- United Kingdom

- /

- Machinery

- /

- AIM:JDG

3 UK Growth Companies With Up To 19% Insider Ownership

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing a dip due to weak trade data from China, highlighting the interconnectedness of global economies. In such uncertain times, companies with high insider ownership can be appealing as they often indicate confidence from those who know the business best. This article explores three UK growth companies where insiders hold up to 19% of shares, potentially aligning their interests closely with shareholders and offering insights into their long-term potential amidst current market conditions.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 108.1% |

| Foresight Group Holdings (LSE:FSG) | 34.9% | 27% |

| Helios Underwriting (AIM:HUW) | 23.8% | 23.1% |

| Judges Scientific (AIM:JDG) | 10.7% | 23.7% |

| LSL Property Services (LSE:LSL) | 10.4% | 26.9% |

| Facilities by ADF (AIM:ADF) | 13.2% | 190% |

| Getech Group (AIM:GTC) | 11.8% | 114.5% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 25.3% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 189.1% |

Here we highlight a subset of our preferred stocks from the screener.

Judges Scientific (AIM:JDG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Judges Scientific plc designs, manufactures, and sells scientific instruments with a market cap of £500.84 million.

Operations: The company generates revenue from two main segments: Vacuum (£65.40 million) and Materials Sciences (£70.20 million).

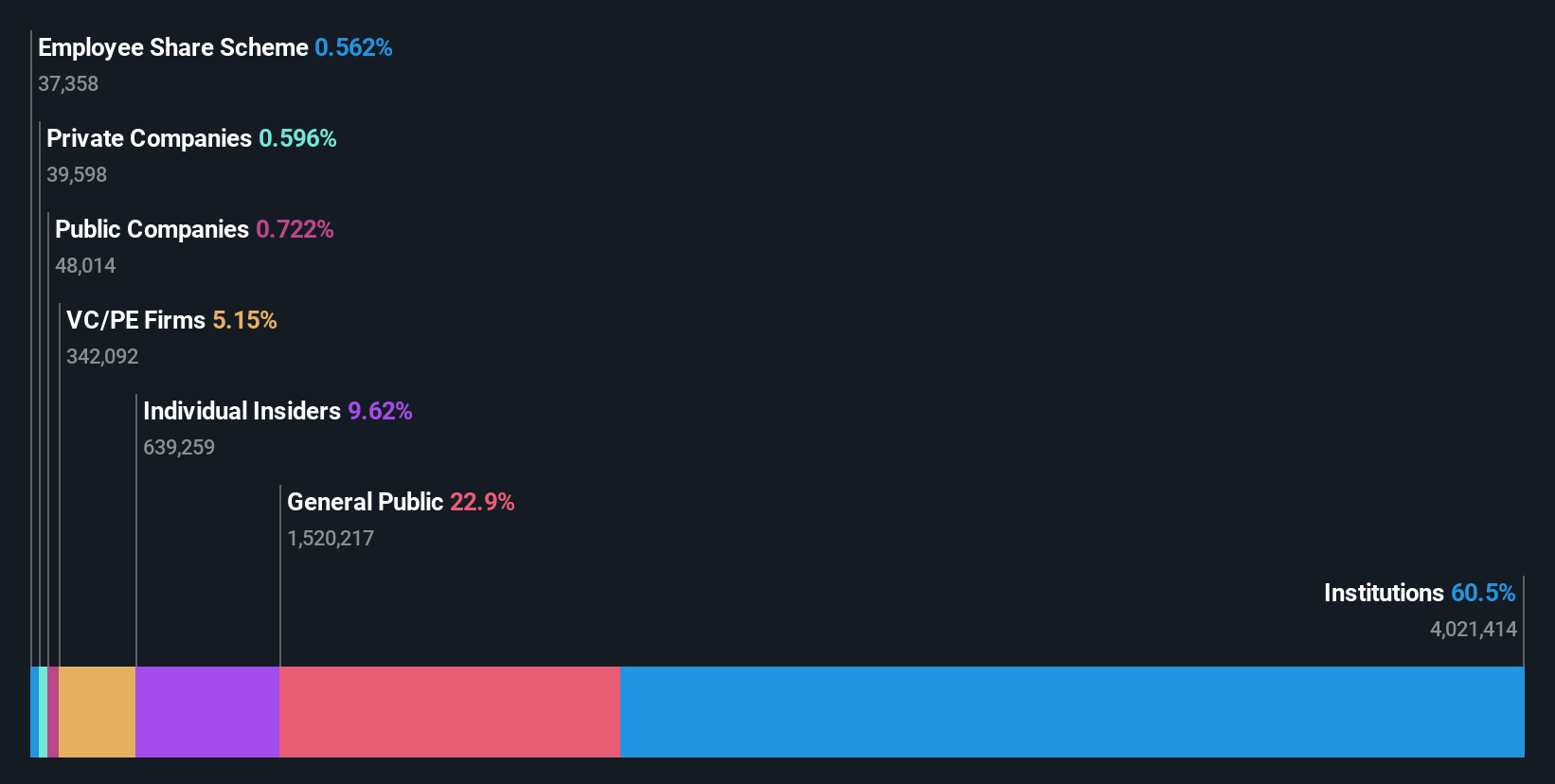

Insider Ownership: 10.7%

Judges Scientific has seen substantial insider buying over the past three months, with no significant selling. The company is trading at 21.8% below its estimated fair value and is forecasted to achieve earnings growth of 23.7% annually, outpacing the UK market's 15%. Despite high debt levels and large one-off items affecting financial results, analysts agree on a potential stock price increase of 40.2%. Leadership changes are underway with Ralph Elman becoming Non-Executive Chair in January 2025.

- Click here and access our complete growth analysis report to understand the dynamics of Judges Scientific.

- Our valuation report here indicates Judges Scientific may be undervalued.

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★★☆

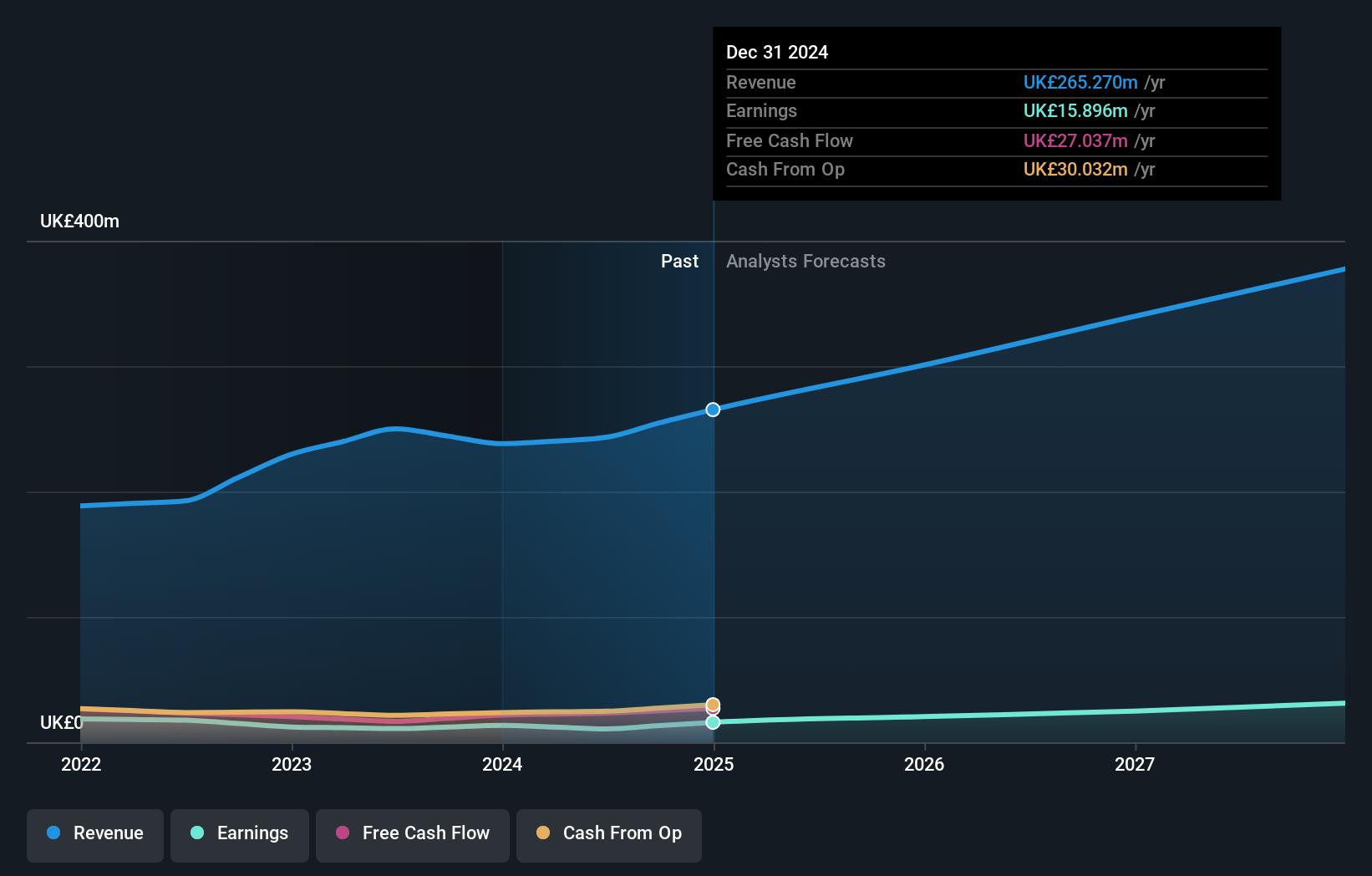

Overview: Mortgage Advice Bureau (Holdings) plc, with a market cap of £520.45 million, provides mortgage advice services in the United Kingdom through its subsidiaries.

Operations: The company generates revenue of £243.31 million from its financial services offerings in the UK.

Insider Ownership: 19.8%

Mortgage Advice Bureau (Holdings) shows promising growth prospects with earnings expected to rise 25.3% annually, surpassing the UK market's 15%. Recent revenue growth of £266 million outpaced the UK's gross lending increase. Insider activity is stable, with more shares bought than sold recently. The company's share price has been volatile, and while dividends are not well-covered by earnings, high insider ownership aligns management interests with shareholders. Leadership changes include new board appointments pending regulatory approval.

- Get an in-depth perspective on Mortgage Advice Bureau (Holdings)'s performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Mortgage Advice Bureau (Holdings) is trading beyond its estimated value.

MJ Gleeson (LSE:GLE)

Simply Wall St Growth Rating: ★★★★☆☆

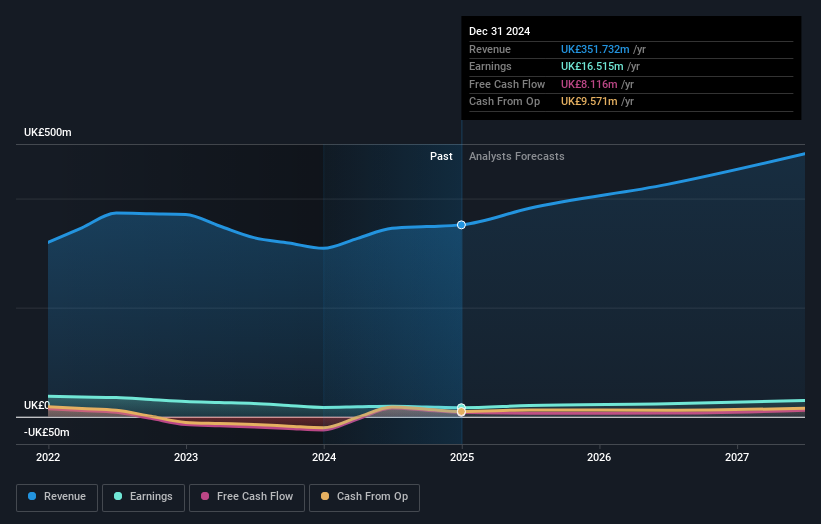

Overview: MJ Gleeson plc operates in the United Kingdom, focusing on house building and land promotion and sales, with a market cap of £279.61 million.

Operations: The company's revenue is derived from two primary segments: Gleeson Land, contributing £8.40 million, and Gleeson Homes, generating £343.33 million.

Insider Ownership: 11.2%

MJ Gleeson demonstrates potential as a growth company with expected earnings growth of 22.4% annually, outpacing the UK market's 15%. Despite a decline in net income to £2.8 million for H1 2025, revenue increased slightly to £157.85 million. The interim dividend remains stable at 4 pence per share, reflecting consistent policy adherence. Insider ownership aligns management interests with shareholders, though recent insider trading activity is limited and return on equity is forecasted to be modest at 8.9%.

- Unlock comprehensive insights into our analysis of MJ Gleeson stock in this growth report.

- The analysis detailed in our MJ Gleeson valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Access the full spectrum of 59 Fast Growing UK Companies With High Insider Ownership by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JDG

Judges Scientific

Designs, manufactures, and sells scientific instruments and services.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives