When The Restaurant Group plc (LON:RTN) reported its results to December 2020 its auditors, Ernst & Young LLP could not be sure that it would be able to continue as a going concern in the next year. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

Given its situation, it may not be in a good position to raise capital on favorable terms. So current risks on the balance sheet could have a big impact on how shareholders fare from here. The biggest concern we would have is the company's debt, since its lenders might force the company into administration if it cannot repay them.

See our latest analysis for Restaurant Group

How Much Debt Does Restaurant Group Carry?

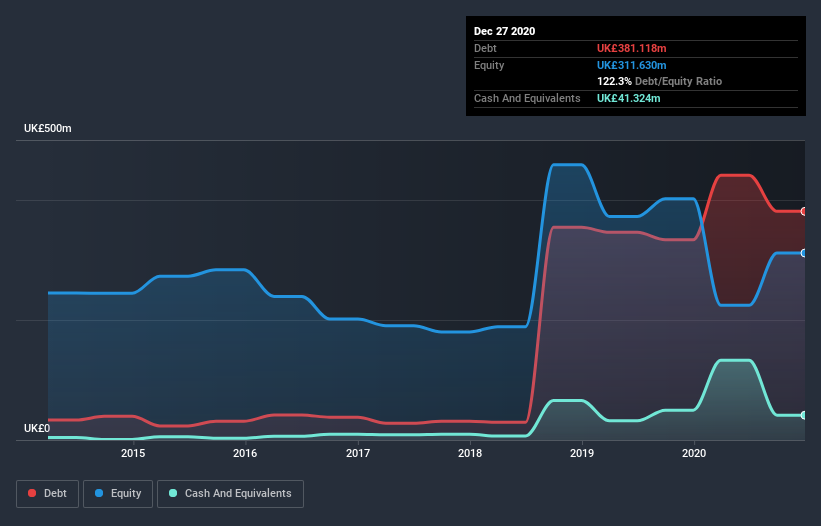

As you can see below, at the end of December 2020, Restaurant Group had UK£381.1m of debt, up from UK£333.8m a year ago. Click the image for more detail. On the flip side, it has UK£41.3m in cash leading to net debt of about UK£339.8m.

How Healthy Is Restaurant Group's Balance Sheet?

According to the last reported balance sheet, Restaurant Group had liabilities of UK£212.5m due within 12 months, and liabilities of UK£823.8m due beyond 12 months. Offsetting these obligations, it had cash of UK£41.3m as well as receivables valued at UK£15.6m due within 12 months. So its liabilities total UK£979.3m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the UK£651.1m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Restaurant Group would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Restaurant Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Restaurant Group had a loss before interest and tax, and actually shrunk its revenue by 57%, to UK£460m. To be frank that doesn't bode well.

Caveat Emptor

While Restaurant Group's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost UK£62m at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. Not least because it burned through UK£81m in negative free cash flow over the last year. That means it's on the risky side of things. We prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. That's because companies should always make sure the auditor has confidence that the company will continue as a going concern, in our view. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for Restaurant Group that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Restaurant Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:RTN

Restaurant Group

The Restaurant Group plc operates restaurants and pubs in the United Kingdom.

Fair value with moderate growth potential.