- United Kingdom

- /

- Renewable Energy

- /

- LSE:DRX

Top UK Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index experiences turbulence due to weak trade data from China, investors are closely monitoring market dynamics and seeking stability amid global uncertainties. In this context, dividend stocks can offer a measure of resilience and consistent income, making them an attractive option for those navigating the current economic landscape.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 6.23% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.30% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.41% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.03% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.96% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.71% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.89% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.35% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.80% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.90% | ★★★★★☆ |

Click here to see the full list of 62 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Drax Group (LSE:DRX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc, along with its subsidiaries, is involved in renewable power generation in the United Kingdom and has a market capitalization of £2.40 billion.

Operations: Drax Group plc's revenue is derived from three main segments: Customers (£4.38 billion), Generation (£5.99 billion), and Pellet Production (£878.40 million).

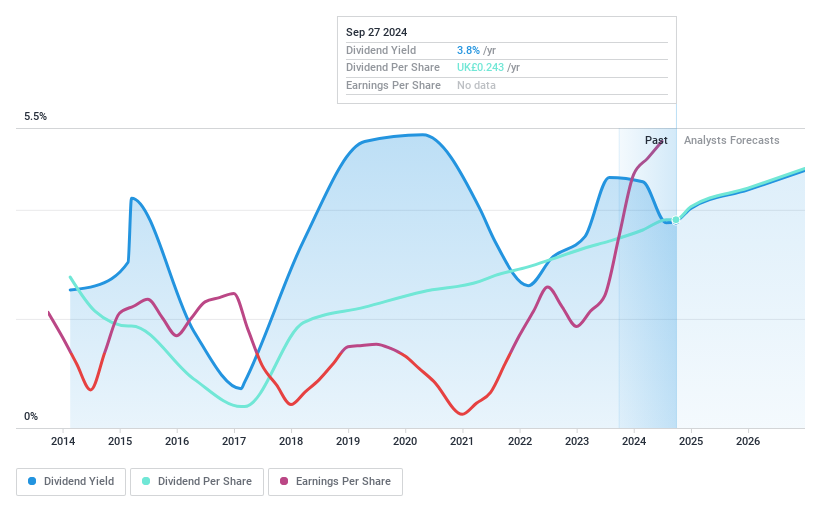

Dividend Yield: 3.7%

Drax Group's dividend payments have increased over the past decade, yet they remain unreliable and volatile. Despite a low payout ratio of 14.4% and cash payout ratio of 22.4%, indicating strong coverage by earnings and cash flows, the company's high debt level poses a risk. Trading at 62.4% below estimated fair value suggests potential for capital appreciation, though earnings are forecasted to decline significantly over the next three years. Recent executive changes may impact future financial strategies.

- Take a closer look at Drax Group's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Drax Group is trading behind its estimated value.

ME Group International (LSE:MEGP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ME Group International plc operates, sells, and services a range of instant-service equipment in the United Kingdom with a market cap of £772.37 million.

Operations: ME Group International plc generates revenue from its Personal Services - Others segment, amounting to £304.20 million.

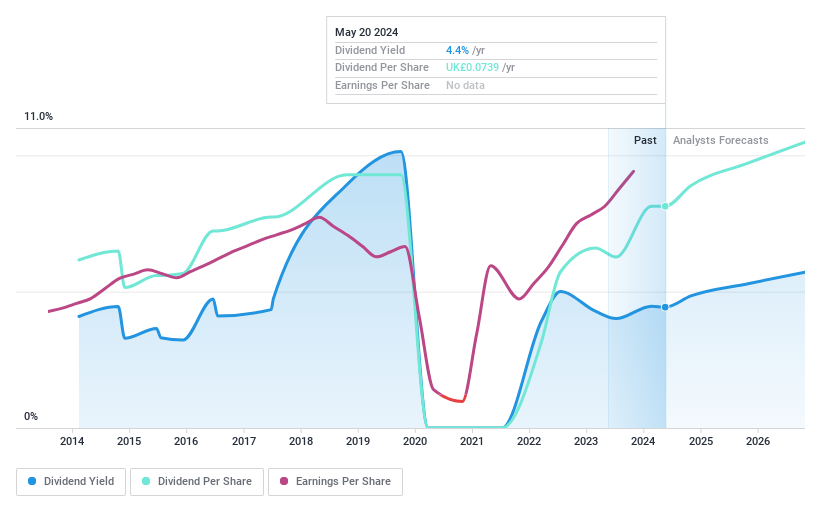

Dividend Yield: 3.8%

ME Group International's dividend payments have grown over the past decade but remain volatile. With a payout ratio of 56.1% and cash payout ratio of 87.4%, dividends are covered by earnings and cash flows, though their reliability is questionable. The stock trades at a good value compared to peers, being 53.5% below its estimated fair value. Recent guidance suggests record profits for fiscal year 2024, with revenue expected to reach £318 million excluding FX impacts.

- Click to explore a detailed breakdown of our findings in ME Group International's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of ME Group International shares in the market.

Record (LSE:REC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Record plc, with a market cap of £102.33 million, offers currency and derivative management services across the United Kingdom, North America, Continental Europe, Australia, and other international markets.

Operations: Record plc generates revenue of £45.02 million from its currency and derivative management services across various regions including the United Kingdom, North America, Continental Europe, and Australia.

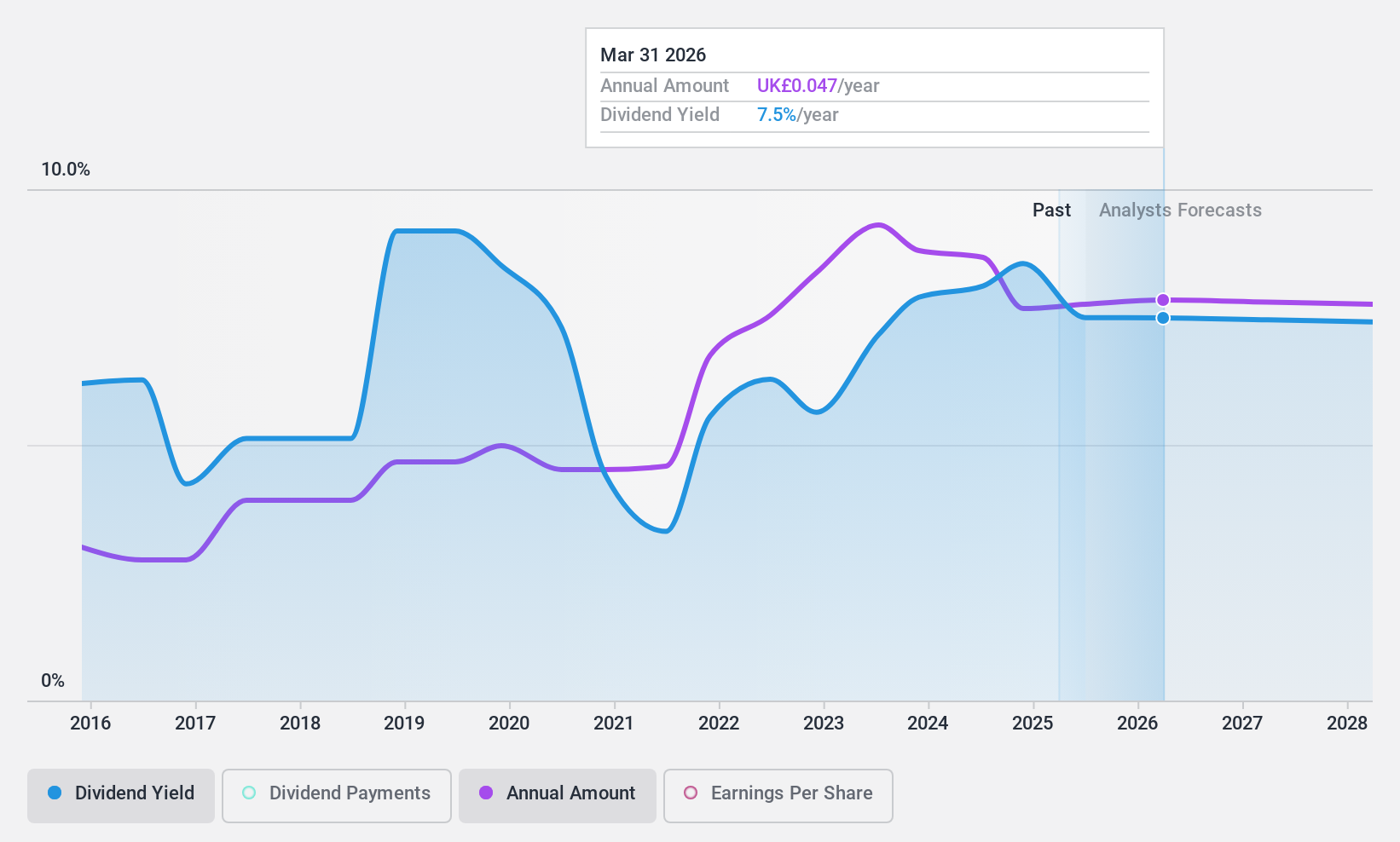

Dividend Yield: 9.8%

Record plc offers a high dividend yield of 9.77%, ranking in the top 25% of UK dividend payers, but its sustainability is questionable due to payout ratios exceeding earnings and cash flows. Despite stable and growing dividends over the past decade, financial coverage remains weak with a cash payout ratio of 116.3%. The stock trades at an attractive value, 45.5% below estimated fair value. Recent results show steady earnings growth with net income at £4.96 million for H1 2025.

- Click here to discover the nuances of Record with our detailed analytical dividend report.

- Our expertly prepared valuation report Record implies its share price may be lower than expected.

Next Steps

- Reveal the 62 hidden gems among our Top UK Dividend Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DRX

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives