- United Kingdom

- /

- Hospitality

- /

- LSE:JDW

Investors are selling off J D Wetherspoon (LON:JDW), lack of profits no doubt contribute to shareholders one-year loss

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in J D Wetherspoon plc (LON:JDW) have tasted that bitter downside in the last year, as the share price dropped 27%. That's disappointing when you consider the market returned 15%. Zooming out, the stock is down 24% in the last three years. Shareholders have had an even rougher run lately, with the share price down 23% in the last 90 days.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for J D Wetherspoon

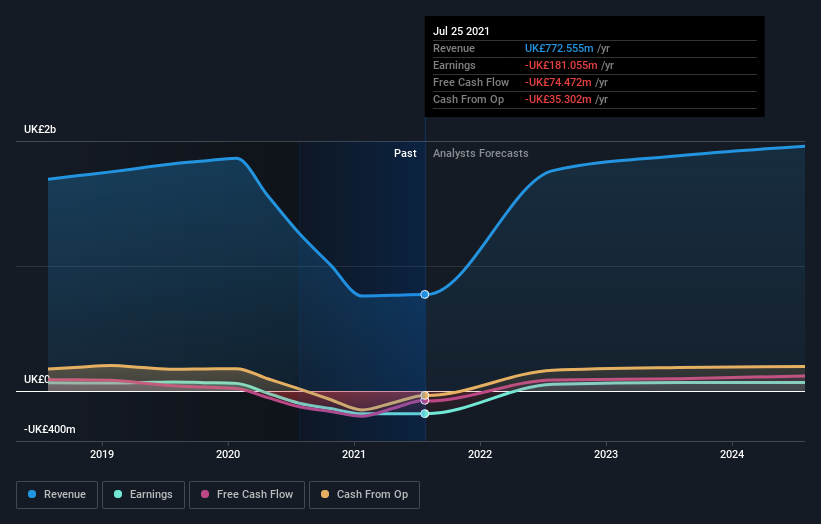

Because J D Wetherspoon made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

J D Wetherspoon's revenue didn't grow at all in the last year. In fact, it fell 39%. That's not what investors generally want to see. Shareholders have seen the share price drop 27% in that time. That seems pretty reasonable given the lack of both profits and revenue growth. It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

J D Wetherspoon is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for J D Wetherspoon in this interactive graph of future profit estimates.

A Different Perspective

J D Wetherspoon shareholders are down 27% for the year, but the market itself is up 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 1.4%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with J D Wetherspoon (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:JDW

J D Wetherspoon

Owns and operates pubs and hotels in the United Kingdom and the Republic of Ireland.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives