- United Kingdom

- /

- Capital Markets

- /

- LSE:ALPH

If EPS Growth Is Important To You, Alpha Group International (LON:ALPH) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Alpha Group International (LON:ALPH). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Alpha Group International

How Quickly Is Alpha Group International Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Alpha Group International's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 45%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

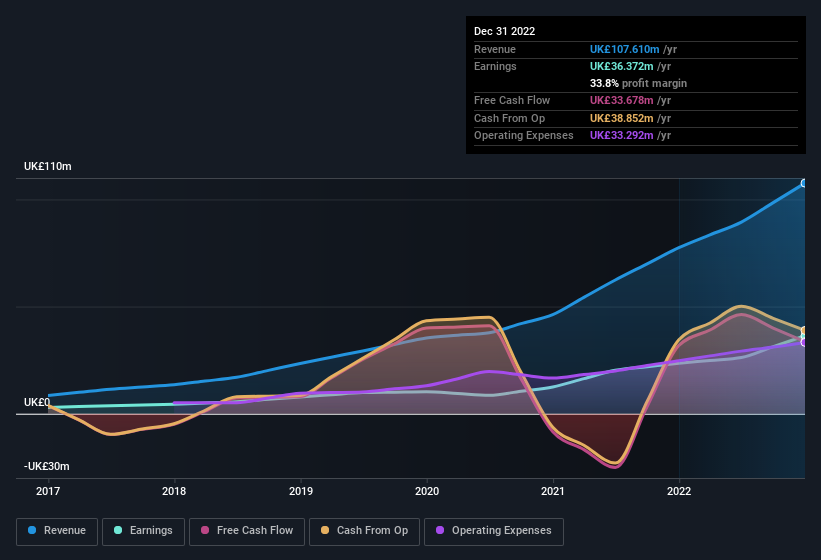

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that Alpha Group International's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Alpha Group International remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 39% to UK£108m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Alpha Group International's balance sheet strength, before getting too excited.

Are Alpha Group International Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Over the last 12 months Alpha Group International insiders spent UK£102k more buying shares than they received from selling them. Shareholders who may have questioned insiders selling will find some reassurance in this fact. We also note that it was the Independent Non-Executive Director, Lisa Gordon, who made the biggest single acquisition, paying UK£102k for shares at about UK£18.00 each.

Along with the insider buying, another encouraging sign for Alpha Group International is that insiders, as a group, have a considerable shareholding. Indeed, they have a considerable amount of wealth invested in it, currently valued at UK£185m. That equates to 23% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, Morgan Tillbrook, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Alpha Group International with market caps between UK£327m and UK£1.3b is about UK£1.1m.

The Alpha Group International CEO received UK£694k in compensation for the year ending December 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Alpha Group International Deserve A Spot On Your Watchlist?

Alpha Group International's earnings have taken off in quite an impressive fashion. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Alpha Group International deserves timely attention. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Alpha Group International that you should be aware of.

The good news is that Alpha Group International is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ALPH

Alpha Group International

Provides cash and risk management solutions in the United Kingdom, Europe, Canada, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives