- United Kingdom

- /

- Consumer Services

- /

- LSE:MEGP

3 Promising Penny Stocks On UK Exchange With Market Caps Over £700M

Reviewed by Simply Wall St

Recent data from China has impacted the UK market, with the FTSE 100 and FTSE 250 indices closing lower due to concerns about China's economic recovery and its effect on global trade. In such a fluctuating market, investors often seek opportunities in less conventional areas like penny stocks, which can offer a unique blend of affordability and potential growth. Despite being considered an outdated term, penny stocks continue to attract attention for their ability to provide value through strong financials and resilience.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.16 | £99.11M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.31 | £202.04M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.35 | £171.93M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.85 | £382.91M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4395 | $255.49M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.12 | £472M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £2.45 | £313.05M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Bakkavor Group (LSE:BAKK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bakkavor Group plc, along with its subsidiaries, specializes in the preparation and marketing of fresh prepared foods across the United Kingdom, the United States, and China, with a market capitalization of £864.63 million.

Operations: The company generates its revenue through the preparation and marketing of fresh prepared foods in the United Kingdom, the United States, and China.

Market Cap: £864.63M

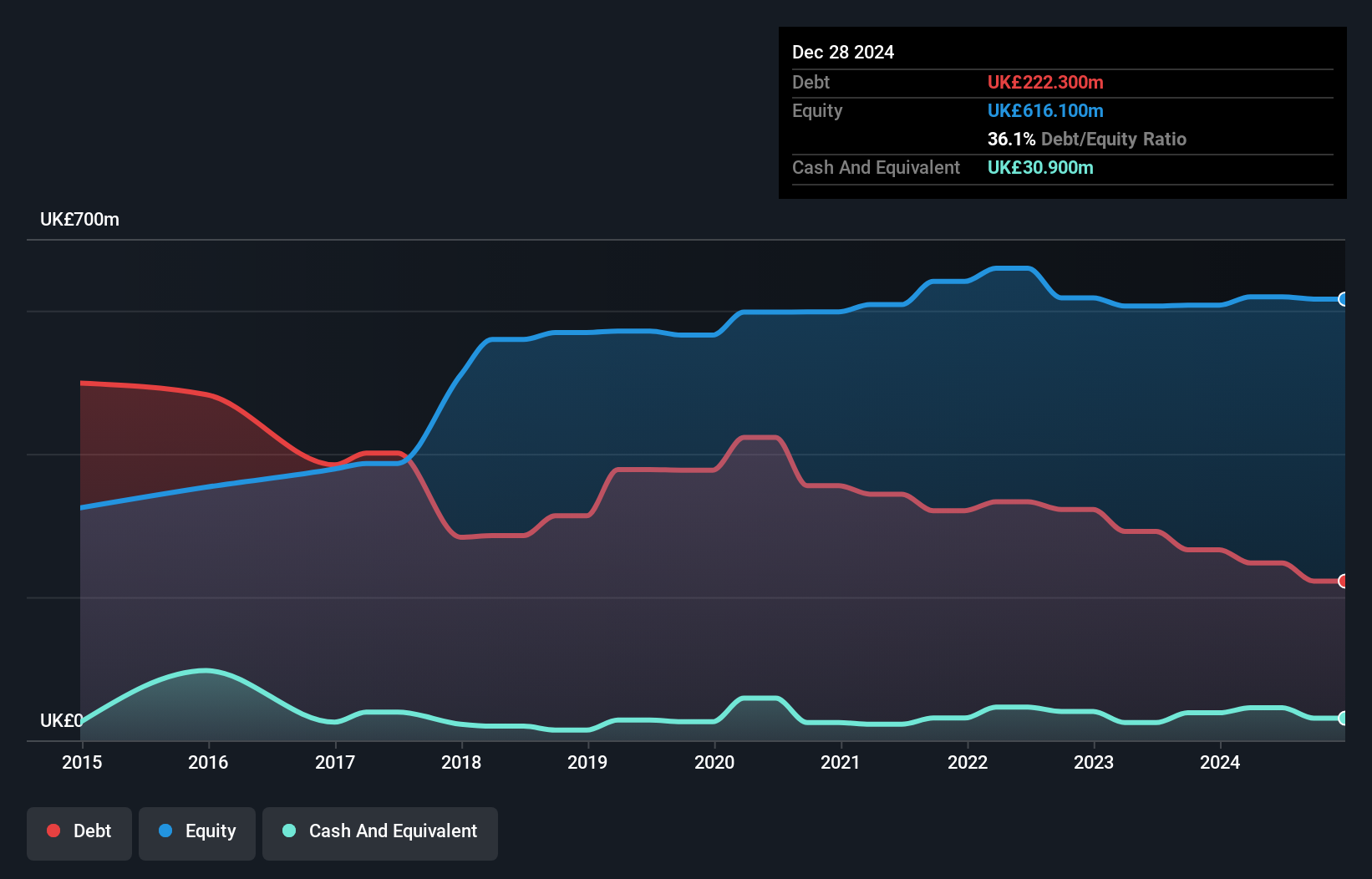

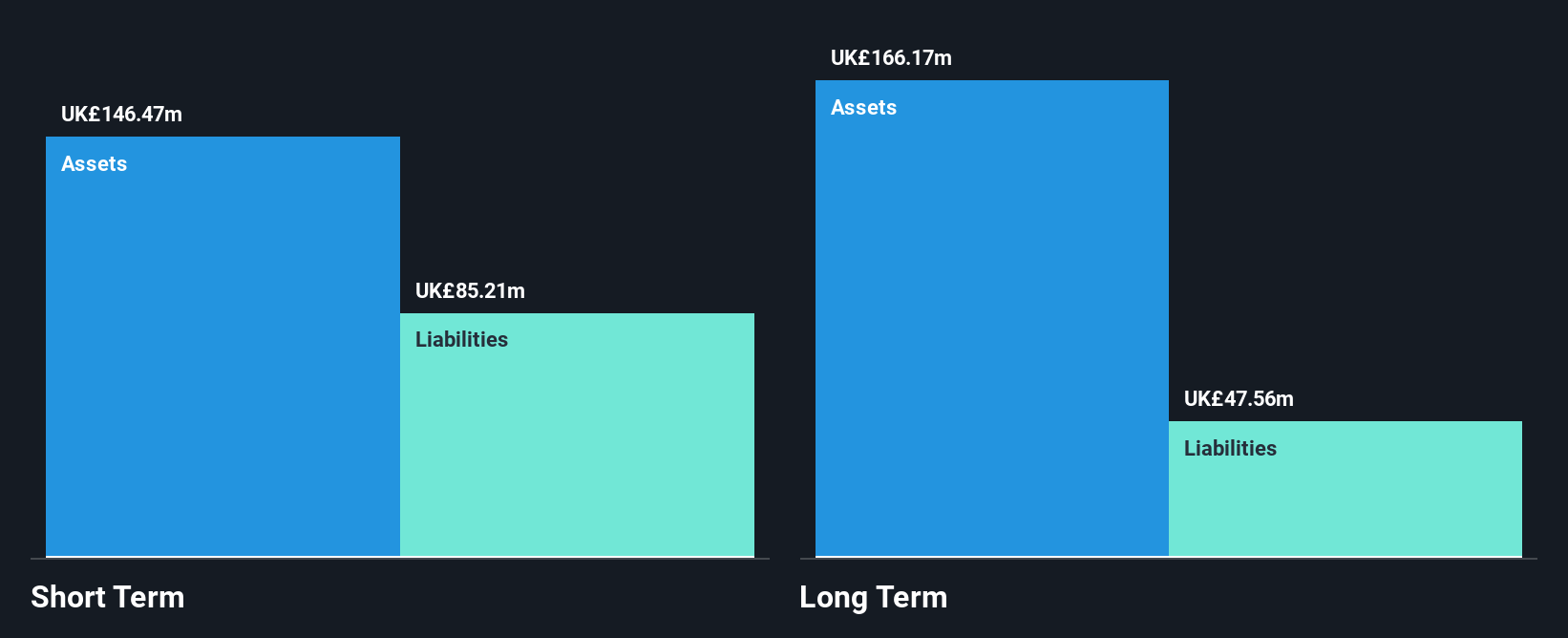

Bakkavor Group presents a mixed picture for investors interested in penny stocks. The company has demonstrated high-quality earnings with impressive growth of 428.7% over the past year, outpacing the industry significantly. Its debt is well covered by operating cash flow, and interest payments are adequately managed. However, Bakkavor's short-term and long-term liabilities exceed its assets, indicating potential liquidity concerns. Despite trading at good value compared to peers, it has a low return on equity at 10.3%, and an unstable dividend track record may deter income-focused investors. Management and board experience add stability amidst these financial dynamics.

- Dive into the specifics of Bakkavor Group here with our thorough balance sheet health report.

- Explore Bakkavor Group's analyst forecasts in our growth report.

IntegraFin Holdings (LSE:IHP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IntegraFin Holdings plc, with a market cap of £1.17 billion, operates an investment platform serving UK financial advisers and their clients.

Operations: The company's revenue is primarily generated from investment administration services (£71.7 million), insurance and life assurance business (£68.3 million), and adviser back-office technology (£4.9 million).

Market Cap: £1.17B

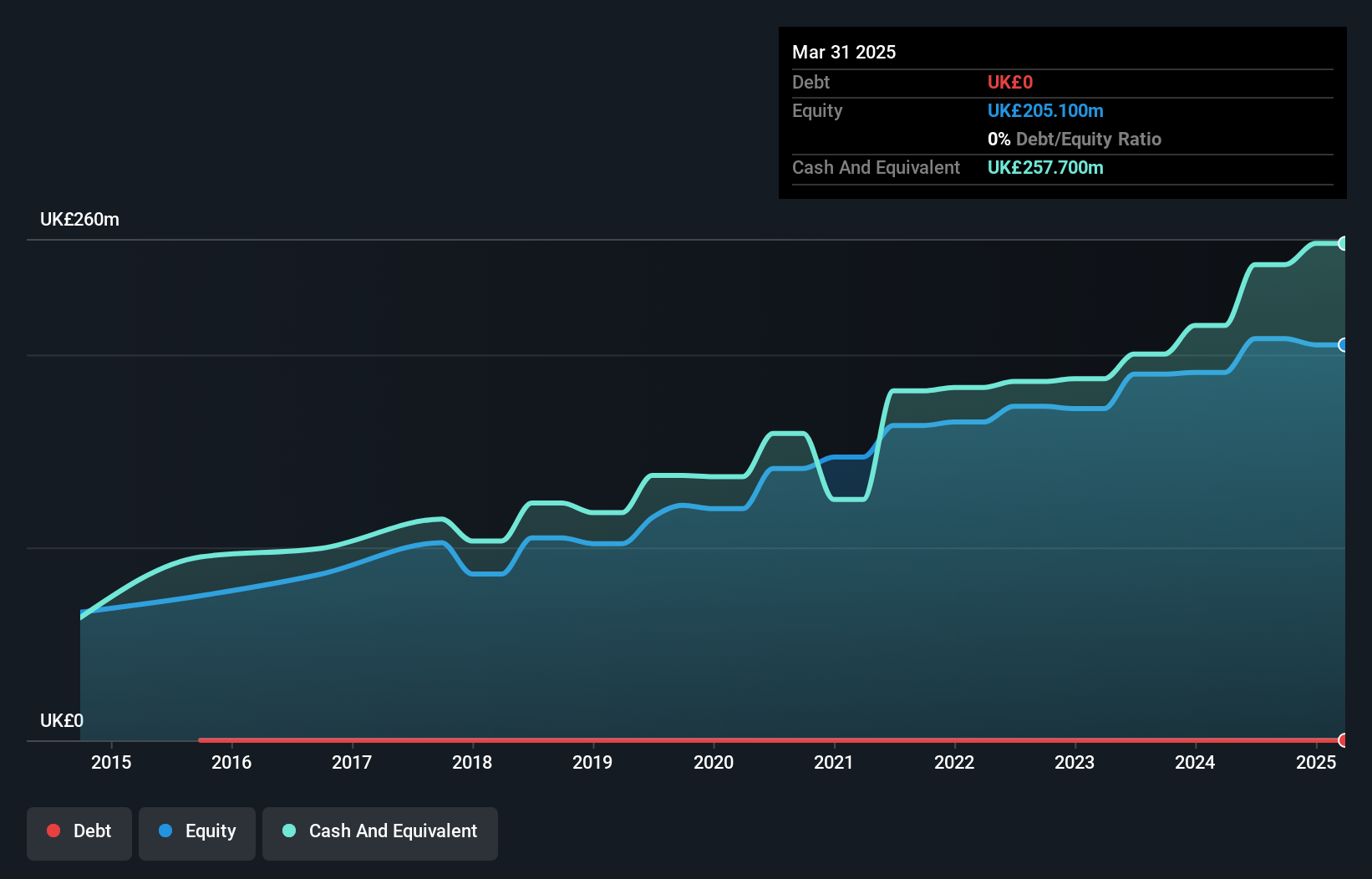

IntegraFin Holdings offers a stable investment outlook with its debt-free status and high-quality earnings. The company's recent financial performance shows steady growth, with annual sales reaching £144.9 million and net income at £52.1 million, reflecting a modest increase from the previous year. Despite slightly reduced profit margins, IntegraFin maintains strong short-term asset coverage over liabilities and has not diluted shareholders recently. Its experienced management team supports operational stability, while the board's seasoned tenure adds governance strength. A consistent dividend increase further highlights its commitment to shareholder returns amidst stable weekly volatility in stock performance.

- Jump into the full analysis health report here for a deeper understanding of IntegraFin Holdings.

- Gain insights into IntegraFin Holdings' future direction by reviewing our growth report.

ME Group International (LSE:MEGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ME Group International plc operates, sells, and services a range of instant-service equipment in the United Kingdom with a market cap of £796.86 million.

Operations: The company's revenue from the Personal Services - Others segment is £304.20 million.

Market Cap: £796.86M

ME Group International exhibits strong financial health, with its short-term assets exceeding both short and long-term liabilities, and cash reserves surpassing total debt. The company has reduced its debt-to-equity ratio over five years while maintaining high-quality earnings. MEGP's net profit margins have improved, supported by robust earnings growth that outpaces industry averages. Trading at a substantial discount to estimated fair value and backed by a seasoned management team, it offers potential value to investors. Recent guidance suggests continued record profitability for 2024 despite board changes, indicating resilience in operational performance amidst market fluctuations.

- Navigate through the intricacies of ME Group International with our comprehensive balance sheet health report here.

- Assess ME Group International's future earnings estimates with our detailed growth reports.

Taking Advantage

- Explore the 472 names from our UK Penny Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MEGP

ME Group International

Operates, sells, and services a range of instant-service equipment in the United Kingdom.

Outstanding track record with flawless balance sheet and pays a dividend.