- United Kingdom

- /

- Life Sciences

- /

- AIM:DXRX

February 2025 Penny Stocks To Watch On The UK Exchange

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market fluctuations, there remain opportunities for investors willing to explore smaller or newer companies. Penny stocks, while an older term, still represent a valuable investment area where solid financial foundations can lead to potential growth and stability.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.98 | £480.06M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.932 | £148.53M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.83 | £309.02M | ★★★★★★ |

| RTC Group (AIM:RTC) | £0.975 | £13.27M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.71 | £421.59M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.185 | £823.34M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.27 | £161.95M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.45 | £84.87M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.18 | £316.27M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £0.90 | £76.53M | ★★★★★★ |

Click here to see the full list of 447 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Diaceutics (AIM:DXRX)

Simply Wall St Financial Health Rating: ★★★★★★

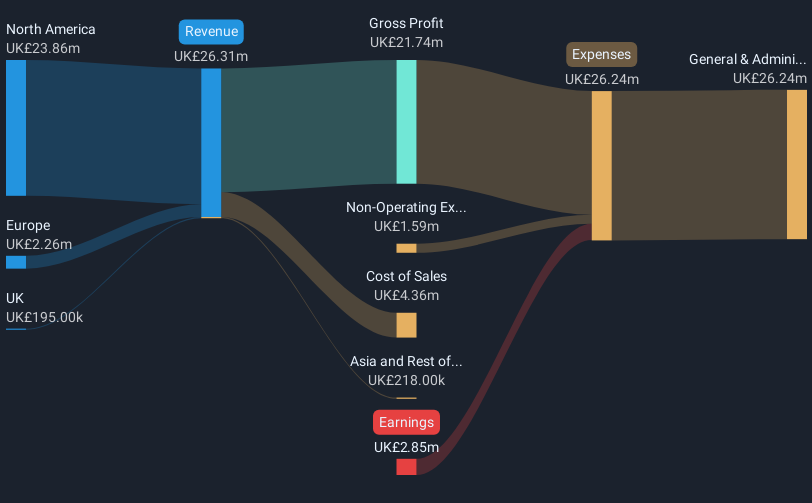

Overview: Diaceutics PLC is a diagnostic commercialisation company offering data, data analytics, and implementation services to pharmaceutical companies globally, with a market cap of £114.10 million.

Operations: The company generates revenue of £26.10 million from its Medical Labs & Research segment.

Market Cap: £114.1M

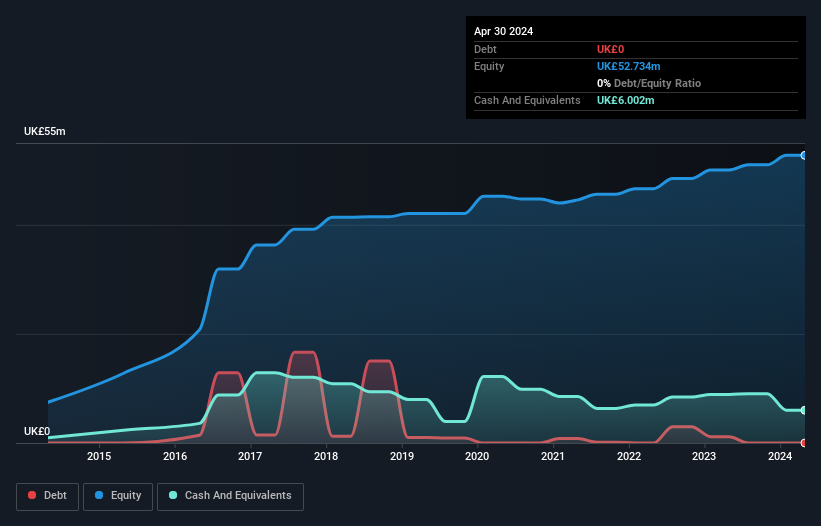

Diaceutics PLC, with a market cap of £114.10 million and revenue of £26.10 million, is expanding its US operations by opening a new headquarters in New Jersey to support 90% of its revenue base. Despite being unprofitable with negative return on equity, the company has no debt and covers liabilities well with short-term assets (£27.2M). Recent strategic moves include launching the Pathology Engagement Liaisons service, securing contracts worth up to $6.9 million combined over several years, enhancing its DXRX platform's utility for pharmaceutical clients globally and potentially increasing future revenues significantly through these engagements.

- Jump into the full analysis health report here for a deeper understanding of Diaceutics.

- Examine Diaceutics' earnings growth report to understand how analysts expect it to perform.

Van Elle Holdings (AIM:VANL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Van Elle Holdings plc operates as a geotechnical and ground engineering contractor in the United Kingdom, with a market cap of £41.12 million.

Operations: The company's revenue is primarily derived from three segments: General Piling (£54.35 million), Specialist Piling & Rail (£46.76 million), and Ground Engineering Services (£34.97 million).

Market Cap: £41.12M

Van Elle Holdings plc, with a market cap of £41.12 million, demonstrates financial stability by maintaining no debt and covering liabilities effectively with short-term assets (£43.4M). Despite a slight decline in half-year sales to £65.16 million from the previous year's £68.21 million, the company continues to generate high-quality earnings and has shown significant profit growth over the past five years (52.8% annually). Recent strategic initiatives include seeking bolt-on acquisitions without accruing significant debt and securing an eight-year agreement with Wood Transmission & Distribution Limited, potentially worth over £30 million, enhancing its long-term revenue prospects.

- Click here to discover the nuances of Van Elle Holdings with our detailed analytical financial health report.

- Gain insights into Van Elle Holdings' future direction by reviewing our growth report.

Virgin Wines UK (AIM:VINO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Virgin Wines UK PLC is a direct-to-consumer online wine retailer in the United Kingdom with a market cap of £18.09 million.

Operations: The company's revenue is primarily derived from the sale of alcohol, totaling £59.01 million.

Market Cap: £18.09M

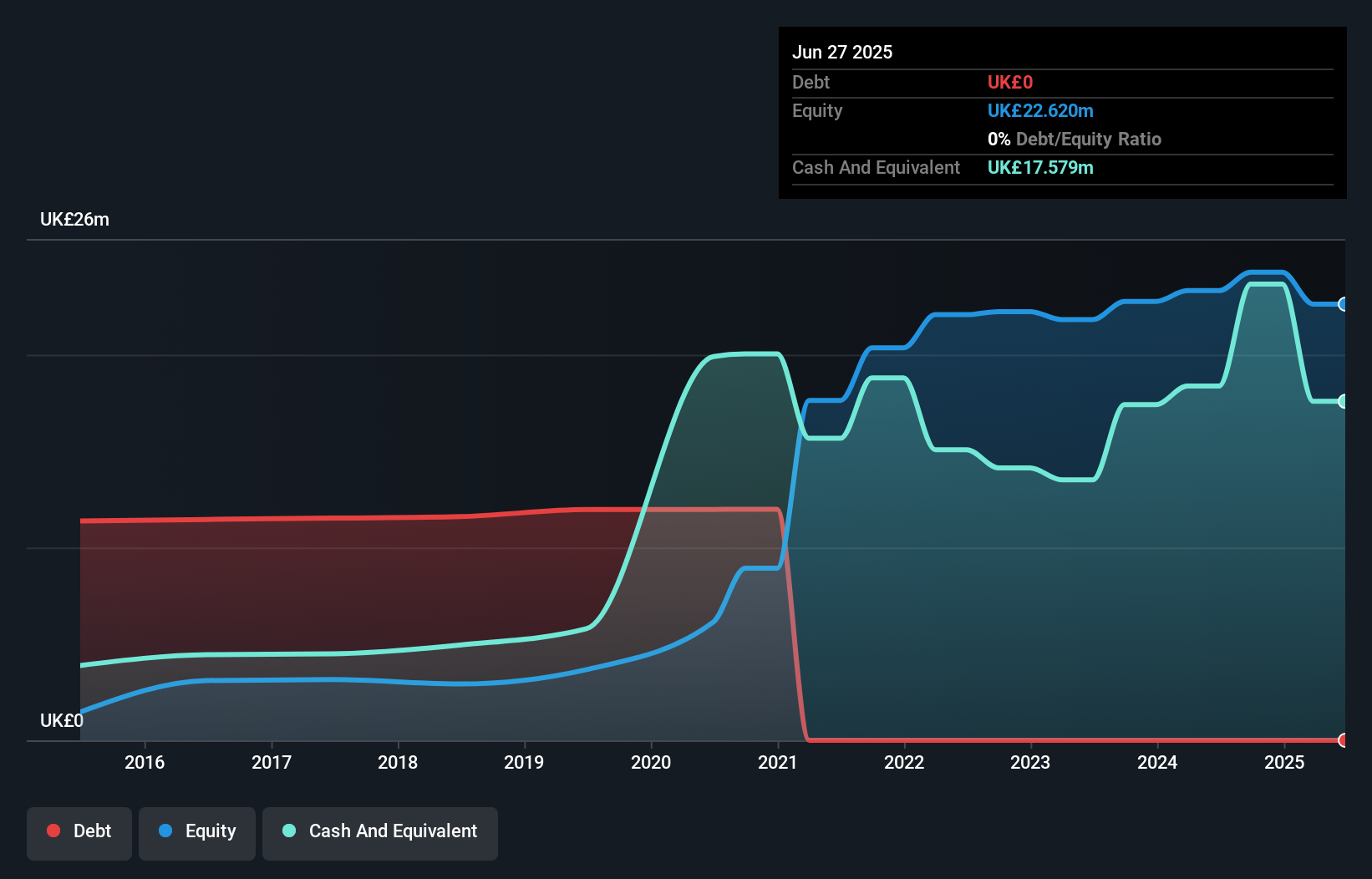

Virgin Wines UK PLC, with a market cap of £18.09 million, has recently turned profitable and operates without debt, reducing financial risk. Its short-term assets (£26.9M) comfortably cover both short-term (£15M) and long-term liabilities (£2.6M), indicating strong liquidity management. The company trades at a significant discount to estimated fair value, suggesting potential for price appreciation if market conditions align with intrinsic valuations. However, earnings have declined by 23.8% annually over the past five years despite recent profitability improvements, highlighting challenges in sustaining growth momentum amidst forecasted modest revenue growth of 3.53% per year.

- Get an in-depth perspective on Virgin Wines UK's performance by reading our balance sheet health report here.

- Gain insights into Virgin Wines UK's outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Jump into our full catalog of 447 UK Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:DXRX

Diaceutics

A diagnostic commercialisation company, provides data, data analytics, and implementation services for pharmaceutical companies worldwide.

Flawless balance sheet and good value.

Market Insights

Community Narratives