- United Kingdom

- /

- Hospitality

- /

- LSE:EVOK

Market Cool On Evoke plc's (LON:EVOK) Revenues Pushing Shares 30% Lower

Evoke plc (LON:EVOK) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 47% in that time.

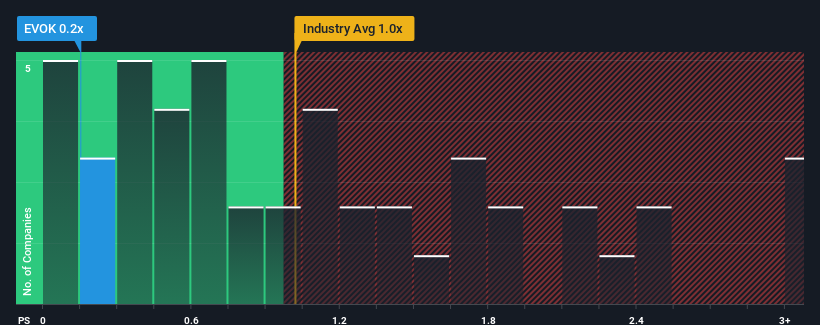

After such a large drop in price, it would be understandable if you think Evoke is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in the United Kingdom's Hospitality industry have P/S ratios above 1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Evoke

What Does Evoke's Recent Performance Look Like?

Recent times have been advantageous for Evoke as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Evoke's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Evoke?

Evoke's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 38% last year. Pleasingly, revenue has also lifted 175% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 4.7% each year over the next three years. That's shaping up to be similar to the 6.1% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Evoke's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Evoke's P/S Mean For Investors?

Evoke's recently weak share price has pulled its P/S back below other Hospitality companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Evoke currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

You should always think about risks. Case in point, we've spotted 1 warning sign for Evoke you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Evoke, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Evoke might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:EVOK

Evoke

Provides online betting and gaming products and solutions in the United Kingdom, Ireland Italy, Spain, and internationally.

Undervalued with high growth potential.