- United Kingdom

- /

- Capital Markets

- /

- LSE:REC

Top UK Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As the UK market grapples with global economic uncertainties, particularly influenced by China's sluggish trade data, investors are keenly observing the performance of indices like the FTSE 100 and FTSE 250. In such a climate, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to navigate these challenging times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.83% | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | 7.93% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.19% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 9.25% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.39% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.34% | ★★★★★☆ |

| DCC (LSE:DCC) | 4.00% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.76% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.89% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.62% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

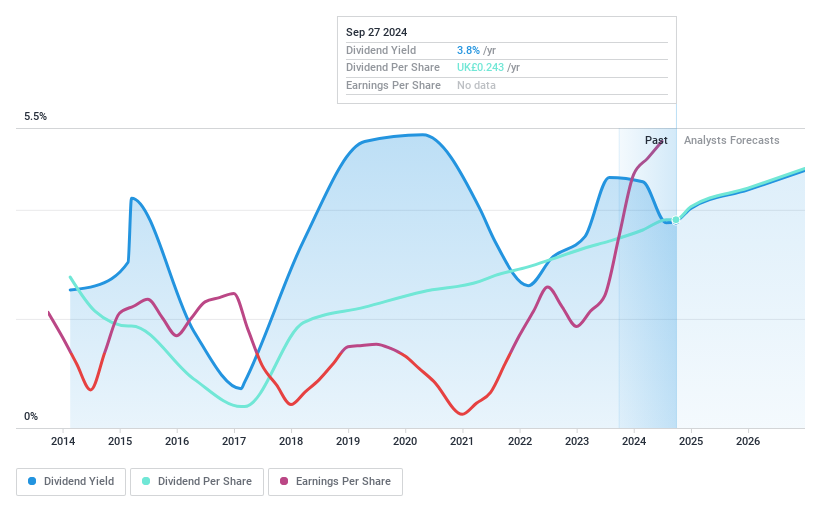

Drax Group (LSE:DRX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc, with a market cap of £2.36 billion, operates in the renewable power generation sector in the United Kingdom through its subsidiaries.

Operations: Drax Group's revenue is primarily derived from three segments: Customers (£4.38 billion), Generation (£5.99 billion), and Pellet Production (£878.40 million).

Dividend Yield: 3.9%

Drax Group's dividend payments have been volatile over the past decade, despite recent increases. Its low payout ratio of 14.4% suggests dividends are well-covered by earnings and cash flows, with a cash payout ratio of 22.9%. However, Drax faces challenges with high debt levels and expected earnings decline by an average of 27.5% annually over the next three years. Recent collaborations in carbon offsetting may bolster its sustainability efforts but don't directly impact dividend stability or yield competitiveness at 3.89%.

- Dive into the specifics of Drax Group here with our thorough dividend report.

- According our valuation report, there's an indication that Drax Group's share price might be on the cheaper side.

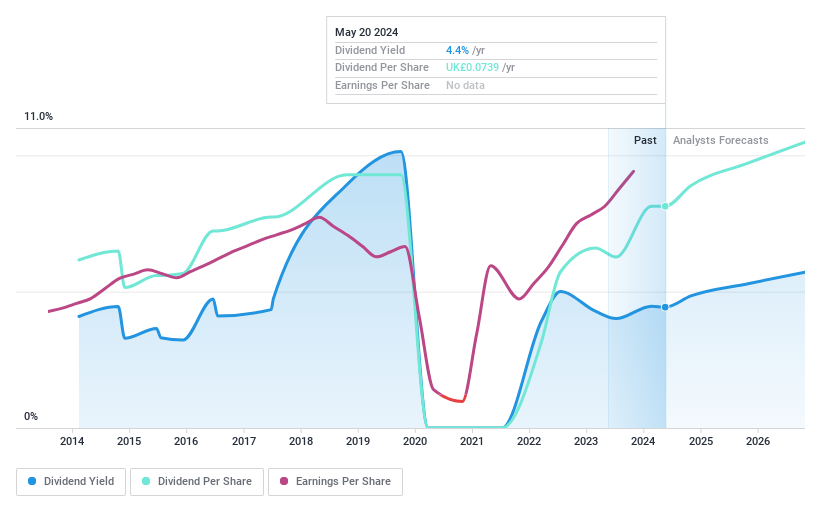

ME Group International (LSE:MEGP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ME Group International plc operates, sells, and services a range of instant-service equipment in the United Kingdom with a market cap of £840.18 million.

Operations: ME Group International plc generates revenue primarily from its Personal Services segment, amounting to £304.20 million.

Dividend Yield: 3.5%

ME Group International's dividend payments have been volatile over the past decade, though they have increased overall. Despite a reasonable payout ratio of 56.1%, indicating dividends are covered by earnings, and a cash payout ratio of 87.4%, the yield remains low at 3.53% compared to top UK dividend payers. Trading at a significant discount to its estimated fair value and with strong recent earnings growth of 23.8%, MEGP presents both opportunities and risks for dividend investors in the UK market.

- Click to explore a detailed breakdown of our findings in ME Group International's dividend report.

- Our valuation report unveils the possibility ME Group International's shares may be trading at a discount.

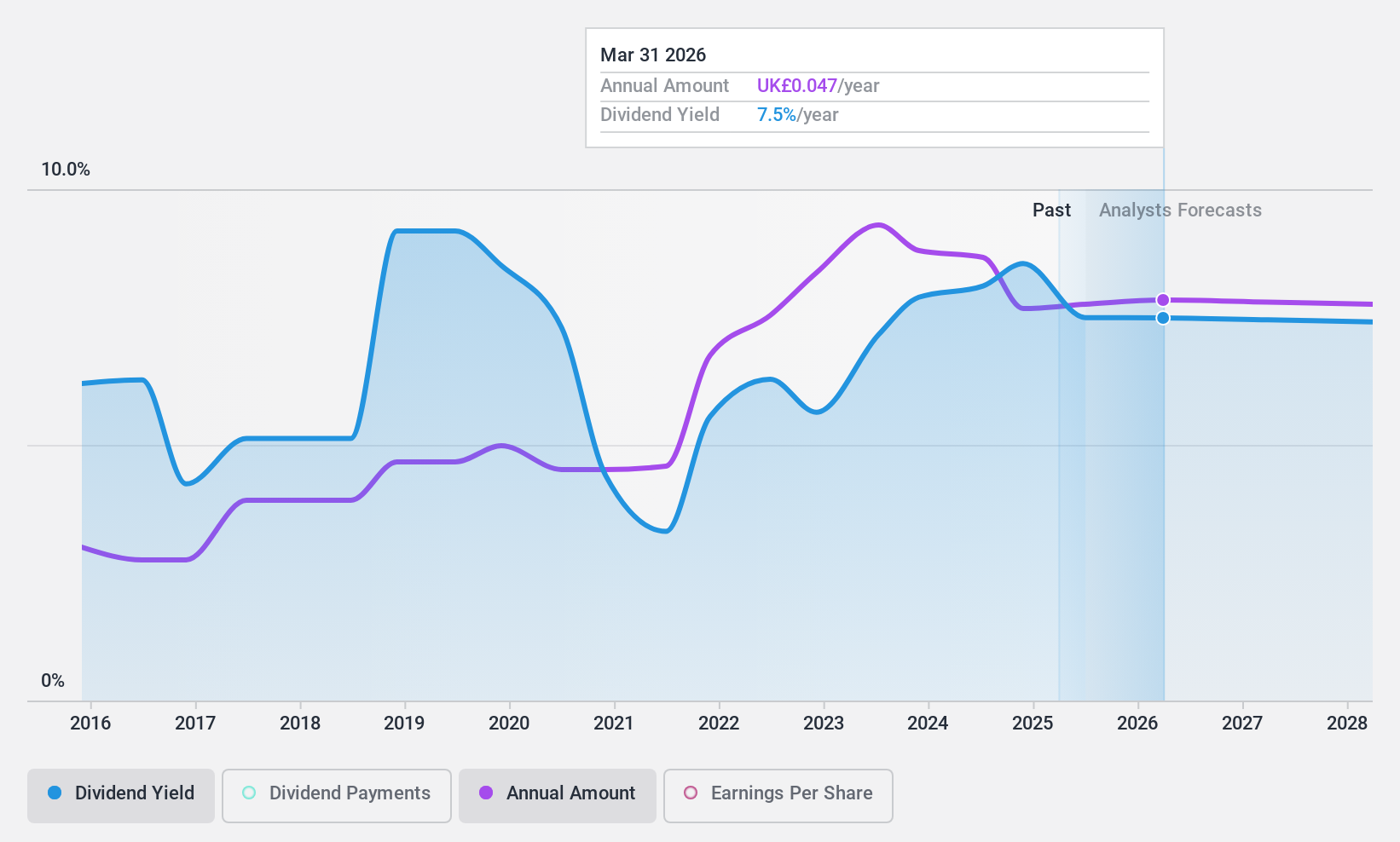

Record (LSE:REC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Record plc offers currency and derivative management services across the United Kingdom, North America, Continental Europe, Australia, and other international markets with a market cap of £123.49 million.

Operations: Record plc's revenue is derived from £45.38 million in currency and derivatives management services.

Dividend Yield: 8.1%

Record's dividend yield of 8.1% ranks in the top 25% of UK dividend payers, with stable growth over the past decade. However, its high payout ratio of 95% raises concerns about sustainability as dividends are not well covered by earnings. The cash payout ratio stands at 81.7%, indicating coverage by cash flows but not earnings. Recent significant insider selling and trading at a substantial discount to fair value present potential risks for investors seeking reliable dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Record.

- The valuation report we've compiled suggests that Record's current price could be quite moderate.

Seize The Opportunity

- Discover the full array of 58 Top UK Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:REC

Record

Through its subsidiaries, provides currency and derivative management services in the United Kingdom, North America, Continental Europe, Australia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives