- New Zealand

- /

- REITS

- /

- NZSE:ARG

Undervalued Small Caps With Insider Activity In Global July 2025

Reviewed by Simply Wall St

In a global market environment marked by record highs for the S&P 500 and Nasdaq Composite, alongside positive movement in the small-cap Russell 2000, investors are closely watching economic indicators like consumer inflation and retail sales that could impact small-cap stocks. As corporate earnings continue to bolster confidence, identifying small-cap companies with active insider participation might offer unique insights into potential opportunities within this dynamic landscape.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| MCAN Mortgage | 11.2x | 6.3x | 49.00% | ★★★★★☆ |

| Daiwa House Logistics Trust | 11.6x | 7.0x | 20.03% | ★★★★★☆ |

| Nexus Industrial REIT | 6.8x | 3.0x | 13.55% | ★★★★☆☆ |

| Sagicor Financial | 10.1x | 0.4x | -169.51% | ★★★★☆☆ |

| CVS Group | 44.6x | 1.3x | 39.67% | ★★★★☆☆ |

| Seeing Machines | NA | 2.9x | 44.26% | ★★★★☆☆ |

| A.G. BARR | 19.7x | 1.9x | 45.56% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.8x | 0.5x | -125.50% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.6x | 1.8x | 13.16% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 11.4x | 0.7x | 5.40% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

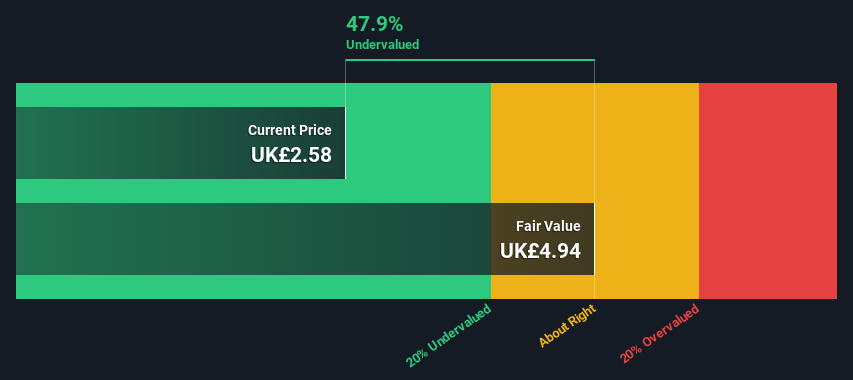

On the Beach Group (LSE:OTB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: On the Beach Group is an online travel company specializing in beach holiday packages, with a market cap of approximately £0.26 billion.

Operations: OTB generates revenue primarily from its Onthebeach.Co.Uk and Sunshine.Co.Uk platforms, with a notable gross profit margin reaching 116.15% as of March 2024. The company incurs substantial operating expenses, including significant allocations to sales and marketing, which amounted to £40.7 million by March 2025. Despite fluctuations in net income over the years, recent periods have shown positive net income margins, such as 19.48% in March 2024 and maintaining above 15% through subsequent quarters up to July 2025.

PE: 22.5x

On the Beach Group, a smaller company with potential, has shown insider confidence through share repurchases of 10.9 million shares for £25 million from December 2024 to March 2025. Despite relying on external borrowing, earnings are projected to grow by over 24% annually. Recent financials reveal a rise in sales to £64.2 million and net income reaching £3 million for the half-year ending March 31, 2025, indicating promising growth potential amidst higher-risk funding challenges.

- Take a closer look at On the Beach Group's potential here in our valuation report.

Evaluate On the Beach Group's historical performance by accessing our past performance report.

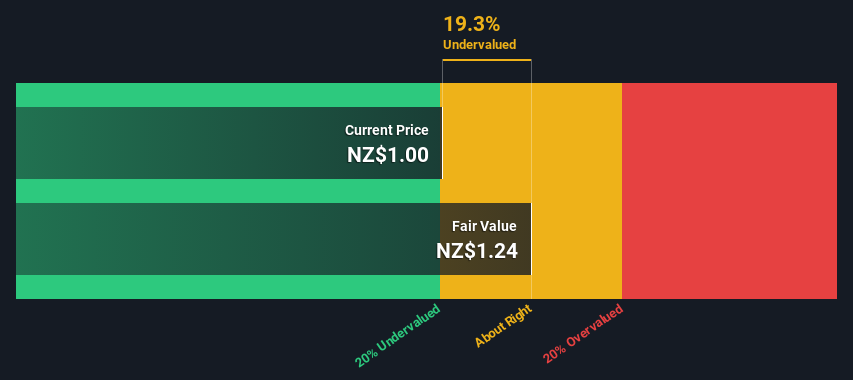

Argosy Property (NZSE:ARG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Argosy Property is a New Zealand-based real estate investment trust with a market cap of approximately NZ$1.27 billion, focusing on investing in and managing commercial properties across the industrial, office, and retail sectors.

Operations: Argosy Property's revenue streams are primarily driven by its ability to generate gross profit, which was NZ$116.88 million as of March 2025, with a gross profit margin of 75.06%. The company incurs costs of goods sold (COGS) and operating expenses, with COGS reported at NZ$38.85 million and operating expenses at NZ$11.41 million in the same period. Net income has shown fluctuations over time, with recent figures indicating a net income margin of 80.82% as of March 2025 after experiencing negative margins in previous quarters due to significant non-operating expenses.

PE: 7.8x

Argosy Property, a smaller player in the market, recently reported a shift from a net loss to a net income of NZ$125.86 million for the year ending March 31, 2025. Despite earnings being impacted by large one-off items and forecasts predicting an average decline of 3.7% annually over the next three years, insider confidence is evident with Peter Mence purchasing shares valued at approximately NZ$199,550 in June 2025. However, Argosy's reliance on external borrowing poses risks due to its lack of customer deposits.

- Get an in-depth perspective on Argosy Property's performance by reading our valuation report here.

Gain insights into Argosy Property's past trends and performance with our Past report.

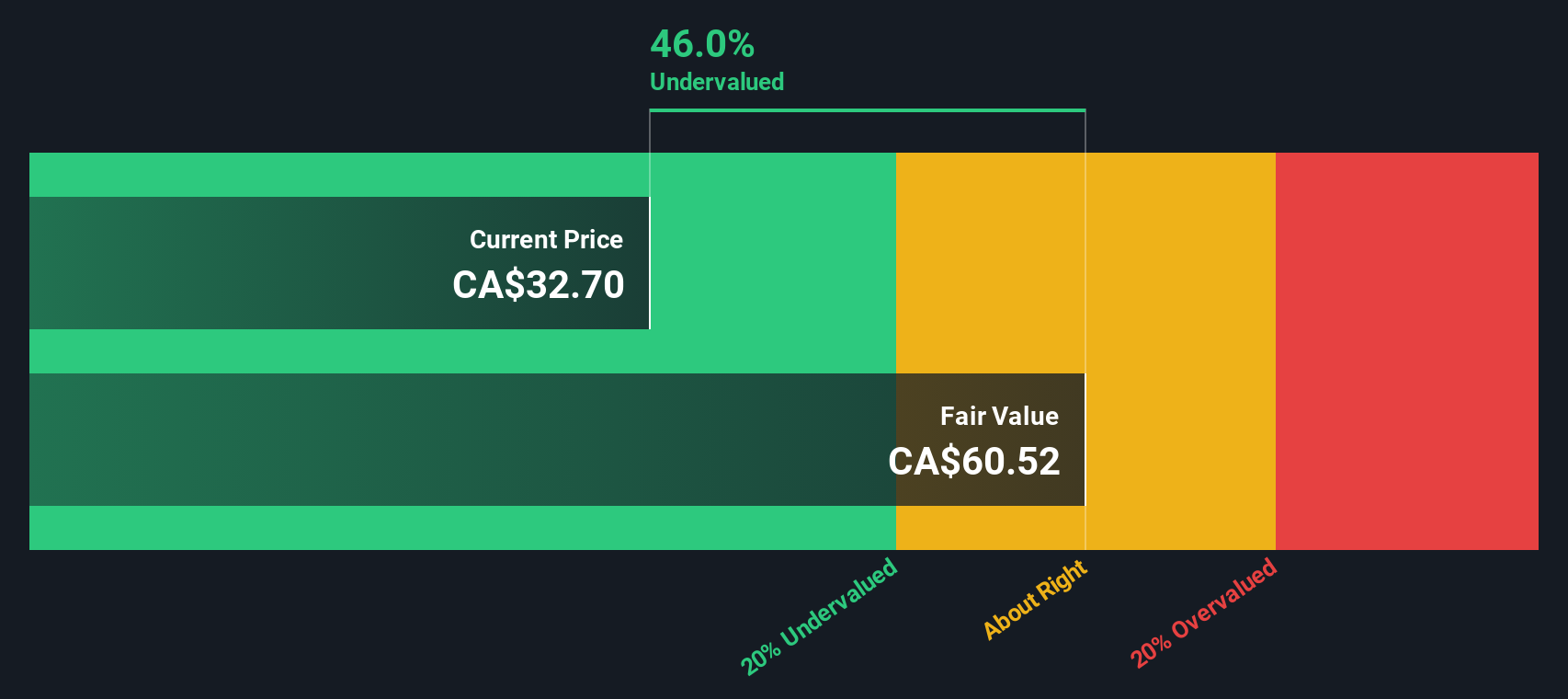

Richards Packaging Income Fund (TSX:RPI.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Richards Packaging Income Fund operates in the wholesale sector, focusing on miscellaneous packaging solutions, with a market capitalization of approximately CA$0.67 billion.

Operations: Richards Packaging Income Fund generates revenue primarily from its wholesale miscellaneous segment, amounting to CA$410.61 million. The company's gross profit margin has shown variability, reaching 23.05% in December 2020 and adjusting to 18.95% by March 2025. Operating expenses have fluctuated over time, impacting the overall profitability of the business.

PE: 11.1x

Richards Packaging Income Fund, a smaller company in the packaging industry, has shown insider confidence with recent share purchases, suggesting belief in its potential. Despite a dip in net income to C$5.11 million for Q1 2025 from C$8.49 million the previous year, revenue increased to C$100.71 million. The fund consistently delivers monthly cash distributions of C$0.11 per unit and is projected to grow revenue by 7% annually, indicating promising future prospects amidst higher-risk external funding sources.

Next Steps

- Access the full spectrum of 117 Undervalued Global Small Caps With Insider Buying by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:ARG

Argosy Property

Argosy Property Limited (APL or the Company) is an FMC Reporting Entity under the Financial Markets Conduct Act 2013 and the Financial Reporting Act 2013.

6 star dividend payer and good value.

Market Insights

Community Narratives