- United Kingdom

- /

- Consumer Services

- /

- LSE:ATG

UK's Top Penny Stocks To Watch In August 2025

Reviewed by Simply Wall St

The UK market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower amid concerns about weak trade data from China. In such fluctuating conditions, investors often look beyond established names to explore opportunities in lesser-known areas. Penny stocks, despite their somewhat outdated moniker, continue to attract attention for their potential affordability and growth prospects. In this article, we explore three penny stocks that stand out for their financial resilience and potential value in today's market landscape.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.63 | £518.91M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.65 | £294.87M | ✅ 4 ⚠️ 2 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.71 | £217.77M | ✅ 4 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.214 | £132.71M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.396 | £42.85M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.897 | £331.69M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.97 | £305.63M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.20 | £190.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 2 ⚠️ 4 View Analysis > |

| Samuel Heath & Sons (AIM:HSM) | £3.30 | £8.36M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 297 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

dotdigital Group (AIM:DOTD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: dotdigital Group Plc provides intuitive software as a service (SaaS) and managed services for digital marketing professionals globally, with a market cap of £221.54 million.

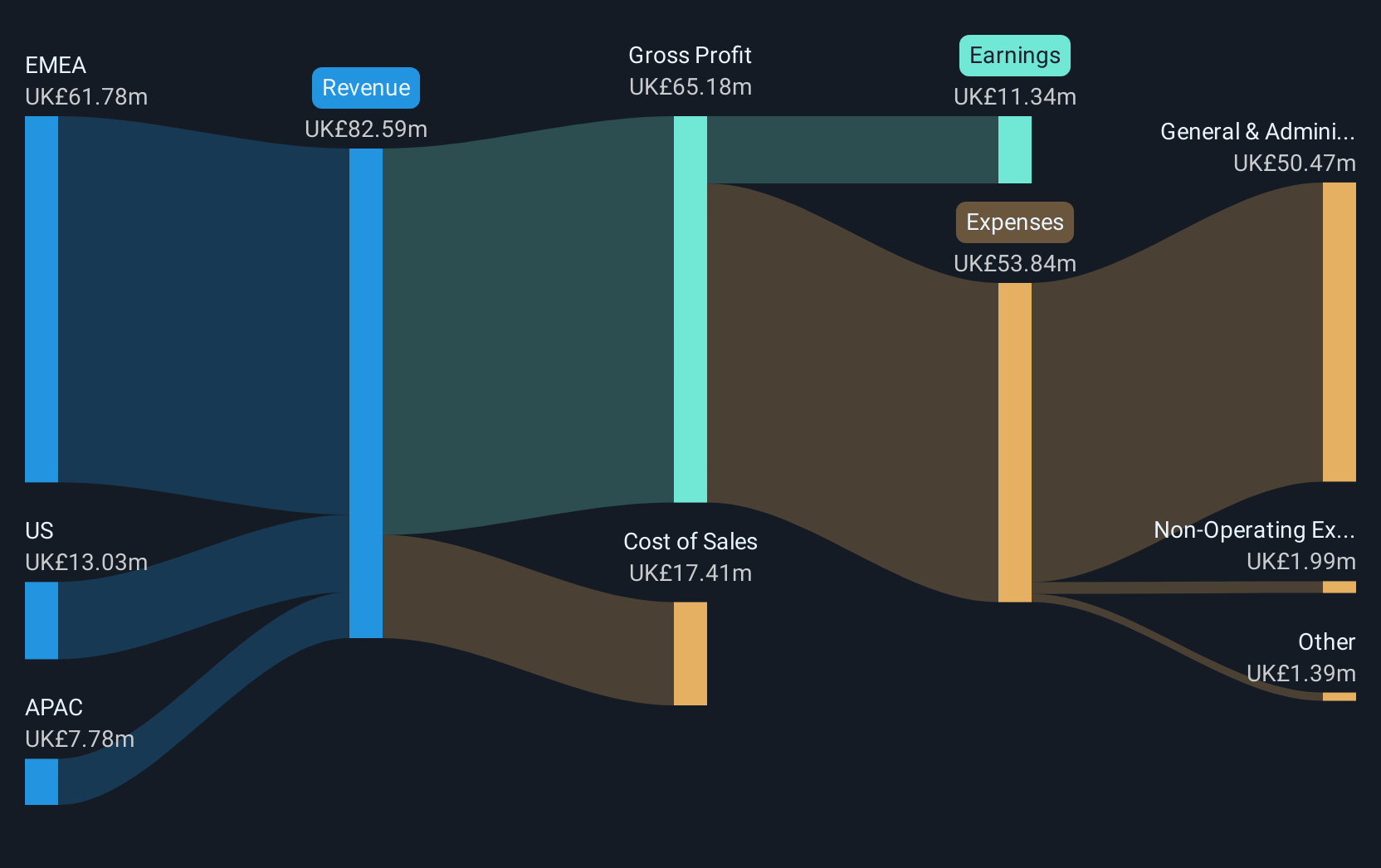

Operations: The company's revenue comes entirely from its data-driven omni-channel marketing automation services, generating £82.59 million.

Market Cap: £221.54M

dotdigital Group Plc, with a market cap of £221.54 million, operates debt-free and is considered to be trading at good value relative to peers. The company has an experienced management team and board, yet its earnings have declined by 0.1% annually over the past five years, with recent negative growth challenging industry comparisons. Despite this, dotdigital maintains high-quality earnings and forecasts suggest a 9.86% annual growth in earnings. Recent announcements include plans for an increased final dividend and revenue guidance in line with expectations despite a minor contract non-renewal impact expected in FY26.

- Jump into the full analysis health report here for a deeper understanding of dotdigital Group.

- Review our growth performance report to gain insights into dotdigital Group's future.

Jersey Oil and Gas (AIM:JOG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jersey Oil and Gas Plc focuses on the exploration, appraisal, development, and production of oil and gas properties in the North Sea of the United Kingdom with a market cap of £41.49 million.

Operations: Jersey Oil and Gas Plc has not reported any specific revenue segments.

Market Cap: £41.49M

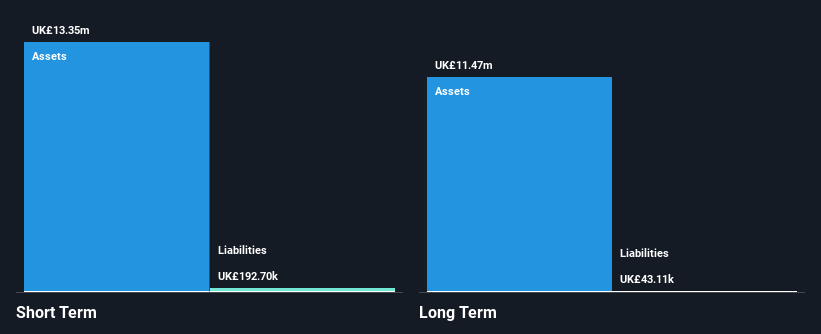

Jersey Oil and Gas Plc, with a market cap of £41.49 million, is pre-revenue and currently unprofitable, reporting a net loss of £3.54 million for 2024. Despite this, the company is debt-free and has sufficient cash runway for over three years based on current free cash flow. Its short-term assets significantly exceed its liabilities, suggesting strong liquidity management. The board and management team are experienced with average tenures of seven and 3.7 years respectively. However, the stock remains highly volatile compared to UK peers and trades at a significant discount to estimated fair value without immediate profitability prospects.

- Click here and access our complete financial health analysis report to understand the dynamics of Jersey Oil and Gas.

- Understand Jersey Oil and Gas' earnings outlook by examining our growth report.

Auction Technology Group (LSE:ATG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Auction Technology Group plc operates online auction marketplaces in the UK, North America, and Germany, with a market cap of £592.93 million.

Operations: Auction Technology Group does not report specific revenue segments.

Market Cap: £592.93M

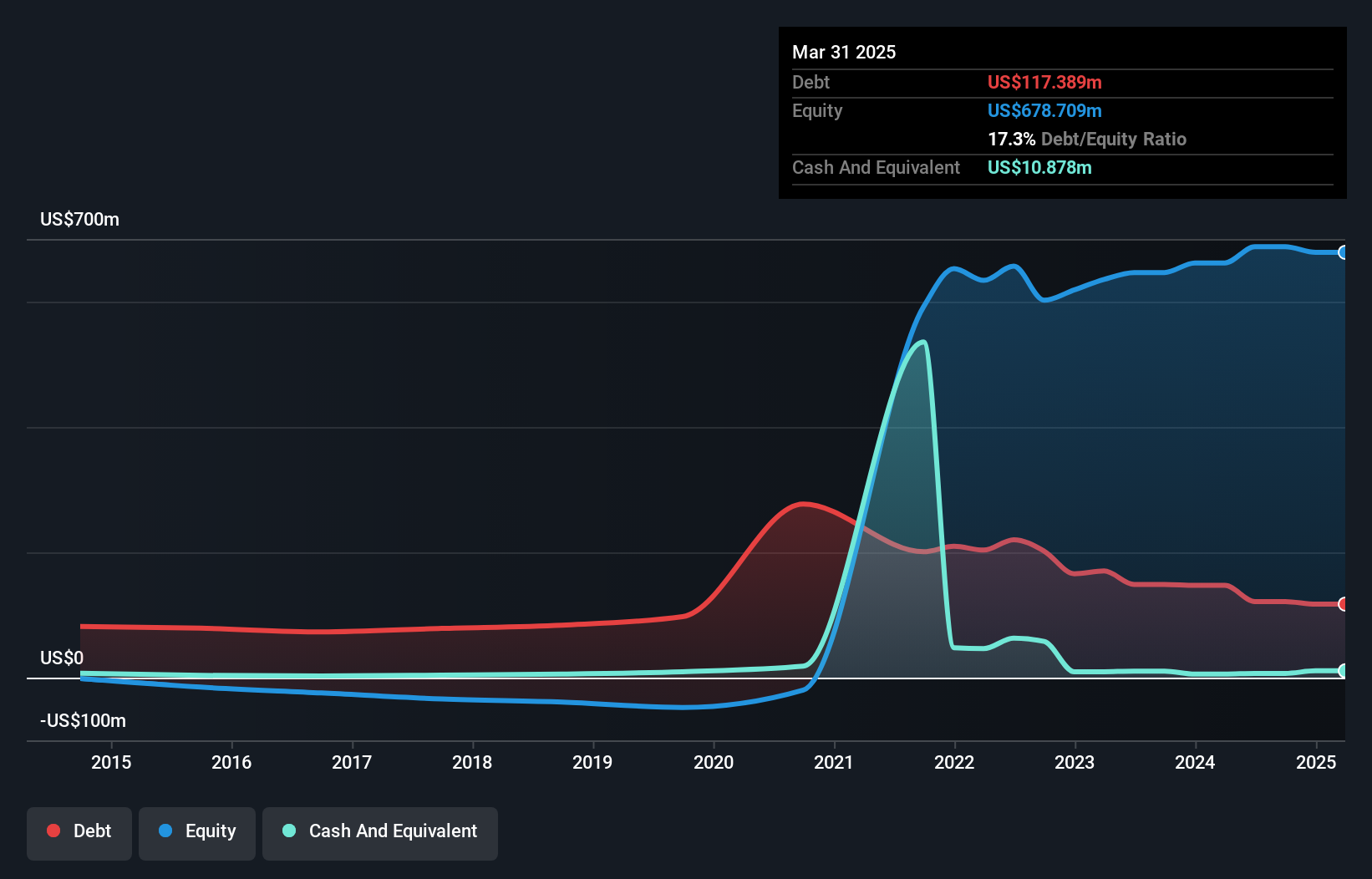

Auction Technology Group plc, with a market cap of £592.93 million, has demonstrated strong earnings growth of 78.4% over the past year, surpassing industry averages. Its financial health is bolstered by positive shareholder equity and well-covered debt levels through operating cash flow (56.8%). The company recently completed a share buyback worth $7.56 million, reflecting confidence in its valuation as it trades below estimated fair value by 45.4%. Despite stable weekly volatility and improved net profit margins (14%), challenges remain with long-term liabilities exceeding short-term assets ($37.6M vs $149.3M). Management and board tenures indicate experienced leadership amidst these dynamics.

- Click here to discover the nuances of Auction Technology Group with our detailed analytical financial health report.

- Gain insights into Auction Technology Group's future direction by reviewing our growth report.

Next Steps

- Click here to access our complete index of 297 UK Penny Stocks.

- Searching for a Fresh Perspective? The end of cancer? These 25 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ATG

Auction Technology Group

Operates online auction marketplaces in the United Kingdom, North America, and Germany.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives