- United Kingdom

- /

- Consumer Durables

- /

- LSE:GLE

UK Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. In such a volatile environment, identifying growth companies with high insider ownership can be particularly appealing as it often suggests confidence in the company's potential and alignment of interests between insiders and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.3% | 59.2% |

| Foresight Group Holdings (LSE:FSG) | 35% | 26.3% |

| Helios Underwriting (AIM:HUW) | 23.6% | 23.1% |

| Facilities by ADF (AIM:ADF) | 13.2% | 161.5% |

| Judges Scientific (AIM:JDG) | 10.7% | 24.4% |

| Audioboom Group (AIM:BOOM) | 15.6% | 59.3% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.7% | 21.4% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Getech Group (AIM:GTC) | 11.8% | 114.5% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 116.2% |

Let's uncover some gems from our specialized screener.

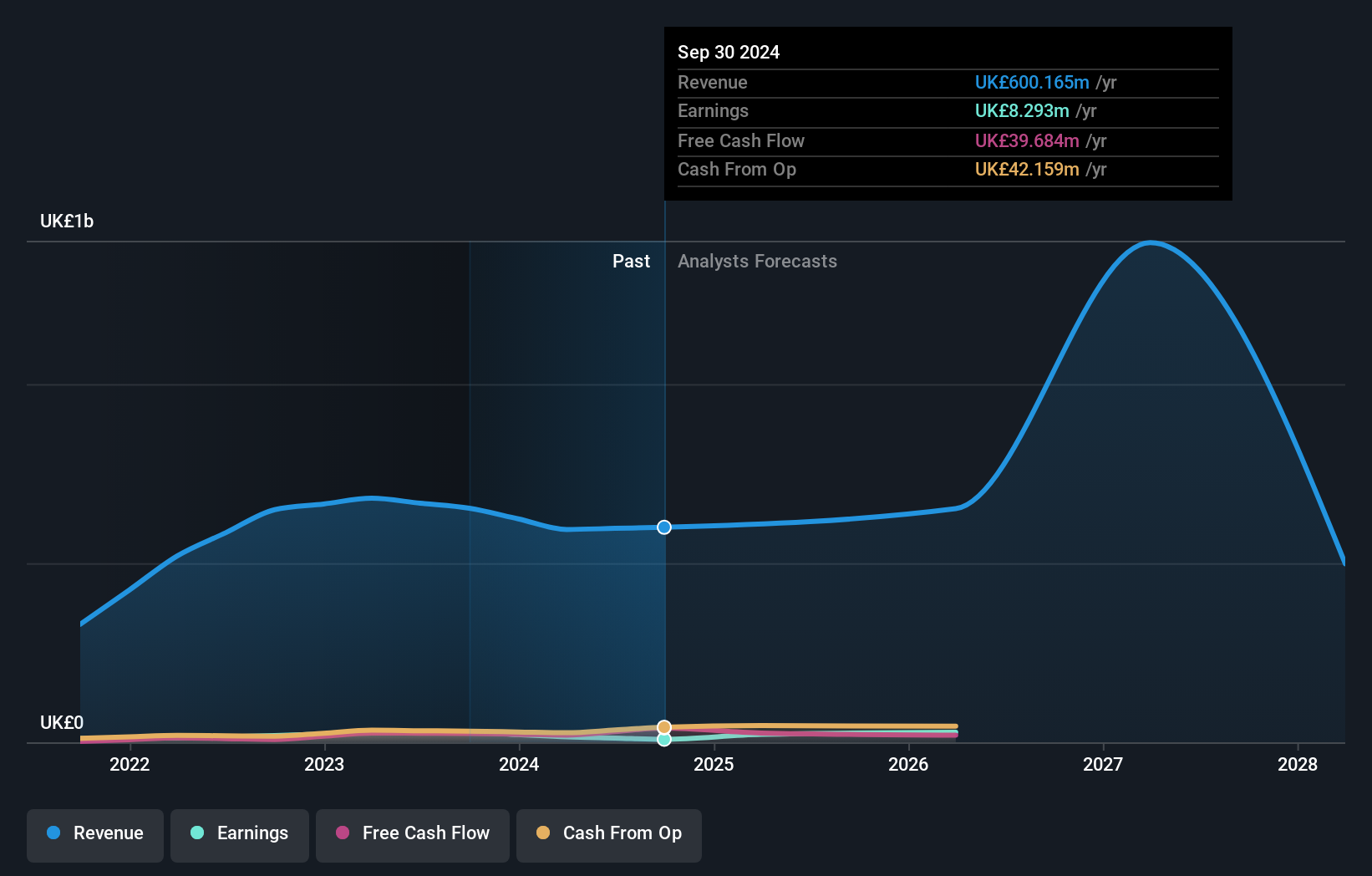

Brickability Group (AIM:BRCK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brickability Group Plc, with a market cap of £190.41 million, supplies, distributes, and imports building products in the United Kingdom through its subsidiaries.

Operations: The company's revenue segments include £90.55 million from importing, £88.22 million from contracting, £63.21 million from distribution, and £380.56 million from bricks and building materials in the United Kingdom.

Insider Ownership: 28.2%

Earnings Growth Forecast: 39.6% p.a.

Brickability Group is poised for significant earnings growth, with forecasts indicating a 39.6% annual increase over the next three years, outpacing the UK market's 13.9%. Despite this, its profit margins have declined to 1.4% from last year's 4.3%, and its dividend yield of 5.66% isn't well covered by earnings. The stock trades at a discount of 21.8% below estimated fair value, suggesting potential undervaluation despite lower-than-benchmark Return on Equity projections (15.4%).

- Click to explore a detailed breakdown of our findings in Brickability Group's earnings growth report.

- Upon reviewing our latest valuation report, Brickability Group's share price might be too pessimistic.

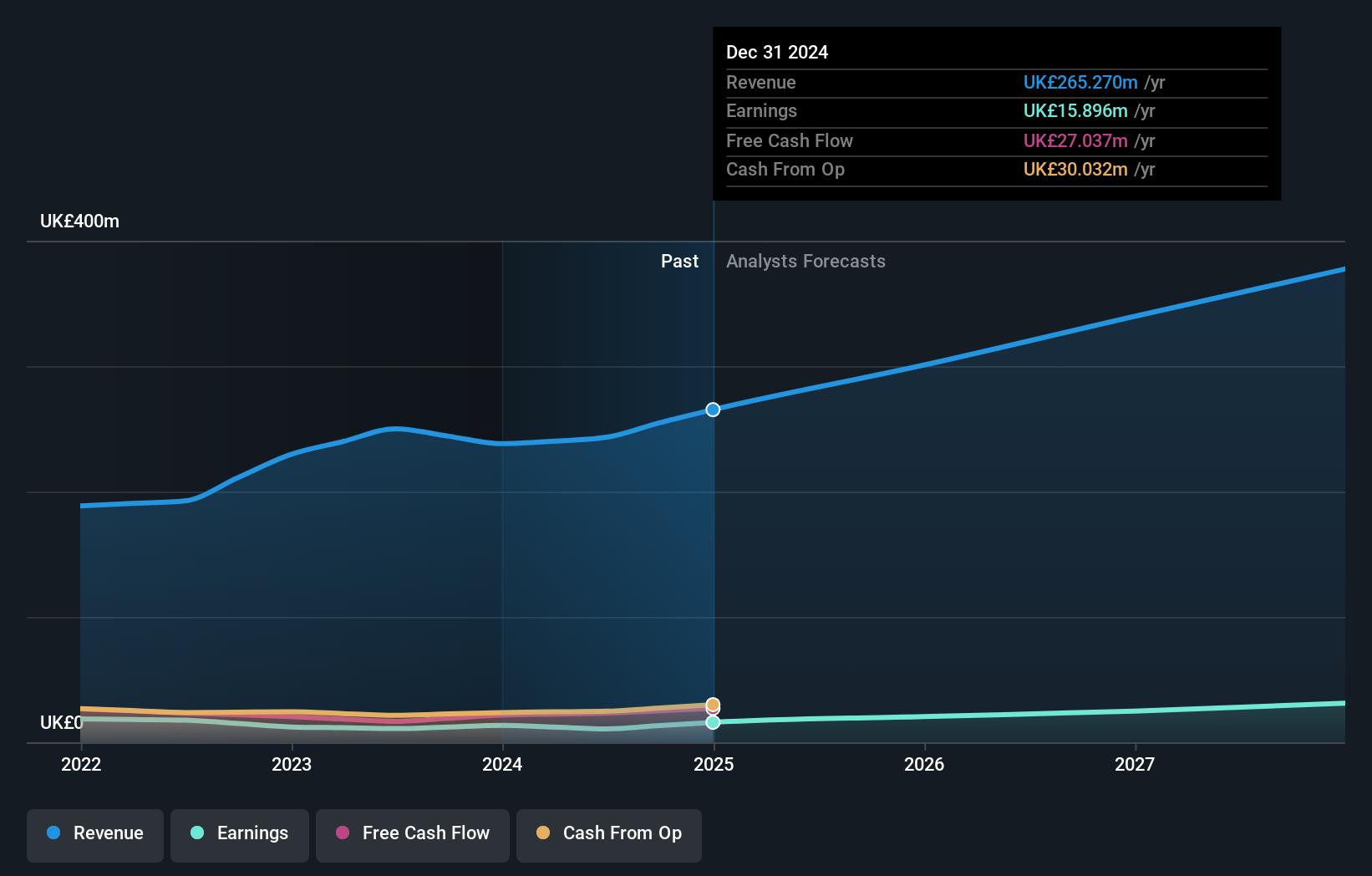

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mortgage Advice Bureau (Holdings) plc, along with its subsidiaries, offers mortgage advice services in the United Kingdom and has a market cap of £440.80 million.

Operations: The company generates its revenue primarily from the provision of financial services, amounting to £265.27 million.

Insider Ownership: 19.7%

Earnings Growth Forecast: 21.4% p.a.

Mortgage Advice Bureau (Holdings) shows promising growth prospects, with earnings forecast to grow 21.4% annually, surpassing the UK market average. Recent financial results reflect a net income rise to £16.08 million and revenue growth of 11% to approximately £266 million, outpacing UK gross lending growth. Insider activity indicates more buying than selling in recent months, though not substantially high volumes. The company's dividend yield of 3.74% is currently not well covered by earnings.

- Unlock comprehensive insights into our analysis of Mortgage Advice Bureau (Holdings) stock in this growth report.

- Our valuation report unveils the possibility Mortgage Advice Bureau (Holdings)'s shares may be trading at a premium.

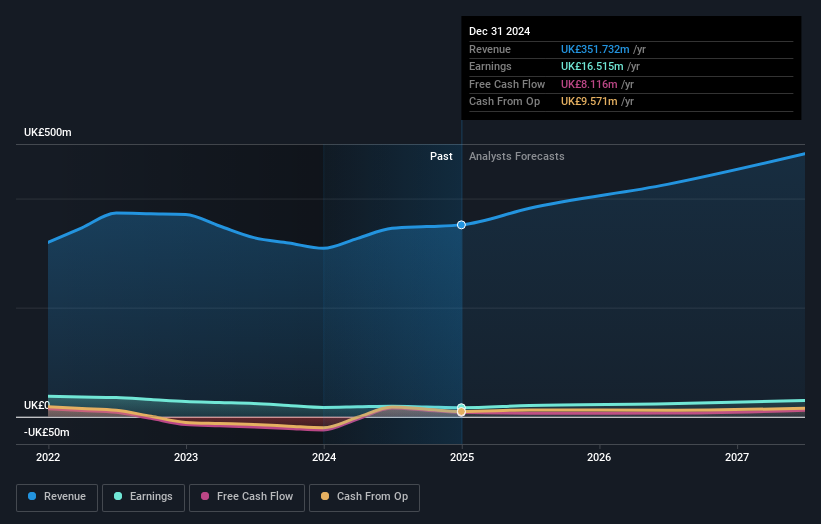

MJ Gleeson (LSE:GLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MJ Gleeson plc operates in the United Kingdom, focusing on house building and land promotion and sales, with a market cap of £267.63 million.

Operations: The company's revenue is derived from two main segments: Gleeson Land, contributing £8.40 million, and Gleeson Homes, generating £343.33 million.

Insider Ownership: 11.2%

Earnings Growth Forecast: 20.2% p.a.

MJ Gleeson demonstrates strong growth potential with earnings forecasted to grow over 20% annually, outpacing the UK market. Revenue is expected to increase by 12.4% per year, faster than the broader market's growth rate. Insider activity has been positive, with substantial buying and no significant selling in recent months. Despite a decline in net income for H1 2025 compared to the previous year, analysts anticipate a stock price rise of 45.5%.

- Click here to discover the nuances of MJ Gleeson with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of MJ Gleeson shares in the market.

Where To Now?

- Click through to start exploring the rest of the 60 Fast Growing UK Companies With High Insider Ownership now.

- Curious About Other Options? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GLE

MJ Gleeson

Engages in house building, and land promotion and sale businesses in the United Kingdom.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives