- United Kingdom

- /

- Consumer Durables

- /

- LSE:GLE

UK Dividend Stocks Offering Yields Up To 4.3%

Reviewed by Simply Wall St

The UK stock market has recently experienced some turbulence, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns about global economic recovery. In such volatile conditions, dividend stocks can offer a measure of stability and income potential for investors seeking reliable returns amidst broader market uncertainties.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 9.52% | ★★★★★★ |

| Treatt (LSE:TET) | 3.43% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 6.78% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.00% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.78% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.01% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.56% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.04% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.66% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.87% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top UK Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

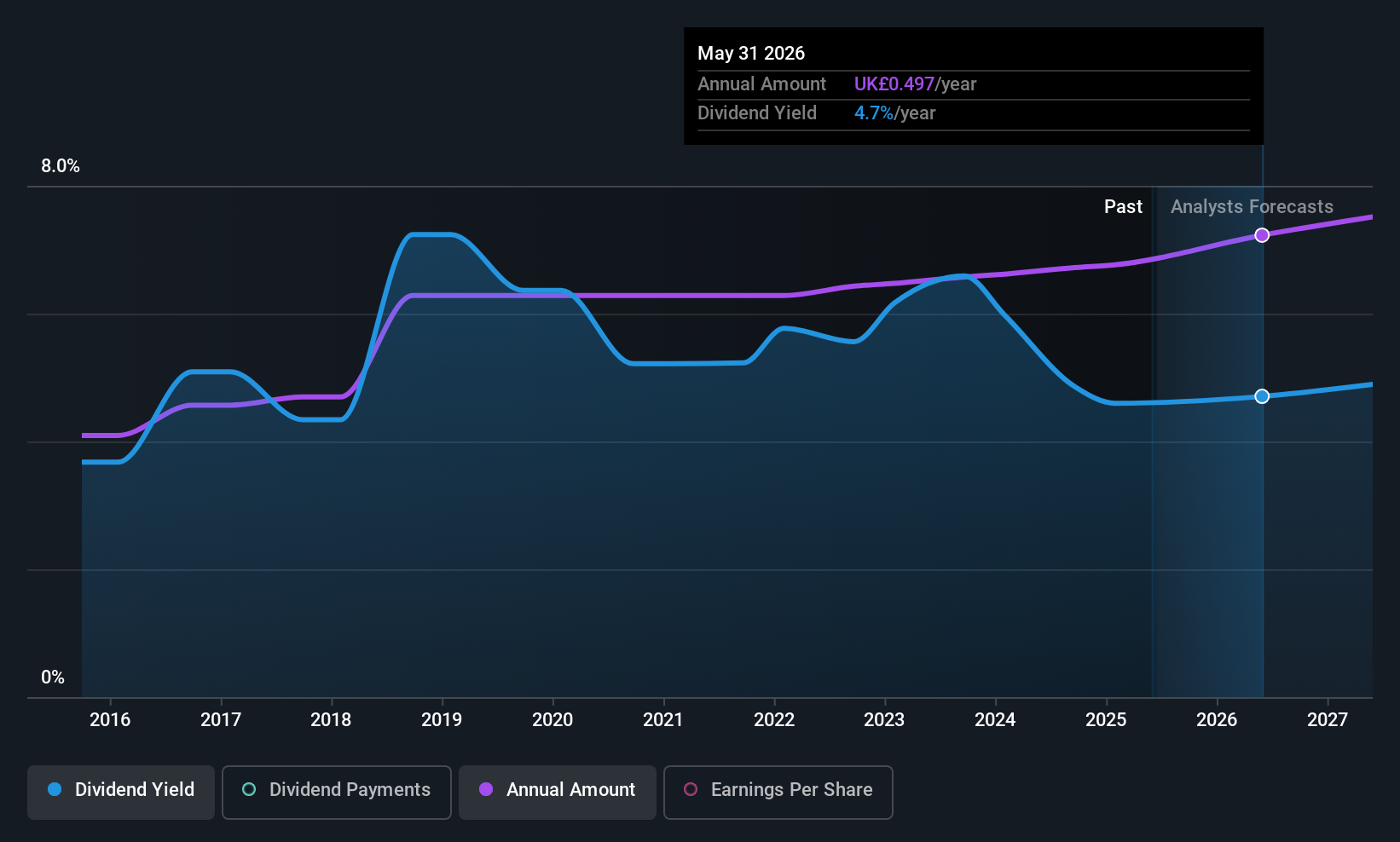

M.P. Evans Group (AIM:MPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M.P. Evans Group PLC, with a market cap of £642.11 million, operates by owning and developing oil palm plantations in Indonesia and Malaysia through its subsidiaries.

Operations: M.P. Evans Group PLC generates its revenue primarily from its plantation operations in Indonesia, which amounted to $352.84 million.

Dividend Yield: 4%

M.P. Evans Group's dividend payments have increased over the past decade, yet they remain volatile and below top-tier yields in the UK market. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 39.6% and 30.4%, respectively. Trading at a significant discount to estimated fair value, it presents good relative value compared to peers. Recent board changes include appointing Katherine Coppinger as an independent director, potentially strengthening corporate governance.

- Dive into the specifics of M.P. Evans Group here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of M.P. Evans Group shares in the market.

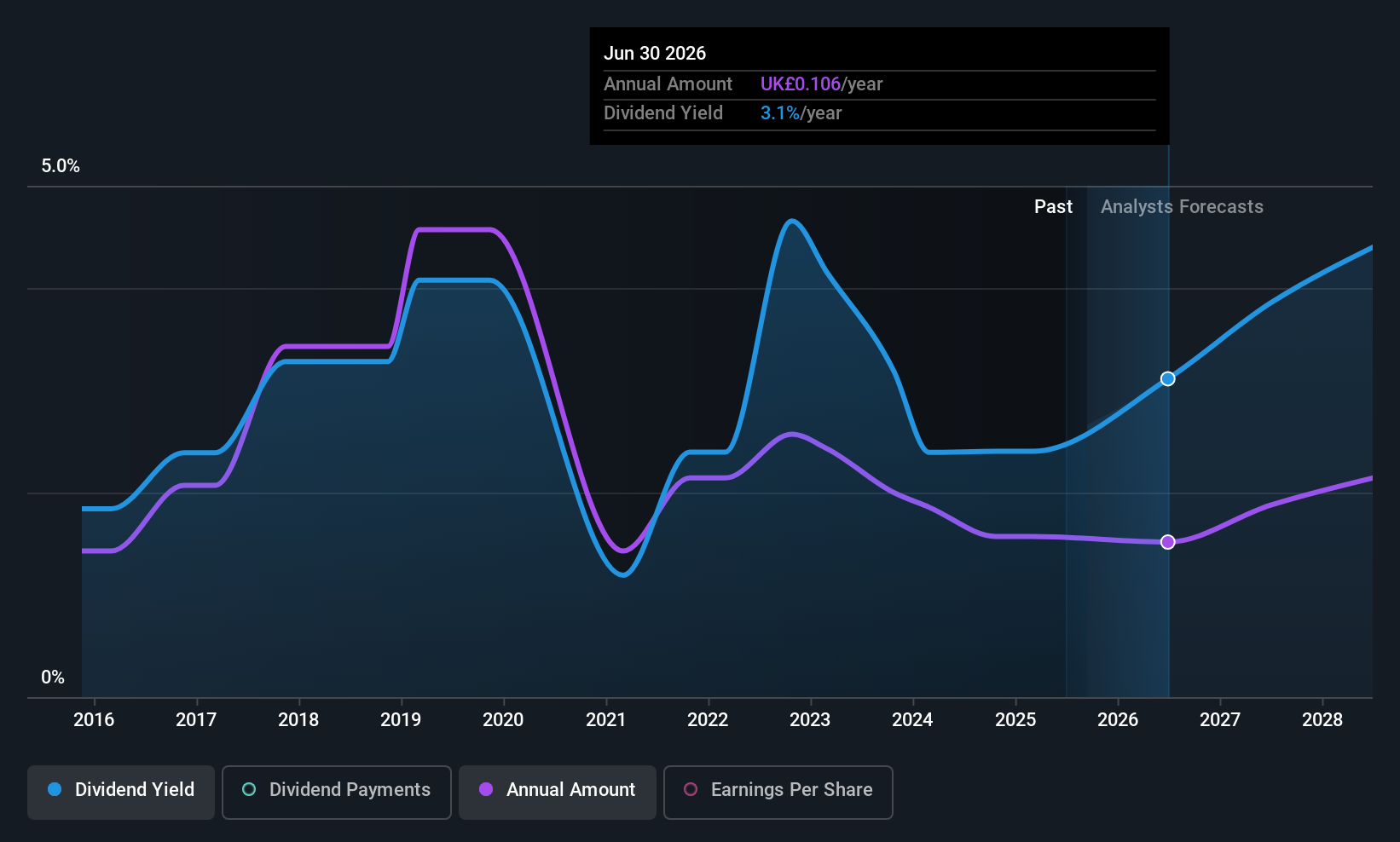

MJ Gleeson (LSE:GLE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MJ Gleeson plc operates in the United Kingdom, focusing on house building and land promotion and sales, with a market cap of £211.53 million.

Operations: The company's revenue is derived from Gleeson Homes at £343.33 million and Gleeson Land at £8.40 million.

Dividend Yield: 3%

MJ Gleeson's dividend yield is modest compared to the UK's top payers, though its payout ratio of 38.8% suggests dividends are well-covered by earnings. However, past dividend volatility raises sustainability concerns despite recent growth. The stock trades at a favorable price-to-earnings ratio of 12.8x against the market's 16x, indicating good value relative to peers. Recent board appointments may enhance governance stability amidst ongoing strategic adjustments in leadership and corporate guidance expectations.

- Get an in-depth perspective on MJ Gleeson's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that MJ Gleeson is trading behind its estimated value.

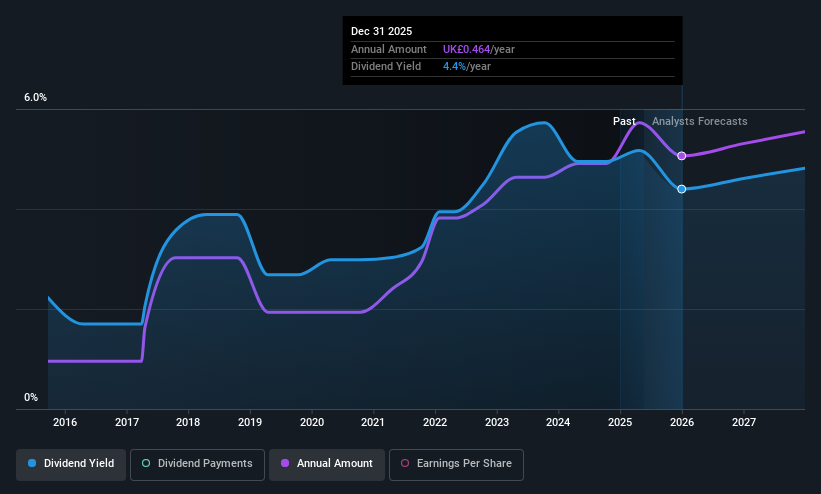

IG Group Holdings (LSE:IGG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IG Group Holdings plc is a fintech company that operates in the online trading business globally with a market cap of £3.71 billion.

Operations: IG Group Holdings plc generates its revenue primarily from its brokerage segment, which amounts to £1.01 billion.

Dividend Yield: 4.4%

IG Group Holdings offers a stable dividend history with consistent growth over the past decade. Its current yield of 4.35% is reliable, though below the UK's top quartile payers. The payout ratios—47.5% from earnings and 28.6% from cash flows—indicate strong coverage and sustainability of dividends. Recent events include closing a buyback plan and issuing new revenue guidance, suggesting potential financial resilience as revenues are expected to meet or exceed £1.05 billion for FY2025.

- Click to explore a detailed breakdown of our findings in IG Group Holdings' dividend report.

- Our comprehensive valuation report raises the possibility that IG Group Holdings is priced lower than what may be justified by its financials.

Next Steps

- Reveal the 56 hidden gems among our Top UK Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GLE

MJ Gleeson

Engages in house building, and land promotion and sale businesses in the United Kingdom.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives