- United Kingdom

- /

- Consumer Services

- /

- LSE:ATG

UK Exchange: Auction Technology Group And 2 More Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic uncertainties. In such a volatile environment, identifying stocks that are trading below their fair value can present potential opportunities for investors seeking to navigate these conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.396 | £0.74 | 46.2% |

| ConvaTec Group (LSE:CTEC) | £2.154 | £3.90 | 44.8% |

| Fevertree Drinks (AIM:FEVR) | £7.215 | £12.90 | 44.1% |

| GlobalData (AIM:DATA) | £1.99 | £3.75 | 46.9% |

| Informa (LSE:INF) | £8.092 | £15.44 | 47.6% |

| Mpac Group (AIM:MPAC) | £5.03 | £9.00 | 44.1% |

| Quartix Technologies (AIM:QTX) | £1.665 | £3.08 | 45.9% |

| Foxtons Group (LSE:FOXT) | £0.584 | £1.06 | 44.7% |

| Auction Technology Group (LSE:ATG) | £4.70 | £8.43 | 44.3% |

| Genel Energy (LSE:GENL) | £0.78 | £1.46 | 46.7% |

Let's uncover some gems from our specialized screener.

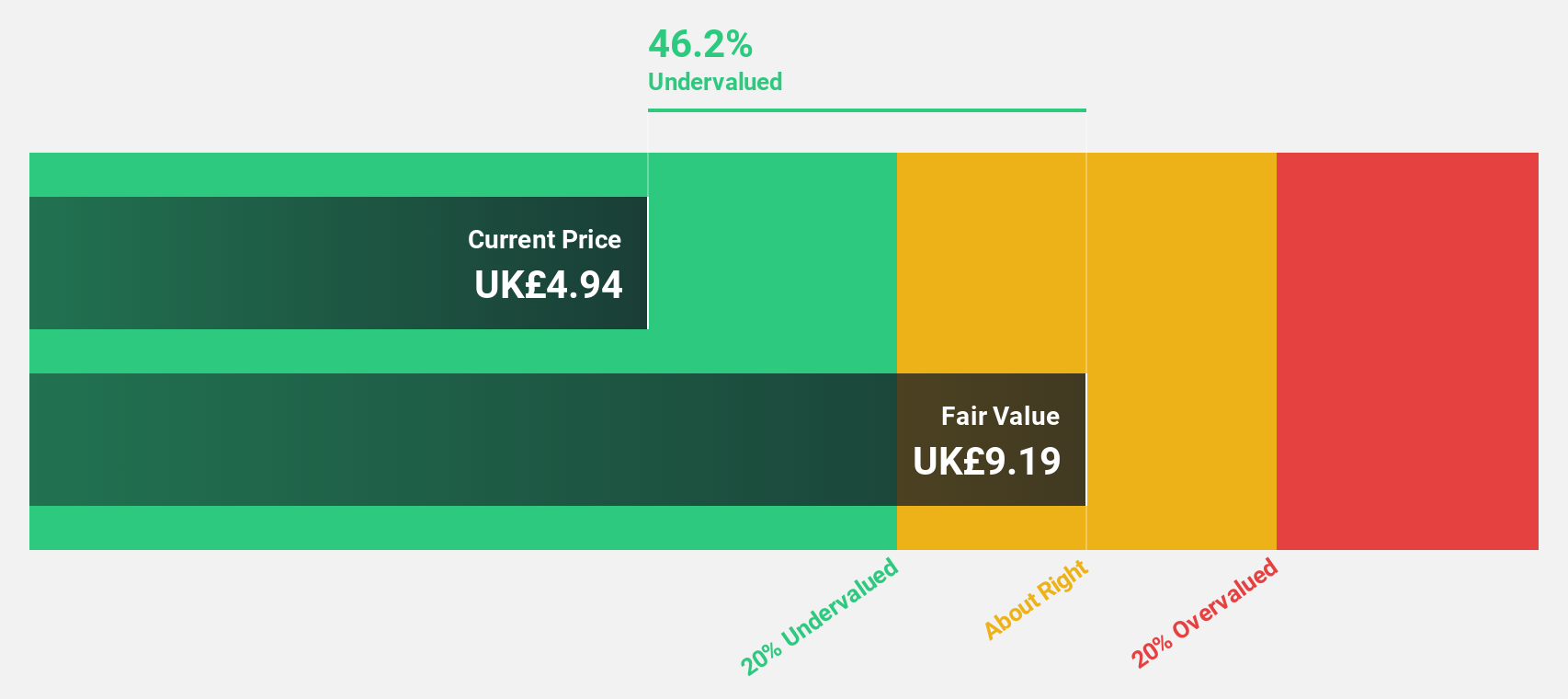

Auction Technology Group (LSE:ATG)

Overview: Auction Technology Group plc operates online auction marketplaces in the United Kingdom, North America, and Germany, with a market cap of £572.05 million.

Operations: Revenue segments for Auction Technology Group plc include Content generating $3.90 million, Auction Services at $9.81 million, Arts and Antiques (A&A) contributing $89.24 million, and Industrial and Commercial (I&C) with $73.06 million.

Estimated Discount To Fair Value: 44.3%

Auction Technology Group appears undervalued based on cash flows, trading at 44.3% below its estimated fair value of £8.43 per share. Despite a forecasted slower revenue growth of 6.2% annually, earnings are expected to grow significantly by 33.5% per year, outpacing the UK market average of 14.4%. Recent guidance indicates a revenue increase to $174 million for 2024, while board changes include Tom Hargreaves stepping down as CFO early next year.

- In light of our recent growth report, it seems possible that Auction Technology Group's financial performance will exceed current levels.

- Get an in-depth perspective on Auction Technology Group's balance sheet by reading our health report here.

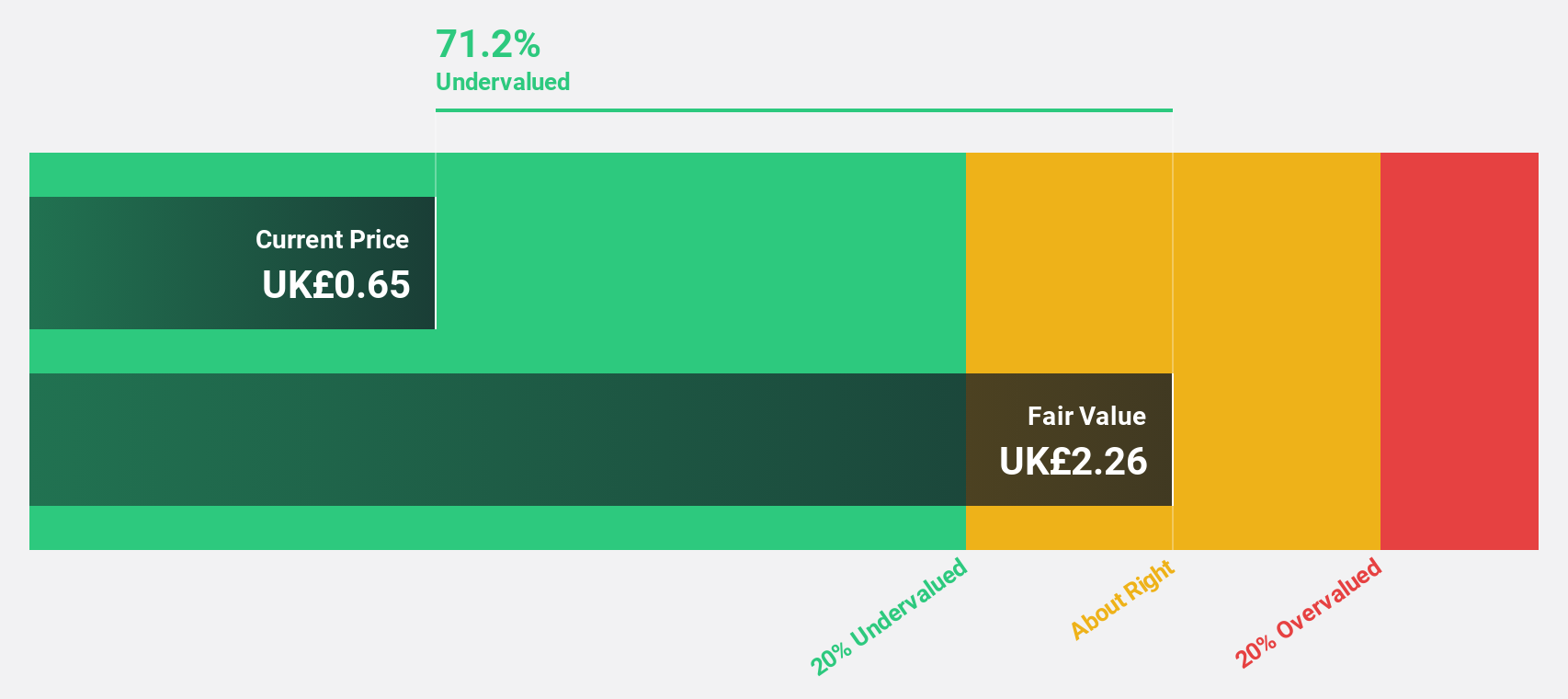

Genel Energy (LSE:GENL)

Overview: Genel Energy plc is an independent oil and gas exploration and production company with a market cap of £216.20 million.

Operations: The company generates revenue primarily from its production segment, amounting to $74.40 million.

Estimated Discount To Fair Value: 46.7%

Genel Energy is trading at £0.78, significantly undervalued compared to its estimated fair value of £1.46, with analysts agreeing on a potential price increase of 23.7%. Despite reporting a net loss of US$21.9 million for the first half of 2024, earnings are projected to grow by 56.49% annually, and revenue is expected to rise by 15.4% per year—outpacing UK market growth forecasts—though return on equity remains low at an anticipated 9.5%.

- Our expertly prepared growth report on Genel Energy implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Genel Energy.

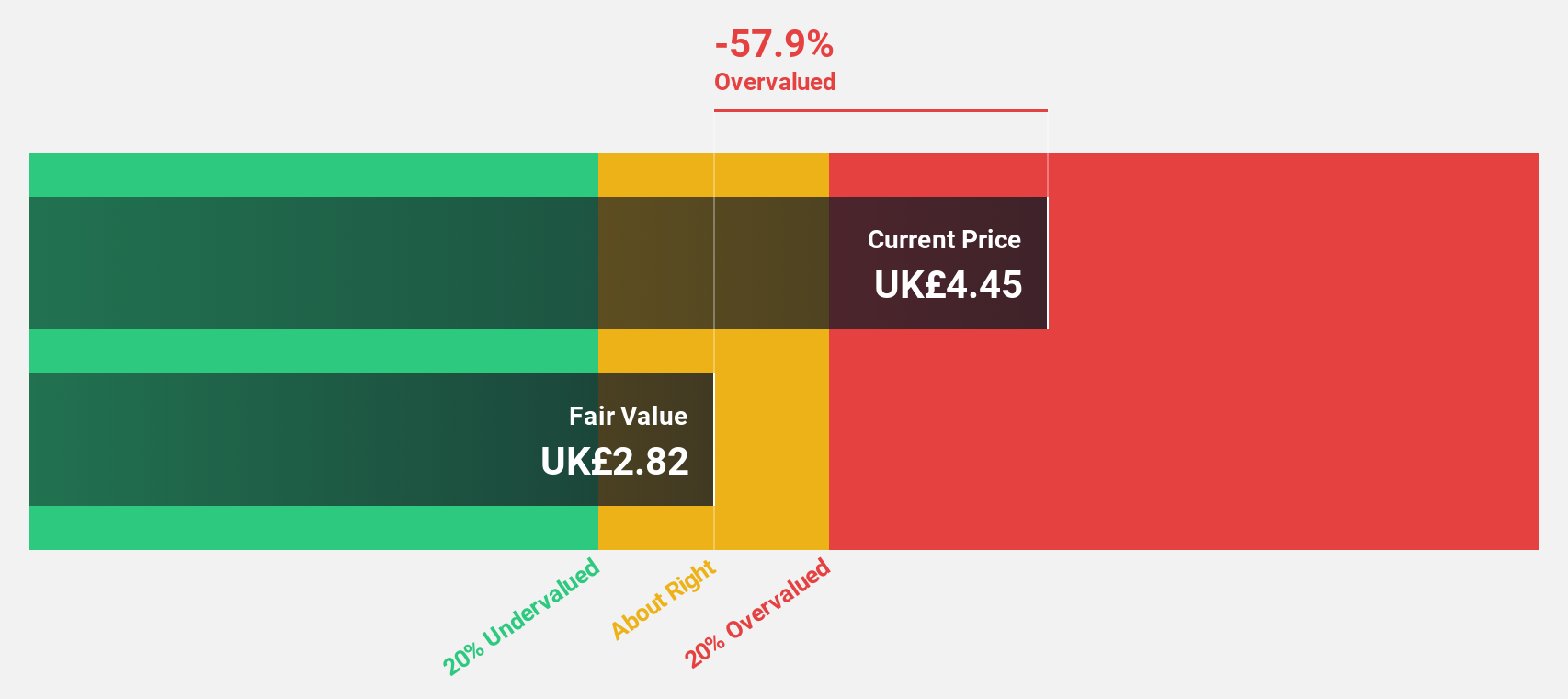

Pinewood Technologies Group (LSE:PINE)

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider serving the automotive industry in the UK and internationally, with a market cap of £281.36 million.

Operations: The company generates revenue of £22.62 million from its software solutions offered to the automotive sector.

Estimated Discount To Fair Value: 39.7%

Pinewood Technologies Group, priced at £3.36, is trading 39.7% below its estimated fair value of £5.58, with analysts predicting a 54.1% price increase. Despite recent shareholder dilution and a drop in net income to £5 million for H1 2024 from £26.9 million the previous year, earnings are projected to grow significantly at 25.09% annually over the next three years, outpacing UK market growth forecasts of 14.4%.

- Insights from our recent growth report point to a promising forecast for Pinewood Technologies Group's business outlook.

- Take a closer look at Pinewood Technologies Group's balance sheet health here in our report.

Next Steps

- Get an in-depth perspective on all 56 Undervalued UK Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ATG

Auction Technology Group

Operates online auction marketplaces in the United Kingdom, North America, and Germany.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives