- United Kingdom

- /

- Capital Markets

- /

- AIM:AGFX

With EPS Growth And More, Argentex Group (LON:AGFX) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Argentex Group (LON:AGFX). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Argentex Group with the means to add long-term value to shareholders.

Check out our latest analysis for Argentex Group

Argentex Group's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Argentex Group's EPS skyrocketed from UK£0.061 to UK£0.082, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 34%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While Argentex Group did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

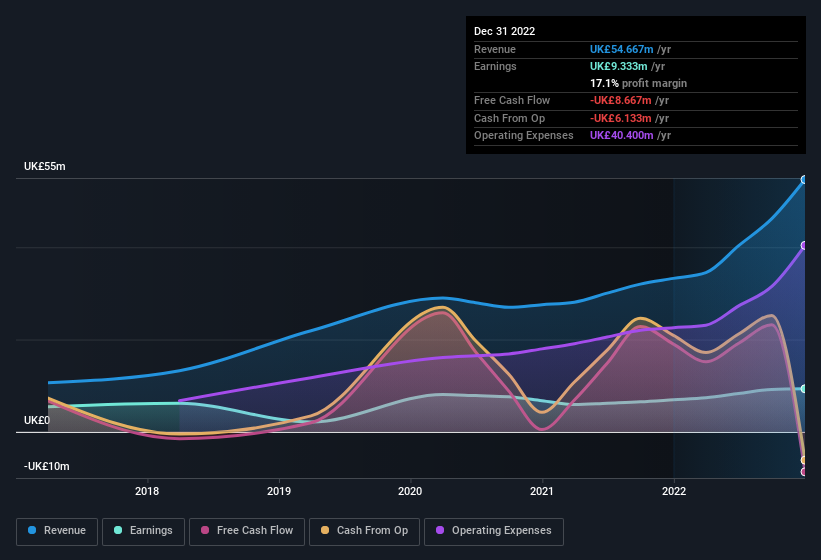

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Argentex Group isn't a huge company, given its market capitalisation of UK£129m. That makes it extra important to check on its balance sheet strength.

Are Argentex Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Argentex Group shares, in the last year. Add in the fact that Nigel Railton, the Senior Independent Director of the company, paid UK£30k for shares at around UK£1.04 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Along with the insider buying, another encouraging sign for Argentex Group is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at UK£38m. This considerable investment should help drive long-term value in the business. As a percentage, this totals to 30% of the shares on issue for the business, an appreciable amount considering the market cap.

Should You Add Argentex Group To Your Watchlist?

For growth investors, Argentex Group's raw rate of earnings growth is a beacon in the night. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. So it's fair to say that this stock may well deserve a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 1 warning sign for Argentex Group you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Argentex Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:AGFX

Argentex Group

Provides currency risk management, payment, and alternative banking solutions in the United Kingdom, the Netherlands, the United Arab Emirates, and Australia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives