- United Kingdom

- /

- Consumer Durables

- /

- LSE:TW.

Are Taylor Wimpey’s Shares Poised for Recovery After Latest Housing Sector News?

Reviewed by Bailey Pemberton

- Ever wondered if Taylor Wimpey is actually undervalued, or if the stock’s recent moves are a sign of something deeper? Let’s dig in to see if there’s real value here or if it’s just market noise.

- Shares have jumped 6.3% this week after previously dropping 4.3% over the past month, and they’re still down 15.1% year-to-date. This recent momentum is worth a closer look.

- Much of this fluctuation is linked to recent news around the UK housing sector, as government planning reforms and mortgage rate updates have added both optimism and uncertainty. Taylor Wimpey was also mentioned following several major project approvals, contributing to renewed investor interest.

- The current valuation score stands at 3 out of 6. This suggests it’s considered undervalued in half the areas we look at. We’ll go through what that means using several common and a few underappreciated valuation approaches, with one perspective you might not expect coming up at the end of the article.

Find out why Taylor Wimpey's -12.7% return over the last year is lagging behind its peers.

Approach 1: Taylor Wimpey Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the underlying value of a company by projecting its future cash flows and discounting them back to their value today. This approach looks at how much cash Taylor Wimpey is expected to generate for shareholders over time, then adjusts for the risk and the time value of money.

Currently, Taylor Wimpey generates around £65 million in free cash flow. Analyst forecasts suggest this number could rise steadily, with projected free cash flow reaching as high as £569 million by 2029 according to available estimates. For years beyond 2029, cash flow projections are extrapolated based on growth trends provided by Simply Wall St. This longer-term view tries to capture not just near-term changes but also the company’s ability to compound its cash generation over the next decade.

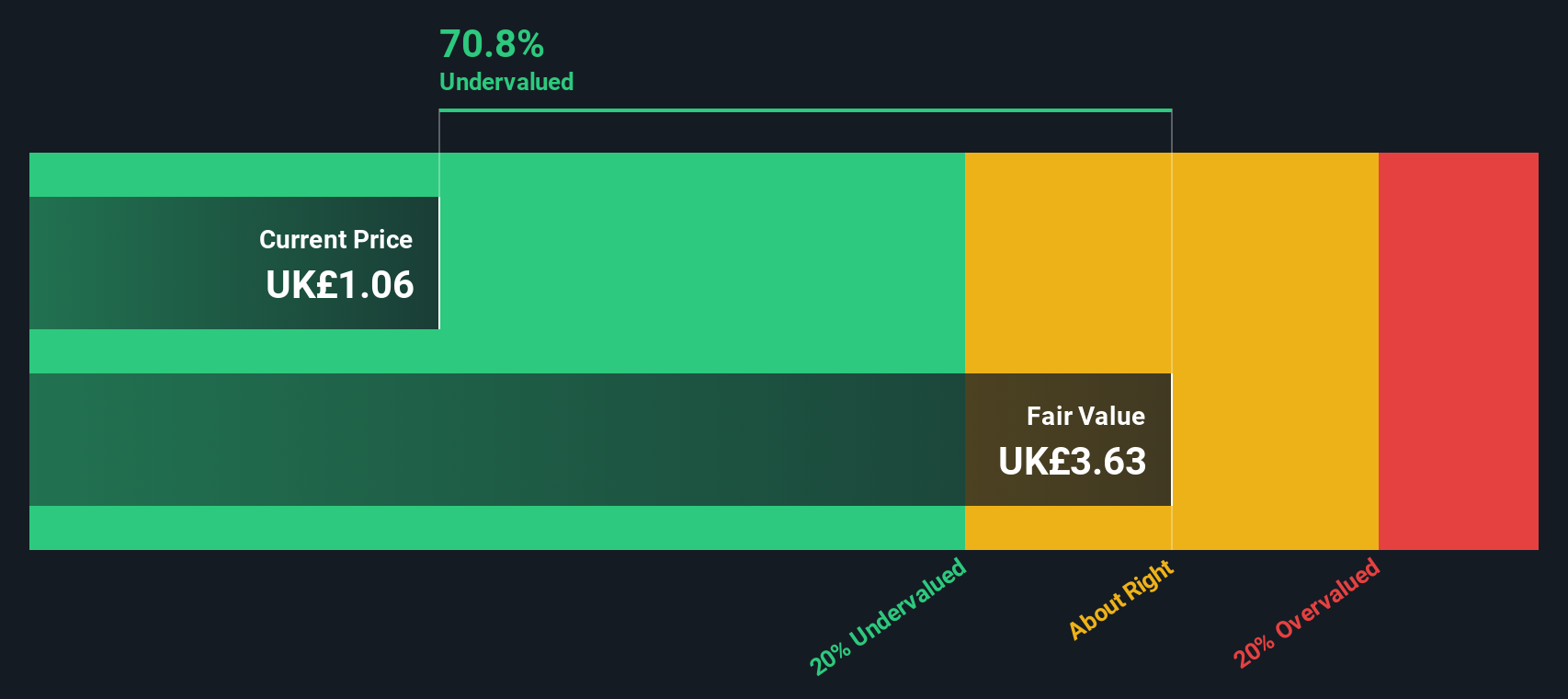

The DCF model calculates an intrinsic value of £3.54 per share, implying a significant discount of 70.7 percent compared to the current market price. This suggests that, if the assumptions hold, the stock price is substantially below what the company could be worth based on future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Taylor Wimpey is undervalued by 70.7%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Taylor Wimpey Price vs Earnings (PE)

For profitable companies like Taylor Wimpey, the Price-to-Earnings (PE) ratio is a common way to gauge whether a stock is attractively valued. The PE ratio tells us how much investors are willing to pay for each £1 of earnings. Higher multiples often reflect strong growth expectations or lower perceived risk, while lower multiples might suggest challenges ahead or broader sector pessimism.

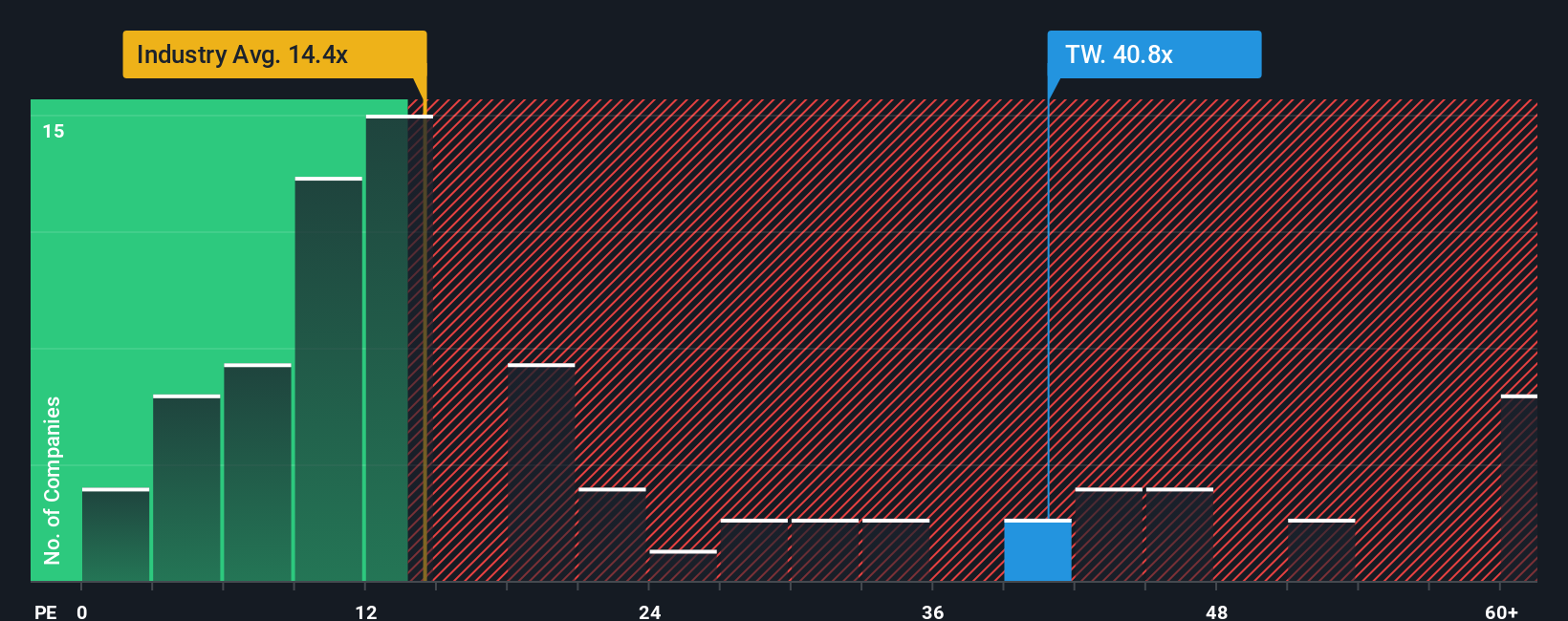

Currently, Taylor Wimpey trades at a PE ratio of 43.3x. That is much higher than both the Consumer Durables industry average of 15.9x and the peer group average of 19.4x. At first glance, this could look expensive. However, raw comparisons can be misleading, as what counts as a “normal” or “fair” PE often depends on expected earnings growth, profit margins, the company’s market cap, and how much risk investors see in the next several years.

This is where Simply Wall St's “Fair Ratio” comes in. Unlike simple peer or industry averages, the Fair Ratio, which is 32.3x here, accounts for the nuances of Taylor Wimpey’s financials, growth forecasts, and the risks specific to its business and sector. It goes beyond the surface and provides a tailored benchmark that is more meaningful for investors searching for intrinsic value.

Comparing the Fair Ratio of 32.3x to Taylor Wimpey’s current PE of 43.3x, the stock appears overvalued on this measure. The gap suggests that even after factoring in growth and risk, the market price currently embeds a premium that may not be fully justified by fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Taylor Wimpey Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives.

A Narrative is simply your story or perspective about a company's future. It is how you see Taylor Wimpey’s revenues, profit margins, and risks evolving over time. Narratives help you connect the company’s strategy, industry trends, and operational strengths with your assumptions for future financial performance, all the way through to an estimated fair value. This approach goes beyond numbers on a page; it gives each investor a chance to tell their own story and automatically translates those beliefs into a financial forecast and a fair value, so you can quickly see how your view lines up against the current share price.

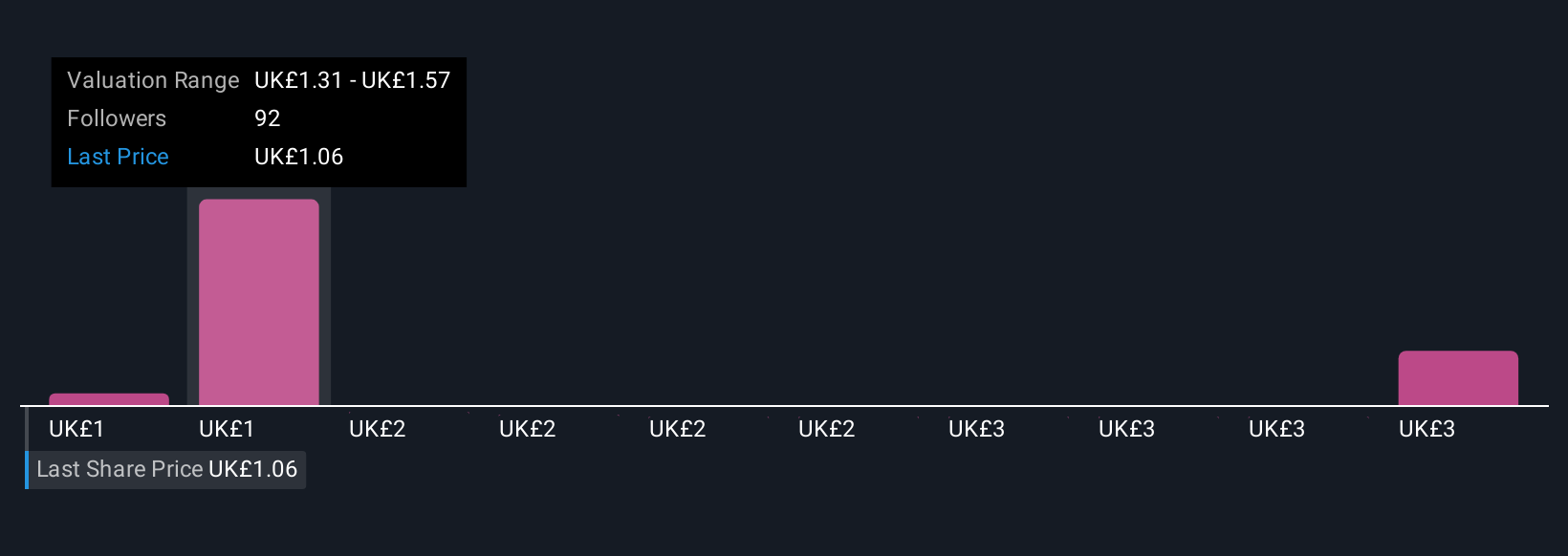

Powerful yet approachable, Narratives are available right now on Simply Wall St's Community page, used by millions of investors. Whenever there is a significant update, such as new earnings, regulatory news, or housing sector developments, your Narrative, its fair value estimate, and suggested actions (buy, hold, or sell) are updated automatically. For example, some investors see Taylor Wimpey’s operational efficiency and land holdings as drivers for a price target of £1.72, while more cautious views project just £1.05, reflecting differences in assumptions about margins, market risks, and growth. Narratives put this dynamic debate and your viewpoint front and center in your investment decisions.

Do you think there's more to the story for Taylor Wimpey? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taylor Wimpey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TW.

Taylor Wimpey

Operates as a homebuilder company in the United Kingdom and Spain.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.