- United Kingdom

- /

- Hospitality

- /

- AIM:VARE

Seascape Energy Asia And 2 More Promising Penny Stocks On UK Exchange

Reviewed by Simply Wall St

As the UK market grapples with global economic challenges, including weaker trade data from China impacting the FTSE 100 and FTSE 250 indices, investors are increasingly looking for opportunities that might not be immediately apparent in larger stocks. Penny stocks, though an older term, continue to offer potential value and growth for those willing to explore smaller or newer companies. In this article, we will explore several penny stocks on the UK exchange that stand out due to their financial strength and potential for long-term success.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £431.2M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £148.85M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.195 | £827.11M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.24 | £159.81M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.43 | £84.49M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.195 | £317.76M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.61 | £2.01B | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.435 | £182.75M | ★★★★★☆ |

Click here to see the full list of 446 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

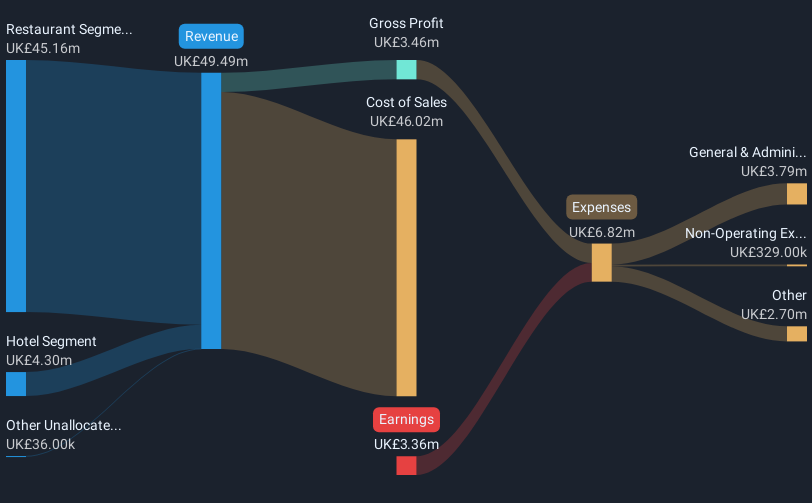

Seascape Energy Asia (AIM:SEA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Seascape Energy Asia plc is a full-cycle exploration and production company that acquires oil and gas assets in Norway, Malaysia, South-East Asia, and the United Kingdom, with a market cap of £22.93 million.

Operations: No specific revenue segments are reported for Seascape Energy Asia.

Market Cap: £22.93M

Seascape Energy Asia plc, with a market cap of £22.93 million, remains a pre-revenue company in the oil and gas sector. Despite being debt-free and having short-term assets that cover liabilities, it faces challenges with high volatility and unprofitability marked by losses increasing at 45.4% annually over five years. The management team is relatively inexperienced, averaging less than a year in tenure. Recent strategic moves include pursuing mergers and acquisitions to expand its portfolio and completing an equity offering raising nearly £2 million to bolster its financial position amidst limited cash runway prospects without further capital infusion.

- Dive into the specifics of Seascape Energy Asia here with our thorough balance sheet health report.

- Understand Seascape Energy Asia's track record by examining our performance history report.

Tissue Regenix Group (AIM:TRX)

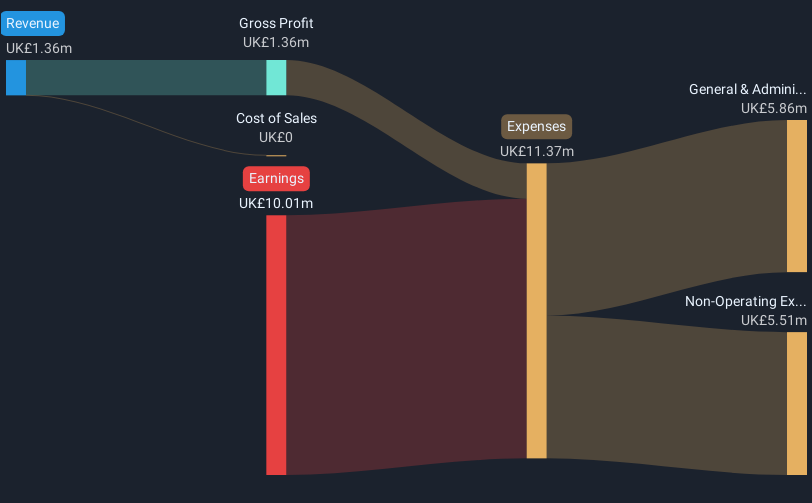

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tissue Regenix Group plc is a medical technology company that develops and commercializes platform technologies for bone graft substitutes and soft tissue in the United States and internationally, with a market cap of £42.03 million.

Operations: The company's revenue is derived from three segments: Dcell ($7.24 million), GBM-V ($3.28 million), and Biorinse ($21.28 million).

Market Cap: £42.03M

Tissue Regenix Group plc, with a market cap of £42.03 million, has shown resilience in the penny stock arena despite being unprofitable. Its revenue streams from Dcell, GBM-V, and Biorinse contributed to a total group revenue increase of 8% to $28.4 million for 2024. The company has managed to reduce net losses significantly over the past year and maintains a satisfactory net debt to equity ratio of 23.1%. Short-term assets exceed both short- and long-term liabilities, providing financial stability while it continues its growth trajectory with projected earnings growth of 170.82% annually according to analyst estimates.

- Take a closer look at Tissue Regenix Group's potential here in our financial health report.

- Understand Tissue Regenix Group's earnings outlook by examining our growth report.

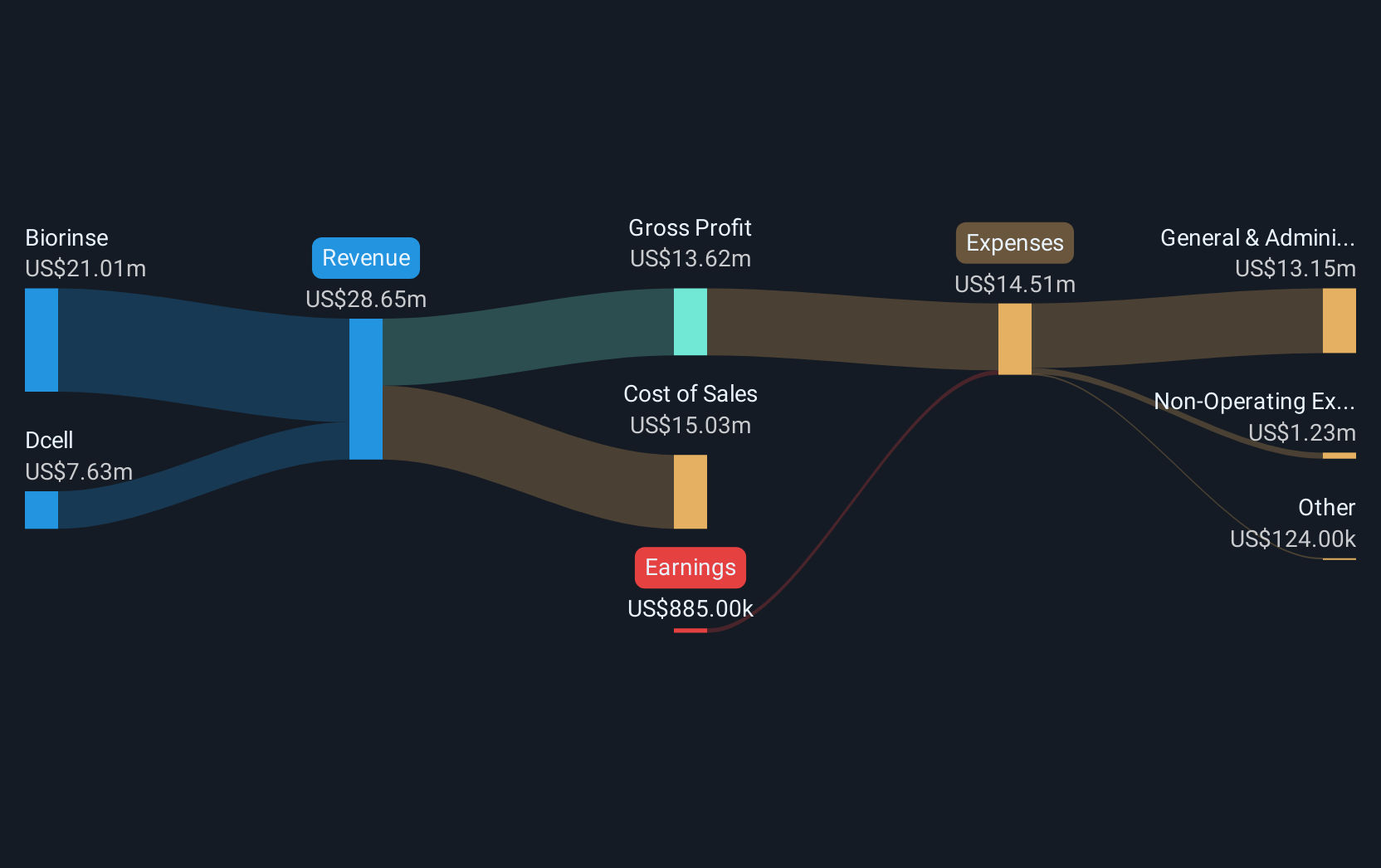

Various Eateries (AIM:VARE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Various Eateries PLC, along with its subsidiaries, owns, develops, and operates restaurant and hotel sites in the United Kingdom with a market capitalization of £27.57 million.

Operations: The company generates revenue primarily from its Restaurant Segment, which accounts for £45.16 million, and its Hotel Segment, contributing £4.30 million.

Market Cap: £27.57M

Various Eateries PLC, with a market cap of £27.57 million, operates in the UK restaurant and hotel sectors. Despite being unprofitable, it has improved its financial position by reducing net losses from £6.68 million to £3.36 million over the past year, while revenues increased to £49.49 million. However, concerns remain as auditors have expressed doubts about its ability to continue as a going concern due to liabilities exceeding assets and negative return on equity (-11.38%). Recent leadership changes include appointing Mark Loughborough as CEO, who brings extensive hospitality industry experience but also has past company liquidations in his history.

- Jump into the full analysis health report here for a deeper understanding of Various Eateries.

- Assess Various Eateries' future earnings estimates with our detailed growth reports.

Where To Now?

- Discover the full array of 446 UK Penny Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VARE

Various Eateries

Owns, develops, and operates restaurant and hotel sites in the United Kingdom.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives