- United Kingdom

- /

- Food and Staples Retail

- /

- AIM:WINE

Naked Wines plc's (LON:WINE) Shares Climb 28% But Its Business Is Yet to Catch Up

Naked Wines plc (LON:WINE) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 12% in the last twelve months.

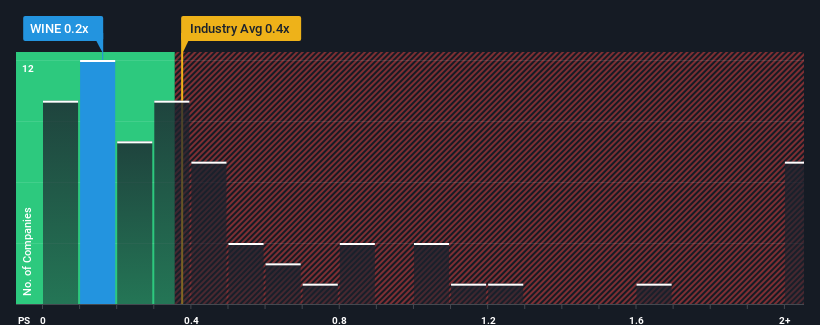

Although its price has surged higher, there still wouldn't be many who think Naked Wines' price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in the United Kingdom's Consumer Retailing industry is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Naked Wines

How Naked Wines Has Been Performing

While the industry has experienced revenue growth lately, Naked Wines' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Naked Wines' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Naked Wines?

In order to justify its P/S ratio, Naked Wines would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. As a result, revenue from three years ago have also fallen 21% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 9.7% as estimated by the three analysts watching the company. Meanwhile, the broader industry is forecast to expand by 3.3%, which paints a poor picture.

In light of this, it's somewhat alarming that Naked Wines' P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

Naked Wines appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

While Naked Wines' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Having said that, be aware Naked Wines is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Naked Wines' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Naked Wines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:WINE

Naked Wines

Engages in the direct-to-consumer retailing of wines in Australia, the United Kingdom, and the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives