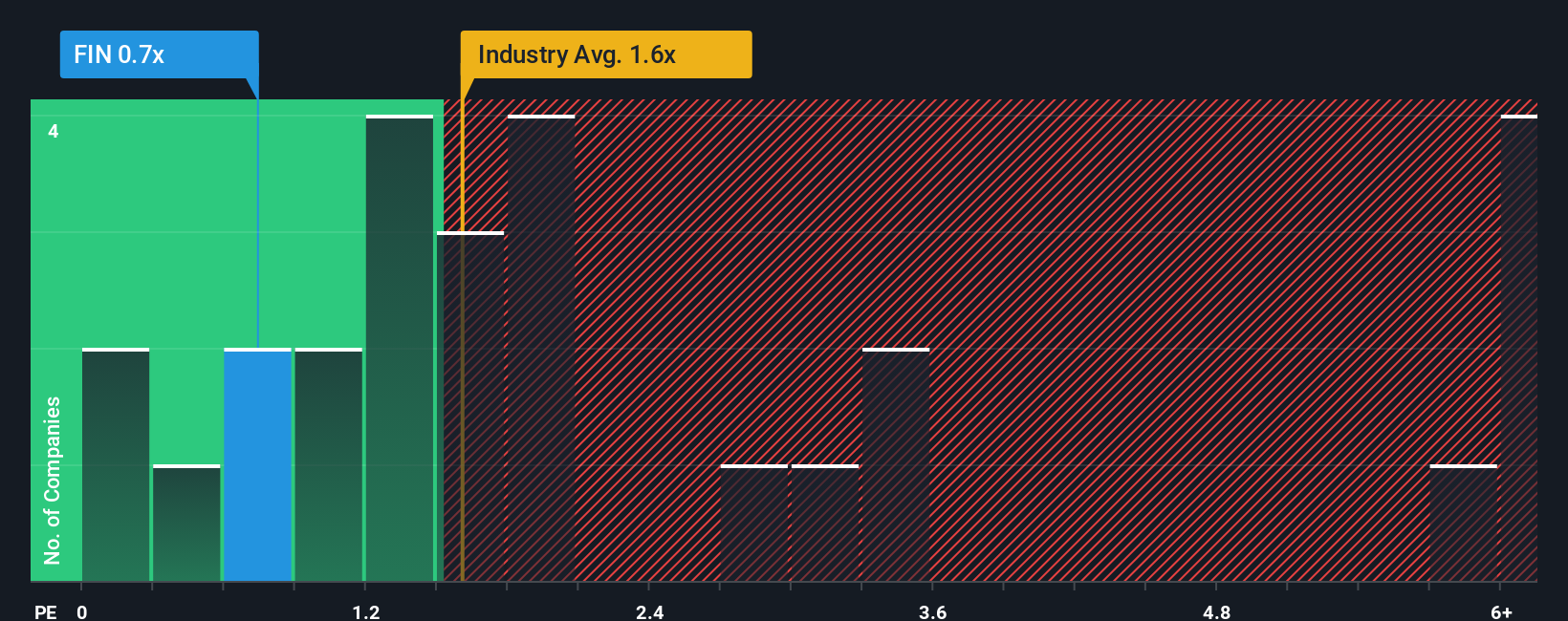

Although its price has dipped substantially, Finseta may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Diversified Financial industry in the United Kingdom have P/S ratios greater than 1.6x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Finseta

What Does Finseta's P/S Mean For Shareholders?

Finseta certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Finseta will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Finseta?

Finseta's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.4% last year. The latest three year period has also seen an excellent 262% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue growth will be highly resilient over the next year growing by 19%. With the rest of the industry predicted to shrink by 16%, that would be a fantastic result.

With this information, we find it very odd that Finseta is trading at a P/S lower than the industry. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

The Bottom Line On Finseta's P/S

Finseta's recently weak share price has pulled its P/S back below other Diversified Financial companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Finseta's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Finseta that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:FIN

Finseta

A foreign exchange and payment company, engages in the provision of multi-currency accounts to businesses and individuals.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives